User login

My inspiration

Kobe Bryant knew me. Not personally, of course. I never received an autograph or shook his hand. But once in a while if I was up early enough, I’d run into Kobe at the gym in Newport Beach where he and I both worked out. As he did for all his fans at the gym, he’d make eye contact with me and nod hello. He was always focused on his workout – working with a trainer, never with headphones on. In person, he appeared enormous. Unlike most retired professional athletes, he still was in great shape. No doubt he could have suited up in purple and gold, and played against the Clippers that night if needed.

Being from New England, I never was a Laker fan. But I thought, if Kobe can head to the gym after midnight and take a 1,000 shots to prepare for a game, then I could set my alarm for 4 a.m. and take a few dozen more questions from my First Aid books. Head down, “Kryptonite” cranked on my iPod, I wasn’t going to let anyone in that test room outwork me. Neither did he. I put in the time and, like Kobe in the 2002 conference finals against Sacramento, I crushed it.*

When we moved to California, I followed Kobe and the Lakers until he retired. To be clear, I didn’t aspire to be like him, firstly because I’m slightly shorter than Michael Bloomberg, but also because although accomplished, Kobe made some poor choices at times. Indeed, it seems he might have been kinder and more considerate when he was at the top. But in his retirement he looked to be toiling to make reparations, refocusing his prodigious energy and talent for the benefit of others rather than for just for scoring 81 points. His Rolls Royce was there before mine at the gym, and I was there early. He was still getting up early and now preparing to be a great venture capitalist, podcaster, author, and father to his girls.

Watching him carry kettle bells across the floor one morning, I wondered, do people like Kobe Bryant look to others for inspiration? Or are they are born with an endless supply of it? For me, I seemed to push harder and faster when watching idols pass by. Whether it was Kobe or Clayton Christensen (author of “The Innovator’s Dilemma”), Joe Jorizzo, or Barack Obama, I found I could do just a bit more if I had them in mind.

On game days, Kobe spoke of arriving at the arena early, long before anyone. He would use the silent, solo time to reflect on what he needed to do perform that night. I tried this last week, arriving at our clinic early, before any patients or staff. I turned the lights on and took a few minutes to think about what we needed to accomplish that day. I previewed patients on my schedule, searched Up to Date for the latest recommendations on a difficult case. I didn’t know Kobe, but I felt like I did.

When I received the text that Kobe Bryant had died, I was actually working on this column. So I decided to change the topic to write about people who inspire me, ironically inspired by him again. May he rest in peace.

Dr. Benabio is director of Healthcare Transformation and chief of dermatology at Kaiser Permanente San Diego. The opinions expressed in this column are his own and do not represent those of Kaiser Permanente. Dr. Benabio is @Dermdoc on Twitter. Write to him at [email protected].

*This article was updated 2/19/2020.

Kobe Bryant knew me. Not personally, of course. I never received an autograph or shook his hand. But once in a while if I was up early enough, I’d run into Kobe at the gym in Newport Beach where he and I both worked out. As he did for all his fans at the gym, he’d make eye contact with me and nod hello. He was always focused on his workout – working with a trainer, never with headphones on. In person, he appeared enormous. Unlike most retired professional athletes, he still was in great shape. No doubt he could have suited up in purple and gold, and played against the Clippers that night if needed.

Being from New England, I never was a Laker fan. But I thought, if Kobe can head to the gym after midnight and take a 1,000 shots to prepare for a game, then I could set my alarm for 4 a.m. and take a few dozen more questions from my First Aid books. Head down, “Kryptonite” cranked on my iPod, I wasn’t going to let anyone in that test room outwork me. Neither did he. I put in the time and, like Kobe in the 2002 conference finals against Sacramento, I crushed it.*

When we moved to California, I followed Kobe and the Lakers until he retired. To be clear, I didn’t aspire to be like him, firstly because I’m slightly shorter than Michael Bloomberg, but also because although accomplished, Kobe made some poor choices at times. Indeed, it seems he might have been kinder and more considerate when he was at the top. But in his retirement he looked to be toiling to make reparations, refocusing his prodigious energy and talent for the benefit of others rather than for just for scoring 81 points. His Rolls Royce was there before mine at the gym, and I was there early. He was still getting up early and now preparing to be a great venture capitalist, podcaster, author, and father to his girls.

Watching him carry kettle bells across the floor one morning, I wondered, do people like Kobe Bryant look to others for inspiration? Or are they are born with an endless supply of it? For me, I seemed to push harder and faster when watching idols pass by. Whether it was Kobe or Clayton Christensen (author of “The Innovator’s Dilemma”), Joe Jorizzo, or Barack Obama, I found I could do just a bit more if I had them in mind.

On game days, Kobe spoke of arriving at the arena early, long before anyone. He would use the silent, solo time to reflect on what he needed to do perform that night. I tried this last week, arriving at our clinic early, before any patients or staff. I turned the lights on and took a few minutes to think about what we needed to accomplish that day. I previewed patients on my schedule, searched Up to Date for the latest recommendations on a difficult case. I didn’t know Kobe, but I felt like I did.

When I received the text that Kobe Bryant had died, I was actually working on this column. So I decided to change the topic to write about people who inspire me, ironically inspired by him again. May he rest in peace.

Dr. Benabio is director of Healthcare Transformation and chief of dermatology at Kaiser Permanente San Diego. The opinions expressed in this column are his own and do not represent those of Kaiser Permanente. Dr. Benabio is @Dermdoc on Twitter. Write to him at [email protected].

*This article was updated 2/19/2020.

Kobe Bryant knew me. Not personally, of course. I never received an autograph or shook his hand. But once in a while if I was up early enough, I’d run into Kobe at the gym in Newport Beach where he and I both worked out. As he did for all his fans at the gym, he’d make eye contact with me and nod hello. He was always focused on his workout – working with a trainer, never with headphones on. In person, he appeared enormous. Unlike most retired professional athletes, he still was in great shape. No doubt he could have suited up in purple and gold, and played against the Clippers that night if needed.

Being from New England, I never was a Laker fan. But I thought, if Kobe can head to the gym after midnight and take a 1,000 shots to prepare for a game, then I could set my alarm for 4 a.m. and take a few dozen more questions from my First Aid books. Head down, “Kryptonite” cranked on my iPod, I wasn’t going to let anyone in that test room outwork me. Neither did he. I put in the time and, like Kobe in the 2002 conference finals against Sacramento, I crushed it.*

When we moved to California, I followed Kobe and the Lakers until he retired. To be clear, I didn’t aspire to be like him, firstly because I’m slightly shorter than Michael Bloomberg, but also because although accomplished, Kobe made some poor choices at times. Indeed, it seems he might have been kinder and more considerate when he was at the top. But in his retirement he looked to be toiling to make reparations, refocusing his prodigious energy and talent for the benefit of others rather than for just for scoring 81 points. His Rolls Royce was there before mine at the gym, and I was there early. He was still getting up early and now preparing to be a great venture capitalist, podcaster, author, and father to his girls.

Watching him carry kettle bells across the floor one morning, I wondered, do people like Kobe Bryant look to others for inspiration? Or are they are born with an endless supply of it? For me, I seemed to push harder and faster when watching idols pass by. Whether it was Kobe or Clayton Christensen (author of “The Innovator’s Dilemma”), Joe Jorizzo, or Barack Obama, I found I could do just a bit more if I had them in mind.

On game days, Kobe spoke of arriving at the arena early, long before anyone. He would use the silent, solo time to reflect on what he needed to do perform that night. I tried this last week, arriving at our clinic early, before any patients or staff. I turned the lights on and took a few minutes to think about what we needed to accomplish that day. I previewed patients on my schedule, searched Up to Date for the latest recommendations on a difficult case. I didn’t know Kobe, but I felt like I did.

When I received the text that Kobe Bryant had died, I was actually working on this column. So I decided to change the topic to write about people who inspire me, ironically inspired by him again. May he rest in peace.

Dr. Benabio is director of Healthcare Transformation and chief of dermatology at Kaiser Permanente San Diego. The opinions expressed in this column are his own and do not represent those of Kaiser Permanente. Dr. Benabio is @Dermdoc on Twitter. Write to him at [email protected].

*This article was updated 2/19/2020.

Survey queries pulmonologists' happiness at work

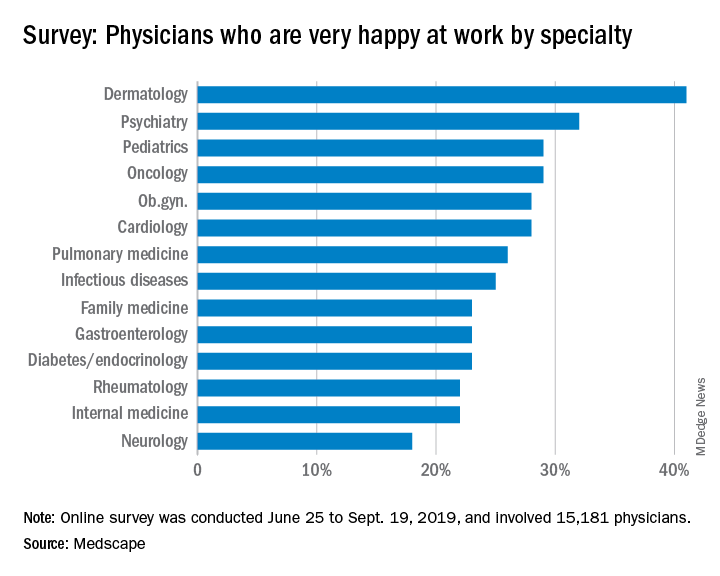

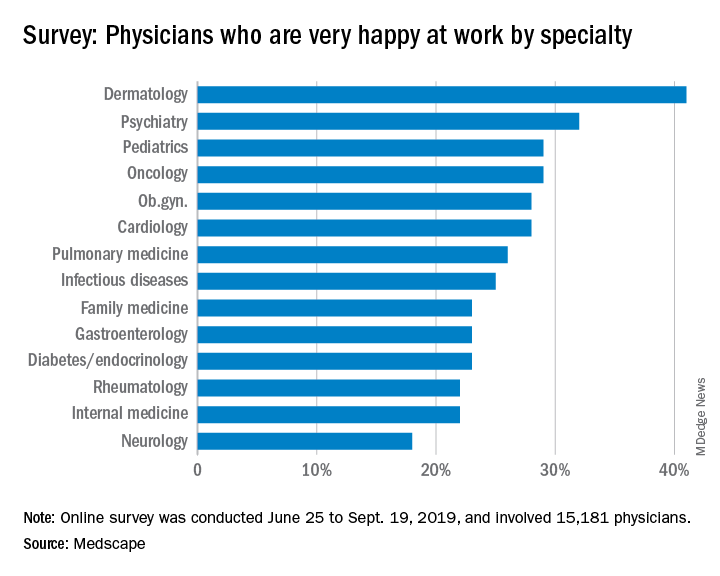

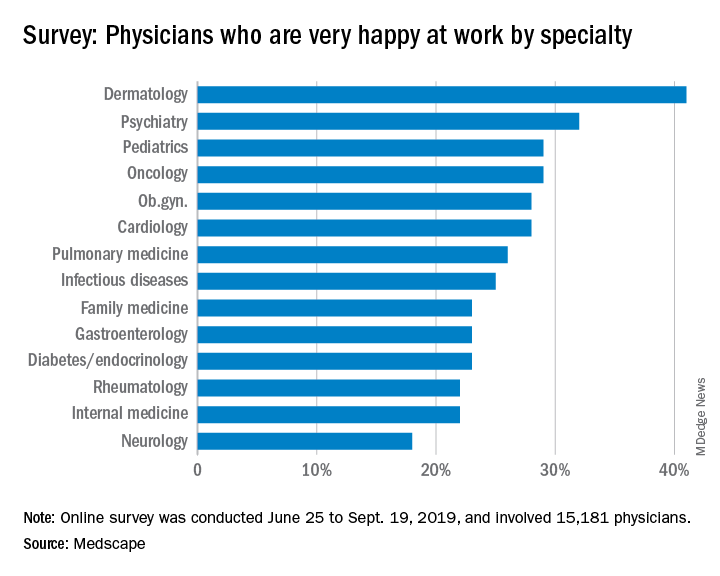

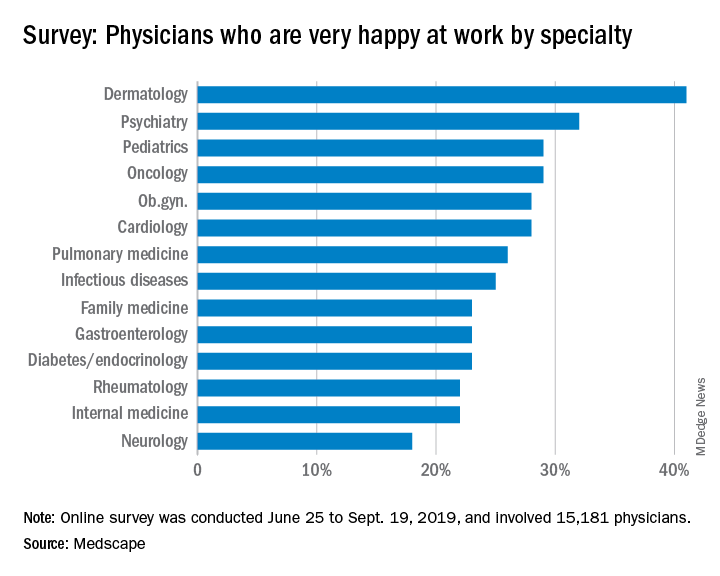

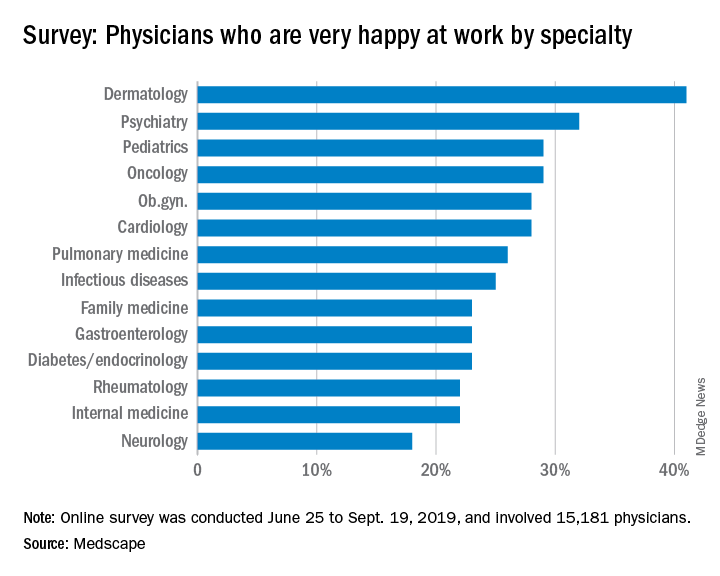

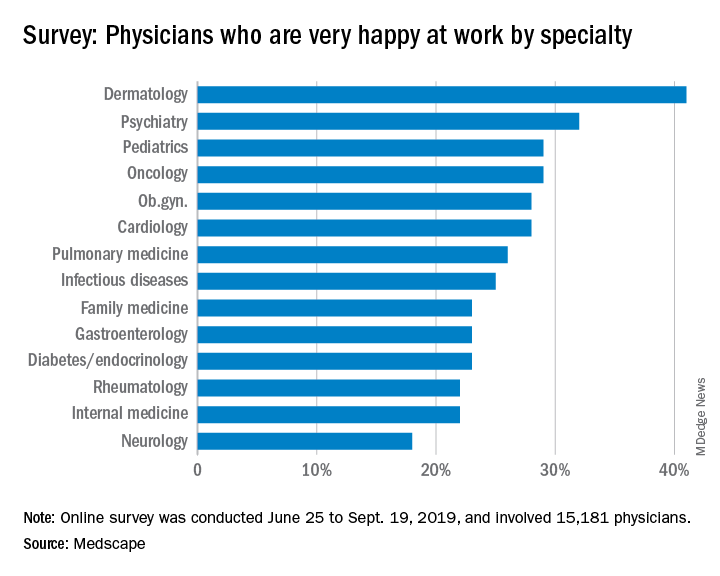

Only 26% of pulmonologists report that they are happy at work, with about twice as many happy outside of work, according to Medscape’s Pulmonologist Lifestyle, Happiness & Burnout Report 2020. Dermatologists are the happiest at work, at 41%, and neurologists are the least happy, at 18%.

According to the report, which surveyed more than 15,000 physicians from various specialties, 29% of pulmonologists report feeling burned out, with 5% reporting feeling depressed and 12% both depressed and burned out. An overabundance of bureaucratic tasks is the lead contributor to burnout (52%), according to pulmonologists, followed by lack of respect from administrators, employers, colleagues, and staff (38%) and spending too many hours at work (35%).

Pulmonologists report that exercise is the biggest way they cope with burnout (47%), compared with neurologists, for example, who ranked it third at 40%. Other ways they deal with burnout include isolating themselves from others (43%) and playing or listening to music (38%).

Among depressed or burned-out pulmonologists, 70% reported not planning to seek professional help or seeking it in the past, while 12% reported currently seeking professional help. Furthermore, almost half of pulmonologists (48%) say they’re unlikely to participate in workplace programs.

When asked for reasons they wouldn’t seek professional help, 60% said they deal with it without professional help and 49% didn’t think their symptoms were severe enough, while 31% were simply too busy.

The slideshow of the full report is available on Medscape.com.

Only 26% of pulmonologists report that they are happy at work, with about twice as many happy outside of work, according to Medscape’s Pulmonologist Lifestyle, Happiness & Burnout Report 2020. Dermatologists are the happiest at work, at 41%, and neurologists are the least happy, at 18%.

According to the report, which surveyed more than 15,000 physicians from various specialties, 29% of pulmonologists report feeling burned out, with 5% reporting feeling depressed and 12% both depressed and burned out. An overabundance of bureaucratic tasks is the lead contributor to burnout (52%), according to pulmonologists, followed by lack of respect from administrators, employers, colleagues, and staff (38%) and spending too many hours at work (35%).

Pulmonologists report that exercise is the biggest way they cope with burnout (47%), compared with neurologists, for example, who ranked it third at 40%. Other ways they deal with burnout include isolating themselves from others (43%) and playing or listening to music (38%).

Among depressed or burned-out pulmonologists, 70% reported not planning to seek professional help or seeking it in the past, while 12% reported currently seeking professional help. Furthermore, almost half of pulmonologists (48%) say they’re unlikely to participate in workplace programs.

When asked for reasons they wouldn’t seek professional help, 60% said they deal with it without professional help and 49% didn’t think their symptoms were severe enough, while 31% were simply too busy.

The slideshow of the full report is available on Medscape.com.

Only 26% of pulmonologists report that they are happy at work, with about twice as many happy outside of work, according to Medscape’s Pulmonologist Lifestyle, Happiness & Burnout Report 2020. Dermatologists are the happiest at work, at 41%, and neurologists are the least happy, at 18%.

According to the report, which surveyed more than 15,000 physicians from various specialties, 29% of pulmonologists report feeling burned out, with 5% reporting feeling depressed and 12% both depressed and burned out. An overabundance of bureaucratic tasks is the lead contributor to burnout (52%), according to pulmonologists, followed by lack of respect from administrators, employers, colleagues, and staff (38%) and spending too many hours at work (35%).

Pulmonologists report that exercise is the biggest way they cope with burnout (47%), compared with neurologists, for example, who ranked it third at 40%. Other ways they deal with burnout include isolating themselves from others (43%) and playing or listening to music (38%).

Among depressed or burned-out pulmonologists, 70% reported not planning to seek professional help or seeking it in the past, while 12% reported currently seeking professional help. Furthermore, almost half of pulmonologists (48%) say they’re unlikely to participate in workplace programs.

When asked for reasons they wouldn’t seek professional help, 60% said they deal with it without professional help and 49% didn’t think their symptoms were severe enough, while 31% were simply too busy.

The slideshow of the full report is available on Medscape.com.

Oncologists are average in terms of happiness, survey suggests

When it comes to physician happiness both in and outside the workplace, oncologists are about average, according to Medscape’s 2020 Lifestyle, Happiness, and Burnout Report.

Oncologists landed in the middle of the pack among all physicians surveyed for happiness. Rheumatologists were most likely to report being very or extremely happy outside of work (60%) and neurologists were least likely to do so (44%), but about half of oncologists (51%) reported being very/extremely happy outside of work. For happiness at work, dermatologists topped the list (41%), neurologists came in last (18%), and oncologists remained in the middle (29%).

Oncologists were average when it came to burnout as well, matching the rate of overall physicians. Specifically, 32% of oncologists were burned out, 4% were depressed, and 9% were both burned out and depressed.

The most commonly reported factors contributing to burnout among oncologists were an overabundance of bureaucratic tasks (74%), spending too many hours at work (42%), and a lack of respect from colleagues in the workplace (36%).

Exercise was the most commonly reported way oncologists dealt with burnout (51%), followed by talking with family and friends (49%), and isolating themselves from others (38%). In addition, 57% of oncologists took 3-4 weeks’ vacation, compared with 44% of physicians overall; 29% of oncologists took less than 3 weeks’ vacation.

About 18% of oncologists said they had contemplated suicide, and 1% said they’d attempted it; 72% said they’d never had thoughts of suicide. Just under one-quarter of oncologists said they were currently seeking professional help or were planning to seek help for symptoms of depression and/or burnout.

“The survey results are concerning on several levels,” Maurie Markman, MD, of Cancer Treatment Centers of America, Philadelphia, said in an interview.

“First, the data suggest a considerable number of oncologists are simply burned out from the day-to-day bureaucracy (paperwork, etc.) of medical practice, which has absolutely nothing to do with the actual care delivered. This likely impacts the willingness to continue in this role. Second, one must be concerned for the future recruitment of physicians to become clinical oncologists. And finally, one must wonder about the impact of these concerning figures on the quality of care being provided to cancer patients.”

This survey was conducted from June 25 to Sept. 19, 2019, and involved 15,181 physicians. Oncologists made up 1% of the survey pool.

When it comes to physician happiness both in and outside the workplace, oncologists are about average, according to Medscape’s 2020 Lifestyle, Happiness, and Burnout Report.

Oncologists landed in the middle of the pack among all physicians surveyed for happiness. Rheumatologists were most likely to report being very or extremely happy outside of work (60%) and neurologists were least likely to do so (44%), but about half of oncologists (51%) reported being very/extremely happy outside of work. For happiness at work, dermatologists topped the list (41%), neurologists came in last (18%), and oncologists remained in the middle (29%).

Oncologists were average when it came to burnout as well, matching the rate of overall physicians. Specifically, 32% of oncologists were burned out, 4% were depressed, and 9% were both burned out and depressed.

The most commonly reported factors contributing to burnout among oncologists were an overabundance of bureaucratic tasks (74%), spending too many hours at work (42%), and a lack of respect from colleagues in the workplace (36%).

Exercise was the most commonly reported way oncologists dealt with burnout (51%), followed by talking with family and friends (49%), and isolating themselves from others (38%). In addition, 57% of oncologists took 3-4 weeks’ vacation, compared with 44% of physicians overall; 29% of oncologists took less than 3 weeks’ vacation.

About 18% of oncologists said they had contemplated suicide, and 1% said they’d attempted it; 72% said they’d never had thoughts of suicide. Just under one-quarter of oncologists said they were currently seeking professional help or were planning to seek help for symptoms of depression and/or burnout.

“The survey results are concerning on several levels,” Maurie Markman, MD, of Cancer Treatment Centers of America, Philadelphia, said in an interview.

“First, the data suggest a considerable number of oncologists are simply burned out from the day-to-day bureaucracy (paperwork, etc.) of medical practice, which has absolutely nothing to do with the actual care delivered. This likely impacts the willingness to continue in this role. Second, one must be concerned for the future recruitment of physicians to become clinical oncologists. And finally, one must wonder about the impact of these concerning figures on the quality of care being provided to cancer patients.”

This survey was conducted from June 25 to Sept. 19, 2019, and involved 15,181 physicians. Oncologists made up 1% of the survey pool.

When it comes to physician happiness both in and outside the workplace, oncologists are about average, according to Medscape’s 2020 Lifestyle, Happiness, and Burnout Report.

Oncologists landed in the middle of the pack among all physicians surveyed for happiness. Rheumatologists were most likely to report being very or extremely happy outside of work (60%) and neurologists were least likely to do so (44%), but about half of oncologists (51%) reported being very/extremely happy outside of work. For happiness at work, dermatologists topped the list (41%), neurologists came in last (18%), and oncologists remained in the middle (29%).

Oncologists were average when it came to burnout as well, matching the rate of overall physicians. Specifically, 32% of oncologists were burned out, 4% were depressed, and 9% were both burned out and depressed.

The most commonly reported factors contributing to burnout among oncologists were an overabundance of bureaucratic tasks (74%), spending too many hours at work (42%), and a lack of respect from colleagues in the workplace (36%).

Exercise was the most commonly reported way oncologists dealt with burnout (51%), followed by talking with family and friends (49%), and isolating themselves from others (38%). In addition, 57% of oncologists took 3-4 weeks’ vacation, compared with 44% of physicians overall; 29% of oncologists took less than 3 weeks’ vacation.

About 18% of oncologists said they had contemplated suicide, and 1% said they’d attempted it; 72% said they’d never had thoughts of suicide. Just under one-quarter of oncologists said they were currently seeking professional help or were planning to seek help for symptoms of depression and/or burnout.

“The survey results are concerning on several levels,” Maurie Markman, MD, of Cancer Treatment Centers of America, Philadelphia, said in an interview.

“First, the data suggest a considerable number of oncologists are simply burned out from the day-to-day bureaucracy (paperwork, etc.) of medical practice, which has absolutely nothing to do with the actual care delivered. This likely impacts the willingness to continue in this role. Second, one must be concerned for the future recruitment of physicians to become clinical oncologists. And finally, one must wonder about the impact of these concerning figures on the quality of care being provided to cancer patients.”

This survey was conducted from June 25 to Sept. 19, 2019, and involved 15,181 physicians. Oncologists made up 1% of the survey pool.

Trump seeks to cut NIH, CDC budgets, some Medicare spending

The Trump administration on Feb. 10 argued for cutting spending for a federal agency at the forefront of the efforts to combat the coronavirus, while also seeking to slow spending in certain parts of the Medicare and Medicaid programs.

President Donald Trump presented his fiscal 2021 request to Congress for refilling the coffers of federal agencies. In any administration, an annual budget serves only as a political blueprint, as the White House document itself makes no changes in federal spending.

In Mr. Trump’s case, several of his requests for agencies within the Department of Health & Human Services run counter to recent budget trends. Republicans and Democrats in Congress have worked together in recent years to increase budgets for major federal health agencies.

But Mr. Trump asked Congress to cut annual budget authority for the National Institute of Allergy and Infectious Diseases by $430 million to $5.446 billion for fiscal 2021. In contrast, Congress has raised the annual budget for NIAID, a key agency in combating the coronavirus, from $5.545 billion in fiscal 2019 to $5.876 billion in fiscal 2020, which began in October, according to an HHS summary of Mr. Trump’s request.

For the Centers for Disease Control and Prevention, which is central to the battle against the coronavirus, Mr. Trump proposed a drop in discretionary funding to $5.627 billion. In contrast, Congress raised the CDC budget from $6.544 billion in fiscal 2019 to $6.917 in fiscal 2020.

Mr. Trump also wants to cut $559 million from the budget of the National Cancer Institute, dropping it to $5.881 billion in fiscal 2021. In contrast, Congress raised NCI’s budget from $6.121 billion in fiscal 2019 to $6.440 billion in fiscal 2020.

Mr. Trump requested a $2.6 billion reduction in the National Institutes of Health’s total discretionary budget, seeking to drop it to $37.70 billion. In contrast, Congress raised NIH’s budget from $37.887 in fiscal 2019 to $40.304 billion in fiscal 2020.

Mr. Trump’s budget proposal also includes an estimate of $152 billion in savings over a decade for Medicaid through the implementation of what the administration calls “community engagement” requirements.

The Trump administration has been at odds with Democrats for years about whether work requirements should be attached to Medicaid. “Well-designed community engagement incentives have great potential to improve health and well-being while empowering beneficiaries to rise out of poverty,” HHS said in a budget document.

Yet researchers last year reported that Arkansas’ attempt to attach work requirements to Medicaid caused almost 17,000 adults to lose this health care coverage within the first 6 months, and there was no significant difference in employment.

The researchers say this loss of coverage was partly a result of bureaucratic obstacles and confusion about the new rules. In June 2018, Arkansas became the first state to implement work requirements for Medicaid, Benjamin D. Sommers, MD, PhD, of the Harvard T.H. Chan School of Public Health, Boston, and colleagues wrote in the New England Journal of Medicine (2019 Sep 12;381[11]:1073-82).

Budget ‘would thwart’ progress

A few medical groups on Monday quickly criticized Mr. Trump’s proposals.

“In a time where our nation continues to face significant public health challenges — including 2019 novel coronavirus, climate change, gun violence, and costly chronic diseases such as heart disease and cancer – the administration should be investing more resources in better health, not cutting federal health budgets,” said Georges C. Benjamin, MD, executive director of the American Public Health Association, in a statement.

David J. Skorton, MD, chief executive and president of the Association of American Medical Colleges (AAMC) also urged increased investment in fighting disease.

“We must continue the bipartisan budget trajectory set forth by Congress over the last several years, not reverse course,” Dr. Skorton said in a statement.

Mr. Trump’s proposed cuts in medical research “would thwart scientific progress on strategies to prevent, diagnose, treat, and cure medical conditions that affect countless patients nationwide,” he said.

In total, the new 2021 appropriations for HHS would fall by $9.46 billion to $85.667 billion under Mr. Trump’s proposal. Appropriations, also called discretionary budget authority, represents the operating budgets for federal agencies. These are decided through annual spending bills.

Congress has separate sets of laws for handling payments the federal government makes through Medicare and Medicaid. These are known as mandatory spending.

‘Untenable cuts’

AAMC’s Dr. Skorton also objected to what he termed Mr. Trump’s bid “to reduce and consolidate Medicare, Medicaid, and children’s hospital graduate medical education into a single grant program.”

This would force teaching hospitals to absorb $52 billion in “untenable cuts,” he said.

“The proposal ignores the intent of the Medicare GME program, which is to ensure an adequate physician workforce to care for Medicare beneficiaries and support the critical patient care missions of America’s teaching hospitals,” Dr. Skorton said.

The budget also seeks cuts to Medicaid, which come in addition to the administration’s “recent proposals to scale back Medicaid coverage,” Dr. Skorton said.

“More than 26% of all Medicaid hospitalizations occur at AAMC-member teaching hospitals, even though these institutions represent only 5% of all hospitals,” Dr. Skorton said. “Each of the administration’s proposals on their own would be devastating for patients – and combined, they would be disastrous.”

Rick Pollack, the chief executive and president of the American Hospital Association, described Mr. Trump’s fiscal 2021 proposal as another bid to undermine medical care in the United States.

“Every year, we adapt to a constantly changing environment, but every year, the administration aims to gut our nation’s health care infrastructure,” Mr. Pollack said in a statement.

In it, he noted that about one in five people in America depend on Medicaid, with children accounting for a large proportion of those covered by the state-federal program.

“The budget’s proposal on Medicaid financing and service delivery would cut hundreds of billions of dollars from the Medicaid program annually,” Mr. Pollack said.

He also objected to “hundreds of billions of proposed reductions to Medicare” endorsed by Mr. Trump.

Medical malpractice overhaul

The Trump administration also offered many suggestions for changing federal laws to reduce health care spending. Among these was a proposed overhaul of the approach to medical malpractice cases.

The president’s budget proposal estimates $40 billion in savings over a decade from steps to limit medical liability, according to a report from the Office of Management and Budget (OMB).

“The current medical liability system does not work for patients or providers, nor does it promote high-quality, evidence-based care,” OMB said. “Providers practice with a threat of potentially frivolous lawsuits, and injured patients often do not receive just compensation for their injuries.”

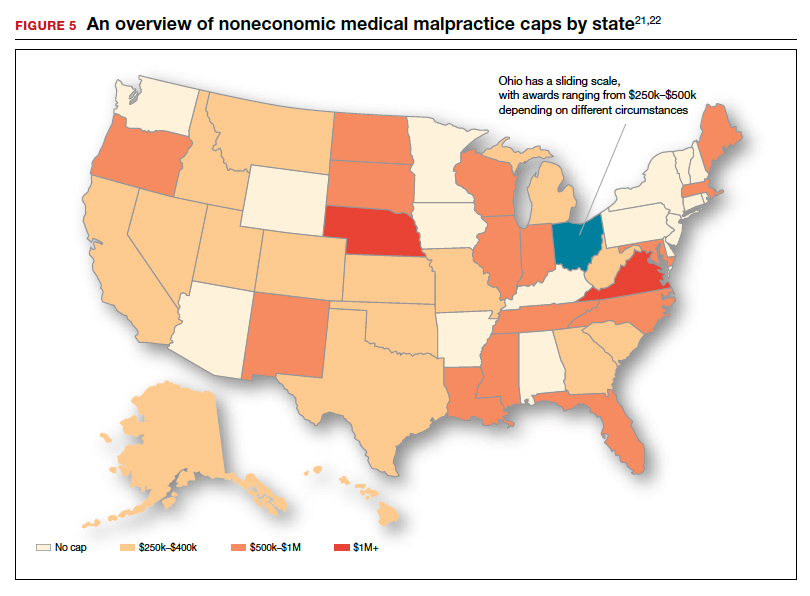

Mr. Trump’s fiscal 2021 budget calls for a cap on noneconomic damage awards of $250,000, which would increase with inflation over time, and a 3-year statute of limitations. Under this plan, courts could also modify attorney’s fee arrangements. HHS could provide guidance to states on how to create expert panels and administrative health care tribunals to review medical liability.

These steps would lead to lower health care spending, with clinicians dropping “defensive medicine practices,” OMB said. That would benefit the Medicare and Medicaid programs as well as lowering costs of health insurance in general.

Mr. Trump’s fiscal 2021 budget also includes a series of proposals for Medicare that it estimates would, in aggregate, save $755.5 billion over a decade.

Site-neutral policy

A large chunk of the estimated Medicare savings in Mr. Trump’s fiscal 2021 health budget would come from lowering payments to hospitals for services provided in their outpatient and physician offices.

In the fiscal 2021 proposal, HHS noted that “Medicare generally pays on-campus hospital outpatient departments substantially more than physician offices for the same services.”

Mr. Trump’s budget proposal seeks a more expansive shift to what’s called a “site-neutral” payment for services delivered in hospital outpatient programs or physician offices. This would bring these payments more in line with those made to independent physician practices.

“This proposal would eliminate the often significant disparity between what Medicare pays in these different settings for the same services,” HHS said in the budget summary.

HHS estimated this change in policy would generate $117.2 billion in savings over a decade. Combined with saving from medical malpractice reforms, the Trump administration estimates these two moves combined could save about $164 billion over a decade.

The site-neutral policy has been a legal battleground, with hospital and physician groups winning a round last year.

Another Medicare proposal included in Mr. Trump’s fiscal 2021 budget homes in on this issue for cases where a hospital owns a physician office. Medicare now pays most off-campus hospital outpatient departments higher rates than the program’s physician fee schedule dictates for the same services.

Switching to a site-neutral policy for these hospital-owned physician offices would result in $47.2 billion in savings over a decade, HHS said in the budget document.

This article first appeared on Medscape.com.

The Trump administration on Feb. 10 argued for cutting spending for a federal agency at the forefront of the efforts to combat the coronavirus, while also seeking to slow spending in certain parts of the Medicare and Medicaid programs.

President Donald Trump presented his fiscal 2021 request to Congress for refilling the coffers of federal agencies. In any administration, an annual budget serves only as a political blueprint, as the White House document itself makes no changes in federal spending.

In Mr. Trump’s case, several of his requests for agencies within the Department of Health & Human Services run counter to recent budget trends. Republicans and Democrats in Congress have worked together in recent years to increase budgets for major federal health agencies.

But Mr. Trump asked Congress to cut annual budget authority for the National Institute of Allergy and Infectious Diseases by $430 million to $5.446 billion for fiscal 2021. In contrast, Congress has raised the annual budget for NIAID, a key agency in combating the coronavirus, from $5.545 billion in fiscal 2019 to $5.876 billion in fiscal 2020, which began in October, according to an HHS summary of Mr. Trump’s request.

For the Centers for Disease Control and Prevention, which is central to the battle against the coronavirus, Mr. Trump proposed a drop in discretionary funding to $5.627 billion. In contrast, Congress raised the CDC budget from $6.544 billion in fiscal 2019 to $6.917 in fiscal 2020.

Mr. Trump also wants to cut $559 million from the budget of the National Cancer Institute, dropping it to $5.881 billion in fiscal 2021. In contrast, Congress raised NCI’s budget from $6.121 billion in fiscal 2019 to $6.440 billion in fiscal 2020.

Mr. Trump requested a $2.6 billion reduction in the National Institutes of Health’s total discretionary budget, seeking to drop it to $37.70 billion. In contrast, Congress raised NIH’s budget from $37.887 in fiscal 2019 to $40.304 billion in fiscal 2020.

Mr. Trump’s budget proposal also includes an estimate of $152 billion in savings over a decade for Medicaid through the implementation of what the administration calls “community engagement” requirements.

The Trump administration has been at odds with Democrats for years about whether work requirements should be attached to Medicaid. “Well-designed community engagement incentives have great potential to improve health and well-being while empowering beneficiaries to rise out of poverty,” HHS said in a budget document.

Yet researchers last year reported that Arkansas’ attempt to attach work requirements to Medicaid caused almost 17,000 adults to lose this health care coverage within the first 6 months, and there was no significant difference in employment.

The researchers say this loss of coverage was partly a result of bureaucratic obstacles and confusion about the new rules. In June 2018, Arkansas became the first state to implement work requirements for Medicaid, Benjamin D. Sommers, MD, PhD, of the Harvard T.H. Chan School of Public Health, Boston, and colleagues wrote in the New England Journal of Medicine (2019 Sep 12;381[11]:1073-82).

Budget ‘would thwart’ progress

A few medical groups on Monday quickly criticized Mr. Trump’s proposals.

“In a time where our nation continues to face significant public health challenges — including 2019 novel coronavirus, climate change, gun violence, and costly chronic diseases such as heart disease and cancer – the administration should be investing more resources in better health, not cutting federal health budgets,” said Georges C. Benjamin, MD, executive director of the American Public Health Association, in a statement.

David J. Skorton, MD, chief executive and president of the Association of American Medical Colleges (AAMC) also urged increased investment in fighting disease.

“We must continue the bipartisan budget trajectory set forth by Congress over the last several years, not reverse course,” Dr. Skorton said in a statement.

Mr. Trump’s proposed cuts in medical research “would thwart scientific progress on strategies to prevent, diagnose, treat, and cure medical conditions that affect countless patients nationwide,” he said.

In total, the new 2021 appropriations for HHS would fall by $9.46 billion to $85.667 billion under Mr. Trump’s proposal. Appropriations, also called discretionary budget authority, represents the operating budgets for federal agencies. These are decided through annual spending bills.

Congress has separate sets of laws for handling payments the federal government makes through Medicare and Medicaid. These are known as mandatory spending.

‘Untenable cuts’

AAMC’s Dr. Skorton also objected to what he termed Mr. Trump’s bid “to reduce and consolidate Medicare, Medicaid, and children’s hospital graduate medical education into a single grant program.”

This would force teaching hospitals to absorb $52 billion in “untenable cuts,” he said.

“The proposal ignores the intent of the Medicare GME program, which is to ensure an adequate physician workforce to care for Medicare beneficiaries and support the critical patient care missions of America’s teaching hospitals,” Dr. Skorton said.

The budget also seeks cuts to Medicaid, which come in addition to the administration’s “recent proposals to scale back Medicaid coverage,” Dr. Skorton said.

“More than 26% of all Medicaid hospitalizations occur at AAMC-member teaching hospitals, even though these institutions represent only 5% of all hospitals,” Dr. Skorton said. “Each of the administration’s proposals on their own would be devastating for patients – and combined, they would be disastrous.”

Rick Pollack, the chief executive and president of the American Hospital Association, described Mr. Trump’s fiscal 2021 proposal as another bid to undermine medical care in the United States.

“Every year, we adapt to a constantly changing environment, but every year, the administration aims to gut our nation’s health care infrastructure,” Mr. Pollack said in a statement.

In it, he noted that about one in five people in America depend on Medicaid, with children accounting for a large proportion of those covered by the state-federal program.

“The budget’s proposal on Medicaid financing and service delivery would cut hundreds of billions of dollars from the Medicaid program annually,” Mr. Pollack said.

He also objected to “hundreds of billions of proposed reductions to Medicare” endorsed by Mr. Trump.

Medical malpractice overhaul

The Trump administration also offered many suggestions for changing federal laws to reduce health care spending. Among these was a proposed overhaul of the approach to medical malpractice cases.

The president’s budget proposal estimates $40 billion in savings over a decade from steps to limit medical liability, according to a report from the Office of Management and Budget (OMB).

“The current medical liability system does not work for patients or providers, nor does it promote high-quality, evidence-based care,” OMB said. “Providers practice with a threat of potentially frivolous lawsuits, and injured patients often do not receive just compensation for their injuries.”

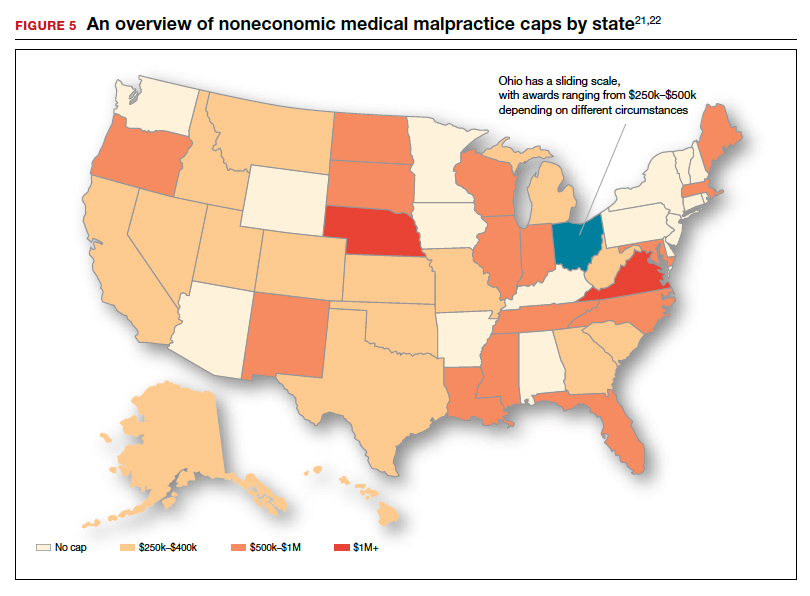

Mr. Trump’s fiscal 2021 budget calls for a cap on noneconomic damage awards of $250,000, which would increase with inflation over time, and a 3-year statute of limitations. Under this plan, courts could also modify attorney’s fee arrangements. HHS could provide guidance to states on how to create expert panels and administrative health care tribunals to review medical liability.

These steps would lead to lower health care spending, with clinicians dropping “defensive medicine practices,” OMB said. That would benefit the Medicare and Medicaid programs as well as lowering costs of health insurance in general.

Mr. Trump’s fiscal 2021 budget also includes a series of proposals for Medicare that it estimates would, in aggregate, save $755.5 billion over a decade.

Site-neutral policy

A large chunk of the estimated Medicare savings in Mr. Trump’s fiscal 2021 health budget would come from lowering payments to hospitals for services provided in their outpatient and physician offices.

In the fiscal 2021 proposal, HHS noted that “Medicare generally pays on-campus hospital outpatient departments substantially more than physician offices for the same services.”

Mr. Trump’s budget proposal seeks a more expansive shift to what’s called a “site-neutral” payment for services delivered in hospital outpatient programs or physician offices. This would bring these payments more in line with those made to independent physician practices.

“This proposal would eliminate the often significant disparity between what Medicare pays in these different settings for the same services,” HHS said in the budget summary.

HHS estimated this change in policy would generate $117.2 billion in savings over a decade. Combined with saving from medical malpractice reforms, the Trump administration estimates these two moves combined could save about $164 billion over a decade.

The site-neutral policy has been a legal battleground, with hospital and physician groups winning a round last year.

Another Medicare proposal included in Mr. Trump’s fiscal 2021 budget homes in on this issue for cases where a hospital owns a physician office. Medicare now pays most off-campus hospital outpatient departments higher rates than the program’s physician fee schedule dictates for the same services.

Switching to a site-neutral policy for these hospital-owned physician offices would result in $47.2 billion in savings over a decade, HHS said in the budget document.

This article first appeared on Medscape.com.

The Trump administration on Feb. 10 argued for cutting spending for a federal agency at the forefront of the efforts to combat the coronavirus, while also seeking to slow spending in certain parts of the Medicare and Medicaid programs.

President Donald Trump presented his fiscal 2021 request to Congress for refilling the coffers of federal agencies. In any administration, an annual budget serves only as a political blueprint, as the White House document itself makes no changes in federal spending.

In Mr. Trump’s case, several of his requests for agencies within the Department of Health & Human Services run counter to recent budget trends. Republicans and Democrats in Congress have worked together in recent years to increase budgets for major federal health agencies.

But Mr. Trump asked Congress to cut annual budget authority for the National Institute of Allergy and Infectious Diseases by $430 million to $5.446 billion for fiscal 2021. In contrast, Congress has raised the annual budget for NIAID, a key agency in combating the coronavirus, from $5.545 billion in fiscal 2019 to $5.876 billion in fiscal 2020, which began in October, according to an HHS summary of Mr. Trump’s request.

For the Centers for Disease Control and Prevention, which is central to the battle against the coronavirus, Mr. Trump proposed a drop in discretionary funding to $5.627 billion. In contrast, Congress raised the CDC budget from $6.544 billion in fiscal 2019 to $6.917 in fiscal 2020.

Mr. Trump also wants to cut $559 million from the budget of the National Cancer Institute, dropping it to $5.881 billion in fiscal 2021. In contrast, Congress raised NCI’s budget from $6.121 billion in fiscal 2019 to $6.440 billion in fiscal 2020.

Mr. Trump requested a $2.6 billion reduction in the National Institutes of Health’s total discretionary budget, seeking to drop it to $37.70 billion. In contrast, Congress raised NIH’s budget from $37.887 in fiscal 2019 to $40.304 billion in fiscal 2020.

Mr. Trump’s budget proposal also includes an estimate of $152 billion in savings over a decade for Medicaid through the implementation of what the administration calls “community engagement” requirements.

The Trump administration has been at odds with Democrats for years about whether work requirements should be attached to Medicaid. “Well-designed community engagement incentives have great potential to improve health and well-being while empowering beneficiaries to rise out of poverty,” HHS said in a budget document.

Yet researchers last year reported that Arkansas’ attempt to attach work requirements to Medicaid caused almost 17,000 adults to lose this health care coverage within the first 6 months, and there was no significant difference in employment.

The researchers say this loss of coverage was partly a result of bureaucratic obstacles and confusion about the new rules. In June 2018, Arkansas became the first state to implement work requirements for Medicaid, Benjamin D. Sommers, MD, PhD, of the Harvard T.H. Chan School of Public Health, Boston, and colleagues wrote in the New England Journal of Medicine (2019 Sep 12;381[11]:1073-82).

Budget ‘would thwart’ progress

A few medical groups on Monday quickly criticized Mr. Trump’s proposals.

“In a time where our nation continues to face significant public health challenges — including 2019 novel coronavirus, climate change, gun violence, and costly chronic diseases such as heart disease and cancer – the administration should be investing more resources in better health, not cutting federal health budgets,” said Georges C. Benjamin, MD, executive director of the American Public Health Association, in a statement.

David J. Skorton, MD, chief executive and president of the Association of American Medical Colleges (AAMC) also urged increased investment in fighting disease.

“We must continue the bipartisan budget trajectory set forth by Congress over the last several years, not reverse course,” Dr. Skorton said in a statement.

Mr. Trump’s proposed cuts in medical research “would thwart scientific progress on strategies to prevent, diagnose, treat, and cure medical conditions that affect countless patients nationwide,” he said.

In total, the new 2021 appropriations for HHS would fall by $9.46 billion to $85.667 billion under Mr. Trump’s proposal. Appropriations, also called discretionary budget authority, represents the operating budgets for federal agencies. These are decided through annual spending bills.

Congress has separate sets of laws for handling payments the federal government makes through Medicare and Medicaid. These are known as mandatory spending.

‘Untenable cuts’

AAMC’s Dr. Skorton also objected to what he termed Mr. Trump’s bid “to reduce and consolidate Medicare, Medicaid, and children’s hospital graduate medical education into a single grant program.”

This would force teaching hospitals to absorb $52 billion in “untenable cuts,” he said.

“The proposal ignores the intent of the Medicare GME program, which is to ensure an adequate physician workforce to care for Medicare beneficiaries and support the critical patient care missions of America’s teaching hospitals,” Dr. Skorton said.

The budget also seeks cuts to Medicaid, which come in addition to the administration’s “recent proposals to scale back Medicaid coverage,” Dr. Skorton said.

“More than 26% of all Medicaid hospitalizations occur at AAMC-member teaching hospitals, even though these institutions represent only 5% of all hospitals,” Dr. Skorton said. “Each of the administration’s proposals on their own would be devastating for patients – and combined, they would be disastrous.”

Rick Pollack, the chief executive and president of the American Hospital Association, described Mr. Trump’s fiscal 2021 proposal as another bid to undermine medical care in the United States.

“Every year, we adapt to a constantly changing environment, but every year, the administration aims to gut our nation’s health care infrastructure,” Mr. Pollack said in a statement.

In it, he noted that about one in five people in America depend on Medicaid, with children accounting for a large proportion of those covered by the state-federal program.

“The budget’s proposal on Medicaid financing and service delivery would cut hundreds of billions of dollars from the Medicaid program annually,” Mr. Pollack said.

He also objected to “hundreds of billions of proposed reductions to Medicare” endorsed by Mr. Trump.

Medical malpractice overhaul

The Trump administration also offered many suggestions for changing federal laws to reduce health care spending. Among these was a proposed overhaul of the approach to medical malpractice cases.

The president’s budget proposal estimates $40 billion in savings over a decade from steps to limit medical liability, according to a report from the Office of Management and Budget (OMB).

“The current medical liability system does not work for patients or providers, nor does it promote high-quality, evidence-based care,” OMB said. “Providers practice with a threat of potentially frivolous lawsuits, and injured patients often do not receive just compensation for their injuries.”

Mr. Trump’s fiscal 2021 budget calls for a cap on noneconomic damage awards of $250,000, which would increase with inflation over time, and a 3-year statute of limitations. Under this plan, courts could also modify attorney’s fee arrangements. HHS could provide guidance to states on how to create expert panels and administrative health care tribunals to review medical liability.

These steps would lead to lower health care spending, with clinicians dropping “defensive medicine practices,” OMB said. That would benefit the Medicare and Medicaid programs as well as lowering costs of health insurance in general.

Mr. Trump’s fiscal 2021 budget also includes a series of proposals for Medicare that it estimates would, in aggregate, save $755.5 billion over a decade.

Site-neutral policy

A large chunk of the estimated Medicare savings in Mr. Trump’s fiscal 2021 health budget would come from lowering payments to hospitals for services provided in their outpatient and physician offices.

In the fiscal 2021 proposal, HHS noted that “Medicare generally pays on-campus hospital outpatient departments substantially more than physician offices for the same services.”

Mr. Trump’s budget proposal seeks a more expansive shift to what’s called a “site-neutral” payment for services delivered in hospital outpatient programs or physician offices. This would bring these payments more in line with those made to independent physician practices.

“This proposal would eliminate the often significant disparity between what Medicare pays in these different settings for the same services,” HHS said in the budget summary.

HHS estimated this change in policy would generate $117.2 billion in savings over a decade. Combined with saving from medical malpractice reforms, the Trump administration estimates these two moves combined could save about $164 billion over a decade.

The site-neutral policy has been a legal battleground, with hospital and physician groups winning a round last year.

Another Medicare proposal included in Mr. Trump’s fiscal 2021 budget homes in on this issue for cases where a hospital owns a physician office. Medicare now pays most off-campus hospital outpatient departments higher rates than the program’s physician fee schedule dictates for the same services.

Switching to a site-neutral policy for these hospital-owned physician offices would result in $47.2 billion in savings over a decade, HHS said in the budget document.

This article first appeared on Medscape.com.

What you absolutely need to know about tail coverage

A 28-year-old pediatrician working in a large group practice in California found a new job in Pennsylvania. The job would allow her to live with her husband, who was a nonphysician.

On her last day of work at the California job, the practice’s office manager asked her, “Do you know about the tail coverage?”

He explained that it is malpractice insurance for any cases filed against her after leaving the job. Without it, he said, she would not be covered for those claims.

The physician (who asked not to be identified) had very little savings and suddenly had to pay a five-figure bill for tail coverage. To provide the extra malpractice coverage, she and her husband had to use savings they’d set aside to buy a house.

Getting tail coverage, known formally as an extended reporting endorsement, often comes as a complete and costly surprise for new doctors, says Dennis Hursh, Esq, a health care attorney based in Middletown, Penn., who deals with physicians’ employment contracts.

“Having to pay for a tail can disrupt lives,” Hursh said. “A tail can cost about one third of a young doctor’s salary. If you don’t feel you can afford to pay that, you may be forced to stay with a job you don’t like.”

Most medical residents don’t think about tail coverage until they apply for their first job, but last year, residents at Hahnemann University Hospital in Philadelphia got a painful early lesson.

In the summer, the hospital went out of business because of financial problems. Hundreds of medical residents and fellows not only were forced to find new programs but also had to prepare to buy tail coverage for their training years at Hahnemann.

“All the guarantees have been yanked out from under us,” said Tom Sibert, MD, a former internal medicine resident at the hospital, who is now finishing his training in California. “Residents don’t have that kind of money.”

Hahnemann trainees have asked the judge in the bankruptcy proceedings to put them ahead of other creditors and to ensure their tail coverage is paid. As of early February, the issue had not been resolved.

Meanwhile, Sibert and many other former trainees were trying to get quotes for purchasing tail coverage. They have been shocked by the amounts they would have to pay.

How tail coverage works

Medical malpractice tail coverage protects from incidents that took place when doctors were at their previous jobs but that later resulted in malpractice claims after they had left that employer.

One type of malpractice insurance, an occurrence policy, does not need tail coverage. Occurrence policies cover any incident that occurred when the policy was in force, no matter when a claim was filed – even if it is filed many years after the claims-filing period of the policy ends.

However, most malpractice policies – as many as 85%, according to one estimate – are claims-made policies. Claims-made policies are more much common because they’re significantly less expensive than occurrence policies.

Under a claims-made policy, coverage for malpractice claims completely stops when the policy ends. It does not cover incidents that occurred when the policy was in force but for which the patients later filed claims, as the occurrence policy does. So a tail is needed to cover these claims.

Physicians in all stages of their career may need tail coverage when they leave a job, change malpractice carriers, or retire.

But young physicians often have greater problems with tail coverage, for several reasons. They tend to be employed, and as such, they cannot choose the coverage they want. As a result, they most likely get claims-made coverage. In addition, the job turnover tends to be higher for these doctors. When leaving a job, the tail comes into play. More than half of new physicians leave their first job within 5 years, and of those, more than half leave after only 1 or 2 years.

Young physicians have no experience with tails and may not even know what they are. “In training, malpractice coverage is not a problem because the program handles it,” Mr. Hursh said. Accreditation standards require that teaching hospitals buy coverage, including a tail when residents leave.

So when young physicians are offered their first job and are handed an employment contract to sign, they may not even look for tail coverage, says Mr. Hursh, who wrote The Final Hurdle, a Physician’s Guide to Negotiating a Fair Employment Agreement. Instead, “young physicians tend to focus on issues like salary, benefits, and signing bonuses,” he said.

Mr. Hursh says the tail is usually the most expensive potential cost in the contract.

There’s no easy way to get out of paying the tail coverage once it is enshrined in the contract. The full tail can cost five or even six figures, depending on the physicians’ specialty, the local malpractice premium, and the physician’s own claims history.

Can you negotiate your tail coverage?

Negotiating tail coverage in the employment contract involves some familiarity with medical malpractice insurance and a close reading of the contract. First, you have to determine that the employer is providing claims-made coverage, which would require a tail if you leave. Then you have to determine whether the employer will pay for the tail coverage.

Often, the contract does not even mention tail coverage. “It could merely state that the practice will be responsible for malpractice coverage while you are working there,” Mr. Hursh said. Although it never specifies the tail, this language indicates that you will be paying for it, he says.

Therefore, it’s wise to have a conversation with your prospective employer about the tail. “Some new doctors never ask the question ‘What happens if I leave? Do I get tail coverage?’ ” said Israel Teitelbaum, an attorney who is chairman of Contemporary Insurance Services, an insurance broker in Silver Spring, Md.

Talking about the tail, however, can be a touchy subject for many young doctors applying for their first job. The tail matters only if you leave the job, and you may not want to imply that you would ever want to leave. Too much money, however, is on the line for you not to ask, Mr. Teitelbaum said.

Even if the employer verbally agrees to pay for the tail coverage, experts advise that you try to get the employer’s commitment in writing and have it put it into the contract.

Getting the employer to cover the tail in the initial contract is crucial because once you have agreed to work there, “it’s much more difficult to get it changed,” Mr. Teitelbaum said. However, even if tail coverage is not in the first contract, you shouldn’t give up, he says. You should try again in the next contract a few years later.

“It’s never too late to bring it up,” Mr. Teitelbaum said. After a few years of employment, you have a track record at the job. “A doctor who is very desirable to the employer may be able to get tail coverage on contract renewal.”

Coverage: Large employers vs. small employers

Willingness to pay for an employee’s tail coverage varies depending on the size of the employer. Large employers – systems, hospitals, and large practices – are much more likely to cover the tail than small and medium-sized practices.

Large employers tend to pay for at least part of the tail because they realize that it is in their interest to do so. Since they have the deepest pockets, they’re often the first to be named in a lawsuit. They might have to pay the whole claim if the physician did not have tail coverage.

However, many large employers want to use tail coverage as a bargaining chip to make sure doctors stay for a while at least. One typical arrangement, Mr. Hursh says, is to pay only one-fifth of the tail if the physician leaves in the first year of employment and then to pay one fifth more in each succeeding year until year five, when the employer assumes the entire cost of the tail.

Smaller practices, on the other hand, are usually close-fisted about tail coverage. “They tend to view the tail as an unnecessary expense,” Mr. Hursh said. “They don’t want to pay for a doctor who is not generating revenue for them any more.”

Traditionally, when physicians become partners, practices are more generous and agree to pay their tails if they leave, Mr. Hursh says. But he thinks this is changing, too – recent partnership contracts he has reviewed did not provide for tail coverage.

Times you don’t need to pay for tail coverage

Even if you’re responsible for the tail coverage, your insurance arrangement may be such that you don’t have to pay for it, says Michelle Perron, a malpractice insurance broker in North Hampton, N.H.

For example, if the carrier at your new job is the same as the one at your old job, your coverage would continue with no break, and you would not need a tail, she says. Even if you move to another state, your old carrier might also sell policies there, and you would then likely have seamless coverage, Ms. Perron says. This would be handy if you could choose your new carrier.

Even when you change carriers, Ms. Perron says, the new one might agree to pick up the old carrier’s coverage in return for getting your business, assuming you are an independent physician buying your own coverage. The new carrier would issue prior acts coverage, also known as nose coverage.

Older doctors going into retirement also have a potential tail coverage problem, but their tail coverage premium is often waived, Ms. Perron says. The need for a tail has to do with claims arising post retirement, after your coverage has ended. Typically, if you have been with the carrier for at least 5 years and you are age 55 years or older, your carrier will waive the tail coverage premium, she says.

However, if the retired doctor starts practicing again, even part time, the carrier may want to take back the free tail, she says. Some retired doctors get around this by buying a lower-priced tail from another company, but the former carrier may still want its money back, Ms. Perron says.

Can you just go without tail coverage?

What happens if physicians with a tail commitment choose to wing it and not pay for the tail? If a claim was never made against them, they may believe that the expense is unnecessary. The situation, however, is not so simple.

Some states require having tail coverage. Malpractice coverage is required in seven states, and at least some of those states explicitly extend this requirement to tails. They are Colorado, Connecticut, Kansas, Massachusetts, New Jersey, Rhode Island, and Wisconsin. Eleven more states tie malpractice coverage, perhaps including tails, to some benefit for the doctor, such as tort reform. These states include Indiana, Nebraska, New Mexico, New York, and Pennsylvania.

Many hospitals require tail coverage for privileges, and some insurers do as well. In addition, Ms. Perron says a missing tail reduces your prospects when looking for a job. “For the employer, having to pay coverage for a new hire will cost more than starting fresh with someone else,” she said.

Still, it’s important to remember the risk of being sued. “If you don’t buy the tail coverage, you are at risk for a lawsuit for many years to come,” Mr. Teitelbaum said.

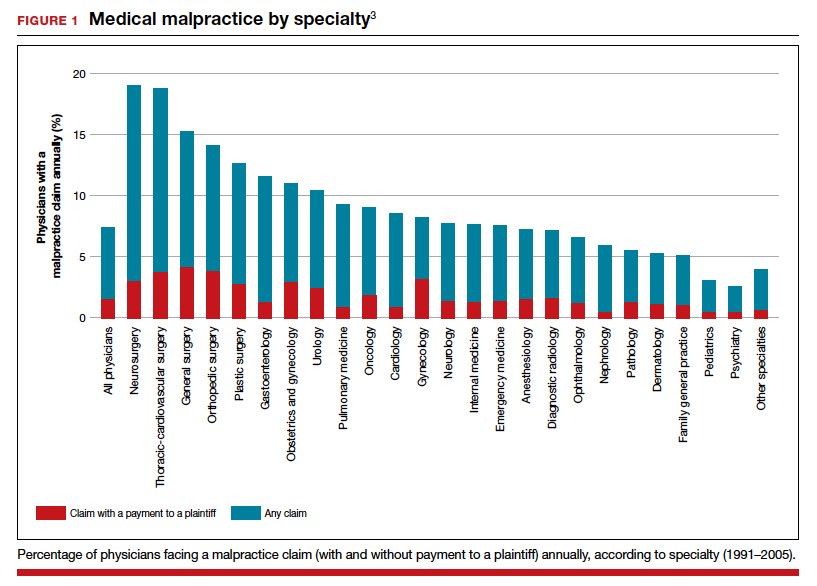

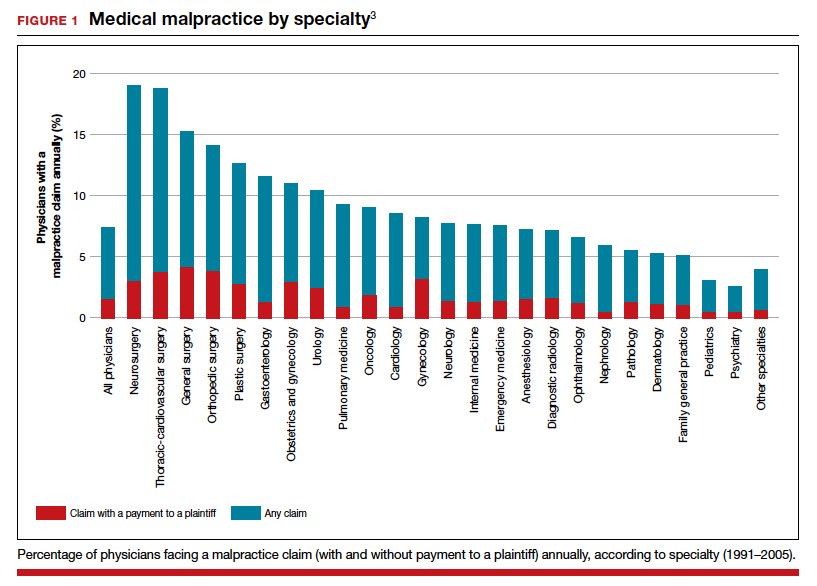

Doctors should consider their potential lifetime risk, not just their current risk. Although only 8% of doctors younger than age 40 have been sued for malpractice, that figure climbs to almost half by the time doctors reach age 55.

The risks are higher in some specialties. About 63% of general surgeons and ob.gyns. have been sued.

Many of these claims are without merit, and doctors pay only the legal expenses of defending the case. Some doctors may think they could risk frivolous suits and cover legal expenses out of pocket. An American Medical Association survey showed that 68% of closed claims against doctors were dropped, dismissed, or withdrawn. It said these claims cost an average of more than $30,000 to defend.

However, Mr. Teitelbaum puts the defense costs for so-called frivolous suits much higher than the AMA, at $250,000 or more. “Even if you’re sure you won’t have to pay a claim, you still have to defend yourself against frivolous suits,” he said. “You won’t recover those expenses.”

How to lower your tail coverage cost

Physicians typically have 60 days to buy tail coverage after their regular coverage has ended. Specialized brokers such as Mr. Teitelbaum and Ms. Perron help physicians look for the best tails to buy.

The cost of the tail depends on how long you’ve been at your job when you leave it, Ms. Perron says. If you leave in the first 1 or 2 years of the policy, she says, the tail price will be lower because the coverage period is shorter.

Usually the most expensive tail available is from the carrier that issued the original policy. Why is this? “Carriers rarely sell a tail that undercuts their retail price,” Mr. Teitelbaum said. “They don’t want to compete with themselves, and in fact doing so could pose regulatory problems for them.”

Instead of buying from their own carrier, doctors can purchase stand-alone tails from competitors, which Mr. Teitelbaum says are 10%-30% less expensive than the policy the original carrier issues. However, stand-alone tails are not always easy to find, especially for high-cost specialties such as neurosurgery and ob.gyn., he says.

Some physicians try to bring down the cost of the tail by limiting the duration of the tail. You can buy tails that only cover claims filed 1-5 years after the incident took place, rather than indefinitely. These limits mirror the typical statute of limitations – the time limit to file a claim in each state. This limit is as little as 2 years in some states, though it can be as long as 6 years in others.

However, some states make exceptions to the statute of limitations. The 2- to 6-year clock doesn’t start ticking until the mistake is discovered or, in the case of children, when they reach adulthood. “This means that with a limited tail, you always have risk,” Perron said.

And yet some doctors insist on these time-limited tails. “If a doctor opts for 3 years’ coverage, that’s better than no years,” Mr. Teitelbaum said. “But I would advise them to take at least 5 years because that gives you coverage for the basic statute of limitations in most states. Three-year tails do yield savings, but often they’re not enough to warrant the risk.”

Another way to reduce costs is to lower the coverage limits of the tail. The standard coverage limit is $1 million per case and $3 million per year, so doctors might be able to save money on the premium by buying limits of $200,000/$600,000. But Mr. Teitelbaum says most companies would refuse to sell a policy with a limit lower than that of the expiring policy.

Further ways to reduce the cost of the tail include buying tail coverage that doesn’t give the physician the right to approve a settlement or that doesn’t include legal fees in the coverage limits. But these options, too, raise the physician’s risks. Whichever option you choose, the important thing is to protect yourself against costly lawsuits.

This article first appeared on Medscape.com.

A 28-year-old pediatrician working in a large group practice in California found a new job in Pennsylvania. The job would allow her to live with her husband, who was a nonphysician.

On her last day of work at the California job, the practice’s office manager asked her, “Do you know about the tail coverage?”

He explained that it is malpractice insurance for any cases filed against her after leaving the job. Without it, he said, she would not be covered for those claims.

The physician (who asked not to be identified) had very little savings and suddenly had to pay a five-figure bill for tail coverage. To provide the extra malpractice coverage, she and her husband had to use savings they’d set aside to buy a house.

Getting tail coverage, known formally as an extended reporting endorsement, often comes as a complete and costly surprise for new doctors, says Dennis Hursh, Esq, a health care attorney based in Middletown, Penn., who deals with physicians’ employment contracts.

“Having to pay for a tail can disrupt lives,” Hursh said. “A tail can cost about one third of a young doctor’s salary. If you don’t feel you can afford to pay that, you may be forced to stay with a job you don’t like.”

Most medical residents don’t think about tail coverage until they apply for their first job, but last year, residents at Hahnemann University Hospital in Philadelphia got a painful early lesson.

In the summer, the hospital went out of business because of financial problems. Hundreds of medical residents and fellows not only were forced to find new programs but also had to prepare to buy tail coverage for their training years at Hahnemann.

“All the guarantees have been yanked out from under us,” said Tom Sibert, MD, a former internal medicine resident at the hospital, who is now finishing his training in California. “Residents don’t have that kind of money.”

Hahnemann trainees have asked the judge in the bankruptcy proceedings to put them ahead of other creditors and to ensure their tail coverage is paid. As of early February, the issue had not been resolved.

Meanwhile, Sibert and many other former trainees were trying to get quotes for purchasing tail coverage. They have been shocked by the amounts they would have to pay.

How tail coverage works

Medical malpractice tail coverage protects from incidents that took place when doctors were at their previous jobs but that later resulted in malpractice claims after they had left that employer.

One type of malpractice insurance, an occurrence policy, does not need tail coverage. Occurrence policies cover any incident that occurred when the policy was in force, no matter when a claim was filed – even if it is filed many years after the claims-filing period of the policy ends.

However, most malpractice policies – as many as 85%, according to one estimate – are claims-made policies. Claims-made policies are more much common because they’re significantly less expensive than occurrence policies.

Under a claims-made policy, coverage for malpractice claims completely stops when the policy ends. It does not cover incidents that occurred when the policy was in force but for which the patients later filed claims, as the occurrence policy does. So a tail is needed to cover these claims.

Physicians in all stages of their career may need tail coverage when they leave a job, change malpractice carriers, or retire.

But young physicians often have greater problems with tail coverage, for several reasons. They tend to be employed, and as such, they cannot choose the coverage they want. As a result, they most likely get claims-made coverage. In addition, the job turnover tends to be higher for these doctors. When leaving a job, the tail comes into play. More than half of new physicians leave their first job within 5 years, and of those, more than half leave after only 1 or 2 years.

Young physicians have no experience with tails and may not even know what they are. “In training, malpractice coverage is not a problem because the program handles it,” Mr. Hursh said. Accreditation standards require that teaching hospitals buy coverage, including a tail when residents leave.

So when young physicians are offered their first job and are handed an employment contract to sign, they may not even look for tail coverage, says Mr. Hursh, who wrote The Final Hurdle, a Physician’s Guide to Negotiating a Fair Employment Agreement. Instead, “young physicians tend to focus on issues like salary, benefits, and signing bonuses,” he said.

Mr. Hursh says the tail is usually the most expensive potential cost in the contract.

There’s no easy way to get out of paying the tail coverage once it is enshrined in the contract. The full tail can cost five or even six figures, depending on the physicians’ specialty, the local malpractice premium, and the physician’s own claims history.

Can you negotiate your tail coverage?

Negotiating tail coverage in the employment contract involves some familiarity with medical malpractice insurance and a close reading of the contract. First, you have to determine that the employer is providing claims-made coverage, which would require a tail if you leave. Then you have to determine whether the employer will pay for the tail coverage.

Often, the contract does not even mention tail coverage. “It could merely state that the practice will be responsible for malpractice coverage while you are working there,” Mr. Hursh said. Although it never specifies the tail, this language indicates that you will be paying for it, he says.

Therefore, it’s wise to have a conversation with your prospective employer about the tail. “Some new doctors never ask the question ‘What happens if I leave? Do I get tail coverage?’ ” said Israel Teitelbaum, an attorney who is chairman of Contemporary Insurance Services, an insurance broker in Silver Spring, Md.

Talking about the tail, however, can be a touchy subject for many young doctors applying for their first job. The tail matters only if you leave the job, and you may not want to imply that you would ever want to leave. Too much money, however, is on the line for you not to ask, Mr. Teitelbaum said.

Even if the employer verbally agrees to pay for the tail coverage, experts advise that you try to get the employer’s commitment in writing and have it put it into the contract.

Getting the employer to cover the tail in the initial contract is crucial because once you have agreed to work there, “it’s much more difficult to get it changed,” Mr. Teitelbaum said. However, even if tail coverage is not in the first contract, you shouldn’t give up, he says. You should try again in the next contract a few years later.

“It’s never too late to bring it up,” Mr. Teitelbaum said. After a few years of employment, you have a track record at the job. “A doctor who is very desirable to the employer may be able to get tail coverage on contract renewal.”

Coverage: Large employers vs. small employers

Willingness to pay for an employee’s tail coverage varies depending on the size of the employer. Large employers – systems, hospitals, and large practices – are much more likely to cover the tail than small and medium-sized practices.

Large employers tend to pay for at least part of the tail because they realize that it is in their interest to do so. Since they have the deepest pockets, they’re often the first to be named in a lawsuit. They might have to pay the whole claim if the physician did not have tail coverage.

However, many large employers want to use tail coverage as a bargaining chip to make sure doctors stay for a while at least. One typical arrangement, Mr. Hursh says, is to pay only one-fifth of the tail if the physician leaves in the first year of employment and then to pay one fifth more in each succeeding year until year five, when the employer assumes the entire cost of the tail.

Smaller practices, on the other hand, are usually close-fisted about tail coverage. “They tend to view the tail as an unnecessary expense,” Mr. Hursh said. “They don’t want to pay for a doctor who is not generating revenue for them any more.”

Traditionally, when physicians become partners, practices are more generous and agree to pay their tails if they leave, Mr. Hursh says. But he thinks this is changing, too – recent partnership contracts he has reviewed did not provide for tail coverage.

Times you don’t need to pay for tail coverage

Even if you’re responsible for the tail coverage, your insurance arrangement may be such that you don’t have to pay for it, says Michelle Perron, a malpractice insurance broker in North Hampton, N.H.

For example, if the carrier at your new job is the same as the one at your old job, your coverage would continue with no break, and you would not need a tail, she says. Even if you move to another state, your old carrier might also sell policies there, and you would then likely have seamless coverage, Ms. Perron says. This would be handy if you could choose your new carrier.

Even when you change carriers, Ms. Perron says, the new one might agree to pick up the old carrier’s coverage in return for getting your business, assuming you are an independent physician buying your own coverage. The new carrier would issue prior acts coverage, also known as nose coverage.

Older doctors going into retirement also have a potential tail coverage problem, but their tail coverage premium is often waived, Ms. Perron says. The need for a tail has to do with claims arising post retirement, after your coverage has ended. Typically, if you have been with the carrier for at least 5 years and you are age 55 years or older, your carrier will waive the tail coverage premium, she says.

However, if the retired doctor starts practicing again, even part time, the carrier may want to take back the free tail, she says. Some retired doctors get around this by buying a lower-priced tail from another company, but the former carrier may still want its money back, Ms. Perron says.

Can you just go without tail coverage?

What happens if physicians with a tail commitment choose to wing it and not pay for the tail? If a claim was never made against them, they may believe that the expense is unnecessary. The situation, however, is not so simple.

Some states require having tail coverage. Malpractice coverage is required in seven states, and at least some of those states explicitly extend this requirement to tails. They are Colorado, Connecticut, Kansas, Massachusetts, New Jersey, Rhode Island, and Wisconsin. Eleven more states tie malpractice coverage, perhaps including tails, to some benefit for the doctor, such as tort reform. These states include Indiana, Nebraska, New Mexico, New York, and Pennsylvania.

Many hospitals require tail coverage for privileges, and some insurers do as well. In addition, Ms. Perron says a missing tail reduces your prospects when looking for a job. “For the employer, having to pay coverage for a new hire will cost more than starting fresh with someone else,” she said.

Still, it’s important to remember the risk of being sued. “If you don’t buy the tail coverage, you are at risk for a lawsuit for many years to come,” Mr. Teitelbaum said.

Doctors should consider their potential lifetime risk, not just their current risk. Although only 8% of doctors younger than age 40 have been sued for malpractice, that figure climbs to almost half by the time doctors reach age 55.

The risks are higher in some specialties. About 63% of general surgeons and ob.gyns. have been sued.