User login

Official Newspaper of the American College of Surgeons

Sinus of Valsalva preserved in aortic valve replacement

The sinus of Valsalva segment can be preserved during aortic valve replacement irrespective of the type of valve pathology, according to a recent study by Rita Karianna Milewski, MD, and her colleagues at the Hospital of the University of Pennsylvania, Philadelphia.

Severe aortic root dilation coupled to aortic valve disease requires root replacement in patients with a tricuspid or bicuspid aortic valve. Commonly, an aortic valve replacement and supracoronary ascending aorta replacement (AVRSCAAR) procedure has been used for patients who have a mild to moderately dilated sinus segment. One advantage of the procedure is that it retains the sinus of Valsalva (SOV) and preserves the intact coronary ostia.

However, the long-term behavior and risk of aortic events for the retained SOV in both BAV and TAV patients remains unclear, according to Dr. Milewski and her colleagues.

Previous researchers have suggested that patients with BAV and TAV have different rates of complications of the remaining aorta and dilation of the proximal aorta and retained sinus segment. In addition, it has been suggested that the cause of aortic dilation is different in patients with aortic stenosis (AS) and aortic insufficiency (AI) and is based on TAV and BAV morphology, histology, and hemodynamic flow patterns.

However, in the August issue of the Journal of Thoracic and Cardiovascular Surgery, Dr. Milewski and her colleagues reported on their study showing that, in patients with nonaneurysmal SOV undergoing AVRSCAAR, the sinus of Valsalva segment can be preserved regardless of the type of valvular pathology (aortic stenosis vs. aortic insufficiency) or valvular morphology (BAV vs. TAV).

The researchers retrospectively reviewed a prospectively maintained institutional database to stratify all patients by BAV or TAV valvular pathology with concomitant ascending aortic aneurysm who underwent an elective AVRSCAAR from 2002 to 2015 (J Thorac Cardiovasc Surg. 2017;154:421-32).

The distribution of the 428 patients meeting inclusion criteria by subgroups was: BAV group (254 patients: BAV-AS = 178; BAV-AI = 76); TAV group (174 patients: TAV-AS = 61; TAV-AI =113). Preoperative sinus of Valsalva dimensions were divided into 3 subgroups (less than 40 mm, 40-45 mm, and greater than 45 mm).

The mean patient age for patients with BAV and TAV was 59 years and 72 years (P less than .001), respectively (with 78% with BAV being men and 57% with TAV being men). There was a significantly higher subpopulation of AS in the BAV cohort vs. TAV-AS (70% vs. 35%; P less than .001).

With regard to SOV sizing, there was no significant difference in mean preoperative aortic root diameters between BAV and TAV cohorts for the AS or AI subpopulations.

In-hospital/30-day mortality was significantly higher in patients with TAV (5.2%) than in patients with BAV (1.6%, P = .033). In addition, the incidence of transient ischemic attack/stroke was significantly higher in the TAV group (3.4%) vs. the BAV group (0.8%, P = .04).

Valvular morphology and pathology at baseline, preoperative SOV diameter, postoperative time course, and interaction effect of preoperative SOV diameters and postoperative time course were used as covariates to assess outcomes. Within-subject and within–stratified subgroup comparison failed to show main effects across the follow-up times on postoperative SOV size patterns (P = .935), implying that the SOV trends were stable and sustained (discharge to greater than or equal to 10 years) irrespective of valvular morphology and pathology (BAV-AI, BAV-AS, TAV-AI, and TAV-AS).

Preoperative SOV dimensions significantly affected the retained postoperative sinus dimensions (P less than .001), according to Dr. Milewski and her colleagues.

The data indicated that an initial and pronounced postoperative decrease in SOV dimensions occurs with AVRSCAAR independently of aortic valve morphology, aortic valve pathology, and age, they added.

The 10-year freedom from aortic reoperation rates were 97% and 95% in the BAV and TAV subgroups, respectively. The BAV group had significantly improved reoperation-free survival, compared with the TAV group (P less than .001), while the type of valvular pathology within each group did not show a significant survival difference.

“Irrespective of the aortic valve morphology or valve pathology, in patients with mild to moderate aortic root dilatation (less than 45 mm), preservation of the SOV segment in the context of an AVRSCAAR procedure is justified. Continued further follow-up will be important to understand the long-term outcomes of sinus preservation, especially in the younger population with BAVs,” the researchers concluded.

The authors reported having no financial conflicts to disclose.

With regard to the question, ‘‘Is it necessary to replace the sinuses of Valsalva in the setting of bicuspid aortic valve aortopathy?’’, the researchers “leverage their enormous institutional experience to find an answer. The results suggest that this answer is ‘no.’ At least not in all cases,” Thoralf M. Sundt, MD, wrote in his invited commentary on the paper (J Thorac Cardiovasc Surg. 2017;154:419-20).

“The findings of this study argue for us to take a step back and ask how much really needs be done,” he added. And although “it is hard to ask a surgeon to do less rather than more; however, the balance of judgment has to be between the operative risk of the more aggressive approach and the natural history of the disease. In other words, what does it ‘cost’ to be aggressive, and what do we gain?” he asked.

Bicuspid aortic valve aortopathy, it would appear, is not cancer after all. Regardless of theoretic arguments that are based on embryology and the migration of neural crest cells, it does not appear to require resection to ‘clean margins,’ even if we believe that the operative risk ‘in our hands’ is low,” concluded Dr. Sundt.

Thoralf M. Sundt, MD, is at Harvard Medical School, Boston. He reported having no disclosures.

With regard to the question, ‘‘Is it necessary to replace the sinuses of Valsalva in the setting of bicuspid aortic valve aortopathy?’’, the researchers “leverage their enormous institutional experience to find an answer. The results suggest that this answer is ‘no.’ At least not in all cases,” Thoralf M. Sundt, MD, wrote in his invited commentary on the paper (J Thorac Cardiovasc Surg. 2017;154:419-20).

“The findings of this study argue for us to take a step back and ask how much really needs be done,” he added. And although “it is hard to ask a surgeon to do less rather than more; however, the balance of judgment has to be between the operative risk of the more aggressive approach and the natural history of the disease. In other words, what does it ‘cost’ to be aggressive, and what do we gain?” he asked.

Bicuspid aortic valve aortopathy, it would appear, is not cancer after all. Regardless of theoretic arguments that are based on embryology and the migration of neural crest cells, it does not appear to require resection to ‘clean margins,’ even if we believe that the operative risk ‘in our hands’ is low,” concluded Dr. Sundt.

Thoralf M. Sundt, MD, is at Harvard Medical School, Boston. He reported having no disclosures.

With regard to the question, ‘‘Is it necessary to replace the sinuses of Valsalva in the setting of bicuspid aortic valve aortopathy?’’, the researchers “leverage their enormous institutional experience to find an answer. The results suggest that this answer is ‘no.’ At least not in all cases,” Thoralf M. Sundt, MD, wrote in his invited commentary on the paper (J Thorac Cardiovasc Surg. 2017;154:419-20).

“The findings of this study argue for us to take a step back and ask how much really needs be done,” he added. And although “it is hard to ask a surgeon to do less rather than more; however, the balance of judgment has to be between the operative risk of the more aggressive approach and the natural history of the disease. In other words, what does it ‘cost’ to be aggressive, and what do we gain?” he asked.

Bicuspid aortic valve aortopathy, it would appear, is not cancer after all. Regardless of theoretic arguments that are based on embryology and the migration of neural crest cells, it does not appear to require resection to ‘clean margins,’ even if we believe that the operative risk ‘in our hands’ is low,” concluded Dr. Sundt.

Thoralf M. Sundt, MD, is at Harvard Medical School, Boston. He reported having no disclosures.

The sinus of Valsalva segment can be preserved during aortic valve replacement irrespective of the type of valve pathology, according to a recent study by Rita Karianna Milewski, MD, and her colleagues at the Hospital of the University of Pennsylvania, Philadelphia.

Severe aortic root dilation coupled to aortic valve disease requires root replacement in patients with a tricuspid or bicuspid aortic valve. Commonly, an aortic valve replacement and supracoronary ascending aorta replacement (AVRSCAAR) procedure has been used for patients who have a mild to moderately dilated sinus segment. One advantage of the procedure is that it retains the sinus of Valsalva (SOV) and preserves the intact coronary ostia.

However, the long-term behavior and risk of aortic events for the retained SOV in both BAV and TAV patients remains unclear, according to Dr. Milewski and her colleagues.

Previous researchers have suggested that patients with BAV and TAV have different rates of complications of the remaining aorta and dilation of the proximal aorta and retained sinus segment. In addition, it has been suggested that the cause of aortic dilation is different in patients with aortic stenosis (AS) and aortic insufficiency (AI) and is based on TAV and BAV morphology, histology, and hemodynamic flow patterns.

However, in the August issue of the Journal of Thoracic and Cardiovascular Surgery, Dr. Milewski and her colleagues reported on their study showing that, in patients with nonaneurysmal SOV undergoing AVRSCAAR, the sinus of Valsalva segment can be preserved regardless of the type of valvular pathology (aortic stenosis vs. aortic insufficiency) or valvular morphology (BAV vs. TAV).

The researchers retrospectively reviewed a prospectively maintained institutional database to stratify all patients by BAV or TAV valvular pathology with concomitant ascending aortic aneurysm who underwent an elective AVRSCAAR from 2002 to 2015 (J Thorac Cardiovasc Surg. 2017;154:421-32).

The distribution of the 428 patients meeting inclusion criteria by subgroups was: BAV group (254 patients: BAV-AS = 178; BAV-AI = 76); TAV group (174 patients: TAV-AS = 61; TAV-AI =113). Preoperative sinus of Valsalva dimensions were divided into 3 subgroups (less than 40 mm, 40-45 mm, and greater than 45 mm).

The mean patient age for patients with BAV and TAV was 59 years and 72 years (P less than .001), respectively (with 78% with BAV being men and 57% with TAV being men). There was a significantly higher subpopulation of AS in the BAV cohort vs. TAV-AS (70% vs. 35%; P less than .001).

With regard to SOV sizing, there was no significant difference in mean preoperative aortic root diameters between BAV and TAV cohorts for the AS or AI subpopulations.

In-hospital/30-day mortality was significantly higher in patients with TAV (5.2%) than in patients with BAV (1.6%, P = .033). In addition, the incidence of transient ischemic attack/stroke was significantly higher in the TAV group (3.4%) vs. the BAV group (0.8%, P = .04).

Valvular morphology and pathology at baseline, preoperative SOV diameter, postoperative time course, and interaction effect of preoperative SOV diameters and postoperative time course were used as covariates to assess outcomes. Within-subject and within–stratified subgroup comparison failed to show main effects across the follow-up times on postoperative SOV size patterns (P = .935), implying that the SOV trends were stable and sustained (discharge to greater than or equal to 10 years) irrespective of valvular morphology and pathology (BAV-AI, BAV-AS, TAV-AI, and TAV-AS).

Preoperative SOV dimensions significantly affected the retained postoperative sinus dimensions (P less than .001), according to Dr. Milewski and her colleagues.

The data indicated that an initial and pronounced postoperative decrease in SOV dimensions occurs with AVRSCAAR independently of aortic valve morphology, aortic valve pathology, and age, they added.

The 10-year freedom from aortic reoperation rates were 97% and 95% in the BAV and TAV subgroups, respectively. The BAV group had significantly improved reoperation-free survival, compared with the TAV group (P less than .001), while the type of valvular pathology within each group did not show a significant survival difference.

“Irrespective of the aortic valve morphology or valve pathology, in patients with mild to moderate aortic root dilatation (less than 45 mm), preservation of the SOV segment in the context of an AVRSCAAR procedure is justified. Continued further follow-up will be important to understand the long-term outcomes of sinus preservation, especially in the younger population with BAVs,” the researchers concluded.

The authors reported having no financial conflicts to disclose.

The sinus of Valsalva segment can be preserved during aortic valve replacement irrespective of the type of valve pathology, according to a recent study by Rita Karianna Milewski, MD, and her colleagues at the Hospital of the University of Pennsylvania, Philadelphia.

Severe aortic root dilation coupled to aortic valve disease requires root replacement in patients with a tricuspid or bicuspid aortic valve. Commonly, an aortic valve replacement and supracoronary ascending aorta replacement (AVRSCAAR) procedure has been used for patients who have a mild to moderately dilated sinus segment. One advantage of the procedure is that it retains the sinus of Valsalva (SOV) and preserves the intact coronary ostia.

However, the long-term behavior and risk of aortic events for the retained SOV in both BAV and TAV patients remains unclear, according to Dr. Milewski and her colleagues.

Previous researchers have suggested that patients with BAV and TAV have different rates of complications of the remaining aorta and dilation of the proximal aorta and retained sinus segment. In addition, it has been suggested that the cause of aortic dilation is different in patients with aortic stenosis (AS) and aortic insufficiency (AI) and is based on TAV and BAV morphology, histology, and hemodynamic flow patterns.

However, in the August issue of the Journal of Thoracic and Cardiovascular Surgery, Dr. Milewski and her colleagues reported on their study showing that, in patients with nonaneurysmal SOV undergoing AVRSCAAR, the sinus of Valsalva segment can be preserved regardless of the type of valvular pathology (aortic stenosis vs. aortic insufficiency) or valvular morphology (BAV vs. TAV).

The researchers retrospectively reviewed a prospectively maintained institutional database to stratify all patients by BAV or TAV valvular pathology with concomitant ascending aortic aneurysm who underwent an elective AVRSCAAR from 2002 to 2015 (J Thorac Cardiovasc Surg. 2017;154:421-32).

The distribution of the 428 patients meeting inclusion criteria by subgroups was: BAV group (254 patients: BAV-AS = 178; BAV-AI = 76); TAV group (174 patients: TAV-AS = 61; TAV-AI =113). Preoperative sinus of Valsalva dimensions were divided into 3 subgroups (less than 40 mm, 40-45 mm, and greater than 45 mm).

The mean patient age for patients with BAV and TAV was 59 years and 72 years (P less than .001), respectively (with 78% with BAV being men and 57% with TAV being men). There was a significantly higher subpopulation of AS in the BAV cohort vs. TAV-AS (70% vs. 35%; P less than .001).

With regard to SOV sizing, there was no significant difference in mean preoperative aortic root diameters between BAV and TAV cohorts for the AS or AI subpopulations.

In-hospital/30-day mortality was significantly higher in patients with TAV (5.2%) than in patients with BAV (1.6%, P = .033). In addition, the incidence of transient ischemic attack/stroke was significantly higher in the TAV group (3.4%) vs. the BAV group (0.8%, P = .04).

Valvular morphology and pathology at baseline, preoperative SOV diameter, postoperative time course, and interaction effect of preoperative SOV diameters and postoperative time course were used as covariates to assess outcomes. Within-subject and within–stratified subgroup comparison failed to show main effects across the follow-up times on postoperative SOV size patterns (P = .935), implying that the SOV trends were stable and sustained (discharge to greater than or equal to 10 years) irrespective of valvular morphology and pathology (BAV-AI, BAV-AS, TAV-AI, and TAV-AS).

Preoperative SOV dimensions significantly affected the retained postoperative sinus dimensions (P less than .001), according to Dr. Milewski and her colleagues.

The data indicated that an initial and pronounced postoperative decrease in SOV dimensions occurs with AVRSCAAR independently of aortic valve morphology, aortic valve pathology, and age, they added.

The 10-year freedom from aortic reoperation rates were 97% and 95% in the BAV and TAV subgroups, respectively. The BAV group had significantly improved reoperation-free survival, compared with the TAV group (P less than .001), while the type of valvular pathology within each group did not show a significant survival difference.

“Irrespective of the aortic valve morphology or valve pathology, in patients with mild to moderate aortic root dilatation (less than 45 mm), preservation of the SOV segment in the context of an AVRSCAAR procedure is justified. Continued further follow-up will be important to understand the long-term outcomes of sinus preservation, especially in the younger population with BAVs,” the researchers concluded.

The authors reported having no financial conflicts to disclose.

FROM THE JOURNAL OF THORACIC AND CARDIOVASCULAR SURGERY

Key clinical point:

Major finding: The 10-year freedom from aortic reoperation rates were 97% and 95% in the BAV and TAV subgroups, respectively.

Data source: A retrospective review of 428 patients in a prospectively maintained database who met study inclusion criteria and were operated on between 2002 and 2015.

Disclosures: The authors reported having no financial conflicts to disclose.

Physicians shift on support of single-payer system

, according to a recent survey by physician recruiting firm Merritt Hawkins.

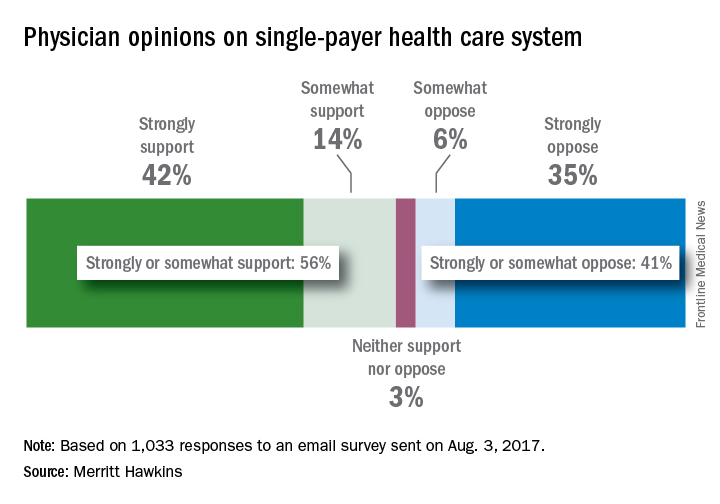

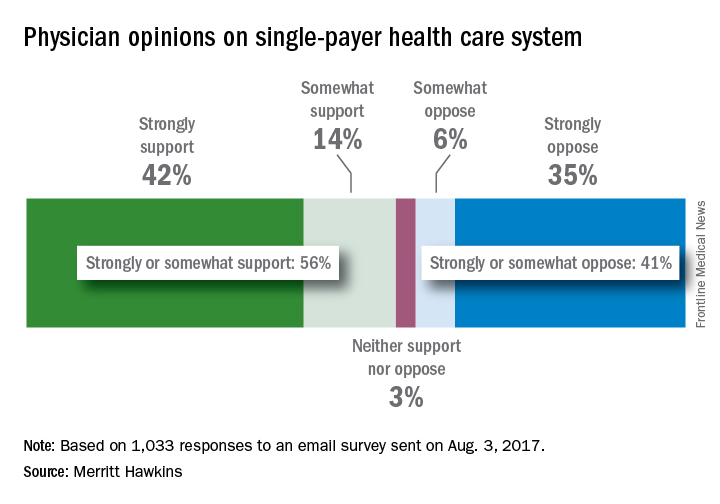

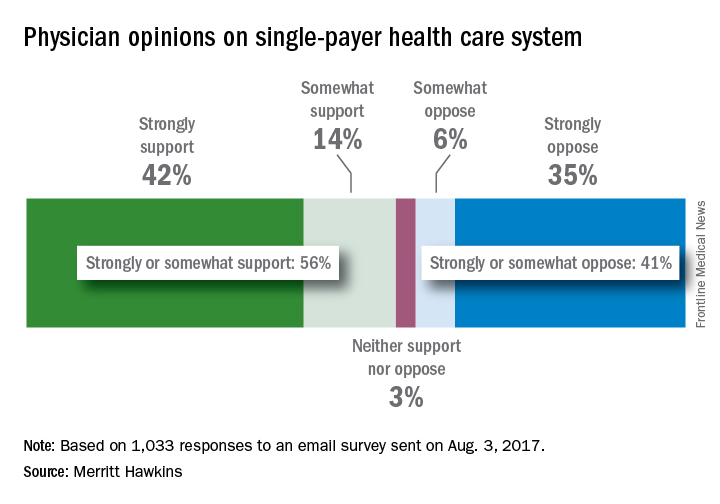

A single-payer system was “strongly supported” by 42% and “somewhat supported” by 14% of the 1,033 physicians who responded to the email survey, which was sent out on Aug. 3. Compared with the 41% who expressed opposition to a single payer – 35% “strongly opposed” and 6% “somewhat opposed” – the total of 56% supporting it was more than enough to cover the margin of error of ±3.1%. The remaining 3% of physicians said that they neither support nor oppose a single-payer system, Merritt Hawkins reported.

In a survey the company conducted in 2008, just 42% of physicians supported a single-payer system and 58% opposed it. “Physicians appear to have evolved on single payer,” Travis Singleton, senior vice president of Merritt Hawkins, said in a statement. “Whether they are enthusiastic about it, are merely resigned to it, or are just seeking clarity, single payer is a concept many physicians appear to be embracing.”

, according to a recent survey by physician recruiting firm Merritt Hawkins.

A single-payer system was “strongly supported” by 42% and “somewhat supported” by 14% of the 1,033 physicians who responded to the email survey, which was sent out on Aug. 3. Compared with the 41% who expressed opposition to a single payer – 35% “strongly opposed” and 6% “somewhat opposed” – the total of 56% supporting it was more than enough to cover the margin of error of ±3.1%. The remaining 3% of physicians said that they neither support nor oppose a single-payer system, Merritt Hawkins reported.

In a survey the company conducted in 2008, just 42% of physicians supported a single-payer system and 58% opposed it. “Physicians appear to have evolved on single payer,” Travis Singleton, senior vice president of Merritt Hawkins, said in a statement. “Whether they are enthusiastic about it, are merely resigned to it, or are just seeking clarity, single payer is a concept many physicians appear to be embracing.”

, according to a recent survey by physician recruiting firm Merritt Hawkins.

A single-payer system was “strongly supported” by 42% and “somewhat supported” by 14% of the 1,033 physicians who responded to the email survey, which was sent out on Aug. 3. Compared with the 41% who expressed opposition to a single payer – 35% “strongly opposed” and 6% “somewhat opposed” – the total of 56% supporting it was more than enough to cover the margin of error of ±3.1%. The remaining 3% of physicians said that they neither support nor oppose a single-payer system, Merritt Hawkins reported.

In a survey the company conducted in 2008, just 42% of physicians supported a single-payer system and 58% opposed it. “Physicians appear to have evolved on single payer,” Travis Singleton, senior vice president of Merritt Hawkins, said in a statement. “Whether they are enthusiastic about it, are merely resigned to it, or are just seeking clarity, single payer is a concept many physicians appear to be embracing.”

CBO: End of ACA subsidies would mean short-term exit of insurers

Terminating the Affordable Care Act’s cost-sharing reduction payments to insurers would cause a short-term exit by insurers from the individual insurance marketplaces, but the availability of plans is expected to rebound, according to the Congressional Budget Office.

In a new analysis requested by Democratic leadership in the House of Representatives, CBO and staff from the congressional Joint Committee on Taxation (JCT) examined what would happen if the Trump administration announced by the end of August that it would cease to make cost-sharing reduction payments at the end of 2017.

However, insurers would be on the hook to cover the payments no longer provided by the government, which means that “participating insurers would raise premiums of ‘silver’ plans to recover the costs.”

Gross premiums for silver plans “would be 20% higher in 2018 and 25% by 2020,” pushing higher premium tax credits and increasing the federal deficit by $194 billion from 2017 through 2026,” the report states. “Most people would pay net premiums (after accounting for premium tax credits) for nongroup insurance throughout the next decade that were similar to or less than what they would pay otherwise.”

The percentage of people facing a “slight increases” would be higher during the next 2 years, they pointed out.

The number of uninsured would be slightly higher in 2018 (about 1 million more uninsured) but then would be slightly lower starting in 2020 (about 1 million less each year).

Should the administration end cost-sharing reduction payments in 2017, those eligible for tax credits who have annual incomes 200%-400% of the federal poverty level would use their subsidies to purchase either gold or bronze plans, with silver plans going almost exclusively to people eligible for cost-sharing reductions (100%-200% of the poverty line).

Terminating the Affordable Care Act’s cost-sharing reduction payments to insurers would cause a short-term exit by insurers from the individual insurance marketplaces, but the availability of plans is expected to rebound, according to the Congressional Budget Office.

In a new analysis requested by Democratic leadership in the House of Representatives, CBO and staff from the congressional Joint Committee on Taxation (JCT) examined what would happen if the Trump administration announced by the end of August that it would cease to make cost-sharing reduction payments at the end of 2017.

However, insurers would be on the hook to cover the payments no longer provided by the government, which means that “participating insurers would raise premiums of ‘silver’ plans to recover the costs.”

Gross premiums for silver plans “would be 20% higher in 2018 and 25% by 2020,” pushing higher premium tax credits and increasing the federal deficit by $194 billion from 2017 through 2026,” the report states. “Most people would pay net premiums (after accounting for premium tax credits) for nongroup insurance throughout the next decade that were similar to or less than what they would pay otherwise.”

The percentage of people facing a “slight increases” would be higher during the next 2 years, they pointed out.

The number of uninsured would be slightly higher in 2018 (about 1 million more uninsured) but then would be slightly lower starting in 2020 (about 1 million less each year).

Should the administration end cost-sharing reduction payments in 2017, those eligible for tax credits who have annual incomes 200%-400% of the federal poverty level would use their subsidies to purchase either gold or bronze plans, with silver plans going almost exclusively to people eligible for cost-sharing reductions (100%-200% of the poverty line).

Terminating the Affordable Care Act’s cost-sharing reduction payments to insurers would cause a short-term exit by insurers from the individual insurance marketplaces, but the availability of plans is expected to rebound, according to the Congressional Budget Office.

In a new analysis requested by Democratic leadership in the House of Representatives, CBO and staff from the congressional Joint Committee on Taxation (JCT) examined what would happen if the Trump administration announced by the end of August that it would cease to make cost-sharing reduction payments at the end of 2017.

However, insurers would be on the hook to cover the payments no longer provided by the government, which means that “participating insurers would raise premiums of ‘silver’ plans to recover the costs.”

Gross premiums for silver plans “would be 20% higher in 2018 and 25% by 2020,” pushing higher premium tax credits and increasing the federal deficit by $194 billion from 2017 through 2026,” the report states. “Most people would pay net premiums (after accounting for premium tax credits) for nongroup insurance throughout the next decade that were similar to or less than what they would pay otherwise.”

The percentage of people facing a “slight increases” would be higher during the next 2 years, they pointed out.

The number of uninsured would be slightly higher in 2018 (about 1 million more uninsured) but then would be slightly lower starting in 2020 (about 1 million less each year).

Should the administration end cost-sharing reduction payments in 2017, those eligible for tax credits who have annual incomes 200%-400% of the federal poverty level would use their subsidies to purchase either gold or bronze plans, with silver plans going almost exclusively to people eligible for cost-sharing reductions (100%-200% of the poverty line).

Clinical trial: Use of robotics for cholecystectomy

The Use of Robotics for Cholecystectomy study is a retrospective review currently recruiting patients who underwent robotic-assisted laparoscopic cholecystectomy from June 2004 through May 2015.

Several methods are considered standard of care for the surgical treatment of cholecystitis, including open surgery, laparoscopic, and robotic-assisted laparoscopic surgery. This study, a retrospective analysis of charts, operating room notes, and operating room documentation of procedures, will review intraoperative and postoperative clinical outcomes of robotic-assisted laparoscopic cholecystectomy.

The intent of the study is to establish the role of robotics in laparoscopic surgery and to assess the learning curve for surgeons. Primary outcomes will be to compare hernia rates between multiport and single-port approaches, and to compare multiport against single-port approaches through the standard of care model of normal postsurgery follow-ups, along with additional follow-ups if complications are seen.

Recruitment for the study ends in May 2019. About 500 people are expected to be included in the final analysis.

Find more information at the study page on Clinicaltrials.gov.

The Use of Robotics for Cholecystectomy study is a retrospective review currently recruiting patients who underwent robotic-assisted laparoscopic cholecystectomy from June 2004 through May 2015.

Several methods are considered standard of care for the surgical treatment of cholecystitis, including open surgery, laparoscopic, and robotic-assisted laparoscopic surgery. This study, a retrospective analysis of charts, operating room notes, and operating room documentation of procedures, will review intraoperative and postoperative clinical outcomes of robotic-assisted laparoscopic cholecystectomy.

The intent of the study is to establish the role of robotics in laparoscopic surgery and to assess the learning curve for surgeons. Primary outcomes will be to compare hernia rates between multiport and single-port approaches, and to compare multiport against single-port approaches through the standard of care model of normal postsurgery follow-ups, along with additional follow-ups if complications are seen.

Recruitment for the study ends in May 2019. About 500 people are expected to be included in the final analysis.

Find more information at the study page on Clinicaltrials.gov.

The Use of Robotics for Cholecystectomy study is a retrospective review currently recruiting patients who underwent robotic-assisted laparoscopic cholecystectomy from June 2004 through May 2015.

Several methods are considered standard of care for the surgical treatment of cholecystitis, including open surgery, laparoscopic, and robotic-assisted laparoscopic surgery. This study, a retrospective analysis of charts, operating room notes, and operating room documentation of procedures, will review intraoperative and postoperative clinical outcomes of robotic-assisted laparoscopic cholecystectomy.

The intent of the study is to establish the role of robotics in laparoscopic surgery and to assess the learning curve for surgeons. Primary outcomes will be to compare hernia rates between multiport and single-port approaches, and to compare multiport against single-port approaches through the standard of care model of normal postsurgery follow-ups, along with additional follow-ups if complications are seen.

Recruitment for the study ends in May 2019. About 500 people are expected to be included in the final analysis.

Find more information at the study page on Clinicaltrials.gov.

SUMMARY FROM CLINICALTRIALS.GOV

VIDEO: How to catch postpartum necrotizing fasciitis in time

PARK CITY, UTAH – , and it’s easy to misdiagnose at first.

There’s no pus, and the skin can look mostly normal with just a little swelling. The tipoff is pain that seems out of proportion to the clinical signs.

David Eschenbach, MD, chair of the department of obstetrics and gynecology at the University of Washington, Seattle, knows the infection well. In an interview at the annual scientific meeting of the Infectious Diseases Society for Obstetrics and Gynecology, he shared his insights on how physicians can recognize and treat postpartum necrotizing fasciitis in time to limit the damage.

The video associated with this article is no longer available on this site. Please view all of our videos on the MDedge YouTube channel

PARK CITY, UTAH – , and it’s easy to misdiagnose at first.

There’s no pus, and the skin can look mostly normal with just a little swelling. The tipoff is pain that seems out of proportion to the clinical signs.

David Eschenbach, MD, chair of the department of obstetrics and gynecology at the University of Washington, Seattle, knows the infection well. In an interview at the annual scientific meeting of the Infectious Diseases Society for Obstetrics and Gynecology, he shared his insights on how physicians can recognize and treat postpartum necrotizing fasciitis in time to limit the damage.

The video associated with this article is no longer available on this site. Please view all of our videos on the MDedge YouTube channel

PARK CITY, UTAH – , and it’s easy to misdiagnose at first.

There’s no pus, and the skin can look mostly normal with just a little swelling. The tipoff is pain that seems out of proportion to the clinical signs.

David Eschenbach, MD, chair of the department of obstetrics and gynecology at the University of Washington, Seattle, knows the infection well. In an interview at the annual scientific meeting of the Infectious Diseases Society for Obstetrics and Gynecology, he shared his insights on how physicians can recognize and treat postpartum necrotizing fasciitis in time to limit the damage.

The video associated with this article is no longer available on this site. Please view all of our videos on the MDedge YouTube channel

AT IDSOG

VIDEO: When to turn to surgery in postpartum uterine infection

PARK CITY, UTAH – When postpartum infections don’t respond to antibiotics, doctors and surgeons need to move fast; surgery – often hysterectomy – is the only thing that will save the woman’s life.

The problem is that with today’s antibiotics, doctors may have never encountered the situation, and sometimes continue to treat with antibiotics until it’s too late.

In Seattle, physicians turn to David Eschenbach, MD, chair of the department of obstetrics and gynecology at the University of Washington, for advice on when it’s time to give up on antibiotics and go to the OR. It’s a difficult decision, especially when patients are young.

In an interview at the annual scientific meeting of the Infectious Diseases Society for Obstetrics and Gynecology, Dr. Eschenbach shared what he’s learned from decades of experience in dealing with one of the most devastating postpartum complications.

PARK CITY, UTAH – When postpartum infections don’t respond to antibiotics, doctors and surgeons need to move fast; surgery – often hysterectomy – is the only thing that will save the woman’s life.

The problem is that with today’s antibiotics, doctors may have never encountered the situation, and sometimes continue to treat with antibiotics until it’s too late.

In Seattle, physicians turn to David Eschenbach, MD, chair of the department of obstetrics and gynecology at the University of Washington, for advice on when it’s time to give up on antibiotics and go to the OR. It’s a difficult decision, especially when patients are young.

In an interview at the annual scientific meeting of the Infectious Diseases Society for Obstetrics and Gynecology, Dr. Eschenbach shared what he’s learned from decades of experience in dealing with one of the most devastating postpartum complications.

PARK CITY, UTAH – When postpartum infections don’t respond to antibiotics, doctors and surgeons need to move fast; surgery – often hysterectomy – is the only thing that will save the woman’s life.

The problem is that with today’s antibiotics, doctors may have never encountered the situation, and sometimes continue to treat with antibiotics until it’s too late.

In Seattle, physicians turn to David Eschenbach, MD, chair of the department of obstetrics and gynecology at the University of Washington, for advice on when it’s time to give up on antibiotics and go to the OR. It’s a difficult decision, especially when patients are young.

In an interview at the annual scientific meeting of the Infectious Diseases Society for Obstetrics and Gynecology, Dr. Eschenbach shared what he’s learned from decades of experience in dealing with one of the most devastating postpartum complications.

AT IDSOG

End-of-life advice: More than 500,000 chat on Medicare’s dime

The 90-year-old woman in the San Diego–area nursing home was quite clear, said Karl Steinberg, MD. She didn’t want aggressive measures to prolong her life. If her heart stopped, she didn’t want CPR.

But when Dr. Steinberg, a palliative care physician, relayed those wishes to the woman’s daughter, the younger woman would have none of it.

“She said, ‘I don’t agree with that. My mom is confused,’ ” Steinberg recalled. “I said, ‘Let’s talk about it.’ ”

Instead of arguing, Dr. Steinberg used an increasingly popular tool to resolve the impasse last month. He brought mother and daughter together for an advance-care planning session, an end-of-life consultation that’s now being paid for by Medicare.

In 2016, the first year that health care providers were allowed to bill for the service, nearly 575,000 Medicare beneficiaries took part in the conversations, new federal data obtained by Kaiser Health News show.

Nearly 23,000 providers submitted about $93 million in charges, including more than $43 million covered by the federal program for seniors and the disabled.

Use was much higher than expected, nearly double the 300,000 people that the American Medical Association projected would use the service in the first year.

That’s good news to proponents of the sessions, which focus on understanding and documenting treatment preferences for people nearing the end of their lives. Patients – and often their families – discuss with a doctor or other provider what kind of care they want if they’re unable to make decisions themselves.

“I think it’s great that half a million people talked with their doctors last year. That’s a good thing,” said Paul Malley, president of Aging with Dignity, a Florida nonprofit that promotes end-of-life discussions. “Physician practices are learning. My guess is that it will increase each year.”

Still, only a fraction of eligible Medicare providers – and patients – have used the benefit, which pays about $86 for the first 30-minute office visit and about $75 for additional sessions.

Nationwide, slightly more than 1% of the more than 56 million Medicare beneficiaries enrolled at the end of 2016 received advance-care planning talks, according to calculations by health policy analysts at Duke University, Durham, N.C. But use varied widely among states, from 0.2% of Alaska Medicare recipients to 2.49% of those enrolled in the program in Hawaii.

“There’s tremendous variation by state. That’s the first thing that jumps out,” said Donald Taylor Jr., a Duke professor of public policy.

In part, that’s because many providers, especially primary care doctors, aren’t aware that the Medicare reimbursement agreement, approved in 2015, has taken effect.

“Some physicians don’t know that this is a service,” said Barbie Hays, a Medicare coding and compliance strategist for the American Academy of Family Physicians. “They don’t know how to get paid for it. One of the struggles here is we’re trying to get this message out to our members.”

There also may be lingering controversy over the sessions, which were famously decried as “death panels” during the 2009 debate about the Affordable Care Act. Earlier this year, the issue resurfaced in Congress, where Rep. Steve King (R-Iowa) introduced the Protecting Life Until Natural Death Act, which would halt Medicare reimbursement for advance-care planning appointments.

Mr. King said the move was financially motivated and not in the interest of Americans “who were promised life-sustaining care in their older years.”

Proponents like Dr. Steinberg, however, contend that informed decisions, not cost savings, are the point of the new policy.

“It’s really important to say the reason for this isn’t to save money, although that may be a side benefit, but it’s really about person-centered care,” he said. “It’s about taking the time when people are ill or even when they’re not ill to talk about what their values are. To talk about what constitutes an acceptable versus an unacceptable quality of life.”

That’s just the discussion that the San Diego nursing home resident was able to have with her daughter, Dr. Steinberg said. The 90-year-old was able to say why she didn’t want CPR or to be intubated if she became seriously ill.

“I believe it brought the two of them closer,” Dr. Steinberg said. Even though the daughter didn’t necessarily hear what she wanted to hear. It was like, “You may not agree with your mom, but she’s your mom, and if she doesn’t want somebody beating her chest or ramming a tube down her throat, that’s her decision.”

KHN’s coverage of end-of-life and serious illness issues is supported by The Gordon and Betty Moore Foundation. Kaiser Health News is a national health policy news service that is part of the nonpartisan Henry J. Kaiser Family Foundation.

The 90-year-old woman in the San Diego–area nursing home was quite clear, said Karl Steinberg, MD. She didn’t want aggressive measures to prolong her life. If her heart stopped, she didn’t want CPR.

But when Dr. Steinberg, a palliative care physician, relayed those wishes to the woman’s daughter, the younger woman would have none of it.

“She said, ‘I don’t agree with that. My mom is confused,’ ” Steinberg recalled. “I said, ‘Let’s talk about it.’ ”

Instead of arguing, Dr. Steinberg used an increasingly popular tool to resolve the impasse last month. He brought mother and daughter together for an advance-care planning session, an end-of-life consultation that’s now being paid for by Medicare.

In 2016, the first year that health care providers were allowed to bill for the service, nearly 575,000 Medicare beneficiaries took part in the conversations, new federal data obtained by Kaiser Health News show.

Nearly 23,000 providers submitted about $93 million in charges, including more than $43 million covered by the federal program for seniors and the disabled.

Use was much higher than expected, nearly double the 300,000 people that the American Medical Association projected would use the service in the first year.

That’s good news to proponents of the sessions, which focus on understanding and documenting treatment preferences for people nearing the end of their lives. Patients – and often their families – discuss with a doctor or other provider what kind of care they want if they’re unable to make decisions themselves.

“I think it’s great that half a million people talked with their doctors last year. That’s a good thing,” said Paul Malley, president of Aging with Dignity, a Florida nonprofit that promotes end-of-life discussions. “Physician practices are learning. My guess is that it will increase each year.”

Still, only a fraction of eligible Medicare providers – and patients – have used the benefit, which pays about $86 for the first 30-minute office visit and about $75 for additional sessions.

Nationwide, slightly more than 1% of the more than 56 million Medicare beneficiaries enrolled at the end of 2016 received advance-care planning talks, according to calculations by health policy analysts at Duke University, Durham, N.C. But use varied widely among states, from 0.2% of Alaska Medicare recipients to 2.49% of those enrolled in the program in Hawaii.

“There’s tremendous variation by state. That’s the first thing that jumps out,” said Donald Taylor Jr., a Duke professor of public policy.

In part, that’s because many providers, especially primary care doctors, aren’t aware that the Medicare reimbursement agreement, approved in 2015, has taken effect.

“Some physicians don’t know that this is a service,” said Barbie Hays, a Medicare coding and compliance strategist for the American Academy of Family Physicians. “They don’t know how to get paid for it. One of the struggles here is we’re trying to get this message out to our members.”

There also may be lingering controversy over the sessions, which were famously decried as “death panels” during the 2009 debate about the Affordable Care Act. Earlier this year, the issue resurfaced in Congress, where Rep. Steve King (R-Iowa) introduced the Protecting Life Until Natural Death Act, which would halt Medicare reimbursement for advance-care planning appointments.

Mr. King said the move was financially motivated and not in the interest of Americans “who were promised life-sustaining care in their older years.”

Proponents like Dr. Steinberg, however, contend that informed decisions, not cost savings, are the point of the new policy.

“It’s really important to say the reason for this isn’t to save money, although that may be a side benefit, but it’s really about person-centered care,” he said. “It’s about taking the time when people are ill or even when they’re not ill to talk about what their values are. To talk about what constitutes an acceptable versus an unacceptable quality of life.”

That’s just the discussion that the San Diego nursing home resident was able to have with her daughter, Dr. Steinberg said. The 90-year-old was able to say why she didn’t want CPR or to be intubated if she became seriously ill.

“I believe it brought the two of them closer,” Dr. Steinberg said. Even though the daughter didn’t necessarily hear what she wanted to hear. It was like, “You may not agree with your mom, but she’s your mom, and if she doesn’t want somebody beating her chest or ramming a tube down her throat, that’s her decision.”

KHN’s coverage of end-of-life and serious illness issues is supported by The Gordon and Betty Moore Foundation. Kaiser Health News is a national health policy news service that is part of the nonpartisan Henry J. Kaiser Family Foundation.

The 90-year-old woman in the San Diego–area nursing home was quite clear, said Karl Steinberg, MD. She didn’t want aggressive measures to prolong her life. If her heart stopped, she didn’t want CPR.

But when Dr. Steinberg, a palliative care physician, relayed those wishes to the woman’s daughter, the younger woman would have none of it.

“She said, ‘I don’t agree with that. My mom is confused,’ ” Steinberg recalled. “I said, ‘Let’s talk about it.’ ”

Instead of arguing, Dr. Steinberg used an increasingly popular tool to resolve the impasse last month. He brought mother and daughter together for an advance-care planning session, an end-of-life consultation that’s now being paid for by Medicare.

In 2016, the first year that health care providers were allowed to bill for the service, nearly 575,000 Medicare beneficiaries took part in the conversations, new federal data obtained by Kaiser Health News show.

Nearly 23,000 providers submitted about $93 million in charges, including more than $43 million covered by the federal program for seniors and the disabled.

Use was much higher than expected, nearly double the 300,000 people that the American Medical Association projected would use the service in the first year.

That’s good news to proponents of the sessions, which focus on understanding and documenting treatment preferences for people nearing the end of their lives. Patients – and often their families – discuss with a doctor or other provider what kind of care they want if they’re unable to make decisions themselves.

“I think it’s great that half a million people talked with their doctors last year. That’s a good thing,” said Paul Malley, president of Aging with Dignity, a Florida nonprofit that promotes end-of-life discussions. “Physician practices are learning. My guess is that it will increase each year.”

Still, only a fraction of eligible Medicare providers – and patients – have used the benefit, which pays about $86 for the first 30-minute office visit and about $75 for additional sessions.

Nationwide, slightly more than 1% of the more than 56 million Medicare beneficiaries enrolled at the end of 2016 received advance-care planning talks, according to calculations by health policy analysts at Duke University, Durham, N.C. But use varied widely among states, from 0.2% of Alaska Medicare recipients to 2.49% of those enrolled in the program in Hawaii.

“There’s tremendous variation by state. That’s the first thing that jumps out,” said Donald Taylor Jr., a Duke professor of public policy.

In part, that’s because many providers, especially primary care doctors, aren’t aware that the Medicare reimbursement agreement, approved in 2015, has taken effect.

“Some physicians don’t know that this is a service,” said Barbie Hays, a Medicare coding and compliance strategist for the American Academy of Family Physicians. “They don’t know how to get paid for it. One of the struggles here is we’re trying to get this message out to our members.”

There also may be lingering controversy over the sessions, which were famously decried as “death panels” during the 2009 debate about the Affordable Care Act. Earlier this year, the issue resurfaced in Congress, where Rep. Steve King (R-Iowa) introduced the Protecting Life Until Natural Death Act, which would halt Medicare reimbursement for advance-care planning appointments.

Mr. King said the move was financially motivated and not in the interest of Americans “who were promised life-sustaining care in their older years.”

Proponents like Dr. Steinberg, however, contend that informed decisions, not cost savings, are the point of the new policy.

“It’s really important to say the reason for this isn’t to save money, although that may be a side benefit, but it’s really about person-centered care,” he said. “It’s about taking the time when people are ill or even when they’re not ill to talk about what their values are. To talk about what constitutes an acceptable versus an unacceptable quality of life.”

That’s just the discussion that the San Diego nursing home resident was able to have with her daughter, Dr. Steinberg said. The 90-year-old was able to say why she didn’t want CPR or to be intubated if she became seriously ill.

“I believe it brought the two of them closer,” Dr. Steinberg said. Even though the daughter didn’t necessarily hear what she wanted to hear. It was like, “You may not agree with your mom, but she’s your mom, and if she doesn’t want somebody beating her chest or ramming a tube down her throat, that’s her decision.”

KHN’s coverage of end-of-life and serious illness issues is supported by The Gordon and Betty Moore Foundation. Kaiser Health News is a national health policy news service that is part of the nonpartisan Henry J. Kaiser Family Foundation.

New-onset AF after aortic valve replacement did not affect long-term survival

New-onset atrial fibrillation after aortic valve replacement was not an independent risk factor for decreased long-term survival, according to the results of a single-center, retrospective study reported by Ben M. Swinkels, MD, of St Antonius Hospital, Nieuwegein, and his colleagues in the Netherlands.

Key to this success, however, is restoring normal sinus rhythm before hospital discharge, they said.

In this retrospective, longitudinal cohort study, 569 consecutive patients with no history of AF who underwent AVR with or without concomitant coronary artery bypass grafting during 1990-1993 were followed for a mean of 17.8 years (J Thorac Cardiovasc Surg. 2017;154:492-8).

Thirty-day and long-term survival rates were determined in the 241 patients (42%) with and the 328 patients (58%) without new-onset postoperative atrial fibrillation (POAF), which was defined as electrocardiographically documented AF lasting for at least several hours, and occurring after AVR while the patient was still admitted. Standard therapy to prevent new onset POAF was the use of sotalol in patients who were not on beta-blocker therapy, and continuation of beta-blocker therapy for those who were already on it.

There were no significant differences between the two groups in demographic characteristics. There were also no significant differences between the two groups in operative characteristics, postoperative in-hospital adverse events, and postoperative hospital lengths of stay until discharge home, except for mechanical ventilation time, which was significantly longer in the patients with new-onset POAF (P = .011).

Thirty-day mortality was 1.2% in the patients with POAF, and 2.7% in those without, a nonsignificant difference. There was no statistically significant difference between the two survival curves and the Kaplan-Meier overall cumulative survival rates at 15 years of follow-up in the patients with new-onset POAF vs. those without were not statistically different (41.5% vs. 41.3%, respectively).

In addition, the 18-year probability of long-term first adverse events, including recurrent AF, transient ischemic attack, ischemic or hemorrhagic stroke, peripheral venous thromboembolism, or major or minor bleeding was not significantly different between the two groups.

“New-onset POAF after AVR does not affect long-term survival when treatment is aimed to restore sinus rhythm before the patient is discharged home. Future studies with a prospective, randomized design should be done to confirm this finding in patients undergoing different kinds of cardiac surgery,” the researchers concluded.

The study was funded by the authors’ home institution; the authors reported they had nothing to disclose.

The incidence of atrial fibrillation after valve surgery has been described to be as high as 50%, Manuel J. Antunes, MD, said in an editorial commentary. “The adverse effect on long-term survival may not be related to the short-lived new-onset AF but rather to the underlying pathology associated to the arrhythmia, especially pathology that affects the myocardium, principally in atherosclerotic coronary artery disease,” he wrote. “It is not survival alone, however, that should be cause for concern; AF, even in episodes of limited duration, may result in transient ischemic attacks, ischemic, or hemorrhagic strokes, and peripheral thromboembolism, which is why affected patients should immediately be anticoagulated.”

This study, however, is at odds with previously published studies, with opposite conclusions, according to Dr. Antunes. Swinkels and his colleagues suggest that one of the reasons for the discrepancy was the homogeneous character of their series, which consisted almost entirely of patients who had isolated AVR. Dr. Antunes also adds that another important aspect to consider is that the antiarrhythmic drugs used prophylactically or therapeutically for this patient cohort (treated during 1990-1993) are no longer used or have been replaced by new and more efficacious pharmacologic agents.

Manuel J. Antunes, MD, of the University Hospital and Faculty of Medicine, Coimbra, Portugal, made these remarks in an invited editorial (J Thorac Cardiovasc Surg. 2017;154:490-1). He reported having nothing to disclose.

The incidence of atrial fibrillation after valve surgery has been described to be as high as 50%, Manuel J. Antunes, MD, said in an editorial commentary. “The adverse effect on long-term survival may not be related to the short-lived new-onset AF but rather to the underlying pathology associated to the arrhythmia, especially pathology that affects the myocardium, principally in atherosclerotic coronary artery disease,” he wrote. “It is not survival alone, however, that should be cause for concern; AF, even in episodes of limited duration, may result in transient ischemic attacks, ischemic, or hemorrhagic strokes, and peripheral thromboembolism, which is why affected patients should immediately be anticoagulated.”

This study, however, is at odds with previously published studies, with opposite conclusions, according to Dr. Antunes. Swinkels and his colleagues suggest that one of the reasons for the discrepancy was the homogeneous character of their series, which consisted almost entirely of patients who had isolated AVR. Dr. Antunes also adds that another important aspect to consider is that the antiarrhythmic drugs used prophylactically or therapeutically for this patient cohort (treated during 1990-1993) are no longer used or have been replaced by new and more efficacious pharmacologic agents.

Manuel J. Antunes, MD, of the University Hospital and Faculty of Medicine, Coimbra, Portugal, made these remarks in an invited editorial (J Thorac Cardiovasc Surg. 2017;154:490-1). He reported having nothing to disclose.

The incidence of atrial fibrillation after valve surgery has been described to be as high as 50%, Manuel J. Antunes, MD, said in an editorial commentary. “The adverse effect on long-term survival may not be related to the short-lived new-onset AF but rather to the underlying pathology associated to the arrhythmia, especially pathology that affects the myocardium, principally in atherosclerotic coronary artery disease,” he wrote. “It is not survival alone, however, that should be cause for concern; AF, even in episodes of limited duration, may result in transient ischemic attacks, ischemic, or hemorrhagic strokes, and peripheral thromboembolism, which is why affected patients should immediately be anticoagulated.”

This study, however, is at odds with previously published studies, with opposite conclusions, according to Dr. Antunes. Swinkels and his colleagues suggest that one of the reasons for the discrepancy was the homogeneous character of their series, which consisted almost entirely of patients who had isolated AVR. Dr. Antunes also adds that another important aspect to consider is that the antiarrhythmic drugs used prophylactically or therapeutically for this patient cohort (treated during 1990-1993) are no longer used or have been replaced by new and more efficacious pharmacologic agents.

Manuel J. Antunes, MD, of the University Hospital and Faculty of Medicine, Coimbra, Portugal, made these remarks in an invited editorial (J Thorac Cardiovasc Surg. 2017;154:490-1). He reported having nothing to disclose.

New-onset atrial fibrillation after aortic valve replacement was not an independent risk factor for decreased long-term survival, according to the results of a single-center, retrospective study reported by Ben M. Swinkels, MD, of St Antonius Hospital, Nieuwegein, and his colleagues in the Netherlands.

Key to this success, however, is restoring normal sinus rhythm before hospital discharge, they said.

In this retrospective, longitudinal cohort study, 569 consecutive patients with no history of AF who underwent AVR with or without concomitant coronary artery bypass grafting during 1990-1993 were followed for a mean of 17.8 years (J Thorac Cardiovasc Surg. 2017;154:492-8).

Thirty-day and long-term survival rates were determined in the 241 patients (42%) with and the 328 patients (58%) without new-onset postoperative atrial fibrillation (POAF), which was defined as electrocardiographically documented AF lasting for at least several hours, and occurring after AVR while the patient was still admitted. Standard therapy to prevent new onset POAF was the use of sotalol in patients who were not on beta-blocker therapy, and continuation of beta-blocker therapy for those who were already on it.

There were no significant differences between the two groups in demographic characteristics. There were also no significant differences between the two groups in operative characteristics, postoperative in-hospital adverse events, and postoperative hospital lengths of stay until discharge home, except for mechanical ventilation time, which was significantly longer in the patients with new-onset POAF (P = .011).

Thirty-day mortality was 1.2% in the patients with POAF, and 2.7% in those without, a nonsignificant difference. There was no statistically significant difference between the two survival curves and the Kaplan-Meier overall cumulative survival rates at 15 years of follow-up in the patients with new-onset POAF vs. those without were not statistically different (41.5% vs. 41.3%, respectively).

In addition, the 18-year probability of long-term first adverse events, including recurrent AF, transient ischemic attack, ischemic or hemorrhagic stroke, peripheral venous thromboembolism, or major or minor bleeding was not significantly different between the two groups.

“New-onset POAF after AVR does not affect long-term survival when treatment is aimed to restore sinus rhythm before the patient is discharged home. Future studies with a prospective, randomized design should be done to confirm this finding in patients undergoing different kinds of cardiac surgery,” the researchers concluded.

The study was funded by the authors’ home institution; the authors reported they had nothing to disclose.

New-onset atrial fibrillation after aortic valve replacement was not an independent risk factor for decreased long-term survival, according to the results of a single-center, retrospective study reported by Ben M. Swinkels, MD, of St Antonius Hospital, Nieuwegein, and his colleagues in the Netherlands.

Key to this success, however, is restoring normal sinus rhythm before hospital discharge, they said.

In this retrospective, longitudinal cohort study, 569 consecutive patients with no history of AF who underwent AVR with or without concomitant coronary artery bypass grafting during 1990-1993 were followed for a mean of 17.8 years (J Thorac Cardiovasc Surg. 2017;154:492-8).

Thirty-day and long-term survival rates were determined in the 241 patients (42%) with and the 328 patients (58%) without new-onset postoperative atrial fibrillation (POAF), which was defined as electrocardiographically documented AF lasting for at least several hours, and occurring after AVR while the patient was still admitted. Standard therapy to prevent new onset POAF was the use of sotalol in patients who were not on beta-blocker therapy, and continuation of beta-blocker therapy for those who were already on it.

There were no significant differences between the two groups in demographic characteristics. There were also no significant differences between the two groups in operative characteristics, postoperative in-hospital adverse events, and postoperative hospital lengths of stay until discharge home, except for mechanical ventilation time, which was significantly longer in the patients with new-onset POAF (P = .011).

Thirty-day mortality was 1.2% in the patients with POAF, and 2.7% in those without, a nonsignificant difference. There was no statistically significant difference between the two survival curves and the Kaplan-Meier overall cumulative survival rates at 15 years of follow-up in the patients with new-onset POAF vs. those without were not statistically different (41.5% vs. 41.3%, respectively).

In addition, the 18-year probability of long-term first adverse events, including recurrent AF, transient ischemic attack, ischemic or hemorrhagic stroke, peripheral venous thromboembolism, or major or minor bleeding was not significantly different between the two groups.

“New-onset POAF after AVR does not affect long-term survival when treatment is aimed to restore sinus rhythm before the patient is discharged home. Future studies with a prospective, randomized design should be done to confirm this finding in patients undergoing different kinds of cardiac surgery,” the researchers concluded.

The study was funded by the authors’ home institution; the authors reported they had nothing to disclose.

FROM THE JOURNAL OF THORACIC AND CARDIOVASCULAR SURGERY

Key clinical point:

Major finding: Cumulative 15-year survival rates were similar in the patients with new-onset postop AF (41.5%) to those without (41.3%).

Data source: A retrospective longitudinal cohort study of 569 consecutive patients without a history of AF who were followed for a mean of 17.8 years after AVR with or without concomitant CABG.

Disclosures: The study was funded by the authors’ home institution and the authors reported they had nothing to disclose.

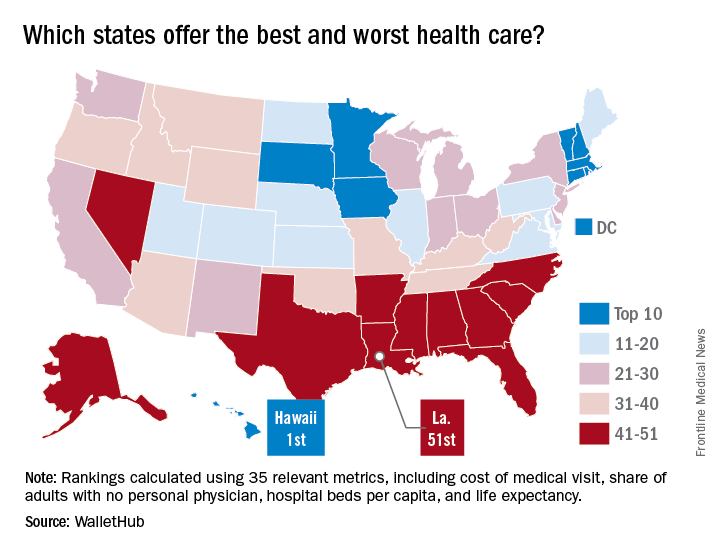

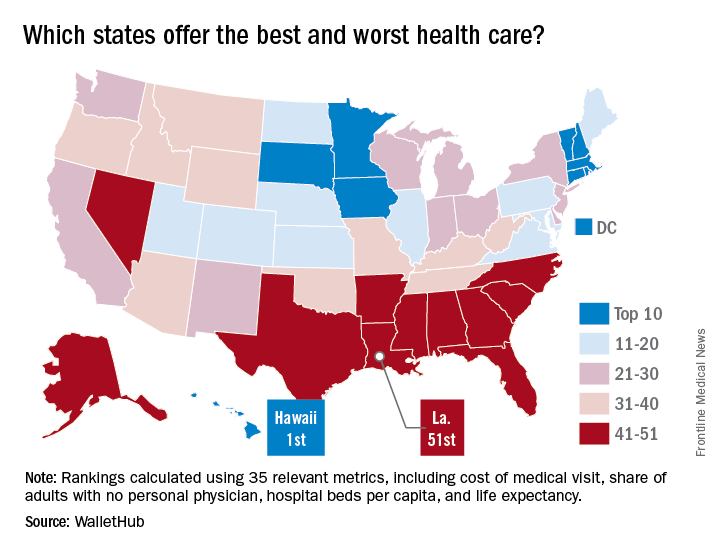

Say ‘Aloha’ to the best health care

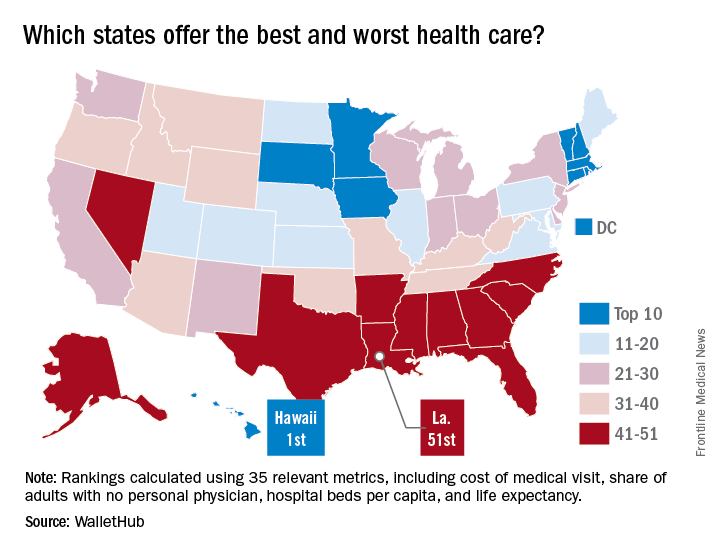

It probably should come as no surprise that Hawaii, which has been named the healthiest state for 5 consecutive years, is now being honored for having the best health care by personal finance website WalletHub.

The state’s high scores in two of the three broad dimensions of health care – first in outcomes and third in cost – used in the WalletHub analysis allowed it to overcome its ranking of 42nd in the third dimension, access, and finish ahead of Iowa and Minnesota, which tied for second. New Hampshire earned a fourth-place finish and the District of Columbia was fifth, courtesy of its first-place finish in the cost dimension, WalletHub reported. Maine, which finished 14th overall, was No. 1 in access.

The state in 51st place is Louisiana, which placed in the top 5 in both cancer and heart disease rates. Mississippi was credited with the 50th-best health care system, just behind Alaska (49), Arkansas (48), North Carolina (47), and Georgia (46). The lowest ranking in each dimension went to Alaska (cost), Texas (access), and Mississippi (outcomes), according to WalletHub’s analysts.

A closer look at some of the individual metrics shows that the District of Columbia has the most physicians per capita and Idaho has the fewest, Medicare acceptance is highest among physicians in North Dakota and lowest in Hawaii, and infant mortality is lowest in New Hampshire and highest in Mississippi, according to the WalletHub analysis, which was based on data from 19 sources, including the Centers for Medicare & Medicaid Services, the Association of American Medical Colleges, and the Social Science Research Council.

It probably should come as no surprise that Hawaii, which has been named the healthiest state for 5 consecutive years, is now being honored for having the best health care by personal finance website WalletHub.

The state’s high scores in two of the three broad dimensions of health care – first in outcomes and third in cost – used in the WalletHub analysis allowed it to overcome its ranking of 42nd in the third dimension, access, and finish ahead of Iowa and Minnesota, which tied for second. New Hampshire earned a fourth-place finish and the District of Columbia was fifth, courtesy of its first-place finish in the cost dimension, WalletHub reported. Maine, which finished 14th overall, was No. 1 in access.

The state in 51st place is Louisiana, which placed in the top 5 in both cancer and heart disease rates. Mississippi was credited with the 50th-best health care system, just behind Alaska (49), Arkansas (48), North Carolina (47), and Georgia (46). The lowest ranking in each dimension went to Alaska (cost), Texas (access), and Mississippi (outcomes), according to WalletHub’s analysts.

A closer look at some of the individual metrics shows that the District of Columbia has the most physicians per capita and Idaho has the fewest, Medicare acceptance is highest among physicians in North Dakota and lowest in Hawaii, and infant mortality is lowest in New Hampshire and highest in Mississippi, according to the WalletHub analysis, which was based on data from 19 sources, including the Centers for Medicare & Medicaid Services, the Association of American Medical Colleges, and the Social Science Research Council.

It probably should come as no surprise that Hawaii, which has been named the healthiest state for 5 consecutive years, is now being honored for having the best health care by personal finance website WalletHub.

The state’s high scores in two of the three broad dimensions of health care – first in outcomes and third in cost – used in the WalletHub analysis allowed it to overcome its ranking of 42nd in the third dimension, access, and finish ahead of Iowa and Minnesota, which tied for second. New Hampshire earned a fourth-place finish and the District of Columbia was fifth, courtesy of its first-place finish in the cost dimension, WalletHub reported. Maine, which finished 14th overall, was No. 1 in access.

The state in 51st place is Louisiana, which placed in the top 5 in both cancer and heart disease rates. Mississippi was credited with the 50th-best health care system, just behind Alaska (49), Arkansas (48), North Carolina (47), and Georgia (46). The lowest ranking in each dimension went to Alaska (cost), Texas (access), and Mississippi (outcomes), according to WalletHub’s analysts.

A closer look at some of the individual metrics shows that the District of Columbia has the most physicians per capita and Idaho has the fewest, Medicare acceptance is highest among physicians in North Dakota and lowest in Hawaii, and infant mortality is lowest in New Hampshire and highest in Mississippi, according to the WalletHub analysis, which was based on data from 19 sources, including the Centers for Medicare & Medicaid Services, the Association of American Medical Colleges, and the Social Science Research Council.

ACA lawsuits progress through the courts

While Republican efforts to repeal and/or replace the Affordable Care Act are likely to resurface after the congressional summer recess, lawsuits challenging the health law continue to wind their way through the courts.

Judges recently ruled in three ACA cases regarding the contraceptive mandate, risk corridors program, and cost-sharing reduction payments.

Real Alternatives Inc. v. HHS

Secular groups are not entitled to a religious exemption to the ACA’s contraceptive mandate and must offer plans to employees that cover birth control, the United States Court of Appeals for the Third Circuit ruled in an Aug. 4 opinion.

But a majority of appeal judges disagreed, concluding that Real Alternatives is not similar to a religious denomination or one of its nontheistic counterparts, “not in structure, not in aim, not in purpose, and not in function.”

“We do not doubt that Real Alternative’s stance on contraceptives is grounded in sincerely-held moral values, but religion is not generally confined to one question or one moral teaching, it has a broader scope,” Judge Marjorie O. Rendell wrote in the majority opinion. “Real Alternatives is functionally similar not to a church, but to the countless nonreligious nonprofit organizations that take morally informed positions on some discrete set of issues ... While commitment to an anti-abortion platform may be important to the people who hold them, that commitment is not a religion in any legally or theologically accepted sense; and organizations do not become quasi-churches for equal-protection purposes merely by espousing a commitment of that sort.”

Molina Healthcare v. HHS

The federal Heath & Human Services department may have to dish out millions to marketplace insurers after a recent decision by the U.S. Court of Federal Claims. In an Aug. 4 opinion, a federal claims judge ruled the federal government owes Long Beach, Calif.–based insurer Molina Healthcare $52 million in risk corridor payments under the ACA.

The decision stems from a lawsuit by Molina and dozens of other insurers against HHS over the ACA’s risk corridor program. The program requires HHS to collect funds from excessively profitable insurers that offer qualified health plans (QHP) under the exchanges, while paying out funds to QHP insurers with excessive losses. Collections from profitable insurers under the program fell short in 2014 and again in 2015, resulting in HHS paying about 12 cents on the dollar in payments to insurers.

Insurers allege they’ve been shortchanged and that the government must reimburse them full payments for 2014 and 2015. Under the Obama administration, the Department of Justice requested to dismiss the cases, arguing that riders attached to appropriations bills in 2015 and 2016 barred it from making full risk corridor payments.

In his decision, Judge Thomas Wheeler said the ACA mandates that HHS pay insurers what they are owed under the risk corridor program, regardless of the riders.

“The undisputed facts show the government entered into an implied-in-fact contract with Molina and subsequently breached the contract when it failed to make full risk corridor payments,” Judge Wheeler wrote. “Importantly, Molina prevails on its argument of breach of an implied-in-fact contract regardless of the government’s appropriation law defenses – later appropriation restrictions cannot erase a previously created contractual obligation ...The government is liable for its breach of a statutory and contractual obligation to make full annual payments to insurers who participated in the risk corridor program.”

Judge Wheeler ruled similarly in February when he concluded the federal government owes Portland, Ore.–based Moda Health $214 million in risk corridor payments.

The issue is far from over. More than 25 lawsuits have been filed in the Court of Federal Claims by insurers seeking risk corridor money. Several of the cases have moved onto federal appeals courts, while other cases have been dismissed. Analysts say the issue is likely to reach the U.S. Supreme Court. It’s unclear where the Trump administration would get the funds to reimburse insurers if the payback rulings stand. About $19.3 billion in risk corridor payments are at stake for 2014 and 2015 and an estimated $3 billion is in play for 2016, the final risk corridor year.

House v. Price

A U.S. appeals court has allowed 16 states to intervene in a lawsuit over whether subsidy payments made to insurers under the ACA are legal. The decision comes as President Trump recently threatened to cut off the cost sharing reduction (CSR) payments to marketplace insurers, calling them a “bailout.”

On Aug. 1, the U.S. Court of Appeals for the District of Columbia Circuit granted a motion by 18 attorneys general to enter the lawsuit. The attorneys general represent California, New York, Connecticut, Delaware, Hawaii, Illinois, Iowa, Kentucky, Maryland, Massachusetts, Minnesota, New Mexico, North Carolina, Pennsylvania, Vermont, Virginia, Washington, and the District of Columbia.

Under the ACA, the federal government provides CSR payments to insurers to offset the costs for providing discount plans to patients who earn up to 200% of the federal poverty level. Plans on the individual exchanges are required to cover a package of essential benefits with pricing limitations to ensure that out-of-pocket costs are low enough for low-income patients.

Republican members of the House of Representatives sued the HHS over the CSR payments under the Obama administration, claiming the funding was illegal because it was never appropriated by Congress. A court ruled in favor of the House in 2016, but an appeal filed by the Obama administration allowed the CSR payments to continue. President Trump has not indicated whether he plans to drop the appeal or carry on the case. But if he fails to continue the suit, the move would immediately end the CSR payments.

On July 29, President Trump tweeted, “If a new HealthCare Bill is not approved quickly, BAILOUTS for Insurance Companies and BAILOUTS for Members of Congress will end very soon!”

The state attorneys general are ready to defend the ACA and the cost sharing reduction payments, California Attorney General Xavier Becerra said in a statement.

“If Donald Trump won’t defend these vital subsidies for American families, then we will,” Mr. Becerra said in the statement. “This ruling gives my fellow attorneys general and me the ability to stand up for the millions of families who otherwise would lack access to affordable health care. It’s time Americans knew we were working for them, not against them.”

[email protected]

On Twitter @legal_med

While Republican efforts to repeal and/or replace the Affordable Care Act are likely to resurface after the congressional summer recess, lawsuits challenging the health law continue to wind their way through the courts.

Judges recently ruled in three ACA cases regarding the contraceptive mandate, risk corridors program, and cost-sharing reduction payments.

Real Alternatives Inc. v. HHS

Secular groups are not entitled to a religious exemption to the ACA’s contraceptive mandate and must offer plans to employees that cover birth control, the United States Court of Appeals for the Third Circuit ruled in an Aug. 4 opinion.

But a majority of appeal judges disagreed, concluding that Real Alternatives is not similar to a religious denomination or one of its nontheistic counterparts, “not in structure, not in aim, not in purpose, and not in function.”

“We do not doubt that Real Alternative’s stance on contraceptives is grounded in sincerely-held moral values, but religion is not generally confined to one question or one moral teaching, it has a broader scope,” Judge Marjorie O. Rendell wrote in the majority opinion. “Real Alternatives is functionally similar not to a church, but to the countless nonreligious nonprofit organizations that take morally informed positions on some discrete set of issues ... While commitment to an anti-abortion platform may be important to the people who hold them, that commitment is not a religion in any legally or theologically accepted sense; and organizations do not become quasi-churches for equal-protection purposes merely by espousing a commitment of that sort.”

Molina Healthcare v. HHS

The federal Heath & Human Services department may have to dish out millions to marketplace insurers after a recent decision by the U.S. Court of Federal Claims. In an Aug. 4 opinion, a federal claims judge ruled the federal government owes Long Beach, Calif.–based insurer Molina Healthcare $52 million in risk corridor payments under the ACA.

The decision stems from a lawsuit by Molina and dozens of other insurers against HHS over the ACA’s risk corridor program. The program requires HHS to collect funds from excessively profitable insurers that offer qualified health plans (QHP) under the exchanges, while paying out funds to QHP insurers with excessive losses. Collections from profitable insurers under the program fell short in 2014 and again in 2015, resulting in HHS paying about 12 cents on the dollar in payments to insurers.

Insurers allege they’ve been shortchanged and that the government must reimburse them full payments for 2014 and 2015. Under the Obama administration, the Department of Justice requested to dismiss the cases, arguing that riders attached to appropriations bills in 2015 and 2016 barred it from making full risk corridor payments.

In his decision, Judge Thomas Wheeler said the ACA mandates that HHS pay insurers what they are owed under the risk corridor program, regardless of the riders.