User login

Official Newspaper of the American College of Surgeons

Reconstruction becoming more common after mastectomy

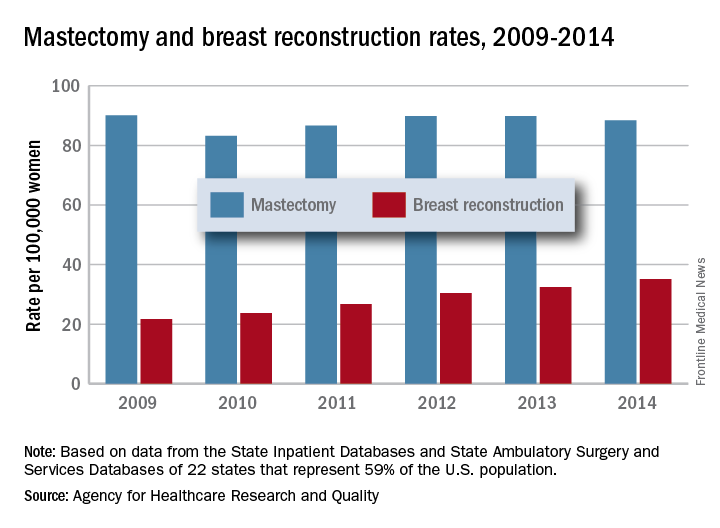

The rate of breast reconstruction surgery for mastectomy increased 62% from 2009 to 2014, while the mastectomy rate itself “remained relatively stable,” according to the Agency for Healthcare Research and Quality.

The rate of breast reconstructions in hospitals and ambulatory surgery settings rose steadily over the 6-year period, going from 21.7 per 100,000 women in 2009 to 35.1 per 100,000 in 2014. Meanwhile, the mastectomy rate dipped from 90.1 in 2009 to 83.2 in 2010 but varied less than 10% over the 2009-2014 time period, reaching 88.4 per 100,000 women in 2014. To put those numbers in a different context, the ratio of reconstructions to mastectomies went from 24-to-100 in 2009 to 40-to-100 in 2014, the AHRQ reported in a Statistical Brief.

Those nonsimultaneous procedures were taking place much more often in ambulatory settings by 2014, as the rate of reconstructions at a separate visit increased 152% from 7.4 per 100,000 women in 2009 to 18.2. Simultaneous reconstructions in ambulatory settings were less common but increased at an even greater rate of 155%, going from 1.1 to 2.8 per 100,000 women. Inpatient reconstruction had little or no growth over the 6 years: Separate-visit procedures went from 6 to 6.8 and simultaneous reconstructions actually dropped from 7.4 per 100,000 women to 7.3, they reported.

The analysis was based on data from AHRQ State Inpatient Databases and State Ambulatory Surgery and Services Databases for 22 states that include 59% of the U.S. population: California, Colorado, Connecticut, Florida, Georgia, Iowa, Indiana, Maryland, Michigan, Minnesota, Missouri, Nebraska, New Jersey, New York, North Carolina, Ohio, South Carolina, South Dakota, Tennessee, Utah, Vermont, and Wisconsin.

The rate of breast reconstruction surgery for mastectomy increased 62% from 2009 to 2014, while the mastectomy rate itself “remained relatively stable,” according to the Agency for Healthcare Research and Quality.

The rate of breast reconstructions in hospitals and ambulatory surgery settings rose steadily over the 6-year period, going from 21.7 per 100,000 women in 2009 to 35.1 per 100,000 in 2014. Meanwhile, the mastectomy rate dipped from 90.1 in 2009 to 83.2 in 2010 but varied less than 10% over the 2009-2014 time period, reaching 88.4 per 100,000 women in 2014. To put those numbers in a different context, the ratio of reconstructions to mastectomies went from 24-to-100 in 2009 to 40-to-100 in 2014, the AHRQ reported in a Statistical Brief.

Those nonsimultaneous procedures were taking place much more often in ambulatory settings by 2014, as the rate of reconstructions at a separate visit increased 152% from 7.4 per 100,000 women in 2009 to 18.2. Simultaneous reconstructions in ambulatory settings were less common but increased at an even greater rate of 155%, going from 1.1 to 2.8 per 100,000 women. Inpatient reconstruction had little or no growth over the 6 years: Separate-visit procedures went from 6 to 6.8 and simultaneous reconstructions actually dropped from 7.4 per 100,000 women to 7.3, they reported.

The analysis was based on data from AHRQ State Inpatient Databases and State Ambulatory Surgery and Services Databases for 22 states that include 59% of the U.S. population: California, Colorado, Connecticut, Florida, Georgia, Iowa, Indiana, Maryland, Michigan, Minnesota, Missouri, Nebraska, New Jersey, New York, North Carolina, Ohio, South Carolina, South Dakota, Tennessee, Utah, Vermont, and Wisconsin.

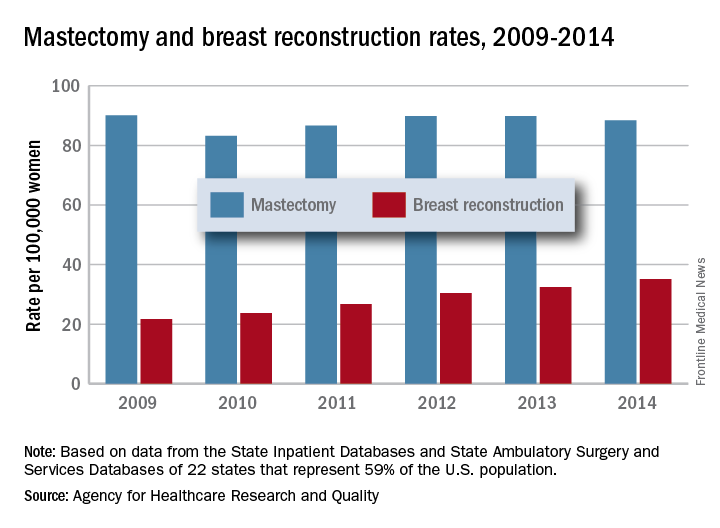

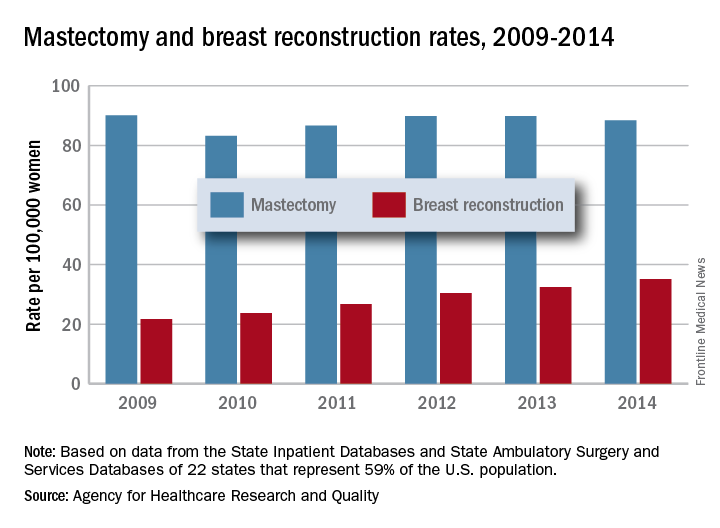

The rate of breast reconstruction surgery for mastectomy increased 62% from 2009 to 2014, while the mastectomy rate itself “remained relatively stable,” according to the Agency for Healthcare Research and Quality.

The rate of breast reconstructions in hospitals and ambulatory surgery settings rose steadily over the 6-year period, going from 21.7 per 100,000 women in 2009 to 35.1 per 100,000 in 2014. Meanwhile, the mastectomy rate dipped from 90.1 in 2009 to 83.2 in 2010 but varied less than 10% over the 2009-2014 time period, reaching 88.4 per 100,000 women in 2014. To put those numbers in a different context, the ratio of reconstructions to mastectomies went from 24-to-100 in 2009 to 40-to-100 in 2014, the AHRQ reported in a Statistical Brief.

Those nonsimultaneous procedures were taking place much more often in ambulatory settings by 2014, as the rate of reconstructions at a separate visit increased 152% from 7.4 per 100,000 women in 2009 to 18.2. Simultaneous reconstructions in ambulatory settings were less common but increased at an even greater rate of 155%, going from 1.1 to 2.8 per 100,000 women. Inpatient reconstruction had little or no growth over the 6 years: Separate-visit procedures went from 6 to 6.8 and simultaneous reconstructions actually dropped from 7.4 per 100,000 women to 7.3, they reported.

The analysis was based on data from AHRQ State Inpatient Databases and State Ambulatory Surgery and Services Databases for 22 states that include 59% of the U.S. population: California, Colorado, Connecticut, Florida, Georgia, Iowa, Indiana, Maryland, Michigan, Minnesota, Missouri, Nebraska, New Jersey, New York, North Carolina, Ohio, South Carolina, South Dakota, Tennessee, Utah, Vermont, and Wisconsin.

MACRA Monday: Advance care plan

If you haven’t started reporting quality data for the Merit-Based Incentive Payment System (MIPS), there’s still time to avoid a 4% cut to your Medicare payments.

Under the Pick Your Pace approach being offered this year, the Centers for Medicare & Medicaid Services allows clinicians to test the system by reporting on one quality measure for one patient through paper-based claims. Be sure to append a Quality Data Code (QDC) to the claim form for care provided up to Dec. 31, 2017, in order to avoid a penalty in payment year 2019.

Consider this measure:

Measure #47: Care Plan

This measure is aimed at capturing the percentage of patients aged 65 years and older who have a documented advance care plan in their medical records.

What you need to do: Discuss with the patient the creation of an advance care plan or the naming of a surrogate decision maker and then document that in the medical record. If the patient does not wish to make a plan or is unable to name a decision maker, document that along with the fact that the issue of advance care planning was discussed.

Eligible cases include patients aged 65 years or older on the date of the encounter and a patient encounter during the performance period. Applicable codes include (CPT or HCPCS): 99201, 99202, 99203, 99204, 99205,99212, 99213, 99214, 99215, 99218, 99219, 99220, 99221, 99222, 99223, 99231, 99232, 99233, 99234, 99235, 99236, 99291, 99304, 99305, 99306, 99307, 99308, 99309, 99310, 99324, 99325, 99326, 99327, 99328, 99334, 99335, 99336, 99337, 99341, 99342, 99343, 99344, 99345, 99347, 99348, 99349, 99350, G0402, G0438, G0439.

To get credit under MIPS, be sure to include a Quality Data Code that shows that you successfully performed the measure or had a good reason for not doing so. For instance, CPT II 1123F indicates that advance care planning was discussed and documented, and an advance care plan or surrogate decision maker was documented in the medical record. On the other hand, CPT II 1124F should be used if advance care planning was discussed and documented in the medical record, but the patient did not wish or was not able to name a surrogate decision maker or provide an advance care plan.

CMS has a full list of measures available for claims-based reporting at qpp.cms.gov. The American Medical Association has also created a step-by-step guide for reporting on one quality measure.

Certain clinicians are exempt from reporting and do not face a penalty under MIPS:

- Those who enrolled in Medicare for the first time during a performance period.

- Those who have Medicare Part B–allowed charges of $30,000 or less.

- Those who have 100 or fewer Medicare Part B patients.

- Those who are significantly participating in an Advanced Alternative Payment Model (APM).

If you haven’t started reporting quality data for the Merit-Based Incentive Payment System (MIPS), there’s still time to avoid a 4% cut to your Medicare payments.

Under the Pick Your Pace approach being offered this year, the Centers for Medicare & Medicaid Services allows clinicians to test the system by reporting on one quality measure for one patient through paper-based claims. Be sure to append a Quality Data Code (QDC) to the claim form for care provided up to Dec. 31, 2017, in order to avoid a penalty in payment year 2019.

Consider this measure:

Measure #47: Care Plan

This measure is aimed at capturing the percentage of patients aged 65 years and older who have a documented advance care plan in their medical records.

What you need to do: Discuss with the patient the creation of an advance care plan or the naming of a surrogate decision maker and then document that in the medical record. If the patient does not wish to make a plan or is unable to name a decision maker, document that along with the fact that the issue of advance care planning was discussed.

Eligible cases include patients aged 65 years or older on the date of the encounter and a patient encounter during the performance period. Applicable codes include (CPT or HCPCS): 99201, 99202, 99203, 99204, 99205,99212, 99213, 99214, 99215, 99218, 99219, 99220, 99221, 99222, 99223, 99231, 99232, 99233, 99234, 99235, 99236, 99291, 99304, 99305, 99306, 99307, 99308, 99309, 99310, 99324, 99325, 99326, 99327, 99328, 99334, 99335, 99336, 99337, 99341, 99342, 99343, 99344, 99345, 99347, 99348, 99349, 99350, G0402, G0438, G0439.

To get credit under MIPS, be sure to include a Quality Data Code that shows that you successfully performed the measure or had a good reason for not doing so. For instance, CPT II 1123F indicates that advance care planning was discussed and documented, and an advance care plan or surrogate decision maker was documented in the medical record. On the other hand, CPT II 1124F should be used if advance care planning was discussed and documented in the medical record, but the patient did not wish or was not able to name a surrogate decision maker or provide an advance care plan.

CMS has a full list of measures available for claims-based reporting at qpp.cms.gov. The American Medical Association has also created a step-by-step guide for reporting on one quality measure.

Certain clinicians are exempt from reporting and do not face a penalty under MIPS:

- Those who enrolled in Medicare for the first time during a performance period.

- Those who have Medicare Part B–allowed charges of $30,000 or less.

- Those who have 100 or fewer Medicare Part B patients.

- Those who are significantly participating in an Advanced Alternative Payment Model (APM).

If you haven’t started reporting quality data for the Merit-Based Incentive Payment System (MIPS), there’s still time to avoid a 4% cut to your Medicare payments.

Under the Pick Your Pace approach being offered this year, the Centers for Medicare & Medicaid Services allows clinicians to test the system by reporting on one quality measure for one patient through paper-based claims. Be sure to append a Quality Data Code (QDC) to the claim form for care provided up to Dec. 31, 2017, in order to avoid a penalty in payment year 2019.

Consider this measure:

Measure #47: Care Plan

This measure is aimed at capturing the percentage of patients aged 65 years and older who have a documented advance care plan in their medical records.

What you need to do: Discuss with the patient the creation of an advance care plan or the naming of a surrogate decision maker and then document that in the medical record. If the patient does not wish to make a plan or is unable to name a decision maker, document that along with the fact that the issue of advance care planning was discussed.

Eligible cases include patients aged 65 years or older on the date of the encounter and a patient encounter during the performance period. Applicable codes include (CPT or HCPCS): 99201, 99202, 99203, 99204, 99205,99212, 99213, 99214, 99215, 99218, 99219, 99220, 99221, 99222, 99223, 99231, 99232, 99233, 99234, 99235, 99236, 99291, 99304, 99305, 99306, 99307, 99308, 99309, 99310, 99324, 99325, 99326, 99327, 99328, 99334, 99335, 99336, 99337, 99341, 99342, 99343, 99344, 99345, 99347, 99348, 99349, 99350, G0402, G0438, G0439.

To get credit under MIPS, be sure to include a Quality Data Code that shows that you successfully performed the measure or had a good reason for not doing so. For instance, CPT II 1123F indicates that advance care planning was discussed and documented, and an advance care plan or surrogate decision maker was documented in the medical record. On the other hand, CPT II 1124F should be used if advance care planning was discussed and documented in the medical record, but the patient did not wish or was not able to name a surrogate decision maker or provide an advance care plan.

CMS has a full list of measures available for claims-based reporting at qpp.cms.gov. The American Medical Association has also created a step-by-step guide for reporting on one quality measure.

Certain clinicians are exempt from reporting and do not face a penalty under MIPS:

- Those who enrolled in Medicare for the first time during a performance period.

- Those who have Medicare Part B–allowed charges of $30,000 or less.

- Those who have 100 or fewer Medicare Part B patients.

- Those who are significantly participating in an Advanced Alternative Payment Model (APM).

Higher stroke risk found for TAVR versus SAVR

SAN DIEGO – There was an 86% greater risk of ischemic stroke after transcatheter aortic valve replacement, compared with surgical aortic valve replacement, and a more than sixfold increased risk of hemorrhagic stroke, in a review of more than 44,000 patients in the Nationwide Readmissions Database who were followed out to a year after having one procedure or the other.

“Our data suggest an elevated risk of both ischemic and hemorrhagic stroke after TAVR [transcatheter aortic valve replacement]. I see a lot of people that have strokes after” TAVR, so “I wasn’t all that surprised that there is an increased risk, but could I have guessed it would have been so high? No.” Perhaps “we are offering it to people we shouldn’t be offering it to,” said lead investigator Laura Stein, MD, a vascular neurology fellow at Mount Sinai Hospital, New York.

The 2013 Nationwide Readmissions Database used in the study captured more than 14 million readmissions in the United States across all payers and the uninsured. “We used this database because its captures all comers” and reflects “more real-world practice,” Dr. Stein said.

There were 6,015 TAVR and 38,624 SAVR cases in 2013, and the team found consistently elevated cumulative risks of ischemic and hemorrhagic stroke after TAVR, compared with SAVR, according to a presentation at the annual meeting of the American Neurological Association.

Compared with SAVR, the hazard ratio for ischemic stroke with TAVR was 1.86 (95% confidence interval, 1.12-3.08; P = .016) and, for hemorrhagic stroke, 6.17 (95% CI, 1.97-19.33; P = .0018). Dr. Stein declined to release absolute numbers of strokes in the two groups, pending publication.

“A lot of attention is being paid to this topic because there has been a push, a lot of it by the device makers, to prove that [TAVR] outcomes are just as good as with traditional surgery, and that we should be offering [TAVR] to more people with higher risk factor profiles who might not have been offered repair otherwise. Our job is to help patients make the most informed decisions. Having another source of data like [ours]” adds to the conversation about risks and benefits, she said.

The investigators adjusted for a large number of potential confounders to make sure the comparison was as fair as possible given the limits of database reviews. Among other variables, they controlled for baseline cardiovascular risk factors, carotid artery disease, heart failure, obesity, smoking, surgical complications, mortality, and illness severity scores, as well as hospital size, teaching hospital status, and urban versus rural location.

“What we can’t know is what medications these patients were on that might have increased their bleeding or ischemia risk. Also, we were relying on coding done by other people,” Dr. Stein said.

The next step is to look at the impact of stenting and other concomitant procedures. “We were surprised by the number of people that had multiple procedures at the same time.” The ultimate goal is to develop a risk score to help patients and doctors decide between the two procedures, she said.

Meanwhile, the team found no difference in stroke risk between coronary artery bypass grafting and percutaneous coronary interventions in the 2013 database.

Three was no industry funding for the work, and Dr. Stein did not have any relevant disclosures.

SAN DIEGO – There was an 86% greater risk of ischemic stroke after transcatheter aortic valve replacement, compared with surgical aortic valve replacement, and a more than sixfold increased risk of hemorrhagic stroke, in a review of more than 44,000 patients in the Nationwide Readmissions Database who were followed out to a year after having one procedure or the other.

“Our data suggest an elevated risk of both ischemic and hemorrhagic stroke after TAVR [transcatheter aortic valve replacement]. I see a lot of people that have strokes after” TAVR, so “I wasn’t all that surprised that there is an increased risk, but could I have guessed it would have been so high? No.” Perhaps “we are offering it to people we shouldn’t be offering it to,” said lead investigator Laura Stein, MD, a vascular neurology fellow at Mount Sinai Hospital, New York.

The 2013 Nationwide Readmissions Database used in the study captured more than 14 million readmissions in the United States across all payers and the uninsured. “We used this database because its captures all comers” and reflects “more real-world practice,” Dr. Stein said.

There were 6,015 TAVR and 38,624 SAVR cases in 2013, and the team found consistently elevated cumulative risks of ischemic and hemorrhagic stroke after TAVR, compared with SAVR, according to a presentation at the annual meeting of the American Neurological Association.

Compared with SAVR, the hazard ratio for ischemic stroke with TAVR was 1.86 (95% confidence interval, 1.12-3.08; P = .016) and, for hemorrhagic stroke, 6.17 (95% CI, 1.97-19.33; P = .0018). Dr. Stein declined to release absolute numbers of strokes in the two groups, pending publication.

“A lot of attention is being paid to this topic because there has been a push, a lot of it by the device makers, to prove that [TAVR] outcomes are just as good as with traditional surgery, and that we should be offering [TAVR] to more people with higher risk factor profiles who might not have been offered repair otherwise. Our job is to help patients make the most informed decisions. Having another source of data like [ours]” adds to the conversation about risks and benefits, she said.

The investigators adjusted for a large number of potential confounders to make sure the comparison was as fair as possible given the limits of database reviews. Among other variables, they controlled for baseline cardiovascular risk factors, carotid artery disease, heart failure, obesity, smoking, surgical complications, mortality, and illness severity scores, as well as hospital size, teaching hospital status, and urban versus rural location.

“What we can’t know is what medications these patients were on that might have increased their bleeding or ischemia risk. Also, we were relying on coding done by other people,” Dr. Stein said.

The next step is to look at the impact of stenting and other concomitant procedures. “We were surprised by the number of people that had multiple procedures at the same time.” The ultimate goal is to develop a risk score to help patients and doctors decide between the two procedures, she said.

Meanwhile, the team found no difference in stroke risk between coronary artery bypass grafting and percutaneous coronary interventions in the 2013 database.

Three was no industry funding for the work, and Dr. Stein did not have any relevant disclosures.

SAN DIEGO – There was an 86% greater risk of ischemic stroke after transcatheter aortic valve replacement, compared with surgical aortic valve replacement, and a more than sixfold increased risk of hemorrhagic stroke, in a review of more than 44,000 patients in the Nationwide Readmissions Database who were followed out to a year after having one procedure or the other.

“Our data suggest an elevated risk of both ischemic and hemorrhagic stroke after TAVR [transcatheter aortic valve replacement]. I see a lot of people that have strokes after” TAVR, so “I wasn’t all that surprised that there is an increased risk, but could I have guessed it would have been so high? No.” Perhaps “we are offering it to people we shouldn’t be offering it to,” said lead investigator Laura Stein, MD, a vascular neurology fellow at Mount Sinai Hospital, New York.

The 2013 Nationwide Readmissions Database used in the study captured more than 14 million readmissions in the United States across all payers and the uninsured. “We used this database because its captures all comers” and reflects “more real-world practice,” Dr. Stein said.

There were 6,015 TAVR and 38,624 SAVR cases in 2013, and the team found consistently elevated cumulative risks of ischemic and hemorrhagic stroke after TAVR, compared with SAVR, according to a presentation at the annual meeting of the American Neurological Association.

Compared with SAVR, the hazard ratio for ischemic stroke with TAVR was 1.86 (95% confidence interval, 1.12-3.08; P = .016) and, for hemorrhagic stroke, 6.17 (95% CI, 1.97-19.33; P = .0018). Dr. Stein declined to release absolute numbers of strokes in the two groups, pending publication.

“A lot of attention is being paid to this topic because there has been a push, a lot of it by the device makers, to prove that [TAVR] outcomes are just as good as with traditional surgery, and that we should be offering [TAVR] to more people with higher risk factor profiles who might not have been offered repair otherwise. Our job is to help patients make the most informed decisions. Having another source of data like [ours]” adds to the conversation about risks and benefits, she said.

The investigators adjusted for a large number of potential confounders to make sure the comparison was as fair as possible given the limits of database reviews. Among other variables, they controlled for baseline cardiovascular risk factors, carotid artery disease, heart failure, obesity, smoking, surgical complications, mortality, and illness severity scores, as well as hospital size, teaching hospital status, and urban versus rural location.

“What we can’t know is what medications these patients were on that might have increased their bleeding or ischemia risk. Also, we were relying on coding done by other people,” Dr. Stein said.

The next step is to look at the impact of stenting and other concomitant procedures. “We were surprised by the number of people that had multiple procedures at the same time.” The ultimate goal is to develop a risk score to help patients and doctors decide between the two procedures, she said.

Meanwhile, the team found no difference in stroke risk between coronary artery bypass grafting and percutaneous coronary interventions in the 2013 database.

Three was no industry funding for the work, and Dr. Stein did not have any relevant disclosures.

AT ANA 2017

Key clinical point:

Major finding: There was an 86% greater risk of ischemic stroke after transcatheter aortic valve replacement, compared with surgical aortic valve replacement, and a more than sixfold increased risk of hemorrhagic stroke.

Data source: Database review of more than 44,000 patients

Disclosures: Three was no industry funding for the work, and the lead investigator did not have any relevant disclosures.

Trump halts ACA cost-sharing reduction subsidy payments

“The Democrats ObamaCare [sic] is imploding. Massive subsidy payments to their pet insurance companies has stopped. Dems should call me to fix!” President Trump tweeted Oct. 13.

The action prompted criticism from medical organizations and health insurers alike.

In a statement, American Medical Association President David Barbe said he was “deeply discouraged” by the cuts. “This most recent action by the administration creates still more uncertainty in the ACA marketplace just as the abbreviated open enrollment period is about to begin, further undermining the law and threatening access to meaningful health insurance coverage for millions of Americans,” Dr. Barbe said.

“We need constructive solutions that increase consumer choice, lower consumer costs, and stabilize local markets,” America’s Health Insurance Plans and the Blue Cross Blue Shield Association said in a joint statement. “Terminating this critical program will do just the opposite. This action will make it harder for patients to access the care they need. Costs will go up and choice will be restricted.”

The U.S. Senate Committee on Health, Education, Labor & Pensions was working on a bipartisan, narrowly focused bill that would have, among other things, codified cost-sharing reduction payments in legislation for at least a year, after witnesses from across the political spectrum testified during four hearings that maintenance of the payments would bring stability to the individual market. That effort was derailed when Senate Majority Leader Mitch McConnell (R-Ky.) instead pushed a broad repeal-and-replace effort, which never reached the Senate floor for consideration when it was clear the action did not have enough votes to pass.

The president’s move follows an executive order that could further destabilize the individual market through broader use of association health plans and an expansion of short-term health insurance plans, neither of which would have to meet the coverage and benefits requirements of the Affordable Care Act.

“The Democrats ObamaCare [sic] is imploding. Massive subsidy payments to their pet insurance companies has stopped. Dems should call me to fix!” President Trump tweeted Oct. 13.

The action prompted criticism from medical organizations and health insurers alike.

In a statement, American Medical Association President David Barbe said he was “deeply discouraged” by the cuts. “This most recent action by the administration creates still more uncertainty in the ACA marketplace just as the abbreviated open enrollment period is about to begin, further undermining the law and threatening access to meaningful health insurance coverage for millions of Americans,” Dr. Barbe said.

“We need constructive solutions that increase consumer choice, lower consumer costs, and stabilize local markets,” America’s Health Insurance Plans and the Blue Cross Blue Shield Association said in a joint statement. “Terminating this critical program will do just the opposite. This action will make it harder for patients to access the care they need. Costs will go up and choice will be restricted.”

The U.S. Senate Committee on Health, Education, Labor & Pensions was working on a bipartisan, narrowly focused bill that would have, among other things, codified cost-sharing reduction payments in legislation for at least a year, after witnesses from across the political spectrum testified during four hearings that maintenance of the payments would bring stability to the individual market. That effort was derailed when Senate Majority Leader Mitch McConnell (R-Ky.) instead pushed a broad repeal-and-replace effort, which never reached the Senate floor for consideration when it was clear the action did not have enough votes to pass.

The president’s move follows an executive order that could further destabilize the individual market through broader use of association health plans and an expansion of short-term health insurance plans, neither of which would have to meet the coverage and benefits requirements of the Affordable Care Act.

“The Democrats ObamaCare [sic] is imploding. Massive subsidy payments to their pet insurance companies has stopped. Dems should call me to fix!” President Trump tweeted Oct. 13.

The action prompted criticism from medical organizations and health insurers alike.

In a statement, American Medical Association President David Barbe said he was “deeply discouraged” by the cuts. “This most recent action by the administration creates still more uncertainty in the ACA marketplace just as the abbreviated open enrollment period is about to begin, further undermining the law and threatening access to meaningful health insurance coverage for millions of Americans,” Dr. Barbe said.

“We need constructive solutions that increase consumer choice, lower consumer costs, and stabilize local markets,” America’s Health Insurance Plans and the Blue Cross Blue Shield Association said in a joint statement. “Terminating this critical program will do just the opposite. This action will make it harder for patients to access the care they need. Costs will go up and choice will be restricted.”

The U.S. Senate Committee on Health, Education, Labor & Pensions was working on a bipartisan, narrowly focused bill that would have, among other things, codified cost-sharing reduction payments in legislation for at least a year, after witnesses from across the political spectrum testified during four hearings that maintenance of the payments would bring stability to the individual market. That effort was derailed when Senate Majority Leader Mitch McConnell (R-Ky.) instead pushed a broad repeal-and-replace effort, which never reached the Senate floor for consideration when it was clear the action did not have enough votes to pass.

The president’s move follows an executive order that could further destabilize the individual market through broader use of association health plans and an expansion of short-term health insurance plans, neither of which would have to meet the coverage and benefits requirements of the Affordable Care Act.

Clinical Trial Summary: Ergonomics of robotic surgery

The Ergonomics in Robotic Surgery clinical trial is being conducted to study the role of ergonomics in adjusting robotic surgery consoles to individual body types of operators. The study will look at comfort and physical support of gynecologic surgeons after performing a hysterectomy using a da Vinci robotic surgery console. One group of surgeons will adjust their own console and another group will have the console adjusted by an ergonomist.

For a further description of the study, go to www.clinicaltrials.gov.

[email protected]

On Twitter @ThereseBorden

The Ergonomics in Robotic Surgery clinical trial is being conducted to study the role of ergonomics in adjusting robotic surgery consoles to individual body types of operators. The study will look at comfort and physical support of gynecologic surgeons after performing a hysterectomy using a da Vinci robotic surgery console. One group of surgeons will adjust their own console and another group will have the console adjusted by an ergonomist.

For a further description of the study, go to www.clinicaltrials.gov.

[email protected]

On Twitter @ThereseBorden

The Ergonomics in Robotic Surgery clinical trial is being conducted to study the role of ergonomics in adjusting robotic surgery consoles to individual body types of operators. The study will look at comfort and physical support of gynecologic surgeons after performing a hysterectomy using a da Vinci robotic surgery console. One group of surgeons will adjust their own console and another group will have the console adjusted by an ergonomist.

For a further description of the study, go to www.clinicaltrials.gov.

[email protected]

On Twitter @ThereseBorden

FROM CLINICALTRIALS.GOV

Malpractice: Communication and compensation program helps to minimize lawsuits

Communication and resolution programs at four Massachusetts medical centers helped resolve adverse medical events without increasing lawsuits or leading to excessive payouts to patients, according to Michelle M. Mello, PhD, and her colleagues.

They evaluated a communication and resolution program (CRP) model known as CARe (Communication, Apology, and Resolution) implemented at Beth Israel Deaconess Medical Center in Boston and Baystate Medical Center in Springfield, Mass., and at two of each center’s community hospitals. As part of the CARe model, hospital staff and insurers communicate with patients when adverse events occur, investigate and explain what happened, and, when appropriate, apologize and offer compensation.

Of 989 total events studied, 929 (90%) entered the program because an adverse event that allegedly exceeded the severity threshold was reported and 60 (6%) entered CARe because a prelitigation notice or claim was received, said Dr. Mello, professor of law and health research and policy at Stanford (Calif.) University.

Few events that entered the CARe process met the criteria for compensation. The standard of care was violated in 26% of cases where a determination could be reached. No determination could be reached in 59 cases, 9 cases were pending at the close of data collection, and 5 were referred directly to the insurer. Of the 241 cases involving standard-of-care violations, 55% were potentially eligible for compensation because they involved significant harm. After further review, monetary compensation was offered in 43 cases and paid in 40 cases by August 2016, with $75,000 as the median payment (Health Aff. 2017 Oct 2;36[10]:1795-1803).

As of August 2016, 5% of the 929 adverse events led to claims or lawsuits. Insurers deemed 14 of the 47 events that ultimately resulted in legal action ineligible for compensation because of a lack of negligence or lack of harm. They deemed 22 of the cases compensable, offered compensation in all of them, and had settled 20 by August 2016.

During the CARe process, patient safety improvements were frequently identified and improvements made, the investigators said. Of 132 cases in which review progressed far enough for patient safety questions to have been answered, 41% of the incidents gave rise to a safety improvement action. Actions included sharing investigation findings with clinical staff members, clinical staff educational efforts, policy changes, safety alerts sent to staff members, input into the quality improvement system for further analysis, new process flow diagrams, and human factor engineering analysis, among others.

Investigators also surveyed clinicians on their satisfaction with the CARe program. Of 162 clinicians (124 physicians), nearly 40% were either not very or not at all familiar with the program. More than two-thirds (69%) of those who felt well informed about the program gave strongly positive ratings and 10% gave a negative rating to the program. The most commonly suggested improvement to CARe was to improve communication with clinicians.

[email protected]

On Twitter @legal_med

Communication and resolution programs at four Massachusetts medical centers helped resolve adverse medical events without increasing lawsuits or leading to excessive payouts to patients, according to Michelle M. Mello, PhD, and her colleagues.

They evaluated a communication and resolution program (CRP) model known as CARe (Communication, Apology, and Resolution) implemented at Beth Israel Deaconess Medical Center in Boston and Baystate Medical Center in Springfield, Mass., and at two of each center’s community hospitals. As part of the CARe model, hospital staff and insurers communicate with patients when adverse events occur, investigate and explain what happened, and, when appropriate, apologize and offer compensation.

Of 989 total events studied, 929 (90%) entered the program because an adverse event that allegedly exceeded the severity threshold was reported and 60 (6%) entered CARe because a prelitigation notice or claim was received, said Dr. Mello, professor of law and health research and policy at Stanford (Calif.) University.

Few events that entered the CARe process met the criteria for compensation. The standard of care was violated in 26% of cases where a determination could be reached. No determination could be reached in 59 cases, 9 cases were pending at the close of data collection, and 5 were referred directly to the insurer. Of the 241 cases involving standard-of-care violations, 55% were potentially eligible for compensation because they involved significant harm. After further review, monetary compensation was offered in 43 cases and paid in 40 cases by August 2016, with $75,000 as the median payment (Health Aff. 2017 Oct 2;36[10]:1795-1803).

As of August 2016, 5% of the 929 adverse events led to claims or lawsuits. Insurers deemed 14 of the 47 events that ultimately resulted in legal action ineligible for compensation because of a lack of negligence or lack of harm. They deemed 22 of the cases compensable, offered compensation in all of them, and had settled 20 by August 2016.

During the CARe process, patient safety improvements were frequently identified and improvements made, the investigators said. Of 132 cases in which review progressed far enough for patient safety questions to have been answered, 41% of the incidents gave rise to a safety improvement action. Actions included sharing investigation findings with clinical staff members, clinical staff educational efforts, policy changes, safety alerts sent to staff members, input into the quality improvement system for further analysis, new process flow diagrams, and human factor engineering analysis, among others.

Investigators also surveyed clinicians on their satisfaction with the CARe program. Of 162 clinicians (124 physicians), nearly 40% were either not very or not at all familiar with the program. More than two-thirds (69%) of those who felt well informed about the program gave strongly positive ratings and 10% gave a negative rating to the program. The most commonly suggested improvement to CARe was to improve communication with clinicians.

[email protected]

On Twitter @legal_med

Communication and resolution programs at four Massachusetts medical centers helped resolve adverse medical events without increasing lawsuits or leading to excessive payouts to patients, according to Michelle M. Mello, PhD, and her colleagues.

They evaluated a communication and resolution program (CRP) model known as CARe (Communication, Apology, and Resolution) implemented at Beth Israel Deaconess Medical Center in Boston and Baystate Medical Center in Springfield, Mass., and at two of each center’s community hospitals. As part of the CARe model, hospital staff and insurers communicate with patients when adverse events occur, investigate and explain what happened, and, when appropriate, apologize and offer compensation.

Of 989 total events studied, 929 (90%) entered the program because an adverse event that allegedly exceeded the severity threshold was reported and 60 (6%) entered CARe because a prelitigation notice or claim was received, said Dr. Mello, professor of law and health research and policy at Stanford (Calif.) University.

Few events that entered the CARe process met the criteria for compensation. The standard of care was violated in 26% of cases where a determination could be reached. No determination could be reached in 59 cases, 9 cases were pending at the close of data collection, and 5 were referred directly to the insurer. Of the 241 cases involving standard-of-care violations, 55% were potentially eligible for compensation because they involved significant harm. After further review, monetary compensation was offered in 43 cases and paid in 40 cases by August 2016, with $75,000 as the median payment (Health Aff. 2017 Oct 2;36[10]:1795-1803).

As of August 2016, 5% of the 929 adverse events led to claims or lawsuits. Insurers deemed 14 of the 47 events that ultimately resulted in legal action ineligible for compensation because of a lack of negligence or lack of harm. They deemed 22 of the cases compensable, offered compensation in all of them, and had settled 20 by August 2016.

During the CARe process, patient safety improvements were frequently identified and improvements made, the investigators said. Of 132 cases in which review progressed far enough for patient safety questions to have been answered, 41% of the incidents gave rise to a safety improvement action. Actions included sharing investigation findings with clinical staff members, clinical staff educational efforts, policy changes, safety alerts sent to staff members, input into the quality improvement system for further analysis, new process flow diagrams, and human factor engineering analysis, among others.

Investigators also surveyed clinicians on their satisfaction with the CARe program. Of 162 clinicians (124 physicians), nearly 40% were either not very or not at all familiar with the program. More than two-thirds (69%) of those who felt well informed about the program gave strongly positive ratings and 10% gave a negative rating to the program. The most commonly suggested improvement to CARe was to improve communication with clinicians.

[email protected]

On Twitter @legal_med

FROM HEALTH AFFAIRS

Key clinical point:

Major finding: Out of 989 events, monetary compensation was paid in 40 cases, with a $75,000 median payment.

Data source: Review of 989 adverse events at four Massachusetts hospitals.

Disclosures: The project was funded by Baystate Health Insurance Company, Blue Cross Blue Shield of Massachusetts, CRICO RMF, Coverys, Harvard Pilgrim Health Care, Massachusetts Medical Society, and Tufts Health Plan. The authors listed no relevant conflicts of interest.

Advance care planning benefit presents challenges

When Donna Sweet, MD, sees patients for routine exams, death and dying are often the furthest thing from their minds. Regardless of age or health status, however, Dr. Sweet regularly asks patients about end-of-life care and whether they’ve considered their options.

In the past, physicians had to be creative in how they coded for such conversations, but Medicare’s newish advance care planning benefit is changing that.

Staring in 2016, the Centers for Medicare & Medicaid Services began reimbursing physicians for advance care planning discussions with the approval of two new codes: 99497 and 99498. The codes pay about $86 for the first 30-minutes of a face-to-face conversation with a patient, family member, and/or surrogate and about $75 for additional sessions. Services can be furnished in both inpatient and ambulatory settings, and payment is not limited to particular physician specialties.

Dr. Sweet said that she uses these codes a couple times a week when patients visit for reasons such as routine hypertension or diabetes exams or annual Medicare wellness visits. To broach the subject, Dr. Sweet said it helps to have literature about advance care planning in the room that patients can review.

“It’s just a matter of bringing it up,” she said. “Considering some of the other codes, the advance care planning code is really pretty simple.”

However, doctors like Dr. Sweet appear to be in the minority when it comes to providing this service. Of the nearly 57 million beneficiaries enrolled in Medicare at the end of 2016, only about 1% received advance care planning sessions, according to analysis of Medicare data posted by Kaiser Health News. Nationwide, health providers submitted about $93 million in charges, of which $43 million was paid by Medicare.

Challenges deter conversations

During a recent visit with a 72-year-old cancer patient, Bridget Fahy, MD, a surgical oncologist at the University of New Mexico, Albuquerque, spent time discussing advance directives and the importance of naming a surrogate decision maker. Dr. Fahy had treated the patient for two different cancers over the course of 4 years, and he was now diagnosed with a third, she recalled during an interview. Figuring out an advance care plan, though, proved complicated: The man was not married, had no children, and had no family members who lived in the state.

Although Dr. Fahy was aware of the Medicare advance care planning codes, she did not bill the session as such.

“Even in the course of having that conversation, I’m more apt to bill on time than I am specifically to meet the Medicare requirements for the documentation for [the benefit],” she said.

“There are two pieces required to take advantage of the advance care planning benefit code: having the conversation and documenting it,” Dr. Fahy noted. “What I write at the end of a resident note or an advanced practice provider note is going to be more focused on the counseling I had with the patient about their condition, the evaluation, and what the treatment plan is going to be. For surgeons to utilize the advance care planning codes, they have to have knowledge of the code, which many do not; they must know the requirements for documenting the conversation; and they have to have the time needed to have the conversation while also addressing all of the surgery-specific issues that need to be covered during the visit. There are a number of hurdles to overcome.”

Danielle B. Scheurer, MD, a hospitalist and chief quality officer at the Medical University of South Carolina, Charleston, said that she, too, has not used advance care planning codes. The reimbursement tool is a positive step forward, she said, but so far, it’s not an easy insert into a hospitalist’s practice.

“It’s not top of mind as far as a billing practice,” she said. “It’s not built into the typical work flow. Obviously, it’s not every patient, it’s not everyday, so you have to remember to put it into your work flow. That’s probably the biggest barrier for most hospitalists: either not knowing about it at all or not yet figuring out how to weave it into what they already do.”

Overcoming hurdles through experience

Using the advance care planning benefit has been easier said than done in his practice, according to Carl R. Olden, MD, a family physician in Yakima, Wash. The logistics of scheduling and patient reluctance are contributing to low usage of the new codes, said Dr. Olden, a member of the American Academy of Family Physicians board of directors.

Between Sept. 1, 2016, and Aug. 31, 2017, the family medicine, primary care, internal medicine, and pulmonary medicine members of Dr. Olden’s network who provide end-of-life counseling submitted billing for a total of 106,160 Medicare visits. Of those visits, the 99497 code was submitted only 32 times, according to data provided by Dr. Olden.

At Dr. Olden’s 16-physician practice, there are no registered nurses to help set up and start Medicare wellness visits, which the advance care planning session benefit is designed to fit within, he said.

“Most of those Medicare wellness visits are driven by having a registered nurse do most of the work,” he said. “[For us] to schedule a wellness visit, it’s mostly physician work and to do a 30-minute wellness visit, most of us can see three patients in that 30-minute slot, so it ends up not being very cost effective.”

“Most of my Medicare patients are folks that have four to five chronic medical conditions, and for them to make a 30-minute visit to the office and not talk about any of those conditions but to talk about home safety and advance directives and fall prevention, it’s hard for them to understand that,” he said.

Dr. Newman stresses that while the billing approach takes time to learn, the codes can be weaved into regular practice with some preparation and planning. At her practice, she primarily uses the codes for patients with challenging changes in their health status, sometimes setting up meetings in advance and, other times, conducting a spur-of-the-moment conversation.

“It’s a wonderful benefit,” she said. “I’m not surprised it’s taking awhile to take hold. The reason is you have to prepare for these visits. It takes preparation, including a chart review.”

A common misconception is that the visit must be scheduled separately and cannot be added to another visit, she said. Doctors can bill the advance care planning codes on the same day as an evaluation and management service. For instance, if a patient is accompanied by a family member and seen for routine follow-up, the physician can discuss the medical conditions first and later have a discussion about advance care planning. When billing, the physician can then use an evaluation and management code for the part of the visit related to the patient’s medical conditions and also bill for the advance care planning discussion using the new Medicare codes, Dr. Newman said.

“You’re allowed to use a modifier to attach to it to get paid for both on the same day,” she said. She suggested checking local Medicare policy for the use of the appropriate modifier, usually 26. “One thing that’s important to understand is there’s a lot of short discussions about advanced care planning that doesn’t fit the code. So if a patient wants to have a 5-minute conversation – that happens a lot – these will not be billable or counted under this new benefit. Fifteen minutes is the least amount of time that qualifies for 99497.”

Dr. Sweet said that she expects greater use of the codes as more doctors become aware of how they can be used.

“Once people use it a time or two, they will use it a lot more,” Dr. Sweet said. “It takes time to change, and it takes time to make time to do the things we need to do. But especially, as we move into high-value care, something like this hopefully, [doctors] will embrace.”

[email protected]

On Twitter @legal_med

When Donna Sweet, MD, sees patients for routine exams, death and dying are often the furthest thing from their minds. Regardless of age or health status, however, Dr. Sweet regularly asks patients about end-of-life care and whether they’ve considered their options.

In the past, physicians had to be creative in how they coded for such conversations, but Medicare’s newish advance care planning benefit is changing that.

Staring in 2016, the Centers for Medicare & Medicaid Services began reimbursing physicians for advance care planning discussions with the approval of two new codes: 99497 and 99498. The codes pay about $86 for the first 30-minutes of a face-to-face conversation with a patient, family member, and/or surrogate and about $75 for additional sessions. Services can be furnished in both inpatient and ambulatory settings, and payment is not limited to particular physician specialties.

Dr. Sweet said that she uses these codes a couple times a week when patients visit for reasons such as routine hypertension or diabetes exams or annual Medicare wellness visits. To broach the subject, Dr. Sweet said it helps to have literature about advance care planning in the room that patients can review.

“It’s just a matter of bringing it up,” she said. “Considering some of the other codes, the advance care planning code is really pretty simple.”

However, doctors like Dr. Sweet appear to be in the minority when it comes to providing this service. Of the nearly 57 million beneficiaries enrolled in Medicare at the end of 2016, only about 1% received advance care planning sessions, according to analysis of Medicare data posted by Kaiser Health News. Nationwide, health providers submitted about $93 million in charges, of which $43 million was paid by Medicare.

Challenges deter conversations

During a recent visit with a 72-year-old cancer patient, Bridget Fahy, MD, a surgical oncologist at the University of New Mexico, Albuquerque, spent time discussing advance directives and the importance of naming a surrogate decision maker. Dr. Fahy had treated the patient for two different cancers over the course of 4 years, and he was now diagnosed with a third, she recalled during an interview. Figuring out an advance care plan, though, proved complicated: The man was not married, had no children, and had no family members who lived in the state.

Although Dr. Fahy was aware of the Medicare advance care planning codes, she did not bill the session as such.

“Even in the course of having that conversation, I’m more apt to bill on time than I am specifically to meet the Medicare requirements for the documentation for [the benefit],” she said.

“There are two pieces required to take advantage of the advance care planning benefit code: having the conversation and documenting it,” Dr. Fahy noted. “What I write at the end of a resident note or an advanced practice provider note is going to be more focused on the counseling I had with the patient about their condition, the evaluation, and what the treatment plan is going to be. For surgeons to utilize the advance care planning codes, they have to have knowledge of the code, which many do not; they must know the requirements for documenting the conversation; and they have to have the time needed to have the conversation while also addressing all of the surgery-specific issues that need to be covered during the visit. There are a number of hurdles to overcome.”

Danielle B. Scheurer, MD, a hospitalist and chief quality officer at the Medical University of South Carolina, Charleston, said that she, too, has not used advance care planning codes. The reimbursement tool is a positive step forward, she said, but so far, it’s not an easy insert into a hospitalist’s practice.

“It’s not top of mind as far as a billing practice,” she said. “It’s not built into the typical work flow. Obviously, it’s not every patient, it’s not everyday, so you have to remember to put it into your work flow. That’s probably the biggest barrier for most hospitalists: either not knowing about it at all or not yet figuring out how to weave it into what they already do.”

Overcoming hurdles through experience

Using the advance care planning benefit has been easier said than done in his practice, according to Carl R. Olden, MD, a family physician in Yakima, Wash. The logistics of scheduling and patient reluctance are contributing to low usage of the new codes, said Dr. Olden, a member of the American Academy of Family Physicians board of directors.

Between Sept. 1, 2016, and Aug. 31, 2017, the family medicine, primary care, internal medicine, and pulmonary medicine members of Dr. Olden’s network who provide end-of-life counseling submitted billing for a total of 106,160 Medicare visits. Of those visits, the 99497 code was submitted only 32 times, according to data provided by Dr. Olden.

At Dr. Olden’s 16-physician practice, there are no registered nurses to help set up and start Medicare wellness visits, which the advance care planning session benefit is designed to fit within, he said.

“Most of those Medicare wellness visits are driven by having a registered nurse do most of the work,” he said. “[For us] to schedule a wellness visit, it’s mostly physician work and to do a 30-minute wellness visit, most of us can see three patients in that 30-minute slot, so it ends up not being very cost effective.”

“Most of my Medicare patients are folks that have four to five chronic medical conditions, and for them to make a 30-minute visit to the office and not talk about any of those conditions but to talk about home safety and advance directives and fall prevention, it’s hard for them to understand that,” he said.

Dr. Newman stresses that while the billing approach takes time to learn, the codes can be weaved into regular practice with some preparation and planning. At her practice, she primarily uses the codes for patients with challenging changes in their health status, sometimes setting up meetings in advance and, other times, conducting a spur-of-the-moment conversation.

“It’s a wonderful benefit,” she said. “I’m not surprised it’s taking awhile to take hold. The reason is you have to prepare for these visits. It takes preparation, including a chart review.”

A common misconception is that the visit must be scheduled separately and cannot be added to another visit, she said. Doctors can bill the advance care planning codes on the same day as an evaluation and management service. For instance, if a patient is accompanied by a family member and seen for routine follow-up, the physician can discuss the medical conditions first and later have a discussion about advance care planning. When billing, the physician can then use an evaluation and management code for the part of the visit related to the patient’s medical conditions and also bill for the advance care planning discussion using the new Medicare codes, Dr. Newman said.

“You’re allowed to use a modifier to attach to it to get paid for both on the same day,” she said. She suggested checking local Medicare policy for the use of the appropriate modifier, usually 26. “One thing that’s important to understand is there’s a lot of short discussions about advanced care planning that doesn’t fit the code. So if a patient wants to have a 5-minute conversation – that happens a lot – these will not be billable or counted under this new benefit. Fifteen minutes is the least amount of time that qualifies for 99497.”

Dr. Sweet said that she expects greater use of the codes as more doctors become aware of how they can be used.

“Once people use it a time or two, they will use it a lot more,” Dr. Sweet said. “It takes time to change, and it takes time to make time to do the things we need to do. But especially, as we move into high-value care, something like this hopefully, [doctors] will embrace.”

[email protected]

On Twitter @legal_med

When Donna Sweet, MD, sees patients for routine exams, death and dying are often the furthest thing from their minds. Regardless of age or health status, however, Dr. Sweet regularly asks patients about end-of-life care and whether they’ve considered their options.

In the past, physicians had to be creative in how they coded for such conversations, but Medicare’s newish advance care planning benefit is changing that.

Staring in 2016, the Centers for Medicare & Medicaid Services began reimbursing physicians for advance care planning discussions with the approval of two new codes: 99497 and 99498. The codes pay about $86 for the first 30-minutes of a face-to-face conversation with a patient, family member, and/or surrogate and about $75 for additional sessions. Services can be furnished in both inpatient and ambulatory settings, and payment is not limited to particular physician specialties.

Dr. Sweet said that she uses these codes a couple times a week when patients visit for reasons such as routine hypertension or diabetes exams or annual Medicare wellness visits. To broach the subject, Dr. Sweet said it helps to have literature about advance care planning in the room that patients can review.

“It’s just a matter of bringing it up,” she said. “Considering some of the other codes, the advance care planning code is really pretty simple.”

However, doctors like Dr. Sweet appear to be in the minority when it comes to providing this service. Of the nearly 57 million beneficiaries enrolled in Medicare at the end of 2016, only about 1% received advance care planning sessions, according to analysis of Medicare data posted by Kaiser Health News. Nationwide, health providers submitted about $93 million in charges, of which $43 million was paid by Medicare.

Challenges deter conversations

During a recent visit with a 72-year-old cancer patient, Bridget Fahy, MD, a surgical oncologist at the University of New Mexico, Albuquerque, spent time discussing advance directives and the importance of naming a surrogate decision maker. Dr. Fahy had treated the patient for two different cancers over the course of 4 years, and he was now diagnosed with a third, she recalled during an interview. Figuring out an advance care plan, though, proved complicated: The man was not married, had no children, and had no family members who lived in the state.

Although Dr. Fahy was aware of the Medicare advance care planning codes, she did not bill the session as such.

“Even in the course of having that conversation, I’m more apt to bill on time than I am specifically to meet the Medicare requirements for the documentation for [the benefit],” she said.

“There are two pieces required to take advantage of the advance care planning benefit code: having the conversation and documenting it,” Dr. Fahy noted. “What I write at the end of a resident note or an advanced practice provider note is going to be more focused on the counseling I had with the patient about their condition, the evaluation, and what the treatment plan is going to be. For surgeons to utilize the advance care planning codes, they have to have knowledge of the code, which many do not; they must know the requirements for documenting the conversation; and they have to have the time needed to have the conversation while also addressing all of the surgery-specific issues that need to be covered during the visit. There are a number of hurdles to overcome.”

Danielle B. Scheurer, MD, a hospitalist and chief quality officer at the Medical University of South Carolina, Charleston, said that she, too, has not used advance care planning codes. The reimbursement tool is a positive step forward, she said, but so far, it’s not an easy insert into a hospitalist’s practice.

“It’s not top of mind as far as a billing practice,” she said. “It’s not built into the typical work flow. Obviously, it’s not every patient, it’s not everyday, so you have to remember to put it into your work flow. That’s probably the biggest barrier for most hospitalists: either not knowing about it at all or not yet figuring out how to weave it into what they already do.”

Overcoming hurdles through experience

Using the advance care planning benefit has been easier said than done in his practice, according to Carl R. Olden, MD, a family physician in Yakima, Wash. The logistics of scheduling and patient reluctance are contributing to low usage of the new codes, said Dr. Olden, a member of the American Academy of Family Physicians board of directors.

Between Sept. 1, 2016, and Aug. 31, 2017, the family medicine, primary care, internal medicine, and pulmonary medicine members of Dr. Olden’s network who provide end-of-life counseling submitted billing for a total of 106,160 Medicare visits. Of those visits, the 99497 code was submitted only 32 times, according to data provided by Dr. Olden.

At Dr. Olden’s 16-physician practice, there are no registered nurses to help set up and start Medicare wellness visits, which the advance care planning session benefit is designed to fit within, he said.

“Most of those Medicare wellness visits are driven by having a registered nurse do most of the work,” he said. “[For us] to schedule a wellness visit, it’s mostly physician work and to do a 30-minute wellness visit, most of us can see three patients in that 30-minute slot, so it ends up not being very cost effective.”

“Most of my Medicare patients are folks that have four to five chronic medical conditions, and for them to make a 30-minute visit to the office and not talk about any of those conditions but to talk about home safety and advance directives and fall prevention, it’s hard for them to understand that,” he said.

Dr. Newman stresses that while the billing approach takes time to learn, the codes can be weaved into regular practice with some preparation and planning. At her practice, she primarily uses the codes for patients with challenging changes in their health status, sometimes setting up meetings in advance and, other times, conducting a spur-of-the-moment conversation.

“It’s a wonderful benefit,” she said. “I’m not surprised it’s taking awhile to take hold. The reason is you have to prepare for these visits. It takes preparation, including a chart review.”

A common misconception is that the visit must be scheduled separately and cannot be added to another visit, she said. Doctors can bill the advance care planning codes on the same day as an evaluation and management service. For instance, if a patient is accompanied by a family member and seen for routine follow-up, the physician can discuss the medical conditions first and later have a discussion about advance care planning. When billing, the physician can then use an evaluation and management code for the part of the visit related to the patient’s medical conditions and also bill for the advance care planning discussion using the new Medicare codes, Dr. Newman said.

“You’re allowed to use a modifier to attach to it to get paid for both on the same day,” she said. She suggested checking local Medicare policy for the use of the appropriate modifier, usually 26. “One thing that’s important to understand is there’s a lot of short discussions about advanced care planning that doesn’t fit the code. So if a patient wants to have a 5-minute conversation – that happens a lot – these will not be billable or counted under this new benefit. Fifteen minutes is the least amount of time that qualifies for 99497.”

Dr. Sweet said that she expects greater use of the codes as more doctors become aware of how they can be used.

“Once people use it a time or two, they will use it a lot more,” Dr. Sweet said. “It takes time to change, and it takes time to make time to do the things we need to do. But especially, as we move into high-value care, something like this hopefully, [doctors] will embrace.”

[email protected]

On Twitter @legal_med

Trump order allows end-around ACA rules

An executive order signed by President Donald J. Trump aims to expand health care coverage options, primarily for small businesses.

The order includes three key provisions.

First, it allows small businesses to band together to buy insurance collectively for their workers and allows plans to be sold across state lines, in theory extending the buying power that comes with a larger base of employees to smaller businesses.

Employers participating in association health plans “cannot exclude any employee from joining the plan and cannot develop premiums based on health condition,” according to a White House statement on the executive order.

Second, the executive order allows broader use of limited duration health insurance – short-term policies that are not intended to be comprehensive offerings and are not subject to Affordable Care Act coverage requirements.

These plans “typically feature broad provider networks and high coverage limits,” according to the White House statement. The plans are geared toward “people between jobs, people in counties with only a single insurer offering exchange plans, people with limited coverage networks, and people who missed the open enrollment period but still want insurance,” according to the executive order.

Association health plans and the short-term, limited duration insurance will not need to fully cover the ACA’s essential health benefits package; instead, they are intended to be alternatives to “expensive, mandate-laden [ACA] insurance,” according to the executive order.

Third, the order directs the secretaries of Health & Human Services, Treasury, and Labor to “explore how they can allow more businesses to use tax-free health reimbursement arrangements, or HRAs, to compensate their employees for their health care expenses,” according to the White House statement.

HRAs allow employers to cover select items, such as copayments, deductibles, and other items, that are not covered by the insurance plan offered to employees.

“With these actions, we are moving toward lower costs and more options in the health care market and taking crucial steps toward saving the American people from the nightmare of Obamacare,” President Trump said, adding that the White House will continue to put pressure on Congress to finish repeal and replace activities. He also said that Congress will be pursuing block grants, presumably for Medicaid, which he said he had the votes to accomplish.

The action taken today by the White House is already receiving pushback.

The American College of Physicians “has said repeatedly that any attempts by Congress to ‘repeal and replace’ the ACA must first do no harm to patients,” Susan Thompson Hingle, MD, chair of the American College of Physicians Board of Regents, said in a statement. “This executive order utterly fails that test.”

Under the association health plans “small employers would be allowed to purchase health plans that do not meet the ACA’s requirement to provide essential health benefits,” Dr. Hingle noted. “This means that plans would no longer have to cover medical patients needs; plans could choose not to cover pregnancy, maternity, and newborn care, or even chemotherapy. This would also mean that the ACA’s prohibition on annual and lifetime limits on coverage would no longer apply to any service an employer decides is not essential. These changes would be devastating for patients who need access to the ‘nonessential’ services, leaving them with potentially millions of dollars in out-of-pocket costs despite being insured.”

Association health plans also could further destabilize the individual market if healthy workers – who currently may have purchased coverage on the individual market – shifted to less comprehensive association health plans, leaving even fewer healthy individuals in the individual market. “Insurers will be forced to either leave the markets in droves or charge much higher premiums.”

The rules may not be able to provide the relief that President Trump has promised, according to Julius Hobson, a Washington-based health care lobbyist

“The changes that he is talking about are going to require departments and agencies to promulgate rules. They just simply can’t do that by fiat,” Mr. Hobson said in an interview. “I am not sure that we will see an immediate impact on the executive order. ... When you get down to the nitty-gritty of implementation, we could be a bit away from seeing anything that actually has impact.”

An executive order signed by President Donald J. Trump aims to expand health care coverage options, primarily for small businesses.

The order includes three key provisions.

First, it allows small businesses to band together to buy insurance collectively for their workers and allows plans to be sold across state lines, in theory extending the buying power that comes with a larger base of employees to smaller businesses.

Employers participating in association health plans “cannot exclude any employee from joining the plan and cannot develop premiums based on health condition,” according to a White House statement on the executive order.

Second, the executive order allows broader use of limited duration health insurance – short-term policies that are not intended to be comprehensive offerings and are not subject to Affordable Care Act coverage requirements.

These plans “typically feature broad provider networks and high coverage limits,” according to the White House statement. The plans are geared toward “people between jobs, people in counties with only a single insurer offering exchange plans, people with limited coverage networks, and people who missed the open enrollment period but still want insurance,” according to the executive order.

Association health plans and the short-term, limited duration insurance will not need to fully cover the ACA’s essential health benefits package; instead, they are intended to be alternatives to “expensive, mandate-laden [ACA] insurance,” according to the executive order.

Third, the order directs the secretaries of Health & Human Services, Treasury, and Labor to “explore how they can allow more businesses to use tax-free health reimbursement arrangements, or HRAs, to compensate their employees for their health care expenses,” according to the White House statement.

HRAs allow employers to cover select items, such as copayments, deductibles, and other items, that are not covered by the insurance plan offered to employees.

“With these actions, we are moving toward lower costs and more options in the health care market and taking crucial steps toward saving the American people from the nightmare of Obamacare,” President Trump said, adding that the White House will continue to put pressure on Congress to finish repeal and replace activities. He also said that Congress will be pursuing block grants, presumably for Medicaid, which he said he had the votes to accomplish.

The action taken today by the White House is already receiving pushback.

The American College of Physicians “has said repeatedly that any attempts by Congress to ‘repeal and replace’ the ACA must first do no harm to patients,” Susan Thompson Hingle, MD, chair of the American College of Physicians Board of Regents, said in a statement. “This executive order utterly fails that test.”

Under the association health plans “small employers would be allowed to purchase health plans that do not meet the ACA’s requirement to provide essential health benefits,” Dr. Hingle noted. “This means that plans would no longer have to cover medical patients needs; plans could choose not to cover pregnancy, maternity, and newborn care, or even chemotherapy. This would also mean that the ACA’s prohibition on annual and lifetime limits on coverage would no longer apply to any service an employer decides is not essential. These changes would be devastating for patients who need access to the ‘nonessential’ services, leaving them with potentially millions of dollars in out-of-pocket costs despite being insured.”

Association health plans also could further destabilize the individual market if healthy workers – who currently may have purchased coverage on the individual market – shifted to less comprehensive association health plans, leaving even fewer healthy individuals in the individual market. “Insurers will be forced to either leave the markets in droves or charge much higher premiums.”

The rules may not be able to provide the relief that President Trump has promised, according to Julius Hobson, a Washington-based health care lobbyist

“The changes that he is talking about are going to require departments and agencies to promulgate rules. They just simply can’t do that by fiat,” Mr. Hobson said in an interview. “I am not sure that we will see an immediate impact on the executive order. ... When you get down to the nitty-gritty of implementation, we could be a bit away from seeing anything that actually has impact.”

An executive order signed by President Donald J. Trump aims to expand health care coverage options, primarily for small businesses.

The order includes three key provisions.

First, it allows small businesses to band together to buy insurance collectively for their workers and allows plans to be sold across state lines, in theory extending the buying power that comes with a larger base of employees to smaller businesses.

Employers participating in association health plans “cannot exclude any employee from joining the plan and cannot develop premiums based on health condition,” according to a White House statement on the executive order.

Second, the executive order allows broader use of limited duration health insurance – short-term policies that are not intended to be comprehensive offerings and are not subject to Affordable Care Act coverage requirements.

These plans “typically feature broad provider networks and high coverage limits,” according to the White House statement. The plans are geared toward “people between jobs, people in counties with only a single insurer offering exchange plans, people with limited coverage networks, and people who missed the open enrollment period but still want insurance,” according to the executive order.

Association health plans and the short-term, limited duration insurance will not need to fully cover the ACA’s essential health benefits package; instead, they are intended to be alternatives to “expensive, mandate-laden [ACA] insurance,” according to the executive order.

Third, the order directs the secretaries of Health & Human Services, Treasury, and Labor to “explore how they can allow more businesses to use tax-free health reimbursement arrangements, or HRAs, to compensate their employees for their health care expenses,” according to the White House statement.

HRAs allow employers to cover select items, such as copayments, deductibles, and other items, that are not covered by the insurance plan offered to employees.

“With these actions, we are moving toward lower costs and more options in the health care market and taking crucial steps toward saving the American people from the nightmare of Obamacare,” President Trump said, adding that the White House will continue to put pressure on Congress to finish repeal and replace activities. He also said that Congress will be pursuing block grants, presumably for Medicaid, which he said he had the votes to accomplish.

The action taken today by the White House is already receiving pushback.

The American College of Physicians “has said repeatedly that any attempts by Congress to ‘repeal and replace’ the ACA must first do no harm to patients,” Susan Thompson Hingle, MD, chair of the American College of Physicians Board of Regents, said in a statement. “This executive order utterly fails that test.”

Under the association health plans “small employers would be allowed to purchase health plans that do not meet the ACA’s requirement to provide essential health benefits,” Dr. Hingle noted. “This means that plans would no longer have to cover medical patients needs; plans could choose not to cover pregnancy, maternity, and newborn care, or even chemotherapy. This would also mean that the ACA’s prohibition on annual and lifetime limits on coverage would no longer apply to any service an employer decides is not essential. These changes would be devastating for patients who need access to the ‘nonessential’ services, leaving them with potentially millions of dollars in out-of-pocket costs despite being insured.”