User login

ACA hassles, payment cuts are top reasons physicians sell practices

When a hospital approached Georgia surgeon Ian Hamilton Jr. about buying his vascular surgery practice, the proposal was too appealing for him to turn down. At the time, Dr. Hamilton’s practice was facing the challenges of meeting new regulatory and business requirements, including the need for a new electronic health record system that would meet meaningful use requirements.

"I didn’t feel that I was going to be able to maintain a solo practice indefinitely," said Dr. Hamilton, who sold his practice in 2013. "I felt something was going to have to change. The reality of what’s happening in American medicine right now makes it very difficult for a solo practitioner at many different levels. It’s become very expensive to be compliant with the Affordable Care Act and the other regulations that are associated with it."

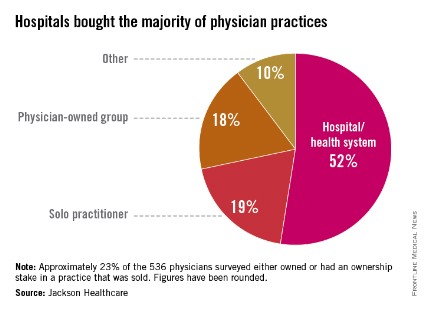

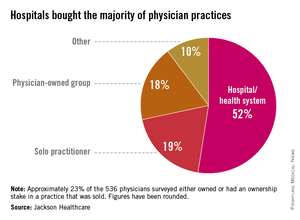

Dr. Hamilton is far from alone in closing up shop because of a more complex and changing health care landscape. Thirty-two percent of physicians who sold their practice within the past 3 years cited the complexities of the ACA as a primary motivator for the sale, according to a nationwide survey by Jackson Healthcare, a health care staffing firm. Of physicians who sold their practices more than 3 years ago, 10% said the law was a factor, according to the survey.

A second survey by Jackson Healthcare found 60% of practice acquisitions by hospitals in 2013 were initiated by the sellers.

"The practice of medicine has increasingly become more complex," said Sheri Sorrell, director of market research for Jackson Healthcare. This includes "getting reimbursement and the amount of paperwork and the amount of regulations [doctors] have to deal with. They can’t keep up with all the regulations. At least if they are selling to a hospital, the hospital has those resources" to comply.

Budding and completed practice acquisitions varied by specialty, the survey found. Nearly 25% of physicians actively seeking to sell their practices described themselves as internal medicine subspecialists, 14% as primary care physicians, and 12% as surgeons. Of the internal medicine subspecialists seeking to sell, 23% described themselves as otolaryngologists, 17% as urologists, and 13% as cardiologists, the survey found.

Hospitals are keen to acquire primary care practices, the second survey found. Family medicine practices made up 58% of practices acquired by hospitals in 2013, while internal medicine made up 40%.

Cardiology practices also are being acquired as physicians seek to avoid significant reimbursement gaps, Dallas health law attorney Cheryl Camin Murray said. Ms. Murray is a shareholder in the health care industry group and corporate securities/mergers and acquisitions practice group of Texas law firm Winstead PC. Hospitals are paid at a higher rate by Medicare than cardiology practices for the same procedures, Ms. Murray said.

While physicians who sell their practices face their share of challenges, the Jackson Healthcare survey found that the majority of doctors who sold are happy with their decision. Fifty-five percent of physicians who sold said they do not miss private practice, and 60% said they are satisfied or very satisfied. Overall, 76% of physician sellers said they would make the same choice again.

One of those physicians is Dr. Hamilton. In the end, he chose not to become an employee of the hospital he sold his practice to, and he is job hunting for nonclinical positions. The sale came at the right time in his practice and career, Dr. Hamilton said.

"For me it was a very good decision," he said. "I’m very happy I was able to get the equity out of my practice that I built over 11 years. For me it was a very timely and very wonderful opportunity."

Data in the first survey were collected from 536 physicians across the United States who responded to a survey about practice acquisitions in 2013. The second survey analyzed responses from 123 hospital executives who had completed acquisitions in 2013 or had acquisitions planned for 2014.

When a hospital approached Georgia surgeon Ian Hamilton Jr. about buying his vascular surgery practice, the proposal was too appealing for him to turn down. At the time, Dr. Hamilton’s practice was facing the challenges of meeting new regulatory and business requirements, including the need for a new electronic health record system that would meet meaningful use requirements.

"I didn’t feel that I was going to be able to maintain a solo practice indefinitely," said Dr. Hamilton, who sold his practice in 2013. "I felt something was going to have to change. The reality of what’s happening in American medicine right now makes it very difficult for a solo practitioner at many different levels. It’s become very expensive to be compliant with the Affordable Care Act and the other regulations that are associated with it."

Dr. Hamilton is far from alone in closing up shop because of a more complex and changing health care landscape. Thirty-two percent of physicians who sold their practice within the past 3 years cited the complexities of the ACA as a primary motivator for the sale, according to a nationwide survey by Jackson Healthcare, a health care staffing firm. Of physicians who sold their practices more than 3 years ago, 10% said the law was a factor, according to the survey.

A second survey by Jackson Healthcare found 60% of practice acquisitions by hospitals in 2013 were initiated by the sellers.

"The practice of medicine has increasingly become more complex," said Sheri Sorrell, director of market research for Jackson Healthcare. This includes "getting reimbursement and the amount of paperwork and the amount of regulations [doctors] have to deal with. They can’t keep up with all the regulations. At least if they are selling to a hospital, the hospital has those resources" to comply.

Budding and completed practice acquisitions varied by specialty, the survey found. Nearly 25% of physicians actively seeking to sell their practices described themselves as internal medicine subspecialists, 14% as primary care physicians, and 12% as surgeons. Of the internal medicine subspecialists seeking to sell, 23% described themselves as otolaryngologists, 17% as urologists, and 13% as cardiologists, the survey found.

Hospitals are keen to acquire primary care practices, the second survey found. Family medicine practices made up 58% of practices acquired by hospitals in 2013, while internal medicine made up 40%.

Cardiology practices also are being acquired as physicians seek to avoid significant reimbursement gaps, Dallas health law attorney Cheryl Camin Murray said. Ms. Murray is a shareholder in the health care industry group and corporate securities/mergers and acquisitions practice group of Texas law firm Winstead PC. Hospitals are paid at a higher rate by Medicare than cardiology practices for the same procedures, Ms. Murray said.

While physicians who sell their practices face their share of challenges, the Jackson Healthcare survey found that the majority of doctors who sold are happy with their decision. Fifty-five percent of physicians who sold said they do not miss private practice, and 60% said they are satisfied or very satisfied. Overall, 76% of physician sellers said they would make the same choice again.

One of those physicians is Dr. Hamilton. In the end, he chose not to become an employee of the hospital he sold his practice to, and he is job hunting for nonclinical positions. The sale came at the right time in his practice and career, Dr. Hamilton said.

"For me it was a very good decision," he said. "I’m very happy I was able to get the equity out of my practice that I built over 11 years. For me it was a very timely and very wonderful opportunity."

Data in the first survey were collected from 536 physicians across the United States who responded to a survey about practice acquisitions in 2013. The second survey analyzed responses from 123 hospital executives who had completed acquisitions in 2013 or had acquisitions planned for 2014.

When a hospital approached Georgia surgeon Ian Hamilton Jr. about buying his vascular surgery practice, the proposal was too appealing for him to turn down. At the time, Dr. Hamilton’s practice was facing the challenges of meeting new regulatory and business requirements, including the need for a new electronic health record system that would meet meaningful use requirements.

"I didn’t feel that I was going to be able to maintain a solo practice indefinitely," said Dr. Hamilton, who sold his practice in 2013. "I felt something was going to have to change. The reality of what’s happening in American medicine right now makes it very difficult for a solo practitioner at many different levels. It’s become very expensive to be compliant with the Affordable Care Act and the other regulations that are associated with it."

Dr. Hamilton is far from alone in closing up shop because of a more complex and changing health care landscape. Thirty-two percent of physicians who sold their practice within the past 3 years cited the complexities of the ACA as a primary motivator for the sale, according to a nationwide survey by Jackson Healthcare, a health care staffing firm. Of physicians who sold their practices more than 3 years ago, 10% said the law was a factor, according to the survey.

A second survey by Jackson Healthcare found 60% of practice acquisitions by hospitals in 2013 were initiated by the sellers.

"The practice of medicine has increasingly become more complex," said Sheri Sorrell, director of market research for Jackson Healthcare. This includes "getting reimbursement and the amount of paperwork and the amount of regulations [doctors] have to deal with. They can’t keep up with all the regulations. At least if they are selling to a hospital, the hospital has those resources" to comply.

Budding and completed practice acquisitions varied by specialty, the survey found. Nearly 25% of physicians actively seeking to sell their practices described themselves as internal medicine subspecialists, 14% as primary care physicians, and 12% as surgeons. Of the internal medicine subspecialists seeking to sell, 23% described themselves as otolaryngologists, 17% as urologists, and 13% as cardiologists, the survey found.

Hospitals are keen to acquire primary care practices, the second survey found. Family medicine practices made up 58% of practices acquired by hospitals in 2013, while internal medicine made up 40%.

Cardiology practices also are being acquired as physicians seek to avoid significant reimbursement gaps, Dallas health law attorney Cheryl Camin Murray said. Ms. Murray is a shareholder in the health care industry group and corporate securities/mergers and acquisitions practice group of Texas law firm Winstead PC. Hospitals are paid at a higher rate by Medicare than cardiology practices for the same procedures, Ms. Murray said.

While physicians who sell their practices face their share of challenges, the Jackson Healthcare survey found that the majority of doctors who sold are happy with their decision. Fifty-five percent of physicians who sold said they do not miss private practice, and 60% said they are satisfied or very satisfied. Overall, 76% of physician sellers said they would make the same choice again.

One of those physicians is Dr. Hamilton. In the end, he chose not to become an employee of the hospital he sold his practice to, and he is job hunting for nonclinical positions. The sale came at the right time in his practice and career, Dr. Hamilton said.

"For me it was a very good decision," he said. "I’m very happy I was able to get the equity out of my practice that I built over 11 years. For me it was a very timely and very wonderful opportunity."

Data in the first survey were collected from 536 physicians across the United States who responded to a survey about practice acquisitions in 2013. The second survey analyzed responses from 123 hospital executives who had completed acquisitions in 2013 or had acquisitions planned for 2014.

Who gets sued when heart disease is missed?

Primary care physicians are sued more often than physicians from any other specialty for failing to diagnose coronary heart disease in women.

An analysis by medical liability insurer The Doctors Company found primary care doctors are the defendants in half of such lawsuits, compared with cardiologists in 22% of suits and emergency physicians in 17%. Hospitalists and orthopedists each were sued in 6% of cardiac disease–related legal claims.

The findings are "not surprising," said Dr. George P. Rodgers, cochair of the American College of Cardiology (ACC) Board of Trustees’ work group on medical professional liability insurance.

"Primary care physicians encounter many more problems and many more patients," Dr. Rodgers said. "They’re the front line. They’re the gateway to further evaluation or not."

The Doctors Company examined 41 malpractice claims involving alleged injuries and deaths from cardiac disease in women between 2007 and 2013. The majority of plaintiffs alleged misdiagnosis, followed by problems with medical treatment.

In 83% of cases, inadequate patient assessment was identified as a factor in patients’ injuries. Failure or delay to obtain a consult or referral was a contributing factor in 28% of cases, and documentation problems contributed to 22% of cases.

In more than 80% of suits, patients experienced serious or fatal outcomes.

"The problem is that when we deal with heart disease, the stakes are high," Dr. Rodgers said. "If you miss the diagnosis, it could be a disastrous result."

"Because [women] are more difficult to diagnose, one would suspect that physicians who have less experience and maybe less training are more likely to make errors," according to Dr. Sandeep Mangalmurti, a Chicago cardiologist and attorney.

In some cases, patients have a hand in a delayed or missed cardiac disease diagnosis. The Doctors Company analysis found women patients contributed to their injuries in 11% of cases, while men contributed in 20% of cases. Patient factors centered on noncompliance with treatment plans, medications, and follow-up appointments.

One way to reduce legal risks is to ensure medical information is properly communicated between physicians within the care spectrum, said Dr. Mangalmurti, a member of the ACC Board of Trustees’ work group on medical professional liability insurance. "That’s as important as the actual diagnosis."

In many cases, "the problem isn’t that the doctor made a mistake in practicing medicine, but that the information gets lost in translation," he added.

Obtain a sufficient amount of history from the patient, no matter how specific or nonspecific symptoms may be, advised Robin Diamond, senior vice president of patient safety and risk management for The Doctors Company.

Strong documentation is also key, Ms. Diamond said. Making note of all patient interactions and event timelines can help defend against a potential lawsuit later.

"When a suit is filed, it’s really important that the documentation is present to show that the office took the right steps to make sure the patient was seen quickly," she said.

During medical discussions, Dr. Rodgers recommends that physicians engage not only with the patient, but with family members. In many cases, a patient may disagree with a doctor’s orders, but then does not share the doctor’s recommendations with the family, Dr. Rodgers said. When a poor outcome or death results, the family may blame the physician, which can lead to a lawsuit.

"If there’s one single thing you can do [to reduce liability], it’s that we have to have really good communication with the patient and the family, even when things are going badly," he said. "The patient and the family need to know that you care and that you’re trying everything you can."

Primary care physicians are sued more often than physicians from any other specialty for failing to diagnose coronary heart disease in women.

An analysis by medical liability insurer The Doctors Company found primary care doctors are the defendants in half of such lawsuits, compared with cardiologists in 22% of suits and emergency physicians in 17%. Hospitalists and orthopedists each were sued in 6% of cardiac disease–related legal claims.

The findings are "not surprising," said Dr. George P. Rodgers, cochair of the American College of Cardiology (ACC) Board of Trustees’ work group on medical professional liability insurance.

"Primary care physicians encounter many more problems and many more patients," Dr. Rodgers said. "They’re the front line. They’re the gateway to further evaluation or not."

The Doctors Company examined 41 malpractice claims involving alleged injuries and deaths from cardiac disease in women between 2007 and 2013. The majority of plaintiffs alleged misdiagnosis, followed by problems with medical treatment.

In 83% of cases, inadequate patient assessment was identified as a factor in patients’ injuries. Failure or delay to obtain a consult or referral was a contributing factor in 28% of cases, and documentation problems contributed to 22% of cases.

In more than 80% of suits, patients experienced serious or fatal outcomes.

"The problem is that when we deal with heart disease, the stakes are high," Dr. Rodgers said. "If you miss the diagnosis, it could be a disastrous result."

"Because [women] are more difficult to diagnose, one would suspect that physicians who have less experience and maybe less training are more likely to make errors," according to Dr. Sandeep Mangalmurti, a Chicago cardiologist and attorney.

In some cases, patients have a hand in a delayed or missed cardiac disease diagnosis. The Doctors Company analysis found women patients contributed to their injuries in 11% of cases, while men contributed in 20% of cases. Patient factors centered on noncompliance with treatment plans, medications, and follow-up appointments.

One way to reduce legal risks is to ensure medical information is properly communicated between physicians within the care spectrum, said Dr. Mangalmurti, a member of the ACC Board of Trustees’ work group on medical professional liability insurance. "That’s as important as the actual diagnosis."

In many cases, "the problem isn’t that the doctor made a mistake in practicing medicine, but that the information gets lost in translation," he added.

Obtain a sufficient amount of history from the patient, no matter how specific or nonspecific symptoms may be, advised Robin Diamond, senior vice president of patient safety and risk management for The Doctors Company.

Strong documentation is also key, Ms. Diamond said. Making note of all patient interactions and event timelines can help defend against a potential lawsuit later.

"When a suit is filed, it’s really important that the documentation is present to show that the office took the right steps to make sure the patient was seen quickly," she said.

During medical discussions, Dr. Rodgers recommends that physicians engage not only with the patient, but with family members. In many cases, a patient may disagree with a doctor’s orders, but then does not share the doctor’s recommendations with the family, Dr. Rodgers said. When a poor outcome or death results, the family may blame the physician, which can lead to a lawsuit.

"If there’s one single thing you can do [to reduce liability], it’s that we have to have really good communication with the patient and the family, even when things are going badly," he said. "The patient and the family need to know that you care and that you’re trying everything you can."

Primary care physicians are sued more often than physicians from any other specialty for failing to diagnose coronary heart disease in women.

An analysis by medical liability insurer The Doctors Company found primary care doctors are the defendants in half of such lawsuits, compared with cardiologists in 22% of suits and emergency physicians in 17%. Hospitalists and orthopedists each were sued in 6% of cardiac disease–related legal claims.

The findings are "not surprising," said Dr. George P. Rodgers, cochair of the American College of Cardiology (ACC) Board of Trustees’ work group on medical professional liability insurance.

"Primary care physicians encounter many more problems and many more patients," Dr. Rodgers said. "They’re the front line. They’re the gateway to further evaluation or not."

The Doctors Company examined 41 malpractice claims involving alleged injuries and deaths from cardiac disease in women between 2007 and 2013. The majority of plaintiffs alleged misdiagnosis, followed by problems with medical treatment.

In 83% of cases, inadequate patient assessment was identified as a factor in patients’ injuries. Failure or delay to obtain a consult or referral was a contributing factor in 28% of cases, and documentation problems contributed to 22% of cases.

In more than 80% of suits, patients experienced serious or fatal outcomes.

"The problem is that when we deal with heart disease, the stakes are high," Dr. Rodgers said. "If you miss the diagnosis, it could be a disastrous result."

"Because [women] are more difficult to diagnose, one would suspect that physicians who have less experience and maybe less training are more likely to make errors," according to Dr. Sandeep Mangalmurti, a Chicago cardiologist and attorney.

In some cases, patients have a hand in a delayed or missed cardiac disease diagnosis. The Doctors Company analysis found women patients contributed to their injuries in 11% of cases, while men contributed in 20% of cases. Patient factors centered on noncompliance with treatment plans, medications, and follow-up appointments.

One way to reduce legal risks is to ensure medical information is properly communicated between physicians within the care spectrum, said Dr. Mangalmurti, a member of the ACC Board of Trustees’ work group on medical professional liability insurance. "That’s as important as the actual diagnosis."

In many cases, "the problem isn’t that the doctor made a mistake in practicing medicine, but that the information gets lost in translation," he added.

Obtain a sufficient amount of history from the patient, no matter how specific or nonspecific symptoms may be, advised Robin Diamond, senior vice president of patient safety and risk management for The Doctors Company.

Strong documentation is also key, Ms. Diamond said. Making note of all patient interactions and event timelines can help defend against a potential lawsuit later.

"When a suit is filed, it’s really important that the documentation is present to show that the office took the right steps to make sure the patient was seen quickly," she said.

During medical discussions, Dr. Rodgers recommends that physicians engage not only with the patient, but with family members. In many cases, a patient may disagree with a doctor’s orders, but then does not share the doctor’s recommendations with the family, Dr. Rodgers said. When a poor outcome or death results, the family may blame the physician, which can lead to a lawsuit.

"If there’s one single thing you can do [to reduce liability], it’s that we have to have really good communication with the patient and the family, even when things are going badly," he said. "The patient and the family need to know that you care and that you’re trying everything you can."

Insurer disputes fueling more lawsuits by doctors

Fed up with unfair practices by some insurance companies, more physicians are heading to the courtroom to resolve conflicts with insurers, litigation experts say. In the last year, doctors in various states took legal action against insurers for such allegations as claim denials, underpayments, and network exclusions.

"Providers are becoming increasingly frustrated [with insurers] on a number of different areas," said David Doyle, founder and CEO of CRT Medical Systems, a medical billing and practice-management company based in Novi, Mich. "Physicians are saying, ‘Enough.’ They’re taking the offensive position and going after the payers."

Recent lawsuits highlight this growing trend. In Connecticut, the medical associations of Fairfield and Hartford counties in November issued a legal challenge against UnitedHealthcare for terminating more than 2,000 doctors from its Medicare Advantage plan network. Physicians claim the terminations were made without cause and will severely harm patient care. UnitedHealthcare has said the restructuring was made to encourage higher quality health care coverage. A district court on Dec. 5 temporarily halted the terminations after the medical associations sought emergency relief.

In the fall, the U.S. District Court for the Northern District of Illinois said a lawsuit brought by an Illinois dermatologist could stand against Humana Insurance Co. The doctor claims the insurer informed his patients falsely that he was no longer in the insurer’s network and to find another doctor. The district court found the doctor had alleged sufficient facts to support his claim of tortious contract interference.

Meanwhile, a Los Angeles Superior Court judge ruled on Dec. 9 that a suit by the California Medical Association and several dozen doctors to move forward against Aetna. The CMA sued Aetna in 2012 for allegedly underpaying out-of-network physicians and failing to approve some out-of-network services.

Aetna moved to dismiss the suit, but the court ruled the doctors pled valid claims under the state’s unfair business practice law. A similar lawsuit over payment denials by the Los Angeles County Medical Association is pending against insurer Health Net.

One reason for the increase in lawsuits is that physicians are better at recognizing insurers’ errors than they were in the past, according to Elizabeth Woodcock, founder of Woodcock & Assoc., a medical practice consulting firm in Atlanta.

"As we’ve gotten more electronic systems, [payment issues] become more identified," she said. "We’ve become better at picking these things up."

Historically, doctors primary struggles with insurance companies consisted of late payments and retroactive denials related to eligibility issues, according to Mark *S. Kopson, a Michigan health law attorney and vice chair of membership for the American Health Lawyers Association’s Payers, Plans and Managed Care Practice Group. Today, insurance battles more often stem from disputes over medically necessary treatment and disagreements over pay for performance measures, he said.

"Those are becoming more prevalent and that’s largely due to the change in reimbursement methods," he said. "The Affordable Care Act has had an impact on the issue. There’s a significant increase in performance-based reimbursement."

Network exclusions and terminations are also a growing catalyst for litigation by doctors, legal experts said. Plans are moving to more restrictive networks to leverage physicians into accepting lower contract rates, and to maintain profits and price competitiveness in the market, said Dr. Myles Riner, a managed care consultant and past president of the American College of Emergency Physicians California chapter.

In addition, insurers often attempt to boot physicians who are viewed as "complainers," said Andrew H. Selesnick, a partner at Los Angeles-based Michelman & Robinson, and chair of the firm’s Healthcare Law Department. Mr. Selesnick recently represented a client who received a network termination letter after the doctor successfully advocated for a Medicare patient to receive coverage for a treatment. The insurer withdrew the termination after Mr. Selesnick argued the move appeared retaliatory and warned of pursuing an injunction.

"For the most part, [network] terminations are profit or retaliation motivated," he said. "You really need to fight those bogus terminations."

Physicians’ success suing over insurer conduct has been mixed. For example, In April, jurors awarded Dr. Jeffrey B. Nordella, a California family physician, $3.8 million in damages after Anthem Blue Cross excluded him from its network. Dr. Nordella claimed the insurer was retaliating against him for his advocacy of patients who were denied coverage.

But in May, a Washington state appeals court threw out a lawsuit by the Washington State Medical Association over fair payments for out-of-network emergency services. The WSMA had sued state Insurance Commissioner Mike Kreidler for allegedly failing to enforce a state law compelling insurers to pay the cost of patients’ out-of-network emergency treatment. The court said the association had no grounds to sue Mr. Kreidler.

"In the major litigation, we’ve seen victories both on the provider and on the plan side," Mr. Kopson said. "One thing that is abundantly clear: This type of litigation is extremely complex and it is extremely expensive."

For this reason, it helps to have multiple health providers involved in a class action against insurers or a medical organization that supports the plaintiff physician, he said. Considering the value of the claim is also important before suing, Ms. Woodcock said. In some cases, the cost of attorney and legal expenses far exceed the disputed payment amount, she noted.

Legal standing is another major consideration, Mr. Selesnick said. Doctors should determine whether they have grounds to sue insurers, with an eye toward legal rules and contract terms. Legal counsel is key, Mr. Selesnick said.

Of course, resolving questions and conflicts with insurers early can prevent lawsuits all together and save both sides significant time and expense, Mr. Kopson said.

"Health plans and providers are undeniably in a symbiotic relationship," he said. "It means you have to pursue a collaborative – as opposed to an adversarial – posture. The best way to avoid litigation is to engage in vigorous discussion and negotiation up front before the contract is signed."

*Correction 2/26/14: A previous version of this story gave the incorrect middle initial of Mr. Mark S. Kopson. This version has been updated.

Fed up with unfair practices by some insurance companies, more physicians are heading to the courtroom to resolve conflicts with insurers, litigation experts say. In the last year, doctors in various states took legal action against insurers for such allegations as claim denials, underpayments, and network exclusions.

"Providers are becoming increasingly frustrated [with insurers] on a number of different areas," said David Doyle, founder and CEO of CRT Medical Systems, a medical billing and practice-management company based in Novi, Mich. "Physicians are saying, ‘Enough.’ They’re taking the offensive position and going after the payers."

Recent lawsuits highlight this growing trend. In Connecticut, the medical associations of Fairfield and Hartford counties in November issued a legal challenge against UnitedHealthcare for terminating more than 2,000 doctors from its Medicare Advantage plan network. Physicians claim the terminations were made without cause and will severely harm patient care. UnitedHealthcare has said the restructuring was made to encourage higher quality health care coverage. A district court on Dec. 5 temporarily halted the terminations after the medical associations sought emergency relief.

In the fall, the U.S. District Court for the Northern District of Illinois said a lawsuit brought by an Illinois dermatologist could stand against Humana Insurance Co. The doctor claims the insurer informed his patients falsely that he was no longer in the insurer’s network and to find another doctor. The district court found the doctor had alleged sufficient facts to support his claim of tortious contract interference.

Meanwhile, a Los Angeles Superior Court judge ruled on Dec. 9 that a suit by the California Medical Association and several dozen doctors to move forward against Aetna. The CMA sued Aetna in 2012 for allegedly underpaying out-of-network physicians and failing to approve some out-of-network services.

Aetna moved to dismiss the suit, but the court ruled the doctors pled valid claims under the state’s unfair business practice law. A similar lawsuit over payment denials by the Los Angeles County Medical Association is pending against insurer Health Net.

One reason for the increase in lawsuits is that physicians are better at recognizing insurers’ errors than they were in the past, according to Elizabeth Woodcock, founder of Woodcock & Assoc., a medical practice consulting firm in Atlanta.

"As we’ve gotten more electronic systems, [payment issues] become more identified," she said. "We’ve become better at picking these things up."

Historically, doctors primary struggles with insurance companies consisted of late payments and retroactive denials related to eligibility issues, according to Mark *S. Kopson, a Michigan health law attorney and vice chair of membership for the American Health Lawyers Association’s Payers, Plans and Managed Care Practice Group. Today, insurance battles more often stem from disputes over medically necessary treatment and disagreements over pay for performance measures, he said.

"Those are becoming more prevalent and that’s largely due to the change in reimbursement methods," he said. "The Affordable Care Act has had an impact on the issue. There’s a significant increase in performance-based reimbursement."

Network exclusions and terminations are also a growing catalyst for litigation by doctors, legal experts said. Plans are moving to more restrictive networks to leverage physicians into accepting lower contract rates, and to maintain profits and price competitiveness in the market, said Dr. Myles Riner, a managed care consultant and past president of the American College of Emergency Physicians California chapter.

In addition, insurers often attempt to boot physicians who are viewed as "complainers," said Andrew H. Selesnick, a partner at Los Angeles-based Michelman & Robinson, and chair of the firm’s Healthcare Law Department. Mr. Selesnick recently represented a client who received a network termination letter after the doctor successfully advocated for a Medicare patient to receive coverage for a treatment. The insurer withdrew the termination after Mr. Selesnick argued the move appeared retaliatory and warned of pursuing an injunction.

"For the most part, [network] terminations are profit or retaliation motivated," he said. "You really need to fight those bogus terminations."

Physicians’ success suing over insurer conduct has been mixed. For example, In April, jurors awarded Dr. Jeffrey B. Nordella, a California family physician, $3.8 million in damages after Anthem Blue Cross excluded him from its network. Dr. Nordella claimed the insurer was retaliating against him for his advocacy of patients who were denied coverage.

But in May, a Washington state appeals court threw out a lawsuit by the Washington State Medical Association over fair payments for out-of-network emergency services. The WSMA had sued state Insurance Commissioner Mike Kreidler for allegedly failing to enforce a state law compelling insurers to pay the cost of patients’ out-of-network emergency treatment. The court said the association had no grounds to sue Mr. Kreidler.

"In the major litigation, we’ve seen victories both on the provider and on the plan side," Mr. Kopson said. "One thing that is abundantly clear: This type of litigation is extremely complex and it is extremely expensive."

For this reason, it helps to have multiple health providers involved in a class action against insurers or a medical organization that supports the plaintiff physician, he said. Considering the value of the claim is also important before suing, Ms. Woodcock said. In some cases, the cost of attorney and legal expenses far exceed the disputed payment amount, she noted.

Legal standing is another major consideration, Mr. Selesnick said. Doctors should determine whether they have grounds to sue insurers, with an eye toward legal rules and contract terms. Legal counsel is key, Mr. Selesnick said.

Of course, resolving questions and conflicts with insurers early can prevent lawsuits all together and save both sides significant time and expense, Mr. Kopson said.

"Health plans and providers are undeniably in a symbiotic relationship," he said. "It means you have to pursue a collaborative – as opposed to an adversarial – posture. The best way to avoid litigation is to engage in vigorous discussion and negotiation up front before the contract is signed."

*Correction 2/26/14: A previous version of this story gave the incorrect middle initial of Mr. Mark S. Kopson. This version has been updated.

Fed up with unfair practices by some insurance companies, more physicians are heading to the courtroom to resolve conflicts with insurers, litigation experts say. In the last year, doctors in various states took legal action against insurers for such allegations as claim denials, underpayments, and network exclusions.

"Providers are becoming increasingly frustrated [with insurers] on a number of different areas," said David Doyle, founder and CEO of CRT Medical Systems, a medical billing and practice-management company based in Novi, Mich. "Physicians are saying, ‘Enough.’ They’re taking the offensive position and going after the payers."

Recent lawsuits highlight this growing trend. In Connecticut, the medical associations of Fairfield and Hartford counties in November issued a legal challenge against UnitedHealthcare for terminating more than 2,000 doctors from its Medicare Advantage plan network. Physicians claim the terminations were made without cause and will severely harm patient care. UnitedHealthcare has said the restructuring was made to encourage higher quality health care coverage. A district court on Dec. 5 temporarily halted the terminations after the medical associations sought emergency relief.

In the fall, the U.S. District Court for the Northern District of Illinois said a lawsuit brought by an Illinois dermatologist could stand against Humana Insurance Co. The doctor claims the insurer informed his patients falsely that he was no longer in the insurer’s network and to find another doctor. The district court found the doctor had alleged sufficient facts to support his claim of tortious contract interference.

Meanwhile, a Los Angeles Superior Court judge ruled on Dec. 9 that a suit by the California Medical Association and several dozen doctors to move forward against Aetna. The CMA sued Aetna in 2012 for allegedly underpaying out-of-network physicians and failing to approve some out-of-network services.

Aetna moved to dismiss the suit, but the court ruled the doctors pled valid claims under the state’s unfair business practice law. A similar lawsuit over payment denials by the Los Angeles County Medical Association is pending against insurer Health Net.

One reason for the increase in lawsuits is that physicians are better at recognizing insurers’ errors than they were in the past, according to Elizabeth Woodcock, founder of Woodcock & Assoc., a medical practice consulting firm in Atlanta.

"As we’ve gotten more electronic systems, [payment issues] become more identified," she said. "We’ve become better at picking these things up."

Historically, doctors primary struggles with insurance companies consisted of late payments and retroactive denials related to eligibility issues, according to Mark *S. Kopson, a Michigan health law attorney and vice chair of membership for the American Health Lawyers Association’s Payers, Plans and Managed Care Practice Group. Today, insurance battles more often stem from disputes over medically necessary treatment and disagreements over pay for performance measures, he said.

"Those are becoming more prevalent and that’s largely due to the change in reimbursement methods," he said. "The Affordable Care Act has had an impact on the issue. There’s a significant increase in performance-based reimbursement."

Network exclusions and terminations are also a growing catalyst for litigation by doctors, legal experts said. Plans are moving to more restrictive networks to leverage physicians into accepting lower contract rates, and to maintain profits and price competitiveness in the market, said Dr. Myles Riner, a managed care consultant and past president of the American College of Emergency Physicians California chapter.

In addition, insurers often attempt to boot physicians who are viewed as "complainers," said Andrew H. Selesnick, a partner at Los Angeles-based Michelman & Robinson, and chair of the firm’s Healthcare Law Department. Mr. Selesnick recently represented a client who received a network termination letter after the doctor successfully advocated for a Medicare patient to receive coverage for a treatment. The insurer withdrew the termination after Mr. Selesnick argued the move appeared retaliatory and warned of pursuing an injunction.

"For the most part, [network] terminations are profit or retaliation motivated," he said. "You really need to fight those bogus terminations."

Physicians’ success suing over insurer conduct has been mixed. For example, In April, jurors awarded Dr. Jeffrey B. Nordella, a California family physician, $3.8 million in damages after Anthem Blue Cross excluded him from its network. Dr. Nordella claimed the insurer was retaliating against him for his advocacy of patients who were denied coverage.

But in May, a Washington state appeals court threw out a lawsuit by the Washington State Medical Association over fair payments for out-of-network emergency services. The WSMA had sued state Insurance Commissioner Mike Kreidler for allegedly failing to enforce a state law compelling insurers to pay the cost of patients’ out-of-network emergency treatment. The court said the association had no grounds to sue Mr. Kreidler.

"In the major litigation, we’ve seen victories both on the provider and on the plan side," Mr. Kopson said. "One thing that is abundantly clear: This type of litigation is extremely complex and it is extremely expensive."

For this reason, it helps to have multiple health providers involved in a class action against insurers or a medical organization that supports the plaintiff physician, he said. Considering the value of the claim is also important before suing, Ms. Woodcock said. In some cases, the cost of attorney and legal expenses far exceed the disputed payment amount, she noted.

Legal standing is another major consideration, Mr. Selesnick said. Doctors should determine whether they have grounds to sue insurers, with an eye toward legal rules and contract terms. Legal counsel is key, Mr. Selesnick said.

Of course, resolving questions and conflicts with insurers early can prevent lawsuits all together and save both sides significant time and expense, Mr. Kopson said.

"Health plans and providers are undeniably in a symbiotic relationship," he said. "It means you have to pursue a collaborative – as opposed to an adversarial – posture. The best way to avoid litigation is to engage in vigorous discussion and negotiation up front before the contract is signed."

*Correction 2/26/14: A previous version of this story gave the incorrect middle initial of Mr. Mark S. Kopson. This version has been updated.

Johnson & Johnson agrees to pay billions in drug misbranding settlement

Janssen Pharmaceuticals, a subsidiary of health care giant Johnson & Johnson, will pay the government more than $2 billion to resolve allegations of drug misbranding, physician kickbacks, and false claims in connection with the schizophrenia medication Risperdal. The agreement is one of the largest health care fraud settlements in U.S. history, according to the U.S. Justice Department.

Janssen also has agreed to plead guilty to a misdemeanor violation of the federal Food, Drug, and Cosmetic Act for marketing Risperdal to physicians and others for unapproved uses. The company allegedly promoted Risperdal for the treatment of dementia symptoms in seniors and mental health disabilities in children, despite safety risks and warnings by the Food and Drug Administration. The settlement also resolves accusations that Janssen unlawfully promoted two other medications for unapproved uses – the heart failure drug Natrecor and the antipsychotic medication Invega.

The penalties against Janssen demonstrate the perilous repercussions that can result when pharmaceutical companies discount FDA regulations, FDA Commissioner Margaret A. Hamburg said in a statement.

"When pharmaceutical companies ignore the FDA’s requirements, they not only risk endangering the public’s health but also damaging the trust that patients have in their doctors and their medications," Dr. Hamburg said.

In a statement, Johnson & Johnson said Janssen accepts accountability for the actions outlined in its criminal misdemeanor plea agreement. However, the company expressly denied the government’s civil allegations, saying the civil settlement is not an admission of any wrongdoing.

"This resolution allows us to move forward and continue to focus on delivering innovative solutions that improve and enhance the health and well-being of patients around the world," said Michael H. Ullmann, Johnson & Johnson vice president and general counsel. "We remain committed to working with the [FDA] and others to ensure greater clarity around the guidance for pharmaceutical industry practices and standards."

Risperdal is approved by the FDA for the treatment of schizophrenia and manic and mixed episodes associated with bipolar I disorder. It also is indicated as an adjunct to mood stabilizers for treating acute manic or mixed episodes associated with bipolar I. But until 2005, Janssen marketed the drug for behavioral disturbances in elderly dementia patients, according to the government’s criminal and civil complaints. Sales representatives aggressively promoted the drug for such unapproved uses to nursing homes and doctors who treated the elderly, the FDA said. The government asserted also that Janssen paid speakers fees to physicians to influence them to write and increase their Risperdal prescriptions.

A federal judge must approve the settlement before it is final.

Janssen Pharmaceuticals, a subsidiary of health care giant Johnson & Johnson, will pay the government more than $2 billion to resolve allegations of drug misbranding, physician kickbacks, and false claims in connection with the schizophrenia medication Risperdal. The agreement is one of the largest health care fraud settlements in U.S. history, according to the U.S. Justice Department.

Janssen also has agreed to plead guilty to a misdemeanor violation of the federal Food, Drug, and Cosmetic Act for marketing Risperdal to physicians and others for unapproved uses. The company allegedly promoted Risperdal for the treatment of dementia symptoms in seniors and mental health disabilities in children, despite safety risks and warnings by the Food and Drug Administration. The settlement also resolves accusations that Janssen unlawfully promoted two other medications for unapproved uses – the heart failure drug Natrecor and the antipsychotic medication Invega.

The penalties against Janssen demonstrate the perilous repercussions that can result when pharmaceutical companies discount FDA regulations, FDA Commissioner Margaret A. Hamburg said in a statement.

"When pharmaceutical companies ignore the FDA’s requirements, they not only risk endangering the public’s health but also damaging the trust that patients have in their doctors and their medications," Dr. Hamburg said.

In a statement, Johnson & Johnson said Janssen accepts accountability for the actions outlined in its criminal misdemeanor plea agreement. However, the company expressly denied the government’s civil allegations, saying the civil settlement is not an admission of any wrongdoing.

"This resolution allows us to move forward and continue to focus on delivering innovative solutions that improve and enhance the health and well-being of patients around the world," said Michael H. Ullmann, Johnson & Johnson vice president and general counsel. "We remain committed to working with the [FDA] and others to ensure greater clarity around the guidance for pharmaceutical industry practices and standards."

Risperdal is approved by the FDA for the treatment of schizophrenia and manic and mixed episodes associated with bipolar I disorder. It also is indicated as an adjunct to mood stabilizers for treating acute manic or mixed episodes associated with bipolar I. But until 2005, Janssen marketed the drug for behavioral disturbances in elderly dementia patients, according to the government’s criminal and civil complaints. Sales representatives aggressively promoted the drug for such unapproved uses to nursing homes and doctors who treated the elderly, the FDA said. The government asserted also that Janssen paid speakers fees to physicians to influence them to write and increase their Risperdal prescriptions.

A federal judge must approve the settlement before it is final.

Janssen Pharmaceuticals, a subsidiary of health care giant Johnson & Johnson, will pay the government more than $2 billion to resolve allegations of drug misbranding, physician kickbacks, and false claims in connection with the schizophrenia medication Risperdal. The agreement is one of the largest health care fraud settlements in U.S. history, according to the U.S. Justice Department.

Janssen also has agreed to plead guilty to a misdemeanor violation of the federal Food, Drug, and Cosmetic Act for marketing Risperdal to physicians and others for unapproved uses. The company allegedly promoted Risperdal for the treatment of dementia symptoms in seniors and mental health disabilities in children, despite safety risks and warnings by the Food and Drug Administration. The settlement also resolves accusations that Janssen unlawfully promoted two other medications for unapproved uses – the heart failure drug Natrecor and the antipsychotic medication Invega.

The penalties against Janssen demonstrate the perilous repercussions that can result when pharmaceutical companies discount FDA regulations, FDA Commissioner Margaret A. Hamburg said in a statement.

"When pharmaceutical companies ignore the FDA’s requirements, they not only risk endangering the public’s health but also damaging the trust that patients have in their doctors and their medications," Dr. Hamburg said.

In a statement, Johnson & Johnson said Janssen accepts accountability for the actions outlined in its criminal misdemeanor plea agreement. However, the company expressly denied the government’s civil allegations, saying the civil settlement is not an admission of any wrongdoing.

"This resolution allows us to move forward and continue to focus on delivering innovative solutions that improve and enhance the health and well-being of patients around the world," said Michael H. Ullmann, Johnson & Johnson vice president and general counsel. "We remain committed to working with the [FDA] and others to ensure greater clarity around the guidance for pharmaceutical industry practices and standards."

Risperdal is approved by the FDA for the treatment of schizophrenia and manic and mixed episodes associated with bipolar I disorder. It also is indicated as an adjunct to mood stabilizers for treating acute manic or mixed episodes associated with bipolar I. But until 2005, Janssen marketed the drug for behavioral disturbances in elderly dementia patients, according to the government’s criminal and civil complaints. Sales representatives aggressively promoted the drug for such unapproved uses to nursing homes and doctors who treated the elderly, the FDA said. The government asserted also that Janssen paid speakers fees to physicians to influence them to write and increase their Risperdal prescriptions.

A federal judge must approve the settlement before it is final.

Pennsylvania joins states with ‘I’m sorry’ laws

Pennsylvania physicians can now apologize to patients after a poor medical outcome without fear that it will be used against them in court.

The Benevolent Gesture Medical Professional Liability Act unanimously passed the Pennsylvania House of Representatives Oct. 22 and was signed by Gov. Tom Corbett, a Republican, the following day. The legislation is in line with other "I’m sorry" laws across the country, said Dr. C. Richard Schott, former president of the Pennsylvania Medical Society (PAMED).

"Physicians, not only in Pennsylvania but around the country, have been concerned that if they offer a benevolent gesture in the setting of a bad outcome, that they can be held liable for their expression of sympathy or empathy to the patient," Dr. Schott said. "It becomes a barrier to otherwise appropriate communication. Other states have this type of legislation in various forms, and we are delighted that it passed" in Pennsylvania.

More than 30 states have some form of apology statute aimed at physicians and other health care providers. The language and extent of legal protection however, depends on the jurisdiction, said Dr. Marlynn Wei, a psychiatrist and attorney in New York City.

Pennsylvania law’s protects any action, conduct, or statement that conveys a sense of apology, condolence, explanation, compassion, or commiseration "emanating from humane impulses." The statute does not protect factual statements or admissions of guilt for a medical outcome or error.

Other states such as Colorado and Idaho shield physicians against admissions of fault being used against them in court.

"The goals of [apology] laws are to be on the side with the patient as opposed to pitting the doctor and patient against each other," said Dr. Wei, who authored an article on the use and effectiveness of state apology laws (J. Health Law 2007;40:107-59). "These laws allow us to be compassionate."

Whether apology laws actually reduce litigation is unclear, Dr. Wei said. Most patients who experience a poor medical outcome want an apology, but whether they ultimately sue depends on the severity of the injury and whether they believe negligence was involved.

"Most apology laws say these [sympathetic] statements cannot be used against you in court, but they don’t prevent a lawsuit from happening," she said.

In Pennsylvania, both physicians and plaintiffs’ attorneys supported the new law . Proponents said agreement between the two sides led to the legislation’s swift passage.

"Stakeholders were able to put aside their competing interests to come to a compromise," Pennsylvania Sen. Pat Vance (R-Cumberland) said in a statement.

The law’s simple intent made the statute easy for doctors and plaintiffs’ attorneys to agree upon, said George B. Faller Jr., a personal injury attorney in Carlisle, Pa.

"The lawyers defending doctors are O.K. with it because [physicians] can say they’re sorry without it being admissible," he said. "The plaintiffs’ lawyers on the other hand, like the fact that if there are factual statements made or admissions of guilt, those are admissible."

Pennsylvania physicians can now apologize to patients after a poor medical outcome without fear that it will be used against them in court.

The Benevolent Gesture Medical Professional Liability Act unanimously passed the Pennsylvania House of Representatives Oct. 22 and was signed by Gov. Tom Corbett, a Republican, the following day. The legislation is in line with other "I’m sorry" laws across the country, said Dr. C. Richard Schott, former president of the Pennsylvania Medical Society (PAMED).

"Physicians, not only in Pennsylvania but around the country, have been concerned that if they offer a benevolent gesture in the setting of a bad outcome, that they can be held liable for their expression of sympathy or empathy to the patient," Dr. Schott said. "It becomes a barrier to otherwise appropriate communication. Other states have this type of legislation in various forms, and we are delighted that it passed" in Pennsylvania.

More than 30 states have some form of apology statute aimed at physicians and other health care providers. The language and extent of legal protection however, depends on the jurisdiction, said Dr. Marlynn Wei, a psychiatrist and attorney in New York City.

Pennsylvania law’s protects any action, conduct, or statement that conveys a sense of apology, condolence, explanation, compassion, or commiseration "emanating from humane impulses." The statute does not protect factual statements or admissions of guilt for a medical outcome or error.

Other states such as Colorado and Idaho shield physicians against admissions of fault being used against them in court.

"The goals of [apology] laws are to be on the side with the patient as opposed to pitting the doctor and patient against each other," said Dr. Wei, who authored an article on the use and effectiveness of state apology laws (J. Health Law 2007;40:107-59). "These laws allow us to be compassionate."

Whether apology laws actually reduce litigation is unclear, Dr. Wei said. Most patients who experience a poor medical outcome want an apology, but whether they ultimately sue depends on the severity of the injury and whether they believe negligence was involved.

"Most apology laws say these [sympathetic] statements cannot be used against you in court, but they don’t prevent a lawsuit from happening," she said.

In Pennsylvania, both physicians and plaintiffs’ attorneys supported the new law . Proponents said agreement between the two sides led to the legislation’s swift passage.

"Stakeholders were able to put aside their competing interests to come to a compromise," Pennsylvania Sen. Pat Vance (R-Cumberland) said in a statement.

The law’s simple intent made the statute easy for doctors and plaintiffs’ attorneys to agree upon, said George B. Faller Jr., a personal injury attorney in Carlisle, Pa.

"The lawyers defending doctors are O.K. with it because [physicians] can say they’re sorry without it being admissible," he said. "The plaintiffs’ lawyers on the other hand, like the fact that if there are factual statements made or admissions of guilt, those are admissible."

Pennsylvania physicians can now apologize to patients after a poor medical outcome without fear that it will be used against them in court.

The Benevolent Gesture Medical Professional Liability Act unanimously passed the Pennsylvania House of Representatives Oct. 22 and was signed by Gov. Tom Corbett, a Republican, the following day. The legislation is in line with other "I’m sorry" laws across the country, said Dr. C. Richard Schott, former president of the Pennsylvania Medical Society (PAMED).

"Physicians, not only in Pennsylvania but around the country, have been concerned that if they offer a benevolent gesture in the setting of a bad outcome, that they can be held liable for their expression of sympathy or empathy to the patient," Dr. Schott said. "It becomes a barrier to otherwise appropriate communication. Other states have this type of legislation in various forms, and we are delighted that it passed" in Pennsylvania.

More than 30 states have some form of apology statute aimed at physicians and other health care providers. The language and extent of legal protection however, depends on the jurisdiction, said Dr. Marlynn Wei, a psychiatrist and attorney in New York City.

Pennsylvania law’s protects any action, conduct, or statement that conveys a sense of apology, condolence, explanation, compassion, or commiseration "emanating from humane impulses." The statute does not protect factual statements or admissions of guilt for a medical outcome or error.

Other states such as Colorado and Idaho shield physicians against admissions of fault being used against them in court.

"The goals of [apology] laws are to be on the side with the patient as opposed to pitting the doctor and patient against each other," said Dr. Wei, who authored an article on the use and effectiveness of state apology laws (J. Health Law 2007;40:107-59). "These laws allow us to be compassionate."

Whether apology laws actually reduce litigation is unclear, Dr. Wei said. Most patients who experience a poor medical outcome want an apology, but whether they ultimately sue depends on the severity of the injury and whether they believe negligence was involved.

"Most apology laws say these [sympathetic] statements cannot be used against you in court, but they don’t prevent a lawsuit from happening," she said.

In Pennsylvania, both physicians and plaintiffs’ attorneys supported the new law . Proponents said agreement between the two sides led to the legislation’s swift passage.

"Stakeholders were able to put aside their competing interests to come to a compromise," Pennsylvania Sen. Pat Vance (R-Cumberland) said in a statement.

The law’s simple intent made the statute easy for doctors and plaintiffs’ attorneys to agree upon, said George B. Faller Jr., a personal injury attorney in Carlisle, Pa.

"The lawyers defending doctors are O.K. with it because [physicians] can say they’re sorry without it being admissible," he said. "The plaintiffs’ lawyers on the other hand, like the fact that if there are factual statements made or admissions of guilt, those are admissible."

ACA could pose unintentional legal dangers for physicians

Federal quality metrics – integrated into the Affordable Care Act to improve and standardize care – are posing unintended legal risks for physicians, medical malpractice experts noted.

"The Affordable Care Act itself doesn’t identify medical malpractice issues," according to Aldo Leiva, a health law attorney in Coral Gables, Fla. "The concern that has arisen has been whether or not the content or language in the [ACA] can be used by plaintiffs’ lawyers against doctors by creating an additional standard of care."

Attorneys and insurers already are hearing reports of federal reimbursement decisions being introduced into medical malpractice cases. In such instances, lawyers use federal payment denials to bolster their claims of negligence, according to Mike Stinson, director of government relations for PIAA, a national trade association representing medical liability insurers.

Hospital readmission standards are one such federal quality measurement that could unfairly impact doctors in court, said Brian K. Atchinson, PIAA president and CEO. The ACA reduces payments to hospitals considered to have excessive readmissions.

"The mere fact that there will be many thousands of people that will be readmitted to a hospital within 30 days, that should not be evidence of inadequate care," Mr. Atchinson said.

Penalties regarding hospital-acquired conditions and value-based incentive payments also could impact lawsuits.

Lawyers are creative and will search for clever ways to further their argument, Mr. Leiva said. "There’s nothing to stop [them] from using that to move the needle a little further" to support their claim."

State legislatures are working to remedy this growing legal jeopardy. Georgia recently passed laws banning federal quality measures from being used to create standards in medical liability cases. Florida has had a similar law on the books since 2011.

Before Georgia’s law was enacted in May, plaintiffs’ attorneys had sought to have information about Medicare reimbursement denials presented to medical malpractice juries, according to Joseph L. Cregan, senior vice president and general counsel for MAG Mutual Insurance, a medical liability insurer that operates in the Southeast.

"Obviously, placing these issues before the jury could adversely affect our physician insureds, because it ... encourages a juror to impose a simplistic analysis instead of the proper legal analysis," Mr. Cregan said. "Our desire was that H.B. 499 would clarify that traditional ‘reasonable physician’ standard of care analysis remains the fundamental key to judging our Georgia physicians."

Since Georgia’s enactment of H.B. 499, other states, including Alabama and Mississippi, have expressed interest in considering similar laws, Mr. Cregan said.

"I think you are going to see the H.B. 499 idea introduced in other state legislatures in 2014, and I think you will see the issue debated and passed in a number of states," he said.

Others are looking toward federal legislation as a solution to unintentional ACA legal traps.

H.R. 1473, the Standard of Care Protection Act, was introduced by Rep. Phil Gingrey (R-Ga.), and is supported by the American Medical Association. It is currently under consideration by subcommittees of the Energy and Commerce Commiteee and the Judiciary Committee; no Senate companion has been introduced.

The bill would prevent ACA guidelines and standards from being construed to establish a standard of care in medical malpractice cases. It also would prevent those provisions from preempting state laws that govern medical liability.

"There should be no room for misinterpretation of the [ACA] to create new causes of action or trump state medical malpractice laws," Rep. Gloria Negrete McLeod (D-Calif.), a cosponsor of the bill, said in a statement.

The bill also was included in H.R. 2810, a bill to replace the Medicare Sustainable Growth Rate formula, which was passed out of the Energy and Commerce Committee in July. Proponents are cautiously optimistic about the bill’s success.

"Over the autumn, we’re going to be paying close attention to how this legislation proceeds," Mr. Atchinson of PIAA said. "We certainly believe it would be good for both the physicians and the nation’s patients."

Federal quality metrics – integrated into the Affordable Care Act to improve and standardize care – are posing unintended legal risks for physicians, medical malpractice experts noted.

"The Affordable Care Act itself doesn’t identify medical malpractice issues," according to Aldo Leiva, a health law attorney in Coral Gables, Fla. "The concern that has arisen has been whether or not the content or language in the [ACA] can be used by plaintiffs’ lawyers against doctors by creating an additional standard of care."

Attorneys and insurers already are hearing reports of federal reimbursement decisions being introduced into medical malpractice cases. In such instances, lawyers use federal payment denials to bolster their claims of negligence, according to Mike Stinson, director of government relations for PIAA, a national trade association representing medical liability insurers.

Hospital readmission standards are one such federal quality measurement that could unfairly impact doctors in court, said Brian K. Atchinson, PIAA president and CEO. The ACA reduces payments to hospitals considered to have excessive readmissions.

"The mere fact that there will be many thousands of people that will be readmitted to a hospital within 30 days, that should not be evidence of inadequate care," Mr. Atchinson said.

Penalties regarding hospital-acquired conditions and value-based incentive payments also could impact lawsuits.

Lawyers are creative and will search for clever ways to further their argument, Mr. Leiva said. "There’s nothing to stop [them] from using that to move the needle a little further" to support their claim."

State legislatures are working to remedy this growing legal jeopardy. Georgia recently passed laws banning federal quality measures from being used to create standards in medical liability cases. Florida has had a similar law on the books since 2011.

Before Georgia’s law was enacted in May, plaintiffs’ attorneys had sought to have information about Medicare reimbursement denials presented to medical malpractice juries, according to Joseph L. Cregan, senior vice president and general counsel for MAG Mutual Insurance, a medical liability insurer that operates in the Southeast.

"Obviously, placing these issues before the jury could adversely affect our physician insureds, because it ... encourages a juror to impose a simplistic analysis instead of the proper legal analysis," Mr. Cregan said. "Our desire was that H.B. 499 would clarify that traditional ‘reasonable physician’ standard of care analysis remains the fundamental key to judging our Georgia physicians."

Since Georgia’s enactment of H.B. 499, other states, including Alabama and Mississippi, have expressed interest in considering similar laws, Mr. Cregan said.

"I think you are going to see the H.B. 499 idea introduced in other state legislatures in 2014, and I think you will see the issue debated and passed in a number of states," he said.

Others are looking toward federal legislation as a solution to unintentional ACA legal traps.

H.R. 1473, the Standard of Care Protection Act, was introduced by Rep. Phil Gingrey (R-Ga.), and is supported by the American Medical Association. It is currently under consideration by subcommittees of the Energy and Commerce Commiteee and the Judiciary Committee; no Senate companion has been introduced.

The bill would prevent ACA guidelines and standards from being construed to establish a standard of care in medical malpractice cases. It also would prevent those provisions from preempting state laws that govern medical liability.

"There should be no room for misinterpretation of the [ACA] to create new causes of action or trump state medical malpractice laws," Rep. Gloria Negrete McLeod (D-Calif.), a cosponsor of the bill, said in a statement.

The bill also was included in H.R. 2810, a bill to replace the Medicare Sustainable Growth Rate formula, which was passed out of the Energy and Commerce Committee in July. Proponents are cautiously optimistic about the bill’s success.

"Over the autumn, we’re going to be paying close attention to how this legislation proceeds," Mr. Atchinson of PIAA said. "We certainly believe it would be good for both the physicians and the nation’s patients."

Federal quality metrics – integrated into the Affordable Care Act to improve and standardize care – are posing unintended legal risks for physicians, medical malpractice experts noted.

"The Affordable Care Act itself doesn’t identify medical malpractice issues," according to Aldo Leiva, a health law attorney in Coral Gables, Fla. "The concern that has arisen has been whether or not the content or language in the [ACA] can be used by plaintiffs’ lawyers against doctors by creating an additional standard of care."

Attorneys and insurers already are hearing reports of federal reimbursement decisions being introduced into medical malpractice cases. In such instances, lawyers use federal payment denials to bolster their claims of negligence, according to Mike Stinson, director of government relations for PIAA, a national trade association representing medical liability insurers.

Hospital readmission standards are one such federal quality measurement that could unfairly impact doctors in court, said Brian K. Atchinson, PIAA president and CEO. The ACA reduces payments to hospitals considered to have excessive readmissions.

"The mere fact that there will be many thousands of people that will be readmitted to a hospital within 30 days, that should not be evidence of inadequate care," Mr. Atchinson said.

Penalties regarding hospital-acquired conditions and value-based incentive payments also could impact lawsuits.

Lawyers are creative and will search for clever ways to further their argument, Mr. Leiva said. "There’s nothing to stop [them] from using that to move the needle a little further" to support their claim."

State legislatures are working to remedy this growing legal jeopardy. Georgia recently passed laws banning federal quality measures from being used to create standards in medical liability cases. Florida has had a similar law on the books since 2011.

Before Georgia’s law was enacted in May, plaintiffs’ attorneys had sought to have information about Medicare reimbursement denials presented to medical malpractice juries, according to Joseph L. Cregan, senior vice president and general counsel for MAG Mutual Insurance, a medical liability insurer that operates in the Southeast.

"Obviously, placing these issues before the jury could adversely affect our physician insureds, because it ... encourages a juror to impose a simplistic analysis instead of the proper legal analysis," Mr. Cregan said. "Our desire was that H.B. 499 would clarify that traditional ‘reasonable physician’ standard of care analysis remains the fundamental key to judging our Georgia physicians."

Since Georgia’s enactment of H.B. 499, other states, including Alabama and Mississippi, have expressed interest in considering similar laws, Mr. Cregan said.

"I think you are going to see the H.B. 499 idea introduced in other state legislatures in 2014, and I think you will see the issue debated and passed in a number of states," he said.

Others are looking toward federal legislation as a solution to unintentional ACA legal traps.

H.R. 1473, the Standard of Care Protection Act, was introduced by Rep. Phil Gingrey (R-Ga.), and is supported by the American Medical Association. It is currently under consideration by subcommittees of the Energy and Commerce Commiteee and the Judiciary Committee; no Senate companion has been introduced.

The bill would prevent ACA guidelines and standards from being construed to establish a standard of care in medical malpractice cases. It also would prevent those provisions from preempting state laws that govern medical liability.

"There should be no room for misinterpretation of the [ACA] to create new causes of action or trump state medical malpractice laws," Rep. Gloria Negrete McLeod (D-Calif.), a cosponsor of the bill, said in a statement.

The bill also was included in H.R. 2810, a bill to replace the Medicare Sustainable Growth Rate formula, which was passed out of the Energy and Commerce Committee in July. Proponents are cautiously optimistic about the bill’s success.

"Over the autumn, we’re going to be paying close attention to how this legislation proceeds," Mr. Atchinson of PIAA said. "We certainly believe it would be good for both the physicians and the nation’s patients."

Mid-level providers bring different risk to practice

A patient called his doctors’ office complaining of postsurgical pain. The practice’s physician assistant recommended increased pain medication, but failed to alert the on-call physician regarding the contact. The patient later sued the PA and the supervising physician after he was diagnosed with compartment syndrome.

But which physician was named in the lawsuit? Not the surgeon. Not the on-call physician. An orthopedist who was out of town during the incident was named as defendant.

The out-of-town orthopedist "was the supervising physician on record," explained Dr. Alan Lembitz, a family physician and chief medical officer for COPIC, a Colorado-based medical liability insurer. "The liability and supervision goes to the doctor who is registered with the medical board."

The vignette goes far to illustrate the type of legal cases that are becoming more common with the increased use of mid-level providers, Dr. Lembitz said.

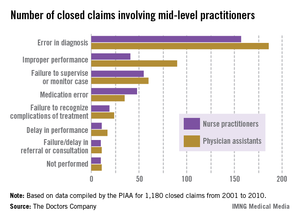

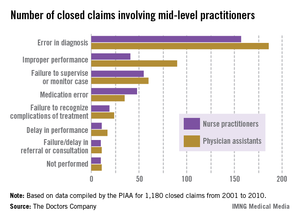

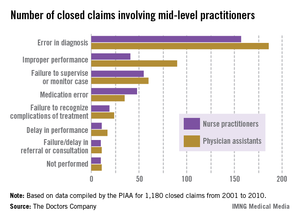

A report from national medical liability insurer the Doctors Company quantifies the situation.

The report examined claims between 2001 and 2010 involving nurse practitioners and physician assistants compiled by the PIAA Data Sharing Project, a claims database operated by PIAA, a national trade association that represents medical liability insurers. (PIAA was formerly known as Physician Insurers Association of America).

Of 1,180 closed claims involving physician assistants (PAs) and nurse practitioners (NPs), the payments were made on behalf of mid-level providers by the supervising physician’s policy or that of the practice’s professional association. Family medicine was the most common specialty associated with claims against mid-level providers.

The average defense payment paid on behalf of NPs was $309,405, while the average defense payment made on behalf of PAs was $321,991, the report said.

With federal incentives aimed at more collaborative care and declining physician reimbursement, the growing demand for physician extenders is inevitable, said George F. Indest III, president of the Health Law Firm, headquartered in Altamonte Springs, Fla.

"With the increased role of [mid-level providers], there will no doubt be some increase in liability placed on physicians who are their supervisors," Mr. Indest said.

Mr. Indest stressed that when used effectively, mid-level providers improve quality of care, fill gaps in medical care coverage, and provide needed treatment for underserved populations. The key is that "supervising physicians must have good rapport with the [mid-level providers] they supervise and keep open channels of communication with them at all times."

Common liability theories

Frequent legal claims faced by physicians supervising mid-level providers include vicarious liability, agency, and failure to supervise.

Vicarious liability assigns liability to a person who did not cause the alleged negligence but who had a legal relationship with the negligent party.

Agency is used to link the negligent acts of one party to another because the two are said to have an agent-principal relationship. In such cases, plaintiffs claim the agent was authorized to act on behalf of the principal.

Failure to supervise is a growing allegation by plaintiffs and by mid-level providers, said Dr. James Szalados, an anesthesiologist and medical liability defense attorney based in New York.

"Inadequate supervision is becoming a bigger issue because mid-levels are using that as a defense," he said. They claim no fault because "the physician did not appropriately supervise."

Physicians also can be disciplined by state medical boards for poor patient outcomes caused by other professionals, according to James W. Saxton, chair of the health care litigation and risk management group at Stevens & Lee, headquartered in Reading, Pa. Most states have supervision requirements that address the oversight of mid-level providers. Running afoul of such rules means state scrutiny.