User login

Aetna wins fraud suit against clinics that billed as ERs

Cleveland Imaging and Surgical Hospital LLC., a four-bed hospital in Cleveland, Texas, and three clinics were ordered Aug. 20 to pay Aetna $8.4 million for fraudulent billing practices.

A judge ruled the hospital violated Texas law by selling the right to use its license-derived billing codes to the clinics – Trinity Healthcare Network, ER DOC 24/7 PLLC, and Premier Emergency Room and Imaging – in exchange for a 15% cut of the reimbursements.

Using the hospital’s provider number made it appear that treatment happened at a full service hospital, rather than the unlicensed clinics, according to an opinion by U.S. District Court, Southern District of Texas Judge Lynn N. Hughes.

In his judgment, Judge Hughes said doctors and clinics may not contract to use a hospital’s billing code to recover fees that were designed to compensate hospitals for expenses the clinics do not have. Aetna will recoup $5.7 million in emergency fees and $2.6 million in nonemergency fees from the health providers.

The hospital does not own or operate the clinics, and physicians who own the hospital have no interest in ER DOC or Trinity. Three of the owners of the hospital and two other doctors own Premier, the opinion said.

Attorneys for the hospital and clinics did not return calls seeking comment.

Aetna filed suit in 2012 against Cleveland Imaging and Surgical Hospital LLC., Trinity Healthcare Network, ER DOC 24/7 PLLC, and Premier Emergency Room and Imaging for allegedly defrauding Aetna by wrongfully posing as emergency rooms and billing at inflated rates. The insurance company said the clinics were violating state law by using the hospital’s license-derived billing code in exchange for 15% of each bill. Within a 2-year period, the hospital, on behalf of the clinics, billed Aetna for $9.2 million, according to court documents. In the year before the license arrangement, the clinics billed the insurer for $387,000.

In a statement, Aetna spokeswoman Cynthia Michener said the company was pleased with the ruling.

"Freestanding ERs trying to circumvent the law and collect facility fees without a state license or any real affiliation with hospitals is outrageous and unacceptable," she said. "This type of fraudulent behavior contributes to the increase in health care costs at a time when the nation is focused on reducing costs."

On Twitter @legal_med

Cleveland Imaging and Surgical Hospital LLC., a four-bed hospital in Cleveland, Texas, and three clinics were ordered Aug. 20 to pay Aetna $8.4 million for fraudulent billing practices.

A judge ruled the hospital violated Texas law by selling the right to use its license-derived billing codes to the clinics – Trinity Healthcare Network, ER DOC 24/7 PLLC, and Premier Emergency Room and Imaging – in exchange for a 15% cut of the reimbursements.

Using the hospital’s provider number made it appear that treatment happened at a full service hospital, rather than the unlicensed clinics, according to an opinion by U.S. District Court, Southern District of Texas Judge Lynn N. Hughes.

In his judgment, Judge Hughes said doctors and clinics may not contract to use a hospital’s billing code to recover fees that were designed to compensate hospitals for expenses the clinics do not have. Aetna will recoup $5.7 million in emergency fees and $2.6 million in nonemergency fees from the health providers.

The hospital does not own or operate the clinics, and physicians who own the hospital have no interest in ER DOC or Trinity. Three of the owners of the hospital and two other doctors own Premier, the opinion said.

Attorneys for the hospital and clinics did not return calls seeking comment.

Aetna filed suit in 2012 against Cleveland Imaging and Surgical Hospital LLC., Trinity Healthcare Network, ER DOC 24/7 PLLC, and Premier Emergency Room and Imaging for allegedly defrauding Aetna by wrongfully posing as emergency rooms and billing at inflated rates. The insurance company said the clinics were violating state law by using the hospital’s license-derived billing code in exchange for 15% of each bill. Within a 2-year period, the hospital, on behalf of the clinics, billed Aetna for $9.2 million, according to court documents. In the year before the license arrangement, the clinics billed the insurer for $387,000.

In a statement, Aetna spokeswoman Cynthia Michener said the company was pleased with the ruling.

"Freestanding ERs trying to circumvent the law and collect facility fees without a state license or any real affiliation with hospitals is outrageous and unacceptable," she said. "This type of fraudulent behavior contributes to the increase in health care costs at a time when the nation is focused on reducing costs."

On Twitter @legal_med

Cleveland Imaging and Surgical Hospital LLC., a four-bed hospital in Cleveland, Texas, and three clinics were ordered Aug. 20 to pay Aetna $8.4 million for fraudulent billing practices.

A judge ruled the hospital violated Texas law by selling the right to use its license-derived billing codes to the clinics – Trinity Healthcare Network, ER DOC 24/7 PLLC, and Premier Emergency Room and Imaging – in exchange for a 15% cut of the reimbursements.

Using the hospital’s provider number made it appear that treatment happened at a full service hospital, rather than the unlicensed clinics, according to an opinion by U.S. District Court, Southern District of Texas Judge Lynn N. Hughes.

In his judgment, Judge Hughes said doctors and clinics may not contract to use a hospital’s billing code to recover fees that were designed to compensate hospitals for expenses the clinics do not have. Aetna will recoup $5.7 million in emergency fees and $2.6 million in nonemergency fees from the health providers.

The hospital does not own or operate the clinics, and physicians who own the hospital have no interest in ER DOC or Trinity. Three of the owners of the hospital and two other doctors own Premier, the opinion said.

Attorneys for the hospital and clinics did not return calls seeking comment.

Aetna filed suit in 2012 against Cleveland Imaging and Surgical Hospital LLC., Trinity Healthcare Network, ER DOC 24/7 PLLC, and Premier Emergency Room and Imaging for allegedly defrauding Aetna by wrongfully posing as emergency rooms and billing at inflated rates. The insurance company said the clinics were violating state law by using the hospital’s license-derived billing code in exchange for 15% of each bill. Within a 2-year period, the hospital, on behalf of the clinics, billed Aetna for $9.2 million, according to court documents. In the year before the license arrangement, the clinics billed the insurer for $387,000.

In a statement, Aetna spokeswoman Cynthia Michener said the company was pleased with the ruling.

"Freestanding ERs trying to circumvent the law and collect facility fees without a state license or any real affiliation with hospitals is outrageous and unacceptable," she said. "This type of fraudulent behavior contributes to the increase in health care costs at a time when the nation is focused on reducing costs."

On Twitter @legal_med

Atypical practice patterns trigger chart reviews

CHICAGO – A recurring diagnosis, a recurring code, and recording omissions are among the top triggers for chart reviews, according to Dr. Howard Wooding Rogers, a Norwich, Conn., dermatologist who conducts chart reviews for private insurers.

Chart reviews by the Medicare Recovery Audit Contractor (RAC) program strike the most fear in physicians’ hearts, but chart reviews are "coming from all directions" – including private insurers, Medicare Advantage plans, and even patients themselves – and they’re becoming more common, Dr. Rogers said at the American Academy of Dermatology summer meeting.

Billing patterns that fall outside the patterns of specialty peers – employing one treatment modality at a higher intensity, treating predominantly one diagnosis, and using only one intervention – can trigger a chart review. So can performing multiple procedures during one visit, recurring procedures in one patient, and elevated use of one procedure code.

Patient complaints and medical record requests also can factor into the mix. "I’m a Mohs surgeon, and when I’m working, frequently patients are uploading their surgical photos in real time to Facebook. At that point, there are potentially 1,000 people out there to help code that [procedure] for the patient. If your code and their code don’t match up, the patient could easily call the insurer and send that selfie," he said.

Complex closures are on insurers’ radar, Dr. Rogers added. "Just last month, I helped [a doctor] defend against a review in which 20 complex closure payments were taken back. The reality was he wasn’t documenting sufficiently [the] extensive undermining [that was required] and he wasn’t documenting medical necessity." Current Procedural Terminology (CPT) states that complex closures are repairs that require more than a layer of closure such as scar revision, extensive undermining, or retention sutures.

Knowing the correct primary and secondary codes for procedures can speed payment and reduce billing scrutiny, Dr. Rogers said. The AAD offers a variety of products for improving coding accuracy.

Failing to include a secondary code when performing medically necessary removal of benign skin lesions often results in Medicare payment denials. Medicare considers lesions to be cosmetic if they do not pose a threat to health or function and the billings include only a primary code. The secondary code informs Medicare when lesions are symptomatic, restricting function of a body orifice, spreading rapidly, or possibly malignant, he pointed out.

"Remember, the one best chance to get paid for what you do is to bill it right the first time," Dr. Rogers noted.

On Twitter @legal_med

CHICAGO – A recurring diagnosis, a recurring code, and recording omissions are among the top triggers for chart reviews, according to Dr. Howard Wooding Rogers, a Norwich, Conn., dermatologist who conducts chart reviews for private insurers.

Chart reviews by the Medicare Recovery Audit Contractor (RAC) program strike the most fear in physicians’ hearts, but chart reviews are "coming from all directions" – including private insurers, Medicare Advantage plans, and even patients themselves – and they’re becoming more common, Dr. Rogers said at the American Academy of Dermatology summer meeting.

Billing patterns that fall outside the patterns of specialty peers – employing one treatment modality at a higher intensity, treating predominantly one diagnosis, and using only one intervention – can trigger a chart review. So can performing multiple procedures during one visit, recurring procedures in one patient, and elevated use of one procedure code.

Patient complaints and medical record requests also can factor into the mix. "I’m a Mohs surgeon, and when I’m working, frequently patients are uploading their surgical photos in real time to Facebook. At that point, there are potentially 1,000 people out there to help code that [procedure] for the patient. If your code and their code don’t match up, the patient could easily call the insurer and send that selfie," he said.

Complex closures are on insurers’ radar, Dr. Rogers added. "Just last month, I helped [a doctor] defend against a review in which 20 complex closure payments were taken back. The reality was he wasn’t documenting sufficiently [the] extensive undermining [that was required] and he wasn’t documenting medical necessity." Current Procedural Terminology (CPT) states that complex closures are repairs that require more than a layer of closure such as scar revision, extensive undermining, or retention sutures.

Knowing the correct primary and secondary codes for procedures can speed payment and reduce billing scrutiny, Dr. Rogers said. The AAD offers a variety of products for improving coding accuracy.

Failing to include a secondary code when performing medically necessary removal of benign skin lesions often results in Medicare payment denials. Medicare considers lesions to be cosmetic if they do not pose a threat to health or function and the billings include only a primary code. The secondary code informs Medicare when lesions are symptomatic, restricting function of a body orifice, spreading rapidly, or possibly malignant, he pointed out.

"Remember, the one best chance to get paid for what you do is to bill it right the first time," Dr. Rogers noted.

On Twitter @legal_med

CHICAGO – A recurring diagnosis, a recurring code, and recording omissions are among the top triggers for chart reviews, according to Dr. Howard Wooding Rogers, a Norwich, Conn., dermatologist who conducts chart reviews for private insurers.

Chart reviews by the Medicare Recovery Audit Contractor (RAC) program strike the most fear in physicians’ hearts, but chart reviews are "coming from all directions" – including private insurers, Medicare Advantage plans, and even patients themselves – and they’re becoming more common, Dr. Rogers said at the American Academy of Dermatology summer meeting.

Billing patterns that fall outside the patterns of specialty peers – employing one treatment modality at a higher intensity, treating predominantly one diagnosis, and using only one intervention – can trigger a chart review. So can performing multiple procedures during one visit, recurring procedures in one patient, and elevated use of one procedure code.

Patient complaints and medical record requests also can factor into the mix. "I’m a Mohs surgeon, and when I’m working, frequently patients are uploading their surgical photos in real time to Facebook. At that point, there are potentially 1,000 people out there to help code that [procedure] for the patient. If your code and their code don’t match up, the patient could easily call the insurer and send that selfie," he said.

Complex closures are on insurers’ radar, Dr. Rogers added. "Just last month, I helped [a doctor] defend against a review in which 20 complex closure payments were taken back. The reality was he wasn’t documenting sufficiently [the] extensive undermining [that was required] and he wasn’t documenting medical necessity." Current Procedural Terminology (CPT) states that complex closures are repairs that require more than a layer of closure such as scar revision, extensive undermining, or retention sutures.

Knowing the correct primary and secondary codes for procedures can speed payment and reduce billing scrutiny, Dr. Rogers said. The AAD offers a variety of products for improving coding accuracy.

Failing to include a secondary code when performing medically necessary removal of benign skin lesions often results in Medicare payment denials. Medicare considers lesions to be cosmetic if they do not pose a threat to health or function and the billings include only a primary code. The secondary code informs Medicare when lesions are symptomatic, restricting function of a body orifice, spreading rapidly, or possibly malignant, he pointed out.

"Remember, the one best chance to get paid for what you do is to bill it right the first time," Dr. Rogers noted.

On Twitter @legal_med

EXPERT ANALYSIS FROM THE AAD SUMMER ACADEMY 2014

CMS finalizes marketplace autoenrollment rule

Patients insured through the federally operated health insurance marketplace will be automatically reenrolled in their current coverage if they fail to change their previous plan, the Centers for Medicare & Medicaid Services announced Sept. 2.

Participants in these Affordable Care Act plans will receive notices before open enrollment begins explaining how they can return to the marketplace and shop for additional assistance and new plans. Insurers will provide information regarding 2015 premiums and tax credits.

If participants do nothing, they will be autoenrolled in the same plan as their 2014 plan year with the same tax credit. Open enrollment begins Nov. 15.

According to the final rule, participants whose 2013 tax returns indicate they have high income or did not grant marketplace administrators permission to access updated tax information will be autoenrolled without financial assistance if they don’t update their plan.

"We are committed to providing a simple, familiar process for consumers to renew their coverage next year," Marilyn Tavenner, administrator of the Centers for Medicare & Medicaid Services, said in a statement. "Consumers should use this time to evaluate their health needs, browse other options, and see if they qualify for additional financial assistance. However, consumers who are happy with their plan and have no changes to their income or family situation can be auto-enrolled in their same plan next year, similar to how it is done in the employer insurance market today."

On Twitter @legal_med

Patients insured through the federally operated health insurance marketplace will be automatically reenrolled in their current coverage if they fail to change their previous plan, the Centers for Medicare & Medicaid Services announced Sept. 2.

Participants in these Affordable Care Act plans will receive notices before open enrollment begins explaining how they can return to the marketplace and shop for additional assistance and new plans. Insurers will provide information regarding 2015 premiums and tax credits.

If participants do nothing, they will be autoenrolled in the same plan as their 2014 plan year with the same tax credit. Open enrollment begins Nov. 15.

According to the final rule, participants whose 2013 tax returns indicate they have high income or did not grant marketplace administrators permission to access updated tax information will be autoenrolled without financial assistance if they don’t update their plan.

"We are committed to providing a simple, familiar process for consumers to renew their coverage next year," Marilyn Tavenner, administrator of the Centers for Medicare & Medicaid Services, said in a statement. "Consumers should use this time to evaluate their health needs, browse other options, and see if they qualify for additional financial assistance. However, consumers who are happy with their plan and have no changes to their income or family situation can be auto-enrolled in their same plan next year, similar to how it is done in the employer insurance market today."

On Twitter @legal_med

Patients insured through the federally operated health insurance marketplace will be automatically reenrolled in their current coverage if they fail to change their previous plan, the Centers for Medicare & Medicaid Services announced Sept. 2.

Participants in these Affordable Care Act plans will receive notices before open enrollment begins explaining how they can return to the marketplace and shop for additional assistance and new plans. Insurers will provide information regarding 2015 premiums and tax credits.

If participants do nothing, they will be autoenrolled in the same plan as their 2014 plan year with the same tax credit. Open enrollment begins Nov. 15.

According to the final rule, participants whose 2013 tax returns indicate they have high income or did not grant marketplace administrators permission to access updated tax information will be autoenrolled without financial assistance if they don’t update their plan.

"We are committed to providing a simple, familiar process for consumers to renew their coverage next year," Marilyn Tavenner, administrator of the Centers for Medicare & Medicaid Services, said in a statement. "Consumers should use this time to evaluate their health needs, browse other options, and see if they qualify for additional financial assistance. However, consumers who are happy with their plan and have no changes to their income or family situation can be auto-enrolled in their same plan next year, similar to how it is done in the employer insurance market today."

On Twitter @legal_med

Advice for surviving a billing audit

CHICAGO – The first rule of a billing audit, according to Dr. Brent Moody: "Don’t take it personally."

Audits are about money, and "there’s always going to be a winner and a loser," he said at the American Academy of Dermatology summer meeting.

To raise the odds of winding up on the winning side of an audit or billing investigation, Dr. Moody advised taking the following steps.

Consider retaining legal counsel. The need for an attorney depends on the size, scope, and seriousness of the audit.

"You may be able to handle it on your own" if a small number of records are requested, he said. But a Recovery Audit Contractor (RAC) audit request for dozens or hundreds of chart records could indicate a more serious audit investigation. "If they come back to you with a big recoupment or a really broad request, you may want to think about getting legal help."

Legal counsel is strongly recommended if audit investigations evolve into allegations of False Claims Act (FCA) violations or qui tam lawsuits, said Dr. Moody, a Nashville dermatologist and the chair of the public policy committee for the American College of Mohs Surgery. The federal FCA law sets criminal and civil penalties for falsely billing the government, overrepresenting the amount of a delivered product, or understating an obligation to the government. Qui tam lawsuits are civil claims under the FCA in which whistle-blowers are rewarded if the claims uncover fraud and recover funds for the government. Both types of cases can mean the involvement of federal authorities, seized documents or equipment, and potential criminal charges.

FCA violations or qui tam lawsuits "are serious issues. You need legal help, and you need it right away," he said.

Decide whether to fight or pay. Complying with a recoupment will reduce hassle and more quickly resolve an audit. An appeal makes sense if the request is erroneous or unfair. Appealing within 30 days halts the recoupment but does not stop interest from accruing.

A letter of rebuttal – a formal statement as to why the recoupment should not take place – is ideal when the wrong doctor or practice has been audited or the audit violates state rules on look-back timelines. Health providers have 15 days to rebut upon notice of an impending recoupment action. Another option is to negotiate by paying the recoupment sum, but getting the auditors to agree that no further look-backs will occur from a certain time frame.

Do your audit homework. Audit resources and information are available from the American Medical Association and state medical societies. The American Academy of Dermatology provides a RAC audit toolkit, and many other medical organizations can provide answers to common audit questions and attorney referral lists.

Be civil to your auditor. While challenging, remaining cordial and respectful to auditors during the audit process can ultimately work in the physician’s favor. "At the end of the day, they are just people doing a job," Dr. Moody said. "Talk to them and try to figure out exactly what they are looking for. You don’t want to fight the wrong battle."

On Twitter @legal_med

CHICAGO – The first rule of a billing audit, according to Dr. Brent Moody: "Don’t take it personally."

Audits are about money, and "there’s always going to be a winner and a loser," he said at the American Academy of Dermatology summer meeting.

To raise the odds of winding up on the winning side of an audit or billing investigation, Dr. Moody advised taking the following steps.

Consider retaining legal counsel. The need for an attorney depends on the size, scope, and seriousness of the audit.

"You may be able to handle it on your own" if a small number of records are requested, he said. But a Recovery Audit Contractor (RAC) audit request for dozens or hundreds of chart records could indicate a more serious audit investigation. "If they come back to you with a big recoupment or a really broad request, you may want to think about getting legal help."

Legal counsel is strongly recommended if audit investigations evolve into allegations of False Claims Act (FCA) violations or qui tam lawsuits, said Dr. Moody, a Nashville dermatologist and the chair of the public policy committee for the American College of Mohs Surgery. The federal FCA law sets criminal and civil penalties for falsely billing the government, overrepresenting the amount of a delivered product, or understating an obligation to the government. Qui tam lawsuits are civil claims under the FCA in which whistle-blowers are rewarded if the claims uncover fraud and recover funds for the government. Both types of cases can mean the involvement of federal authorities, seized documents or equipment, and potential criminal charges.

FCA violations or qui tam lawsuits "are serious issues. You need legal help, and you need it right away," he said.

Decide whether to fight or pay. Complying with a recoupment will reduce hassle and more quickly resolve an audit. An appeal makes sense if the request is erroneous or unfair. Appealing within 30 days halts the recoupment but does not stop interest from accruing.

A letter of rebuttal – a formal statement as to why the recoupment should not take place – is ideal when the wrong doctor or practice has been audited or the audit violates state rules on look-back timelines. Health providers have 15 days to rebut upon notice of an impending recoupment action. Another option is to negotiate by paying the recoupment sum, but getting the auditors to agree that no further look-backs will occur from a certain time frame.

Do your audit homework. Audit resources and information are available from the American Medical Association and state medical societies. The American Academy of Dermatology provides a RAC audit toolkit, and many other medical organizations can provide answers to common audit questions and attorney referral lists.

Be civil to your auditor. While challenging, remaining cordial and respectful to auditors during the audit process can ultimately work in the physician’s favor. "At the end of the day, they are just people doing a job," Dr. Moody said. "Talk to them and try to figure out exactly what they are looking for. You don’t want to fight the wrong battle."

On Twitter @legal_med

CHICAGO – The first rule of a billing audit, according to Dr. Brent Moody: "Don’t take it personally."

Audits are about money, and "there’s always going to be a winner and a loser," he said at the American Academy of Dermatology summer meeting.

To raise the odds of winding up on the winning side of an audit or billing investigation, Dr. Moody advised taking the following steps.

Consider retaining legal counsel. The need for an attorney depends on the size, scope, and seriousness of the audit.

"You may be able to handle it on your own" if a small number of records are requested, he said. But a Recovery Audit Contractor (RAC) audit request for dozens or hundreds of chart records could indicate a more serious audit investigation. "If they come back to you with a big recoupment or a really broad request, you may want to think about getting legal help."

Legal counsel is strongly recommended if audit investigations evolve into allegations of False Claims Act (FCA) violations or qui tam lawsuits, said Dr. Moody, a Nashville dermatologist and the chair of the public policy committee for the American College of Mohs Surgery. The federal FCA law sets criminal and civil penalties for falsely billing the government, overrepresenting the amount of a delivered product, or understating an obligation to the government. Qui tam lawsuits are civil claims under the FCA in which whistle-blowers are rewarded if the claims uncover fraud and recover funds for the government. Both types of cases can mean the involvement of federal authorities, seized documents or equipment, and potential criminal charges.

FCA violations or qui tam lawsuits "are serious issues. You need legal help, and you need it right away," he said.

Decide whether to fight or pay. Complying with a recoupment will reduce hassle and more quickly resolve an audit. An appeal makes sense if the request is erroneous or unfair. Appealing within 30 days halts the recoupment but does not stop interest from accruing.

A letter of rebuttal – a formal statement as to why the recoupment should not take place – is ideal when the wrong doctor or practice has been audited or the audit violates state rules on look-back timelines. Health providers have 15 days to rebut upon notice of an impending recoupment action. Another option is to negotiate by paying the recoupment sum, but getting the auditors to agree that no further look-backs will occur from a certain time frame.

Do your audit homework. Audit resources and information are available from the American Medical Association and state medical societies. The American Academy of Dermatology provides a RAC audit toolkit, and many other medical organizations can provide answers to common audit questions and attorney referral lists.

Be civil to your auditor. While challenging, remaining cordial and respectful to auditors during the audit process can ultimately work in the physician’s favor. "At the end of the day, they are just people doing a job," Dr. Moody said. "Talk to them and try to figure out exactly what they are looking for. You don’t want to fight the wrong battle."

On Twitter @legal_med

EXPERT ANALYSIS FROM THE AAD 2014 SUMMER ACADEMY

Waiving protections can affect payment investigations

CHICAGO – Accepting poor legal advice or inadvertently waiving the client-attorney privilege may result in tougher judicial scrutiny or have a direct impact the outcome of payment investigations, experts warned at a physicians’ legal issues conference held by the American Bar Association.

"While some audits are relatively minor, others can result in huge reimbursement demands or even more frightening things, including civil or criminal charges being made based on claims of fraud and abuse," said Michael E. Clark, chair of the American Bar Association’s Health Law Section. Legal advisers need to be able to guide physicians through the payment investigation process while protecting their rights.

Bad advice by a lawyer cannot be used as a court defense for a physician’s acts or oversights, health lawyer Eric C. Tostrud said. However, in some instances, poor legal advice can be used as a defense to a fraud claim.

"There are important nuances to the issue," said Mr. Tostrud, an attorney in Minneapolis. For example, a defense of "poor legal advice" depends on the accuracy and completeness of the information the doctor initially disclosed to the attorney as well as whether the physician was completely forthcoming. In addition, courts will review whether health providers disregarded one attorney’s advice for more self-seeking guidance from another lawyer.

The question of bad legal advice arose in the recent case of U.S. v. Tuomey Healthcare System, in which the South Carolina–based health system was accused of submitting Medicare claims that violated the Stark Law. This purported violation included reimbursement claims for services by physicians with whom Tuomey allegedly had financial relationships. As part of its defense, Tuomey said it had relied on attorneys to design and approve the physician contracts. But during the trial, the government presented evidence that Tuomey had dismissed adverse legal and expert opinions when entering into the contracts and had retained subsequent legal opinions that supported the arrangements. A federal jury found the system had violated Stark Law and the False Claims Act, and a federal judge in 2013 ordered Tuomey to pay $237 million in fines.

The attorney-client privilege is another complex concept that can land physicians – and their attorneys – in legal trouble. The privilege protects communications between an attorney and client that are made for the purpose of furnishing or obtaining professional legal advice or assistance. But physicians can waive the privilege by disclosing confidential information through conversations, paper documentation, or e-mails. Doctors who reveal details about such communications to colleagues thus relinquish the protection, Mr. Tostrud said.

"Doctors by their nature are very collaborative," he said in an interview. "They want to talk to other people and consult with others about issues and that includes the advice they might be getting from a lawyer. But the risk of doing that is that they will waive the privilege."

Also, not every communication from or to a lawyer is privileged. The privilege generally protects communications involving legal advice, but does not extend to underlying facts.

In the case of U.S. v. Halifax Hospital Medical Center, a federal court ruled that the Daytona Beach, Fla.–based hospital’s compliance "referral log" was not subject to the privilege even though it was prepared at the instruction of an attorney. The logs merely recorded facts and did not meet the purpose of the privilege. The court concluded also that hundreds of e-mails and other documents relating to Halifax’s compliance and audit activities were not protected. While an attorney may have been included in the e-mails, the lawyer was copied for business purposes, not for legal advice, the court said. Halifax in March agreed to pay the government $85 million to resolve False Claims Act and Stark Law violations.

"E-mail often becomes a lawyer’s nightmare because it’s permanent and clients and people generally tend to treat e-mail like a conversation," Mr. Tostrud said in an interview. "They are not thinking about the permanency of it and are not thinking of the long-term litigation consequences."

One privileged e-mail does not necessarily extend the privilege to an entire string of e-mails, he said. To be protected, each e-mail within a string must be for the purposes of legal advice.

Enlisting the help of an attorney early in an audit or payment investigation is essential, said Mr. Clark, who practices law in Houston. For instance, if it becomes necessary to retain specialized consultants to help review coding and documentation issues, an attorney can help structure a framework whereby the consultants report to the attorney, and the attorney then formulates advice to the physician client.

"Most physicians have a basic understanding about the attorney-client privilege and its scope, but don’t fully understand or appreciate how that legal protection can be lost inadvertently," Mr. Clark said. "Having an attorney on board early in the process of an audit or broader investigation is important to ensuring that the privilege is properly established and protected."

This article was updated Sept. 2, 2014.

On Twitter @legal_med

CHICAGO – Accepting poor legal advice or inadvertently waiving the client-attorney privilege may result in tougher judicial scrutiny or have a direct impact the outcome of payment investigations, experts warned at a physicians’ legal issues conference held by the American Bar Association.

"While some audits are relatively minor, others can result in huge reimbursement demands or even more frightening things, including civil or criminal charges being made based on claims of fraud and abuse," said Michael E. Clark, chair of the American Bar Association’s Health Law Section. Legal advisers need to be able to guide physicians through the payment investigation process while protecting their rights.

Bad advice by a lawyer cannot be used as a court defense for a physician’s acts or oversights, health lawyer Eric C. Tostrud said. However, in some instances, poor legal advice can be used as a defense to a fraud claim.

"There are important nuances to the issue," said Mr. Tostrud, an attorney in Minneapolis. For example, a defense of "poor legal advice" depends on the accuracy and completeness of the information the doctor initially disclosed to the attorney as well as whether the physician was completely forthcoming. In addition, courts will review whether health providers disregarded one attorney’s advice for more self-seeking guidance from another lawyer.

The question of bad legal advice arose in the recent case of U.S. v. Tuomey Healthcare System, in which the South Carolina–based health system was accused of submitting Medicare claims that violated the Stark Law. This purported violation included reimbursement claims for services by physicians with whom Tuomey allegedly had financial relationships. As part of its defense, Tuomey said it had relied on attorneys to design and approve the physician contracts. But during the trial, the government presented evidence that Tuomey had dismissed adverse legal and expert opinions when entering into the contracts and had retained subsequent legal opinions that supported the arrangements. A federal jury found the system had violated Stark Law and the False Claims Act, and a federal judge in 2013 ordered Tuomey to pay $237 million in fines.

The attorney-client privilege is another complex concept that can land physicians – and their attorneys – in legal trouble. The privilege protects communications between an attorney and client that are made for the purpose of furnishing or obtaining professional legal advice or assistance. But physicians can waive the privilege by disclosing confidential information through conversations, paper documentation, or e-mails. Doctors who reveal details about such communications to colleagues thus relinquish the protection, Mr. Tostrud said.

"Doctors by their nature are very collaborative," he said in an interview. "They want to talk to other people and consult with others about issues and that includes the advice they might be getting from a lawyer. But the risk of doing that is that they will waive the privilege."

Also, not every communication from or to a lawyer is privileged. The privilege generally protects communications involving legal advice, but does not extend to underlying facts.

In the case of U.S. v. Halifax Hospital Medical Center, a federal court ruled that the Daytona Beach, Fla.–based hospital’s compliance "referral log" was not subject to the privilege even though it was prepared at the instruction of an attorney. The logs merely recorded facts and did not meet the purpose of the privilege. The court concluded also that hundreds of e-mails and other documents relating to Halifax’s compliance and audit activities were not protected. While an attorney may have been included in the e-mails, the lawyer was copied for business purposes, not for legal advice, the court said. Halifax in March agreed to pay the government $85 million to resolve False Claims Act and Stark Law violations.

"E-mail often becomes a lawyer’s nightmare because it’s permanent and clients and people generally tend to treat e-mail like a conversation," Mr. Tostrud said in an interview. "They are not thinking about the permanency of it and are not thinking of the long-term litigation consequences."

One privileged e-mail does not necessarily extend the privilege to an entire string of e-mails, he said. To be protected, each e-mail within a string must be for the purposes of legal advice.

Enlisting the help of an attorney early in an audit or payment investigation is essential, said Mr. Clark, who practices law in Houston. For instance, if it becomes necessary to retain specialized consultants to help review coding and documentation issues, an attorney can help structure a framework whereby the consultants report to the attorney, and the attorney then formulates advice to the physician client.

"Most physicians have a basic understanding about the attorney-client privilege and its scope, but don’t fully understand or appreciate how that legal protection can be lost inadvertently," Mr. Clark said. "Having an attorney on board early in the process of an audit or broader investigation is important to ensuring that the privilege is properly established and protected."

This article was updated Sept. 2, 2014.

On Twitter @legal_med

CHICAGO – Accepting poor legal advice or inadvertently waiving the client-attorney privilege may result in tougher judicial scrutiny or have a direct impact the outcome of payment investigations, experts warned at a physicians’ legal issues conference held by the American Bar Association.

"While some audits are relatively minor, others can result in huge reimbursement demands or even more frightening things, including civil or criminal charges being made based on claims of fraud and abuse," said Michael E. Clark, chair of the American Bar Association’s Health Law Section. Legal advisers need to be able to guide physicians through the payment investigation process while protecting their rights.

Bad advice by a lawyer cannot be used as a court defense for a physician’s acts or oversights, health lawyer Eric C. Tostrud said. However, in some instances, poor legal advice can be used as a defense to a fraud claim.

"There are important nuances to the issue," said Mr. Tostrud, an attorney in Minneapolis. For example, a defense of "poor legal advice" depends on the accuracy and completeness of the information the doctor initially disclosed to the attorney as well as whether the physician was completely forthcoming. In addition, courts will review whether health providers disregarded one attorney’s advice for more self-seeking guidance from another lawyer.

The question of bad legal advice arose in the recent case of U.S. v. Tuomey Healthcare System, in which the South Carolina–based health system was accused of submitting Medicare claims that violated the Stark Law. This purported violation included reimbursement claims for services by physicians with whom Tuomey allegedly had financial relationships. As part of its defense, Tuomey said it had relied on attorneys to design and approve the physician contracts. But during the trial, the government presented evidence that Tuomey had dismissed adverse legal and expert opinions when entering into the contracts and had retained subsequent legal opinions that supported the arrangements. A federal jury found the system had violated Stark Law and the False Claims Act, and a federal judge in 2013 ordered Tuomey to pay $237 million in fines.

The attorney-client privilege is another complex concept that can land physicians – and their attorneys – in legal trouble. The privilege protects communications between an attorney and client that are made for the purpose of furnishing or obtaining professional legal advice or assistance. But physicians can waive the privilege by disclosing confidential information through conversations, paper documentation, or e-mails. Doctors who reveal details about such communications to colleagues thus relinquish the protection, Mr. Tostrud said.

"Doctors by their nature are very collaborative," he said in an interview. "They want to talk to other people and consult with others about issues and that includes the advice they might be getting from a lawyer. But the risk of doing that is that they will waive the privilege."

Also, not every communication from or to a lawyer is privileged. The privilege generally protects communications involving legal advice, but does not extend to underlying facts.

In the case of U.S. v. Halifax Hospital Medical Center, a federal court ruled that the Daytona Beach, Fla.–based hospital’s compliance "referral log" was not subject to the privilege even though it was prepared at the instruction of an attorney. The logs merely recorded facts and did not meet the purpose of the privilege. The court concluded also that hundreds of e-mails and other documents relating to Halifax’s compliance and audit activities were not protected. While an attorney may have been included in the e-mails, the lawyer was copied for business purposes, not for legal advice, the court said. Halifax in March agreed to pay the government $85 million to resolve False Claims Act and Stark Law violations.

"E-mail often becomes a lawyer’s nightmare because it’s permanent and clients and people generally tend to treat e-mail like a conversation," Mr. Tostrud said in an interview. "They are not thinking about the permanency of it and are not thinking of the long-term litigation consequences."

One privileged e-mail does not necessarily extend the privilege to an entire string of e-mails, he said. To be protected, each e-mail within a string must be for the purposes of legal advice.

Enlisting the help of an attorney early in an audit or payment investigation is essential, said Mr. Clark, who practices law in Houston. For instance, if it becomes necessary to retain specialized consultants to help review coding and documentation issues, an attorney can help structure a framework whereby the consultants report to the attorney, and the attorney then formulates advice to the physician client.

"Most physicians have a basic understanding about the attorney-client privilege and its scope, but don’t fully understand or appreciate how that legal protection can be lost inadvertently," Mr. Clark said. "Having an attorney on board early in the process of an audit or broader investigation is important to ensuring that the privilege is properly established and protected."

This article was updated Sept. 2, 2014.

On Twitter @legal_med

EXPERT ANALYSIS AT AN ABA CONFERENCE

Social Media Can Help, Harm Liability Cases

Physicians should be mindful of how social media can affect a medical malpractice case for better or worse and take steps to avoid legal dangers.

As a case proceeds through the legal process, social media "can be used to take the pulse of the parties, to discover public information that can be used in [cross examinations], and to explore themes for trials," said John E. Hall Jr., an Atlanta-based medical liability defense attorney, at the American Conference Institute’s obstetric malpractice claims forum in Philadelphia.

Plaintiffs’ and defense attorneys both turn toward social media use by patients and physicians to search for ways to build their respective cases. For the defense, this could mean reviewing a patient’s Facebook or Twitter account for information that contradicts their alleged injury claim. For instance, a patient who alleges a serious leg injury may be posting pictures of recent running activities.

On the other hand, plaintiffs may search social media for evidence about physicians’ activities around the time the alleged malpractice occurred. For example, by arguing a doctor’s late-night posts suggest the doctor had little sleep and was less than attentive during the patient’s visit, said Adam J. Davis, a Cleveland-based medical liability defense attorney. He was a copresenter at the obstetric claims conference.

"The courts are viewing electronically stored information, such as Facebook profiles, no differently than a person’s photo album at home or a journal that relates to the care in question, all of which have been discoverable in litigation," Mr. Davis said in an interview. Judges "are treating electronically stored information in much the same way they treat real, [tangible] evidence. Once that information is out there in a public forum, it’s fair game."

To prevent social media postings from being used against them in court, physicians should considering making their personal accounts private, Mr. Davis said. They should also be wary about what information they are posting or forwarding on public websites or on their practice’s social media accounts.

Deleting or changing a social media posting because it may arise during a malpractice case is a bad idea. Data residing in social media sites is subject to the same "duty to preserve" as other types of electronically stored information, Mr. Davis said. The duty to preserve is triggered when a party reasonably foresees the information may be relevant to issues in litigation. Deleting Facebook posts or other social media texts could result in sanctions for physicians or a spoliation of evidence claim.

If physicians believe a medical malpractice lawsuit may be forthcoming, it might be helpful to monitor the social media landscape and review what is being said about their care or practices, legal experts add. Physicians can search mainstream media, blogger websites, online reviews or tweets for their names or facilities. Such information could help them be more prepared if a suit is filed and help them direct their attorneys to relevant online comments.

"Monitoring [social media] pre-, during, and post trial can give a variety of information from the opinion of the case in the community, the predispositions witnesses may have, and compliance with court directives and rules," Mr. Hall said in an interview.

However, doctors should leave to attorneys the searching of jurors on social media, especially during trial. Contacting jurors during trial – even accidently – can lead to serious legal consequences for physicians, such as a mistrial.

"The best practice is for doctors not to be checking on jurors during trial – leave that to counsel," Mr. Davis said. "It’s too risky for the physician. A physician’s inadvertent communication with a juror over social media – say they accidently send a friend request – that’s considered communication, and it could result in a mistrial or the [excusing] of the juror or the start a new trial."

On Twitter @legal_med

Physicians should be mindful of how social media can affect a medical malpractice case for better or worse and take steps to avoid legal dangers.

As a case proceeds through the legal process, social media "can be used to take the pulse of the parties, to discover public information that can be used in [cross examinations], and to explore themes for trials," said John E. Hall Jr., an Atlanta-based medical liability defense attorney, at the American Conference Institute’s obstetric malpractice claims forum in Philadelphia.

Plaintiffs’ and defense attorneys both turn toward social media use by patients and physicians to search for ways to build their respective cases. For the defense, this could mean reviewing a patient’s Facebook or Twitter account for information that contradicts their alleged injury claim. For instance, a patient who alleges a serious leg injury may be posting pictures of recent running activities.

On the other hand, plaintiffs may search social media for evidence about physicians’ activities around the time the alleged malpractice occurred. For example, by arguing a doctor’s late-night posts suggest the doctor had little sleep and was less than attentive during the patient’s visit, said Adam J. Davis, a Cleveland-based medical liability defense attorney. He was a copresenter at the obstetric claims conference.

"The courts are viewing electronically stored information, such as Facebook profiles, no differently than a person’s photo album at home or a journal that relates to the care in question, all of which have been discoverable in litigation," Mr. Davis said in an interview. Judges "are treating electronically stored information in much the same way they treat real, [tangible] evidence. Once that information is out there in a public forum, it’s fair game."

To prevent social media postings from being used against them in court, physicians should considering making their personal accounts private, Mr. Davis said. They should also be wary about what information they are posting or forwarding on public websites or on their practice’s social media accounts.

Deleting or changing a social media posting because it may arise during a malpractice case is a bad idea. Data residing in social media sites is subject to the same "duty to preserve" as other types of electronically stored information, Mr. Davis said. The duty to preserve is triggered when a party reasonably foresees the information may be relevant to issues in litigation. Deleting Facebook posts or other social media texts could result in sanctions for physicians or a spoliation of evidence claim.

If physicians believe a medical malpractice lawsuit may be forthcoming, it might be helpful to monitor the social media landscape and review what is being said about their care or practices, legal experts add. Physicians can search mainstream media, blogger websites, online reviews or tweets for their names or facilities. Such information could help them be more prepared if a suit is filed and help them direct their attorneys to relevant online comments.

"Monitoring [social media] pre-, during, and post trial can give a variety of information from the opinion of the case in the community, the predispositions witnesses may have, and compliance with court directives and rules," Mr. Hall said in an interview.

However, doctors should leave to attorneys the searching of jurors on social media, especially during trial. Contacting jurors during trial – even accidently – can lead to serious legal consequences for physicians, such as a mistrial.

"The best practice is for doctors not to be checking on jurors during trial – leave that to counsel," Mr. Davis said. "It’s too risky for the physician. A physician’s inadvertent communication with a juror over social media – say they accidently send a friend request – that’s considered communication, and it could result in a mistrial or the [excusing] of the juror or the start a new trial."

On Twitter @legal_med

Physicians should be mindful of how social media can affect a medical malpractice case for better or worse and take steps to avoid legal dangers.

As a case proceeds through the legal process, social media "can be used to take the pulse of the parties, to discover public information that can be used in [cross examinations], and to explore themes for trials," said John E. Hall Jr., an Atlanta-based medical liability defense attorney, at the American Conference Institute’s obstetric malpractice claims forum in Philadelphia.

Plaintiffs’ and defense attorneys both turn toward social media use by patients and physicians to search for ways to build their respective cases. For the defense, this could mean reviewing a patient’s Facebook or Twitter account for information that contradicts their alleged injury claim. For instance, a patient who alleges a serious leg injury may be posting pictures of recent running activities.

On the other hand, plaintiffs may search social media for evidence about physicians’ activities around the time the alleged malpractice occurred. For example, by arguing a doctor’s late-night posts suggest the doctor had little sleep and was less than attentive during the patient’s visit, said Adam J. Davis, a Cleveland-based medical liability defense attorney. He was a copresenter at the obstetric claims conference.

"The courts are viewing electronically stored information, such as Facebook profiles, no differently than a person’s photo album at home or a journal that relates to the care in question, all of which have been discoverable in litigation," Mr. Davis said in an interview. Judges "are treating electronically stored information in much the same way they treat real, [tangible] evidence. Once that information is out there in a public forum, it’s fair game."

To prevent social media postings from being used against them in court, physicians should considering making their personal accounts private, Mr. Davis said. They should also be wary about what information they are posting or forwarding on public websites or on their practice’s social media accounts.

Deleting or changing a social media posting because it may arise during a malpractice case is a bad idea. Data residing in social media sites is subject to the same "duty to preserve" as other types of electronically stored information, Mr. Davis said. The duty to preserve is triggered when a party reasonably foresees the information may be relevant to issues in litigation. Deleting Facebook posts or other social media texts could result in sanctions for physicians or a spoliation of evidence claim.

If physicians believe a medical malpractice lawsuit may be forthcoming, it might be helpful to monitor the social media landscape and review what is being said about their care or practices, legal experts add. Physicians can search mainstream media, blogger websites, online reviews or tweets for their names or facilities. Such information could help them be more prepared if a suit is filed and help them direct their attorneys to relevant online comments.

"Monitoring [social media] pre-, during, and post trial can give a variety of information from the opinion of the case in the community, the predispositions witnesses may have, and compliance with court directives and rules," Mr. Hall said in an interview.

However, doctors should leave to attorneys the searching of jurors on social media, especially during trial. Contacting jurors during trial – even accidently – can lead to serious legal consequences for physicians, such as a mistrial.

"The best practice is for doctors not to be checking on jurors during trial – leave that to counsel," Mr. Davis said. "It’s too risky for the physician. A physician’s inadvertent communication with a juror over social media – say they accidently send a friend request – that’s considered communication, and it could result in a mistrial or the [excusing] of the juror or the start a new trial."

On Twitter @legal_med

Settling a Malpractice Suit Is Seldom a Straightforward Decision

Sometimes it makes sense to settle a malpractice lawsuit, but making that decision is seldom straightforward, according to legal experts.

Top reasons to settle a case include indefensible actions, inadequate malpractice insurance, and an expert review that concludes a failure to meet the standard of care, Joshua R. Cohen, a medical liability defense attorney practicing in New York, said in an interview.

A low insurance limit could lead to personal assets being tapped if a high trial verdict exceeds the physician’s insurance threshold. By settling early, doctors and their attorneys generally can negotiate a discounted payment, provide for quicker compensation to an injured patient and reduce ongoing defense costs, he said.

Settling also alleviates the time and burden of participating in a malpractice trial, said George F. Indest III, president and managing partner in a law firm specializing in health law in Orlando.

Settlement brings a resolution, "including relief from the worry and stress that such litigation carries with it, the imposition on the defendant’s time that depositions, hearings, and the trial might require, and the mental anxiety which the uncertainty causes," Mr. Indest said in an interview.

One distinct disadvantage of such financial agreements is that they must be reported to the National Practitioner Data Bank (NPDB), said Michael J. Sacopulos, founder and president of a consulting and liability risk management firm in Terre Haute, Ind. The reporting requirement means settlement details can arise during new employment, professional reviews or application for privileges.

"It is in many physicians’ minds, a stain that goes with them for the rest of their career," Mr. Sacopulos said in an interview.

Settlements also are reported to state licensure boards and state departments of insurance, which may lead to separate investigations against physicians based on the facts of the settlement, Mr. Indest said. Additionally, most medical staff bylaws require that physicians report settlements to the hospital and medical staff, which may result in peer-review actions.

For physicians who believe their case is strong and want to preserve their reputations, taking a case to trial may be the best option.

"For the most part, most malpractice cases fall into a gray area," Mr. Cohen said. "There could be some issues with the charting, but the medicine itself is defensible. The question is do you want to roll the dice as to what the jury is going to decide?"

To allow for that decision, ensure that contracts with insurance companies include a "consent to settle" clause. The clauses make certain that lawsuits are not settled without a doctor’s permission. Communication with attorneys and insurers throughout the lawsuit process is essential, Mr. Sacopulos said. Attorneys and insurers should make clear relevant case updates, potential success rates and possible loss values.

In a contraction accident case, a large corporation is affected, but with a doctor, it’s personal, Mr. Cohen said. Many equate malpractice with a violation of the Hippocratic Oath, "To do no harm." Doctors want their reputations defended when they believe they didn’t do anything wrong or if there was a complication that was not a result of malpractice. They want to go to trial.

Despite the strong emotions that come with a lawsuit, the decision about whether to settle or take a suit to trial should not be rushed, Mr. Sacopulos advised. "As the case goes on, more facts come out," he said. "The decision you make today as to what’s best for you may not be the best decision down the road. You need to continue to revisit (the situation) as the facts come out."

On Twitter @legal_med

Sometimes it makes sense to settle a malpractice lawsuit, but making that decision is seldom straightforward, according to legal experts.

Top reasons to settle a case include indefensible actions, inadequate malpractice insurance, and an expert review that concludes a failure to meet the standard of care, Joshua R. Cohen, a medical liability defense attorney practicing in New York, said in an interview.

A low insurance limit could lead to personal assets being tapped if a high trial verdict exceeds the physician’s insurance threshold. By settling early, doctors and their attorneys generally can negotiate a discounted payment, provide for quicker compensation to an injured patient and reduce ongoing defense costs, he said.

Settling also alleviates the time and burden of participating in a malpractice trial, said George F. Indest III, president and managing partner in a law firm specializing in health law in Orlando.

Settlement brings a resolution, "including relief from the worry and stress that such litigation carries with it, the imposition on the defendant’s time that depositions, hearings, and the trial might require, and the mental anxiety which the uncertainty causes," Mr. Indest said in an interview.

One distinct disadvantage of such financial agreements is that they must be reported to the National Practitioner Data Bank (NPDB), said Michael J. Sacopulos, founder and president of a consulting and liability risk management firm in Terre Haute, Ind. The reporting requirement means settlement details can arise during new employment, professional reviews or application for privileges.

"It is in many physicians’ minds, a stain that goes with them for the rest of their career," Mr. Sacopulos said in an interview.

Settlements also are reported to state licensure boards and state departments of insurance, which may lead to separate investigations against physicians based on the facts of the settlement, Mr. Indest said. Additionally, most medical staff bylaws require that physicians report settlements to the hospital and medical staff, which may result in peer-review actions.

For physicians who believe their case is strong and want to preserve their reputations, taking a case to trial may be the best option.

"For the most part, most malpractice cases fall into a gray area," Mr. Cohen said. "There could be some issues with the charting, but the medicine itself is defensible. The question is do you want to roll the dice as to what the jury is going to decide?"

To allow for that decision, ensure that contracts with insurance companies include a "consent to settle" clause. The clauses make certain that lawsuits are not settled without a doctor’s permission. Communication with attorneys and insurers throughout the lawsuit process is essential, Mr. Sacopulos said. Attorneys and insurers should make clear relevant case updates, potential success rates and possible loss values.

In a contraction accident case, a large corporation is affected, but with a doctor, it’s personal, Mr. Cohen said. Many equate malpractice with a violation of the Hippocratic Oath, "To do no harm." Doctors want their reputations defended when they believe they didn’t do anything wrong or if there was a complication that was not a result of malpractice. They want to go to trial.

Despite the strong emotions that come with a lawsuit, the decision about whether to settle or take a suit to trial should not be rushed, Mr. Sacopulos advised. "As the case goes on, more facts come out," he said. "The decision you make today as to what’s best for you may not be the best decision down the road. You need to continue to revisit (the situation) as the facts come out."

On Twitter @legal_med

Sometimes it makes sense to settle a malpractice lawsuit, but making that decision is seldom straightforward, according to legal experts.

Top reasons to settle a case include indefensible actions, inadequate malpractice insurance, and an expert review that concludes a failure to meet the standard of care, Joshua R. Cohen, a medical liability defense attorney practicing in New York, said in an interview.

A low insurance limit could lead to personal assets being tapped if a high trial verdict exceeds the physician’s insurance threshold. By settling early, doctors and their attorneys generally can negotiate a discounted payment, provide for quicker compensation to an injured patient and reduce ongoing defense costs, he said.

Settling also alleviates the time and burden of participating in a malpractice trial, said George F. Indest III, president and managing partner in a law firm specializing in health law in Orlando.

Settlement brings a resolution, "including relief from the worry and stress that such litigation carries with it, the imposition on the defendant’s time that depositions, hearings, and the trial might require, and the mental anxiety which the uncertainty causes," Mr. Indest said in an interview.

One distinct disadvantage of such financial agreements is that they must be reported to the National Practitioner Data Bank (NPDB), said Michael J. Sacopulos, founder and president of a consulting and liability risk management firm in Terre Haute, Ind. The reporting requirement means settlement details can arise during new employment, professional reviews or application for privileges.

"It is in many physicians’ minds, a stain that goes with them for the rest of their career," Mr. Sacopulos said in an interview.

Settlements also are reported to state licensure boards and state departments of insurance, which may lead to separate investigations against physicians based on the facts of the settlement, Mr. Indest said. Additionally, most medical staff bylaws require that physicians report settlements to the hospital and medical staff, which may result in peer-review actions.

For physicians who believe their case is strong and want to preserve their reputations, taking a case to trial may be the best option.

"For the most part, most malpractice cases fall into a gray area," Mr. Cohen said. "There could be some issues with the charting, but the medicine itself is defensible. The question is do you want to roll the dice as to what the jury is going to decide?"

To allow for that decision, ensure that contracts with insurance companies include a "consent to settle" clause. The clauses make certain that lawsuits are not settled without a doctor’s permission. Communication with attorneys and insurers throughout the lawsuit process is essential, Mr. Sacopulos said. Attorneys and insurers should make clear relevant case updates, potential success rates and possible loss values.

In a contraction accident case, a large corporation is affected, but with a doctor, it’s personal, Mr. Cohen said. Many equate malpractice with a violation of the Hippocratic Oath, "To do no harm." Doctors want their reputations defended when they believe they didn’t do anything wrong or if there was a complication that was not a result of malpractice. They want to go to trial.

Despite the strong emotions that come with a lawsuit, the decision about whether to settle or take a suit to trial should not be rushed, Mr. Sacopulos advised. "As the case goes on, more facts come out," he said. "The decision you make today as to what’s best for you may not be the best decision down the road. You need to continue to revisit (the situation) as the facts come out."

On Twitter @legal_med

Law discourages drug-addicted pregnant women from seeking care

The enactment of a Tennessee law that criminalizes substance abuse by pregnant women has made patients increasingly hesitant to pursue treatment for their drug addictions, according to Dr. Jessica Young, an obstetrician/gynecologist at Vanderbilt University Medical Center in Nashville, Tenn.

Tennessee’s law, which became effective in July, defines illegal narcotic use by pregnant women as assault, depending on whether the child is born addicted to or is harmed by the narcotic. A 26-year-old woman was among the first to be arrested in mid-July under the law.

"Since the new law was passed, women . . . often express a fatalistic attitude of, ‘Even if I do the right thing, I will be arrested or have my baby taken away,’ " said Dr. Young, who leads the Vanderbilt Drug Dependency Clinic for pregnant women.

The concern is that women will hide their addictions or self-detox at home, she said. "I think it will require some negative outcomes for this law to be struck down."

Physician associations, including the American Medical Association and ACOG, have long maintained that criminal punishment is not the answer to curbing drug abuse by pregnant women and that such laws create further harm to children. Fear of being reported to police was a primary reason women who abused drugs did not seek prenatal care, a recent study found (Am. J. Obstet. Gynecol. 2009;200:412.e1-10).

Laws that mandate criminal penalties against pregnant women who use drugs can significantly harm the physician-patient relationship, according to Dr. John M. Thorp, professor of obstetrics and gynecology at the University of North Carolina and director of women’s primary health care for UNC Healthcare, both in Chapel Hill.

These laws "put the physician or the clinic or hospital in the role of reporting the crime, which is completely the antithesis of wanting patients to be able to tell physicians what’s wrong with them and being able to offer treatment instead of punishment," Dr. Thorp said in an interview. "These laws are a real setback to the concept that substance abuse addiction is a disease, [and they are] another barrier for women seeking treatment."

Tennessee is the only state to consider drug abuse by pregnant women to be "assault." The law states that a woman may be prosecuted for assault if her child is born addicted or harmed by the drug and for homicide if the child dies from drug exposure. It is an affirmative defense to prosecution if the woman is actively enrolled in an addiction recovery program before the baby is born, remains in the program after delivery, and successfully completes the program.

The American Civil Liberties Union of Tennessee plans to challenge the law in court.

The Tennessee Medical Association opposed the law, but successfully pushed for amendments that would lessen the punitive damages against women, Dave Chaney, TMA director of communications, said in an interview. The medical association successfully lobbied to lower the charging level in the bill to a misdemeanor and helped secure a stipulation that women who enter a treatment program be punished only by a fine.

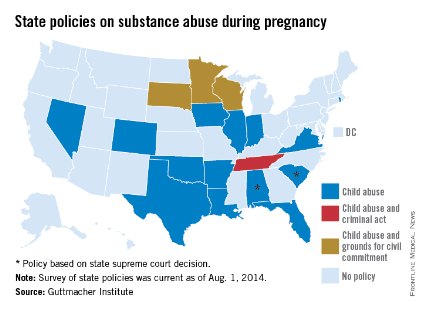

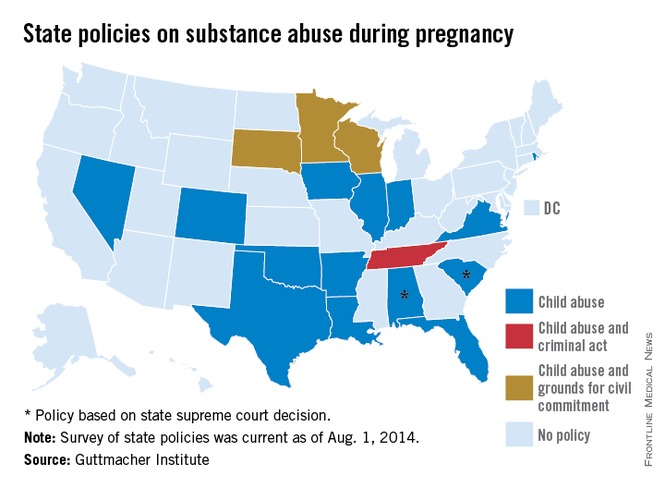

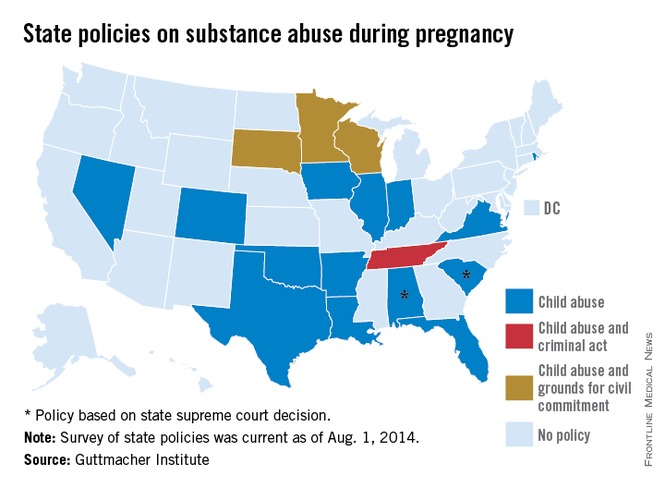

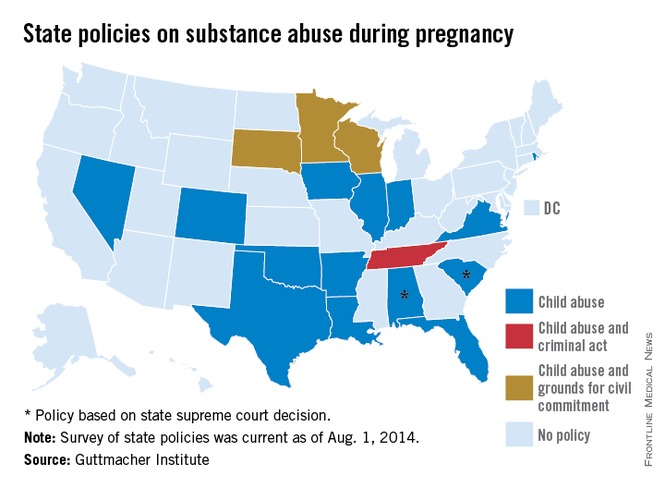

Various states pursue criminal charges against pregnant women who use narcotics. Eighteen states consider substance abuse during pregnancy to be "child abuse," and three other states consider substance abuse during pregnancy to be grounds for civil commitment, according to an August 2014 analysis by the Guttmacher Institute. Fifteen states require physicians to report suspected prenatal drug abuse to authorities, and four states require health providers to test for prenatal drug exposure if they suspect substance abuse.

Other states could soon follow in Tennessee’s footsteps, Elizabeth Nash, Guttmacher Institute state issues manager, said in an interview. "Legislatures see what’s happening in other states and decide whether it may be right for them."

Meanwhile, a newly proposed federal bill could assist states in addressing the issue of drug-addicted pregnant mothers and babies and drive more effective responses to the crisis. The Protecting Our Infants Act, introduced July 31 by Rep. Mitch McConnell (R-Ky.), aims to better identify and treat opioid use by pregnant women and neonatal abstinence syndrome (NAS) in newborns. The legislation is backed by ACOG.

"Currently, states vary widely in how they mandate and administer screening, diagnosis, and treatment of pregnant women using opioids," ACOG President John C. Jennings said in a statement. The federal "legislation will help identify, compile, and disseminate best practices developed by medical professional organizations, including ACOG, and identify any gaps in best practices that may require additional research or analysis."

The proposed legislation would facilitate the research and dissemination of evidence-informed recommendations for addressing maternal addiction and NAS and provide for NAS studies. The measure also would encourage the Centers for Disease Control and Prevention to work with states to improve the availability and quality of data to more effectively respond to drug-addicted pregnant women. At this article’s deadline, the proposed act was in the Committee on Health, Education, Labor and Pensions.

"My legislation is no silver bullet, but it will help ensure that our public health system is better equipped to prevent and treat opiate addiction in mothers and their newborn children," Mr. McConnell said in a statement. "Together, we can overcome this tragic problem."

Developing resources that promote better medical care for addicted women and their children is a more effective answer than punitive laws, added Hendree Jones, Ph.D., a professor of obstetrics and gynecology at the university and executive director of the UNC Horizons programs. Horizons provides substance abuse treatment and child care to women who are pregnant or parenting young children.

"Incarcerating women to reduce the prevalence of drug use during pregnancy is a misguided solution to the issue," Dr. Jones said in an interview. "Increasing access to high-quality treatment would be a much more fruitful approach."

On Twitter @legal_med

The enactment of a Tennessee law that criminalizes substance abuse by pregnant women has made patients increasingly hesitant to pursue treatment for their drug addictions, according to Dr. Jessica Young, an obstetrician/gynecologist at Vanderbilt University Medical Center in Nashville, Tenn.

Tennessee’s law, which became effective in July, defines illegal narcotic use by pregnant women as assault, depending on whether the child is born addicted to or is harmed by the narcotic. A 26-year-old woman was among the first to be arrested in mid-July under the law.

"Since the new law was passed, women . . . often express a fatalistic attitude of, ‘Even if I do the right thing, I will be arrested or have my baby taken away,’ " said Dr. Young, who leads the Vanderbilt Drug Dependency Clinic for pregnant women.

The concern is that women will hide their addictions or self-detox at home, she said. "I think it will require some negative outcomes for this law to be struck down."

Physician associations, including the American Medical Association and ACOG, have long maintained that criminal punishment is not the answer to curbing drug abuse by pregnant women and that such laws create further harm to children. Fear of being reported to police was a primary reason women who abused drugs did not seek prenatal care, a recent study found (Am. J. Obstet. Gynecol. 2009;200:412.e1-10).

Laws that mandate criminal penalties against pregnant women who use drugs can significantly harm the physician-patient relationship, according to Dr. John M. Thorp, professor of obstetrics and gynecology at the University of North Carolina and director of women’s primary health care for UNC Healthcare, both in Chapel Hill.

These laws "put the physician or the clinic or hospital in the role of reporting the crime, which is completely the antithesis of wanting patients to be able to tell physicians what’s wrong with them and being able to offer treatment instead of punishment," Dr. Thorp said in an interview. "These laws are a real setback to the concept that substance abuse addiction is a disease, [and they are] another barrier for women seeking treatment."

Tennessee is the only state to consider drug abuse by pregnant women to be "assault." The law states that a woman may be prosecuted for assault if her child is born addicted or harmed by the drug and for homicide if the child dies from drug exposure. It is an affirmative defense to prosecution if the woman is actively enrolled in an addiction recovery program before the baby is born, remains in the program after delivery, and successfully completes the program.

The American Civil Liberties Union of Tennessee plans to challenge the law in court.

The Tennessee Medical Association opposed the law, but successfully pushed for amendments that would lessen the punitive damages against women, Dave Chaney, TMA director of communications, said in an interview. The medical association successfully lobbied to lower the charging level in the bill to a misdemeanor and helped secure a stipulation that women who enter a treatment program be punished only by a fine.

Various states pursue criminal charges against pregnant women who use narcotics. Eighteen states consider substance abuse during pregnancy to be "child abuse," and three other states consider substance abuse during pregnancy to be grounds for civil commitment, according to an August 2014 analysis by the Guttmacher Institute. Fifteen states require physicians to report suspected prenatal drug abuse to authorities, and four states require health providers to test for prenatal drug exposure if they suspect substance abuse.