User login

House votes to repeal SGR, reauthorize CHIP

After years of failed attempts and temporary fixes, the House of Representatives on March 26 passed H.R. 2, a bill to repeal the Medicare Sustainable Growth Rate formula (SGR) and replace it with an alternative system that temporarily would raise Medicare physician pay and focus on value-based performance. The bill also reauthorizes the Children’s Health Insurance Program (CHIP) for 2 years, as well as other provisions.

Check back for detailed analysis and next steps for the legislation later on March 26.

After years of failed attempts and temporary fixes, the House of Representatives on March 26 passed H.R. 2, a bill to repeal the Medicare Sustainable Growth Rate formula (SGR) and replace it with an alternative system that temporarily would raise Medicare physician pay and focus on value-based performance. The bill also reauthorizes the Children’s Health Insurance Program (CHIP) for 2 years, as well as other provisions.

Check back for detailed analysis and next steps for the legislation later on March 26.

After years of failed attempts and temporary fixes, the House of Representatives on March 26 passed H.R. 2, a bill to repeal the Medicare Sustainable Growth Rate formula (SGR) and replace it with an alternative system that temporarily would raise Medicare physician pay and focus on value-based performance. The bill also reauthorizes the Children’s Health Insurance Program (CHIP) for 2 years, as well as other provisions.

Check back for detailed analysis and next steps for the legislation later on March 26.

New bill consolidates SGR fix, CHIP reauthorization

Bipartisan lawmakers have introduced a bill that would repeal the Medicare Sustainable Growth Rate (SGR) formula, this time with language that would reauthorize the Children’s Health Insurance Program (CHIP) for 2 years.

Leaders on the House Energy and Commerce and House Ways and Means committees on March 24 announced H.R. 2, the Medicare Access and CHIP Reauthorization Act. The proposal builds on H.R. 1470, the SGR Repeal and Medicare Provider Payment Modernization Act – reintroduced March 19 – by extending CHIP funding through fiscal 2017. Funding for the program expires in September. The Medicare Access and CHIP Reauthorization Act also includes 2-year reauthorization of the Community Health Centers program, the National Health Service Corps, and the Teaching Health Centers program, all of which would expire in 2015.

The changes would be paid for by income-related premium adjustments for Medicare parts B and D, Medigap reforms, an increase of levy authority on payments to Medicare providers with delinquent tax debt, adjustments to inpatient hospital payment rates, a delay of Medicaid Disproportionate Share Hospital (DSH) changes until 2018, and a 1% market basket update for post–acute care providers.

The payment proposals of the bill reflect a working framework released by committee members March 20. A vote on the SGR package is expected this week.

The bill culminates years of efforts by lawmakers and stakeholders and will strengthen Medicare over the long term, according to Energy and Commerce Committee Chairman Fred Upton (R-Mich.).

“We can see the light at the end of the SGR tunnel – finally,” Rep. Upton said in a statement. “This responsible legislative package reflects years of bipartisan work, is a good deal for seniors, and a good deal for children, too. It’s time to put a stop once and for all to the repeated SGR crises and start to put Medicare on a stronger path forward for our seniors.”

The committee’s ranking member, Rep. Frank Pallone (D-N.J.) agreed.

“Finally, after a decade of trying, we have a bipartisan bill that will permanently repeal the flawed SGR and move Medicare to a health care system based on quality and efficiency, that is good for seniors and doctors alike,” Rep. Pallone said.

“As with any bipartisan effort, this legislation reflects give and take on both sides. However, we have come to a balanced compromise that will end uncertainty in the system, extend CHIP, fund Community Health Centers, and make permanent the Qualifying Individual (QI) program that helps low income seniors pay their Medicare premiums,” he added.

In addition to repealing the SGR, the final bill includes a 0.5% pay increase per year for the next 5 years; consolidates existing quality programs into a single value-based performance program; incentivizes physicians to use alternate payment models that focus on care coordination and preventive care; and pushes for more transparency of Medicare data for physicians, providers, and patients.

The latest bill comes a week before the current SGR patch expires on March 31. Without legislative action, physicians will see a 21% cut in Medicare pay.

Bipartisan lawmakers have introduced a bill that would repeal the Medicare Sustainable Growth Rate (SGR) formula, this time with language that would reauthorize the Children’s Health Insurance Program (CHIP) for 2 years.

Leaders on the House Energy and Commerce and House Ways and Means committees on March 24 announced H.R. 2, the Medicare Access and CHIP Reauthorization Act. The proposal builds on H.R. 1470, the SGR Repeal and Medicare Provider Payment Modernization Act – reintroduced March 19 – by extending CHIP funding through fiscal 2017. Funding for the program expires in September. The Medicare Access and CHIP Reauthorization Act also includes 2-year reauthorization of the Community Health Centers program, the National Health Service Corps, and the Teaching Health Centers program, all of which would expire in 2015.

The changes would be paid for by income-related premium adjustments for Medicare parts B and D, Medigap reforms, an increase of levy authority on payments to Medicare providers with delinquent tax debt, adjustments to inpatient hospital payment rates, a delay of Medicaid Disproportionate Share Hospital (DSH) changes until 2018, and a 1% market basket update for post–acute care providers.

The payment proposals of the bill reflect a working framework released by committee members March 20. A vote on the SGR package is expected this week.

The bill culminates years of efforts by lawmakers and stakeholders and will strengthen Medicare over the long term, according to Energy and Commerce Committee Chairman Fred Upton (R-Mich.).

“We can see the light at the end of the SGR tunnel – finally,” Rep. Upton said in a statement. “This responsible legislative package reflects years of bipartisan work, is a good deal for seniors, and a good deal for children, too. It’s time to put a stop once and for all to the repeated SGR crises and start to put Medicare on a stronger path forward for our seniors.”

The committee’s ranking member, Rep. Frank Pallone (D-N.J.) agreed.

“Finally, after a decade of trying, we have a bipartisan bill that will permanently repeal the flawed SGR and move Medicare to a health care system based on quality and efficiency, that is good for seniors and doctors alike,” Rep. Pallone said.

“As with any bipartisan effort, this legislation reflects give and take on both sides. However, we have come to a balanced compromise that will end uncertainty in the system, extend CHIP, fund Community Health Centers, and make permanent the Qualifying Individual (QI) program that helps low income seniors pay their Medicare premiums,” he added.

In addition to repealing the SGR, the final bill includes a 0.5% pay increase per year for the next 5 years; consolidates existing quality programs into a single value-based performance program; incentivizes physicians to use alternate payment models that focus on care coordination and preventive care; and pushes for more transparency of Medicare data for physicians, providers, and patients.

The latest bill comes a week before the current SGR patch expires on March 31. Without legislative action, physicians will see a 21% cut in Medicare pay.

Bipartisan lawmakers have introduced a bill that would repeal the Medicare Sustainable Growth Rate (SGR) formula, this time with language that would reauthorize the Children’s Health Insurance Program (CHIP) for 2 years.

Leaders on the House Energy and Commerce and House Ways and Means committees on March 24 announced H.R. 2, the Medicare Access and CHIP Reauthorization Act. The proposal builds on H.R. 1470, the SGR Repeal and Medicare Provider Payment Modernization Act – reintroduced March 19 – by extending CHIP funding through fiscal 2017. Funding for the program expires in September. The Medicare Access and CHIP Reauthorization Act also includes 2-year reauthorization of the Community Health Centers program, the National Health Service Corps, and the Teaching Health Centers program, all of which would expire in 2015.

The changes would be paid for by income-related premium adjustments for Medicare parts B and D, Medigap reforms, an increase of levy authority on payments to Medicare providers with delinquent tax debt, adjustments to inpatient hospital payment rates, a delay of Medicaid Disproportionate Share Hospital (DSH) changes until 2018, and a 1% market basket update for post–acute care providers.

The payment proposals of the bill reflect a working framework released by committee members March 20. A vote on the SGR package is expected this week.

The bill culminates years of efforts by lawmakers and stakeholders and will strengthen Medicare over the long term, according to Energy and Commerce Committee Chairman Fred Upton (R-Mich.).

“We can see the light at the end of the SGR tunnel – finally,” Rep. Upton said in a statement. “This responsible legislative package reflects years of bipartisan work, is a good deal for seniors, and a good deal for children, too. It’s time to put a stop once and for all to the repeated SGR crises and start to put Medicare on a stronger path forward for our seniors.”

The committee’s ranking member, Rep. Frank Pallone (D-N.J.) agreed.

“Finally, after a decade of trying, we have a bipartisan bill that will permanently repeal the flawed SGR and move Medicare to a health care system based on quality and efficiency, that is good for seniors and doctors alike,” Rep. Pallone said.

“As with any bipartisan effort, this legislation reflects give and take on both sides. However, we have come to a balanced compromise that will end uncertainty in the system, extend CHIP, fund Community Health Centers, and make permanent the Qualifying Individual (QI) program that helps low income seniors pay their Medicare premiums,” he added.

In addition to repealing the SGR, the final bill includes a 0.5% pay increase per year for the next 5 years; consolidates existing quality programs into a single value-based performance program; incentivizes physicians to use alternate payment models that focus on care coordination and preventive care; and pushes for more transparency of Medicare data for physicians, providers, and patients.

The latest bill comes a week before the current SGR patch expires on March 31. Without legislative action, physicians will see a 21% cut in Medicare pay.

Uncompensated hospital care declines by $7 billion

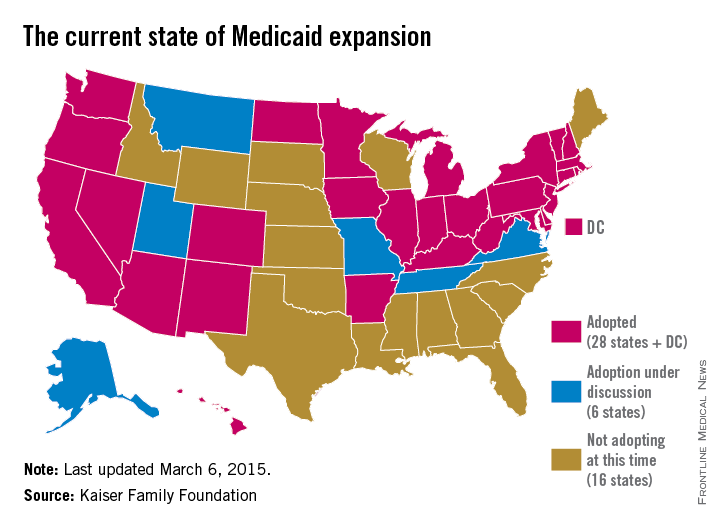

Uncompensated hospital care costs fell by an estimated $7 billion in 2014 because of marketplace coverage and state Medicaid expansions under the Affordable Care Act, according to a March 23 report by the Department of Health & Human Services. State Medicaid expansions accounted for an estimated $5 billion of the reduction, the HHS analysis found.

U.S. hospitals provided $50 billion in uncompensated care in 2013, the report found. Based on estimated coverage gains in 2014, the HHS Office of the Assistant Secretary for Planning and Evaluation (ASPE) estimates that uncompensated care costs were $7.4 billion lower in 2014 than they would have been had insurance coverage remained at 2013 levels. Hospitals spent an estimated $27 billion in uncompensated care in 2014, compared with an estimated $35 billion at 2013 coverage levels, a 21% reduction in uncompensated care spending. To arrive at the figures, ASPE analyzed uncompensated hospital care levels and cost reports from the Centers for Medicare & Medicaid Services, census data, estimates from Gallup-Healthways, and Medicaid enrollment data.

While $5 billion of the reduction came from the 28 states that have expanded Medicaid, $2 billion resulted from the 22 states that have not expanded Medicaid, according to ASPE. The government noted that if the nonexpansion states had increases proportionately as large in Medicaid coverage as did the expansion states, their uncompensated care costs would have declined by an additional $1.4 billion.

March 23 marked the fifth anniversary of President Obama’s signing the ACA into law. In a statement by the White House, the president praised the law’s success, and its impact on patients and the country.

On Twitter @legal_med

Uncompensated hospital care costs fell by an estimated $7 billion in 2014 because of marketplace coverage and state Medicaid expansions under the Affordable Care Act, according to a March 23 report by the Department of Health & Human Services. State Medicaid expansions accounted for an estimated $5 billion of the reduction, the HHS analysis found.

U.S. hospitals provided $50 billion in uncompensated care in 2013, the report found. Based on estimated coverage gains in 2014, the HHS Office of the Assistant Secretary for Planning and Evaluation (ASPE) estimates that uncompensated care costs were $7.4 billion lower in 2014 than they would have been had insurance coverage remained at 2013 levels. Hospitals spent an estimated $27 billion in uncompensated care in 2014, compared with an estimated $35 billion at 2013 coverage levels, a 21% reduction in uncompensated care spending. To arrive at the figures, ASPE analyzed uncompensated hospital care levels and cost reports from the Centers for Medicare & Medicaid Services, census data, estimates from Gallup-Healthways, and Medicaid enrollment data.

While $5 billion of the reduction came from the 28 states that have expanded Medicaid, $2 billion resulted from the 22 states that have not expanded Medicaid, according to ASPE. The government noted that if the nonexpansion states had increases proportionately as large in Medicaid coverage as did the expansion states, their uncompensated care costs would have declined by an additional $1.4 billion.

March 23 marked the fifth anniversary of President Obama’s signing the ACA into law. In a statement by the White House, the president praised the law’s success, and its impact on patients and the country.

On Twitter @legal_med

Uncompensated hospital care costs fell by an estimated $7 billion in 2014 because of marketplace coverage and state Medicaid expansions under the Affordable Care Act, according to a March 23 report by the Department of Health & Human Services. State Medicaid expansions accounted for an estimated $5 billion of the reduction, the HHS analysis found.

U.S. hospitals provided $50 billion in uncompensated care in 2013, the report found. Based on estimated coverage gains in 2014, the HHS Office of the Assistant Secretary for Planning and Evaluation (ASPE) estimates that uncompensated care costs were $7.4 billion lower in 2014 than they would have been had insurance coverage remained at 2013 levels. Hospitals spent an estimated $27 billion in uncompensated care in 2014, compared with an estimated $35 billion at 2013 coverage levels, a 21% reduction in uncompensated care spending. To arrive at the figures, ASPE analyzed uncompensated hospital care levels and cost reports from the Centers for Medicare & Medicaid Services, census data, estimates from Gallup-Healthways, and Medicaid enrollment data.

While $5 billion of the reduction came from the 28 states that have expanded Medicaid, $2 billion resulted from the 22 states that have not expanded Medicaid, according to ASPE. The government noted that if the nonexpansion states had increases proportionately as large in Medicaid coverage as did the expansion states, their uncompensated care costs would have declined by an additional $1.4 billion.

March 23 marked the fifth anniversary of President Obama’s signing the ACA into law. In a statement by the White House, the president praised the law’s success, and its impact on patients and the country.

On Twitter @legal_med

Feds recover $3 billion in health fraud in 2014

The federal government recouped $3 billion in health fraud settlements and judgments in fiscal 2014, down from $4 billion in 2013, according to a March 19 announcement by the Department of Health and Human Services.

The Health Care Fraud and Abuse Control (HCFAC) Program has recovered nearly $30 billion since it began in 1997.

The Department of Justice (DOJ) in 2014 also opened 924 new criminal health care fraud investigations, and federal prosecutors filed criminal charges in 496 cases involving 805 defendants, HHS said in its report. A total of 734 defendants were convicted of health care fraud–related crimes during last year.

Meanwhile, investigations by the HHS Office of Inspector General resulted in 867 criminal actions against individuals or entities that engaged in crimes related to Medicare and Medicaid and 529 civil actions, which include false claims and unjust-enrichment lawsuits. HHS excluded 4,017 health providers from participation in Medicare and Medicaid and other federal health care programs as a result of program violations, criminal actions, and licensure revocations.

The government touted the False Claims Act (FCA) as a leading tool in the fight against health fraud and recoupment of funding.

In 2014, the DOJ civil division, along with state officials, obtained $2.3 billion in settlements and judgments from FCA cases involving fraud and false claims. The department also opened 782 new civil health care fraud investigations under the FCA and had 957 civil health care fraud matters pending at the end of 2014.

For every dollar spent on health care–related fraud and abuse investigations in the last 3 years, HHS officials said they recovered $7.70. This is about $2 higher than the average return on investment when HCFAC was created in 1997.

However, the report noted that there were fewer resources for the federal government to fight health fraud and abuses because of sequestration of mandatory funding in 2014. A total of $32 million was sequestered from the HCFAC program in fiscal 2014, for a combined total of $62 million in the past 2 years.

[email protected]

On Twitter @legal_med

The federal government recouped $3 billion in health fraud settlements and judgments in fiscal 2014, down from $4 billion in 2013, according to a March 19 announcement by the Department of Health and Human Services.

The Health Care Fraud and Abuse Control (HCFAC) Program has recovered nearly $30 billion since it began in 1997.

The Department of Justice (DOJ) in 2014 also opened 924 new criminal health care fraud investigations, and federal prosecutors filed criminal charges in 496 cases involving 805 defendants, HHS said in its report. A total of 734 defendants were convicted of health care fraud–related crimes during last year.

Meanwhile, investigations by the HHS Office of Inspector General resulted in 867 criminal actions against individuals or entities that engaged in crimes related to Medicare and Medicaid and 529 civil actions, which include false claims and unjust-enrichment lawsuits. HHS excluded 4,017 health providers from participation in Medicare and Medicaid and other federal health care programs as a result of program violations, criminal actions, and licensure revocations.

The government touted the False Claims Act (FCA) as a leading tool in the fight against health fraud and recoupment of funding.

In 2014, the DOJ civil division, along with state officials, obtained $2.3 billion in settlements and judgments from FCA cases involving fraud and false claims. The department also opened 782 new civil health care fraud investigations under the FCA and had 957 civil health care fraud matters pending at the end of 2014.

For every dollar spent on health care–related fraud and abuse investigations in the last 3 years, HHS officials said they recovered $7.70. This is about $2 higher than the average return on investment when HCFAC was created in 1997.

However, the report noted that there were fewer resources for the federal government to fight health fraud and abuses because of sequestration of mandatory funding in 2014. A total of $32 million was sequestered from the HCFAC program in fiscal 2014, for a combined total of $62 million in the past 2 years.

[email protected]

On Twitter @legal_med

The federal government recouped $3 billion in health fraud settlements and judgments in fiscal 2014, down from $4 billion in 2013, according to a March 19 announcement by the Department of Health and Human Services.

The Health Care Fraud and Abuse Control (HCFAC) Program has recovered nearly $30 billion since it began in 1997.

The Department of Justice (DOJ) in 2014 also opened 924 new criminal health care fraud investigations, and federal prosecutors filed criminal charges in 496 cases involving 805 defendants, HHS said in its report. A total of 734 defendants were convicted of health care fraud–related crimes during last year.

Meanwhile, investigations by the HHS Office of Inspector General resulted in 867 criminal actions against individuals or entities that engaged in crimes related to Medicare and Medicaid and 529 civil actions, which include false claims and unjust-enrichment lawsuits. HHS excluded 4,017 health providers from participation in Medicare and Medicaid and other federal health care programs as a result of program violations, criminal actions, and licensure revocations.

The government touted the False Claims Act (FCA) as a leading tool in the fight against health fraud and recoupment of funding.

In 2014, the DOJ civil division, along with state officials, obtained $2.3 billion in settlements and judgments from FCA cases involving fraud and false claims. The department also opened 782 new civil health care fraud investigations under the FCA and had 957 civil health care fraud matters pending at the end of 2014.

For every dollar spent on health care–related fraud and abuse investigations in the last 3 years, HHS officials said they recovered $7.70. This is about $2 higher than the average return on investment when HCFAC was created in 1997.

However, the report noted that there were fewer resources for the federal government to fight health fraud and abuses because of sequestration of mandatory funding in 2014. A total of $32 million was sequestered from the HCFAC program in fiscal 2014, for a combined total of $62 million in the past 2 years.

[email protected]

On Twitter @legal_med

States expand Medicaid through unique approaches

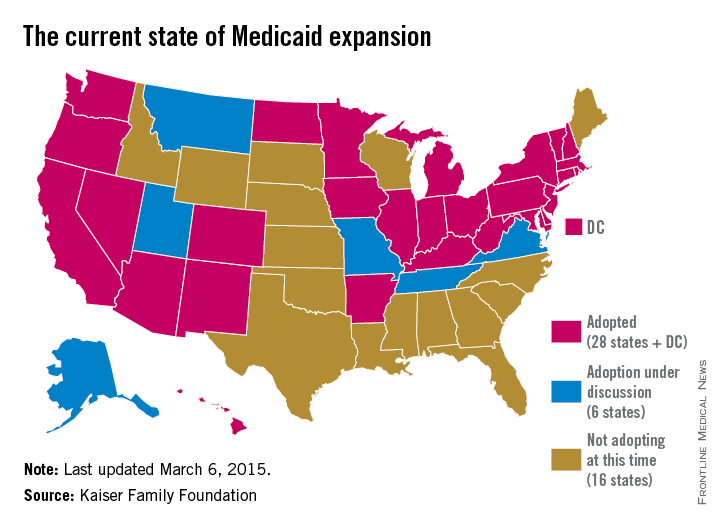

State government officials are getting creative in their efforts to expand Medicaid under the Affordable Care Act.

After the 2014 election, some states sought to expand their Medicaid programs “with some kind of special arrangement in an attempt to fine tune it to their specific state needs and political objectives,” James F. Blumstein, a constitutional and health law professor at Vanderbilt University in Nashville, said in an interview. The Republican-controlled Congress is a key reason why, he said. “The Obama [administration] realized if they didn’t make some substantial concessions [in the form of Medicaid waivers] to various local political needs and goals, that those states would not have expanded.”

While at least 12 states chose to expand Medicaid in the 2 years immediately after ACA enactment, others held back.

Debate over the ideal expansion plan – and refusal by some states to expand – is largely based on political views, budget concerns, and resistance to federal programs, Robin Rudowitz, associate director for the Kaiser Commission on Medicaid and the Uninsured said during a webinar.

“Some of the states that have opposed have certainly [refused to expand] on ideological grounds,” she said during the presentation. “Some states have cited concerns about cost. Some states are concerned about the federal government’s commitment to maintain the high match.”

So far, six states have earned a federal waiver to create their own brand of Medicaid reform; New Hampshire is the latest. Gov. Maggie Hassan (D) announced on March 5 that the Centers for Medicare & Medicaid Services approved her state’s waiver to expand the New Hampshire Health Protection Program. New Hampshire’s plan implements mandatory qualified health plan (QHP) premium assistance for new patients to purchase coverage. QHPs refer to health plans that are certified by the federal health insurance marketplace, provide essential health benefits, follow established limits on cost-sharing, and meet other federal requirements. New Hampshire’s plan also includes the authority to waive retroactive coverage, a provision that has not been approved in other states.

Expansion waivers approved in Arkansas and Iowa follow similar QHP approaches. Arkansas’s expansion program, approved by CMS through December 2016, allows the state to implement Medicaid expansion through a premium assistance model that uses federal Medicaid funds to purchase coverage through QHPs. Iowa is using the same premium assistance model and also received approval for another option that provides Medicaid coverage through a medical home model for patients with incomes up to 100% of the federal poverty line (FPL) and for medically frail patients up to 138% of the FPL. Meanwhile, Michigan’s alternative program, called Healthy Michigan allows patients to participate in health savings accounts that can be used for required cost-sharing payments. Pennsylvania is transitioning from an approved alternative model to a traditional expansion approach. Former Pennsylvania Gov. Tom Corbett’s (R) Healthy PA program was undone when Gov. Tom Wolf (D) took office. Gov. Wolf plans to move the state to a traditional expansion by Sept. 1.

Indiana’s expansion approach is perhaps the most unique. Similar to other waivers, the state’s plan includes premium assistance and monthly contributions by patients to a personal health savings account. However, unlike other states, Indiana can prevent beneficiaries from reenrolling in coverage for 6 months if they are disenrolled for nonpayment of premiums. The plan also provides a less-generous benefit package to newly eligible beneficiaries at or below the federal poverty level who do not pay premiums. To receive the more generous benefit package, even patients with very little or no income must pay premiums of $1 per month, and medically frail patients above the federal poverty level who do not pay premiums must pay state plan copayments.

Indiana’s expansion encourages personal responsibility by patients, Gov. Mike Pence(R) said in a statement. “We have worked hard to ensure that low-income Hoosiers have access to a health care plan that empowers them to take charge of their health and prepares them to move to private insurance as they improve their lives.”

But constitutional and health law professor David Orentlicher of Indiana University, Indianapolis, said that he believes the expansion may backfire.

“When patients are expected to pay more for their health care, whether through increases in premiums, deductibles, or copayments, they are less able to afford health care,” Mr. Orentlicher said in an interview. “For low-income persons, that can mean not filling prescriptions or seeing a physician when sick. As a result, the health of poor patients may suffer.”

Indiana’s expansion could encourage more states to adopt similar approaches. “It’s important to understand what CMS has approved and what they have said they would deny because these actions set the guideposts and parameters for other states that are considering waiver approaches to implement the expansion,” Ms. Rudowitz said during the webinar.

Traditional Medicaid expansion bills are currently under consideration in Florida, Montana, and Alaska. In other states, alternative Medicaid expansions has been voted down. The Utah House on March 5 killed Gov. Gary Herbert’s (R) Healthy Utah plan in a 16-56 vote. The proposal would have covered residents earning up to 138% of the poverty line. Instead, the Utah House on Mar. 6 passed Utah Cares, an expansion plan that would use traditional Medicaid and the state’s Primary Care Network to provide limited health care to Utahans earning up to 100% of the poverty line. That bill, sponsored by House Majority Leader Jim Dunnigan (R), has been sent on to the state senate.

And in February, a Senate panel defeated Tennessee Gov. Bill Haslam’s alternative plan to expand Medicaid under the ACA. Tennessee was widely seen as the next Republican state that could expand Medicaid, with Gov. Haslam negotiating for months with the federal government for a plan that included conservative policy elements. The governor’s Insure Tennessee plan had included two coverage tracks for patients making less than 138% of the poverty level. One plan included defined contributions for beneficiaries with employer-sponsored plans to help them pay for premiums and copays. The other option would have created health savings accounts for consumers who can earn credits to pay for health care costs by engaging in healthy behaviors.

A wild card in the future of Medicaid expansions is the case of King v. Burwell before the Supreme Court, Mr. Blumstein said. Justices are weighing whether patients in states that use the federal exchange can receive federal tax credits to buy insurance or whether the credits apply only in state-run exchanges The high court heard oral arguments in the case March 4. Some states, such as North Carolina, will not consider expanding until after the court rules.

If the court rules for the plaintiffs, “there’s going to have to be a reassessment,” Mr. Blumstein said. “The Legislature and various states will have to figure out how they want to handle Medicaid expansion and whether they want to get into the business of handling an exchange. It adds a level of complexity.”

On Twitter @legal_med

State government officials are getting creative in their efforts to expand Medicaid under the Affordable Care Act.

After the 2014 election, some states sought to expand their Medicaid programs “with some kind of special arrangement in an attempt to fine tune it to their specific state needs and political objectives,” James F. Blumstein, a constitutional and health law professor at Vanderbilt University in Nashville, said in an interview. The Republican-controlled Congress is a key reason why, he said. “The Obama [administration] realized if they didn’t make some substantial concessions [in the form of Medicaid waivers] to various local political needs and goals, that those states would not have expanded.”

While at least 12 states chose to expand Medicaid in the 2 years immediately after ACA enactment, others held back.

Debate over the ideal expansion plan – and refusal by some states to expand – is largely based on political views, budget concerns, and resistance to federal programs, Robin Rudowitz, associate director for the Kaiser Commission on Medicaid and the Uninsured said during a webinar.

“Some of the states that have opposed have certainly [refused to expand] on ideological grounds,” she said during the presentation. “Some states have cited concerns about cost. Some states are concerned about the federal government’s commitment to maintain the high match.”

So far, six states have earned a federal waiver to create their own brand of Medicaid reform; New Hampshire is the latest. Gov. Maggie Hassan (D) announced on March 5 that the Centers for Medicare & Medicaid Services approved her state’s waiver to expand the New Hampshire Health Protection Program. New Hampshire’s plan implements mandatory qualified health plan (QHP) premium assistance for new patients to purchase coverage. QHPs refer to health plans that are certified by the federal health insurance marketplace, provide essential health benefits, follow established limits on cost-sharing, and meet other federal requirements. New Hampshire’s plan also includes the authority to waive retroactive coverage, a provision that has not been approved in other states.

Expansion waivers approved in Arkansas and Iowa follow similar QHP approaches. Arkansas’s expansion program, approved by CMS through December 2016, allows the state to implement Medicaid expansion through a premium assistance model that uses federal Medicaid funds to purchase coverage through QHPs. Iowa is using the same premium assistance model and also received approval for another option that provides Medicaid coverage through a medical home model for patients with incomes up to 100% of the federal poverty line (FPL) and for medically frail patients up to 138% of the FPL. Meanwhile, Michigan’s alternative program, called Healthy Michigan allows patients to participate in health savings accounts that can be used for required cost-sharing payments. Pennsylvania is transitioning from an approved alternative model to a traditional expansion approach. Former Pennsylvania Gov. Tom Corbett’s (R) Healthy PA program was undone when Gov. Tom Wolf (D) took office. Gov. Wolf plans to move the state to a traditional expansion by Sept. 1.

Indiana’s expansion approach is perhaps the most unique. Similar to other waivers, the state’s plan includes premium assistance and monthly contributions by patients to a personal health savings account. However, unlike other states, Indiana can prevent beneficiaries from reenrolling in coverage for 6 months if they are disenrolled for nonpayment of premiums. The plan also provides a less-generous benefit package to newly eligible beneficiaries at or below the federal poverty level who do not pay premiums. To receive the more generous benefit package, even patients with very little or no income must pay premiums of $1 per month, and medically frail patients above the federal poverty level who do not pay premiums must pay state plan copayments.

Indiana’s expansion encourages personal responsibility by patients, Gov. Mike Pence(R) said in a statement. “We have worked hard to ensure that low-income Hoosiers have access to a health care plan that empowers them to take charge of their health and prepares them to move to private insurance as they improve their lives.”

But constitutional and health law professor David Orentlicher of Indiana University, Indianapolis, said that he believes the expansion may backfire.

“When patients are expected to pay more for their health care, whether through increases in premiums, deductibles, or copayments, they are less able to afford health care,” Mr. Orentlicher said in an interview. “For low-income persons, that can mean not filling prescriptions or seeing a physician when sick. As a result, the health of poor patients may suffer.”

Indiana’s expansion could encourage more states to adopt similar approaches. “It’s important to understand what CMS has approved and what they have said they would deny because these actions set the guideposts and parameters for other states that are considering waiver approaches to implement the expansion,” Ms. Rudowitz said during the webinar.

Traditional Medicaid expansion bills are currently under consideration in Florida, Montana, and Alaska. In other states, alternative Medicaid expansions has been voted down. The Utah House on March 5 killed Gov. Gary Herbert’s (R) Healthy Utah plan in a 16-56 vote. The proposal would have covered residents earning up to 138% of the poverty line. Instead, the Utah House on Mar. 6 passed Utah Cares, an expansion plan that would use traditional Medicaid and the state’s Primary Care Network to provide limited health care to Utahans earning up to 100% of the poverty line. That bill, sponsored by House Majority Leader Jim Dunnigan (R), has been sent on to the state senate.

And in February, a Senate panel defeated Tennessee Gov. Bill Haslam’s alternative plan to expand Medicaid under the ACA. Tennessee was widely seen as the next Republican state that could expand Medicaid, with Gov. Haslam negotiating for months with the federal government for a plan that included conservative policy elements. The governor’s Insure Tennessee plan had included two coverage tracks for patients making less than 138% of the poverty level. One plan included defined contributions for beneficiaries with employer-sponsored plans to help them pay for premiums and copays. The other option would have created health savings accounts for consumers who can earn credits to pay for health care costs by engaging in healthy behaviors.

A wild card in the future of Medicaid expansions is the case of King v. Burwell before the Supreme Court, Mr. Blumstein said. Justices are weighing whether patients in states that use the federal exchange can receive federal tax credits to buy insurance or whether the credits apply only in state-run exchanges The high court heard oral arguments in the case March 4. Some states, such as North Carolina, will not consider expanding until after the court rules.

If the court rules for the plaintiffs, “there’s going to have to be a reassessment,” Mr. Blumstein said. “The Legislature and various states will have to figure out how they want to handle Medicaid expansion and whether they want to get into the business of handling an exchange. It adds a level of complexity.”

On Twitter @legal_med

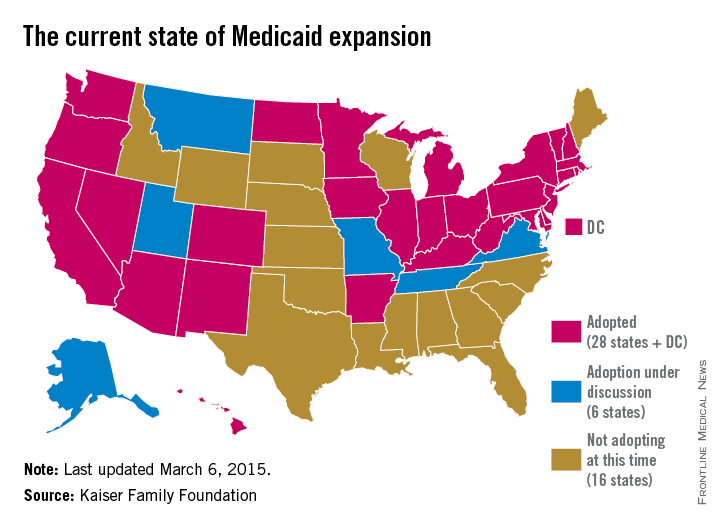

State government officials are getting creative in their efforts to expand Medicaid under the Affordable Care Act.

After the 2014 election, some states sought to expand their Medicaid programs “with some kind of special arrangement in an attempt to fine tune it to their specific state needs and political objectives,” James F. Blumstein, a constitutional and health law professor at Vanderbilt University in Nashville, said in an interview. The Republican-controlled Congress is a key reason why, he said. “The Obama [administration] realized if they didn’t make some substantial concessions [in the form of Medicaid waivers] to various local political needs and goals, that those states would not have expanded.”

While at least 12 states chose to expand Medicaid in the 2 years immediately after ACA enactment, others held back.

Debate over the ideal expansion plan – and refusal by some states to expand – is largely based on political views, budget concerns, and resistance to federal programs, Robin Rudowitz, associate director for the Kaiser Commission on Medicaid and the Uninsured said during a webinar.

“Some of the states that have opposed have certainly [refused to expand] on ideological grounds,” she said during the presentation. “Some states have cited concerns about cost. Some states are concerned about the federal government’s commitment to maintain the high match.”

So far, six states have earned a federal waiver to create their own brand of Medicaid reform; New Hampshire is the latest. Gov. Maggie Hassan (D) announced on March 5 that the Centers for Medicare & Medicaid Services approved her state’s waiver to expand the New Hampshire Health Protection Program. New Hampshire’s plan implements mandatory qualified health plan (QHP) premium assistance for new patients to purchase coverage. QHPs refer to health plans that are certified by the federal health insurance marketplace, provide essential health benefits, follow established limits on cost-sharing, and meet other federal requirements. New Hampshire’s plan also includes the authority to waive retroactive coverage, a provision that has not been approved in other states.

Expansion waivers approved in Arkansas and Iowa follow similar QHP approaches. Arkansas’s expansion program, approved by CMS through December 2016, allows the state to implement Medicaid expansion through a premium assistance model that uses federal Medicaid funds to purchase coverage through QHPs. Iowa is using the same premium assistance model and also received approval for another option that provides Medicaid coverage through a medical home model for patients with incomes up to 100% of the federal poverty line (FPL) and for medically frail patients up to 138% of the FPL. Meanwhile, Michigan’s alternative program, called Healthy Michigan allows patients to participate in health savings accounts that can be used for required cost-sharing payments. Pennsylvania is transitioning from an approved alternative model to a traditional expansion approach. Former Pennsylvania Gov. Tom Corbett’s (R) Healthy PA program was undone when Gov. Tom Wolf (D) took office. Gov. Wolf plans to move the state to a traditional expansion by Sept. 1.

Indiana’s expansion approach is perhaps the most unique. Similar to other waivers, the state’s plan includes premium assistance and monthly contributions by patients to a personal health savings account. However, unlike other states, Indiana can prevent beneficiaries from reenrolling in coverage for 6 months if they are disenrolled for nonpayment of premiums. The plan also provides a less-generous benefit package to newly eligible beneficiaries at or below the federal poverty level who do not pay premiums. To receive the more generous benefit package, even patients with very little or no income must pay premiums of $1 per month, and medically frail patients above the federal poverty level who do not pay premiums must pay state plan copayments.

Indiana’s expansion encourages personal responsibility by patients, Gov. Mike Pence(R) said in a statement. “We have worked hard to ensure that low-income Hoosiers have access to a health care plan that empowers them to take charge of their health and prepares them to move to private insurance as they improve their lives.”

But constitutional and health law professor David Orentlicher of Indiana University, Indianapolis, said that he believes the expansion may backfire.

“When patients are expected to pay more for their health care, whether through increases in premiums, deductibles, or copayments, they are less able to afford health care,” Mr. Orentlicher said in an interview. “For low-income persons, that can mean not filling prescriptions or seeing a physician when sick. As a result, the health of poor patients may suffer.”

Indiana’s expansion could encourage more states to adopt similar approaches. “It’s important to understand what CMS has approved and what they have said they would deny because these actions set the guideposts and parameters for other states that are considering waiver approaches to implement the expansion,” Ms. Rudowitz said during the webinar.

Traditional Medicaid expansion bills are currently under consideration in Florida, Montana, and Alaska. In other states, alternative Medicaid expansions has been voted down. The Utah House on March 5 killed Gov. Gary Herbert’s (R) Healthy Utah plan in a 16-56 vote. The proposal would have covered residents earning up to 138% of the poverty line. Instead, the Utah House on Mar. 6 passed Utah Cares, an expansion plan that would use traditional Medicaid and the state’s Primary Care Network to provide limited health care to Utahans earning up to 100% of the poverty line. That bill, sponsored by House Majority Leader Jim Dunnigan (R), has been sent on to the state senate.

And in February, a Senate panel defeated Tennessee Gov. Bill Haslam’s alternative plan to expand Medicaid under the ACA. Tennessee was widely seen as the next Republican state that could expand Medicaid, with Gov. Haslam negotiating for months with the federal government for a plan that included conservative policy elements. The governor’s Insure Tennessee plan had included two coverage tracks for patients making less than 138% of the poverty level. One plan included defined contributions for beneficiaries with employer-sponsored plans to help them pay for premiums and copays. The other option would have created health savings accounts for consumers who can earn credits to pay for health care costs by engaging in healthy behaviors.

A wild card in the future of Medicaid expansions is the case of King v. Burwell before the Supreme Court, Mr. Blumstein said. Justices are weighing whether patients in states that use the federal exchange can receive federal tax credits to buy insurance or whether the credits apply only in state-run exchanges The high court heard oral arguments in the case March 4. Some states, such as North Carolina, will not consider expanding until after the court rules.

If the court rules for the plaintiffs, “there’s going to have to be a reassessment,” Mr. Blumstein said. “The Legislature and various states will have to figure out how they want to handle Medicaid expansion and whether they want to get into the business of handling an exchange. It adds a level of complexity.”

On Twitter @legal_med

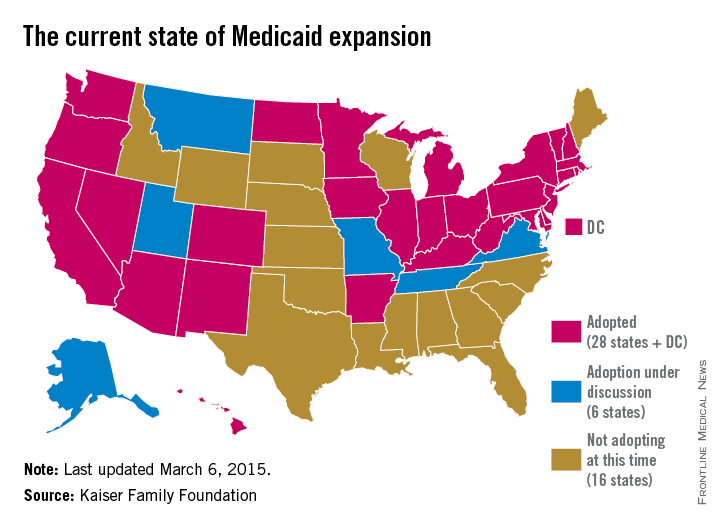

HHS report: Record number of patients covered under ACA

About 16.4 million Americans have gained health insurance coverage since the Affordable Care Act took effect, dropping the U.S. uninsured rate by 7 percentage points, according to a new report released March 16 by the Department of Health and Human Services.

That includes 14.1 million adults who secured coverage since the beginning of open enrollment in October 2013 and 2.3 million young adults who have obtained coverage since 2010 because of the ACA’s provision allowing them to remain on a parent’s plan until age 26 years. From October 2013 to March 2015, the rate of uninsured patients fell from 20% to 13%, the report found.

Dr. Richard G. Frank, HHS assistant secretary for planning and evaluation called the reduction unprecedented.

“This is a historical drop in the uninsured, and nothing since the implementation of Medicare and Medicaid comes near to this type of change,” Dr. Frank said during a press conference. “We’re seeing gains across races and ethnicities. We’re seeing gains in all age groups, and we’re seeing notable gains in expansion states. ... Numbers and statistics are important, and the story they are telling is that the Affordable Care Act is working to drive down the number of uninsured.”

The uninsured rate has declined across all race and ethnicities since the law’s 2010 implementation, with a greater reduction among uninsured blacks and Hispanics, the report found. This includes 5-percentage point reduction in the rate of uninsured whites, a 9-percentage point reduction in the rate of uninsured blacks, and a 12-percentage point reduction in the rate of uninsured Hispanics.

Coverage gains were especially strong in states that expanded their Medicaid programs, according to the report. The baseline uninsurance rate in expansion states was 18%; by March 2015, that had dropped 7.4 percentage points. In states that have not expanded Medicaid, the average baseline uninsured rate was 23%; that rate has dropped almost 7 percentage points since the law took effect.

For young adults aged 19-25 years, the uninsured rate fell from 34% to 27% between 2010 and October 2013. In a statement, HHS Secretary Sylvia M. Burwell said the uninsured rate reduction is the largest in 4 decades.

“Because of the Affordable Care Act, young adults are able to stay on their parents’ plans until age 26, states can expand their Medicaid programs, and tax credits are available to millions of Americans in all 50 states, making health care coverage more affordable and accessible,” Ms. Burwell said in the statement. “When it comes to the key metrics of affordability, access, and quality, the evidence shows that the Affordable Care Act is working, and families, businesses and taxpayers are better off as a result.”

On Twitter @legal_med

About 16.4 million Americans have gained health insurance coverage since the Affordable Care Act took effect, dropping the U.S. uninsured rate by 7 percentage points, according to a new report released March 16 by the Department of Health and Human Services.

That includes 14.1 million adults who secured coverage since the beginning of open enrollment in October 2013 and 2.3 million young adults who have obtained coverage since 2010 because of the ACA’s provision allowing them to remain on a parent’s plan until age 26 years. From October 2013 to March 2015, the rate of uninsured patients fell from 20% to 13%, the report found.

Dr. Richard G. Frank, HHS assistant secretary for planning and evaluation called the reduction unprecedented.

“This is a historical drop in the uninsured, and nothing since the implementation of Medicare and Medicaid comes near to this type of change,” Dr. Frank said during a press conference. “We’re seeing gains across races and ethnicities. We’re seeing gains in all age groups, and we’re seeing notable gains in expansion states. ... Numbers and statistics are important, and the story they are telling is that the Affordable Care Act is working to drive down the number of uninsured.”

The uninsured rate has declined across all race and ethnicities since the law’s 2010 implementation, with a greater reduction among uninsured blacks and Hispanics, the report found. This includes 5-percentage point reduction in the rate of uninsured whites, a 9-percentage point reduction in the rate of uninsured blacks, and a 12-percentage point reduction in the rate of uninsured Hispanics.

Coverage gains were especially strong in states that expanded their Medicaid programs, according to the report. The baseline uninsurance rate in expansion states was 18%; by March 2015, that had dropped 7.4 percentage points. In states that have not expanded Medicaid, the average baseline uninsured rate was 23%; that rate has dropped almost 7 percentage points since the law took effect.

For young adults aged 19-25 years, the uninsured rate fell from 34% to 27% between 2010 and October 2013. In a statement, HHS Secretary Sylvia M. Burwell said the uninsured rate reduction is the largest in 4 decades.

“Because of the Affordable Care Act, young adults are able to stay on their parents’ plans until age 26, states can expand their Medicaid programs, and tax credits are available to millions of Americans in all 50 states, making health care coverage more affordable and accessible,” Ms. Burwell said in the statement. “When it comes to the key metrics of affordability, access, and quality, the evidence shows that the Affordable Care Act is working, and families, businesses and taxpayers are better off as a result.”

On Twitter @legal_med

About 16.4 million Americans have gained health insurance coverage since the Affordable Care Act took effect, dropping the U.S. uninsured rate by 7 percentage points, according to a new report released March 16 by the Department of Health and Human Services.

That includes 14.1 million adults who secured coverage since the beginning of open enrollment in October 2013 and 2.3 million young adults who have obtained coverage since 2010 because of the ACA’s provision allowing them to remain on a parent’s plan until age 26 years. From October 2013 to March 2015, the rate of uninsured patients fell from 20% to 13%, the report found.

Dr. Richard G. Frank, HHS assistant secretary for planning and evaluation called the reduction unprecedented.

“This is a historical drop in the uninsured, and nothing since the implementation of Medicare and Medicaid comes near to this type of change,” Dr. Frank said during a press conference. “We’re seeing gains across races and ethnicities. We’re seeing gains in all age groups, and we’re seeing notable gains in expansion states. ... Numbers and statistics are important, and the story they are telling is that the Affordable Care Act is working to drive down the number of uninsured.”

The uninsured rate has declined across all race and ethnicities since the law’s 2010 implementation, with a greater reduction among uninsured blacks and Hispanics, the report found. This includes 5-percentage point reduction in the rate of uninsured whites, a 9-percentage point reduction in the rate of uninsured blacks, and a 12-percentage point reduction in the rate of uninsured Hispanics.

Coverage gains were especially strong in states that expanded their Medicaid programs, according to the report. The baseline uninsurance rate in expansion states was 18%; by March 2015, that had dropped 7.4 percentage points. In states that have not expanded Medicaid, the average baseline uninsured rate was 23%; that rate has dropped almost 7 percentage points since the law took effect.

For young adults aged 19-25 years, the uninsured rate fell from 34% to 27% between 2010 and October 2013. In a statement, HHS Secretary Sylvia M. Burwell said the uninsured rate reduction is the largest in 4 decades.

“Because of the Affordable Care Act, young adults are able to stay on their parents’ plans until age 26, states can expand their Medicaid programs, and tax credits are available to millions of Americans in all 50 states, making health care coverage more affordable and accessible,” Ms. Burwell said in the statement. “When it comes to the key metrics of affordability, access, and quality, the evidence shows that the Affordable Care Act is working, and families, businesses and taxpayers are better off as a result.”

On Twitter @legal_med

House negotiating SGR fix, repeal could come soon

Negotiations are apparently underway in the House of Representatives over the Medicare Sustainable Growth Rate (SGR) formula, and agreement on a possible repeal could be on the horizon.

The new efforts will hopefully lead to an improved, permanent payment system that ensures Medicare is on a sustainable path going forward, said Sen. Ron Wyden (D-Ore.), ranking member of the Senate Finance Committee.

“I’ve been in Congress long enough to be skeptical of rumors, but what we are hearing from the House suggests there is real movement to fully repeal and replace the flawed formula for paying Medicare providers known as SGR,” Sen. Wyden said in a statement. “If what we’re hearing is true, it’s good news and moves us closer to something I’ve been working tirelessly to achieve – a payment formula that stands on its own, doesn’t require annual and expensive ‘patches,’ and which opens the door to improving the way care is delivered.”

The current SGR patch expires March 31, after which physicians can expect a 21% pay cut.

A new analysis of last year’s repeal legislation notes the bill has strengths and weaknesses for physicians (Health Aff. 2015 doi: 10.1377/hlthaff.2014.1429). Current congressional deliberations are focused on how to pay for the SGR fix, with wide consensus that the 2014 legislation will remain the basic model for reform.

The SGR Repeal and Medicare Provider Payment Modernization Act of 2014 includes opportunities for specialists to participate in pay-for-performance programs and other alternative payment models, according to author James Reschovsky, a senior fellow at policy research firm Mathematica Policy Research. The legislation would create two new payment pathways for doctors, one for those who want to continue to receive fee-for-service payments, and another for those already participating in value-based payment models, including accountable care arrangements and bundled payment initiatives.

But the bill fails to address distortions in Medicare’s fee-for-service fee schedule, which some argue overvalues specialty care services, while undervaluing preventive care, Mr. Reschovsky and his colleagues said. Without fixing that defect, specialists may find it more lucrative to stay in Medicare’s fee-for-service program and continue to concentrate on providing high-cost services. Attempts to bring down costs through ACOs and other alternative payment methods also will be difficult as long as the fee-for-service pay rates underlying these programs are skewed.

“Correcting fee schedule valuations will be a substantial and controversial undertaking,” they wrote. “But it is one that is vitally important to the SGR fix’s prospects for success.”

The SGR Repeal and Medicare Provider Payment Modernization Act of 2014 passed the House last year, but was not taken up by the Senate

On Twitter @legal_med

Negotiations are apparently underway in the House of Representatives over the Medicare Sustainable Growth Rate (SGR) formula, and agreement on a possible repeal could be on the horizon.

The new efforts will hopefully lead to an improved, permanent payment system that ensures Medicare is on a sustainable path going forward, said Sen. Ron Wyden (D-Ore.), ranking member of the Senate Finance Committee.

“I’ve been in Congress long enough to be skeptical of rumors, but what we are hearing from the House suggests there is real movement to fully repeal and replace the flawed formula for paying Medicare providers known as SGR,” Sen. Wyden said in a statement. “If what we’re hearing is true, it’s good news and moves us closer to something I’ve been working tirelessly to achieve – a payment formula that stands on its own, doesn’t require annual and expensive ‘patches,’ and which opens the door to improving the way care is delivered.”

The current SGR patch expires March 31, after which physicians can expect a 21% pay cut.

A new analysis of last year’s repeal legislation notes the bill has strengths and weaknesses for physicians (Health Aff. 2015 doi: 10.1377/hlthaff.2014.1429). Current congressional deliberations are focused on how to pay for the SGR fix, with wide consensus that the 2014 legislation will remain the basic model for reform.

The SGR Repeal and Medicare Provider Payment Modernization Act of 2014 includes opportunities for specialists to participate in pay-for-performance programs and other alternative payment models, according to author James Reschovsky, a senior fellow at policy research firm Mathematica Policy Research. The legislation would create two new payment pathways for doctors, one for those who want to continue to receive fee-for-service payments, and another for those already participating in value-based payment models, including accountable care arrangements and bundled payment initiatives.

But the bill fails to address distortions in Medicare’s fee-for-service fee schedule, which some argue overvalues specialty care services, while undervaluing preventive care, Mr. Reschovsky and his colleagues said. Without fixing that defect, specialists may find it more lucrative to stay in Medicare’s fee-for-service program and continue to concentrate on providing high-cost services. Attempts to bring down costs through ACOs and other alternative payment methods also will be difficult as long as the fee-for-service pay rates underlying these programs are skewed.

“Correcting fee schedule valuations will be a substantial and controversial undertaking,” they wrote. “But it is one that is vitally important to the SGR fix’s prospects for success.”

The SGR Repeal and Medicare Provider Payment Modernization Act of 2014 passed the House last year, but was not taken up by the Senate

On Twitter @legal_med

Negotiations are apparently underway in the House of Representatives over the Medicare Sustainable Growth Rate (SGR) formula, and agreement on a possible repeal could be on the horizon.

The new efforts will hopefully lead to an improved, permanent payment system that ensures Medicare is on a sustainable path going forward, said Sen. Ron Wyden (D-Ore.), ranking member of the Senate Finance Committee.

“I’ve been in Congress long enough to be skeptical of rumors, but what we are hearing from the House suggests there is real movement to fully repeal and replace the flawed formula for paying Medicare providers known as SGR,” Sen. Wyden said in a statement. “If what we’re hearing is true, it’s good news and moves us closer to something I’ve been working tirelessly to achieve – a payment formula that stands on its own, doesn’t require annual and expensive ‘patches,’ and which opens the door to improving the way care is delivered.”

The current SGR patch expires March 31, after which physicians can expect a 21% pay cut.

A new analysis of last year’s repeal legislation notes the bill has strengths and weaknesses for physicians (Health Aff. 2015 doi: 10.1377/hlthaff.2014.1429). Current congressional deliberations are focused on how to pay for the SGR fix, with wide consensus that the 2014 legislation will remain the basic model for reform.

The SGR Repeal and Medicare Provider Payment Modernization Act of 2014 includes opportunities for specialists to participate in pay-for-performance programs and other alternative payment models, according to author James Reschovsky, a senior fellow at policy research firm Mathematica Policy Research. The legislation would create two new payment pathways for doctors, one for those who want to continue to receive fee-for-service payments, and another for those already participating in value-based payment models, including accountable care arrangements and bundled payment initiatives.

But the bill fails to address distortions in Medicare’s fee-for-service fee schedule, which some argue overvalues specialty care services, while undervaluing preventive care, Mr. Reschovsky and his colleagues said. Without fixing that defect, specialists may find it more lucrative to stay in Medicare’s fee-for-service program and continue to concentrate on providing high-cost services. Attempts to bring down costs through ACOs and other alternative payment methods also will be difficult as long as the fee-for-service pay rates underlying these programs are skewed.

“Correcting fee schedule valuations will be a substantial and controversial undertaking,” they wrote. “But it is one that is vitally important to the SGR fix’s prospects for success.”

The SGR Repeal and Medicare Provider Payment Modernization Act of 2014 passed the House last year, but was not taken up by the Senate

On Twitter @legal_med

Experts: New ACO model positive for physicians

The new Next Generation Accountable Care Organization (ACO) model improves upon other ACO models and allows for greater success for physicians, according to ACO experts.

“It’s a really good sign generally that CMS is willing and able to adapt to some of the major structural problems with the Medicare ACO model,” said Julian D. “Bo” Bobbitt Jr., a health law attorney in Raleigh, N.C. “Changing incentives to reward higher quality at lower cost and to align those is extraordinarily promising.”

The Next Generation ACO model offers predictable financial targets, enables providers and patients greater opportunities to coordinate care, and aims to attain the highest standards of care, according to a March 10 announcement from the Centers for Medicare & Medicaid Services. The new model means greater financial risks for doctors and hospitals in exchange for greater shared savings for high performance. To support the increased risk sharing, the new ACOs will have a stable, predictable benchmark and flexible payment options that support investments in care improvement infrastructure that provide high quality care to patients, CMS said in its release.

Like the Pioneer ACO Model and the Medicare Shared Savings Program, ACOs that successfully reduce the cost of care may keep some of the savings. But the next generation model uses a new formula to calculate savings targets that do not exclusively rely on historical performance. Physicians have criticized that older method as unfair to health providers who already deliver lower-cost care. The new formula will take into account regional and national efficiency, and ACOs that have already attained cost efficiency, compared with their regions, will receive a more favorable discount, according to CMS.

Beneficiaries, too, will have the chance to voluntarily align with the Next Generation ACO model by confirming their care relationship with specific ACO providers. Patients can also receive rewards, such as waived or reduced copays, for receiving their care from ACO physicians as well as coverage of skilled nursing care without prior hospitalization, and expanded coverage of telehealth and postdischarge home services. In any event, patients retain the freedom to seek services and providers of their choice.

Beneficiary incentives are a key contributor to successful care management, said Larry Kocot, a health law attorney in Washington.

“It’s really hard for a provider to be able to deliver coordinated care to a beneficiary if the beneficiary is not a full participant,” Mr. Kocot said in an interview. “In order for the beneficiary to be a full participant, [he or she] should for instance, be able to select [his or her] provider. This model will allow for that.”

Dr. Patrick Conway, chief medical officer at CMS, said the next generation ACO is a response to physicians’ feedback and requests.

“The ACO model responds to stakeholder requests for ... greater engagement of beneficiaries; a more predictable, prospective financial model; and the flexibility to utilize additional tools to coordinate care for beneficiaries,” he said in a statement.

CMS will accept ACOs into the next generation program through two rounds of applications in 2015 and 2016, with participation expected to last up to 5 years. Participants in the Medicare Shared Savings Program and the Pioneer ACO Model may apply, as well as all other groups that meet

eligibility requirements. CMS expects about 15-20 ACOs to participate in the Next Generation ACO Model.

Mr. Kocot notes that the new model will not be the best choice for physicians new to ACOs or for those in smaller communities, who cannot take on the extra risk.

“This is really limited to a small subset of providers who are able to accept a higher amount of risk,” he said in an interview. “Physician practices vary across the country; they’re not all homogeneous. It’s not going to be the option for all providers.”

The unveiling of the next generation ACO comes on the heels of an effort by the Obama administration to shift payments away from fee for service by having half of all Medicare dollars paid to doctors through alternative payment models by the end of 2018.

The new ACO model is a likely reflection of how other accountable care organizations will be structured in the future, notes Dr. Farzad Mostashari, cofounder and CEO of Aledade, an ACO consultancy. Dr. Mostashari is the former national coordinator for health information technology.

“It is a glimpse of what the whole program is going to look like in a few years’ time,” Dr. Mostashari said in an interview. “This is directionally, absolutely where the Medicare Shared Savings Program is headed.”

Those interested in applying to the next generation models in 2015 must submit a Letter of Intent by May 1 and an application by June 1. Second-round Letters of Intent and applications will be available in spring 2016. More information on the Next Generation model can be found on CMS’ Web page.

On Twitter @legal_med

The new Next Generation Accountable Care Organization (ACO) model improves upon other ACO models and allows for greater success for physicians, according to ACO experts.

“It’s a really good sign generally that CMS is willing and able to adapt to some of the major structural problems with the Medicare ACO model,” said Julian D. “Bo” Bobbitt Jr., a health law attorney in Raleigh, N.C. “Changing incentives to reward higher quality at lower cost and to align those is extraordinarily promising.”

The Next Generation ACO model offers predictable financial targets, enables providers and patients greater opportunities to coordinate care, and aims to attain the highest standards of care, according to a March 10 announcement from the Centers for Medicare & Medicaid Services. The new model means greater financial risks for doctors and hospitals in exchange for greater shared savings for high performance. To support the increased risk sharing, the new ACOs will have a stable, predictable benchmark and flexible payment options that support investments in care improvement infrastructure that provide high quality care to patients, CMS said in its release.

Like the Pioneer ACO Model and the Medicare Shared Savings Program, ACOs that successfully reduce the cost of care may keep some of the savings. But the next generation model uses a new formula to calculate savings targets that do not exclusively rely on historical performance. Physicians have criticized that older method as unfair to health providers who already deliver lower-cost care. The new formula will take into account regional and national efficiency, and ACOs that have already attained cost efficiency, compared with their regions, will receive a more favorable discount, according to CMS.

Beneficiaries, too, will have the chance to voluntarily align with the Next Generation ACO model by confirming their care relationship with specific ACO providers. Patients can also receive rewards, such as waived or reduced copays, for receiving their care from ACO physicians as well as coverage of skilled nursing care without prior hospitalization, and expanded coverage of telehealth and postdischarge home services. In any event, patients retain the freedom to seek services and providers of their choice.

Beneficiary incentives are a key contributor to successful care management, said Larry Kocot, a health law attorney in Washington.

“It’s really hard for a provider to be able to deliver coordinated care to a beneficiary if the beneficiary is not a full participant,” Mr. Kocot said in an interview. “In order for the beneficiary to be a full participant, [he or she] should for instance, be able to select [his or her] provider. This model will allow for that.”

Dr. Patrick Conway, chief medical officer at CMS, said the next generation ACO is a response to physicians’ feedback and requests.

“The ACO model responds to stakeholder requests for ... greater engagement of beneficiaries; a more predictable, prospective financial model; and the flexibility to utilize additional tools to coordinate care for beneficiaries,” he said in a statement.

CMS will accept ACOs into the next generation program through two rounds of applications in 2015 and 2016, with participation expected to last up to 5 years. Participants in the Medicare Shared Savings Program and the Pioneer ACO Model may apply, as well as all other groups that meet

eligibility requirements. CMS expects about 15-20 ACOs to participate in the Next Generation ACO Model.

Mr. Kocot notes that the new model will not be the best choice for physicians new to ACOs or for those in smaller communities, who cannot take on the extra risk.

“This is really limited to a small subset of providers who are able to accept a higher amount of risk,” he said in an interview. “Physician practices vary across the country; they’re not all homogeneous. It’s not going to be the option for all providers.”

The unveiling of the next generation ACO comes on the heels of an effort by the Obama administration to shift payments away from fee for service by having half of all Medicare dollars paid to doctors through alternative payment models by the end of 2018.

The new ACO model is a likely reflection of how other accountable care organizations will be structured in the future, notes Dr. Farzad Mostashari, cofounder and CEO of Aledade, an ACO consultancy. Dr. Mostashari is the former national coordinator for health information technology.

“It is a glimpse of what the whole program is going to look like in a few years’ time,” Dr. Mostashari said in an interview. “This is directionally, absolutely where the Medicare Shared Savings Program is headed.”

Those interested in applying to the next generation models in 2015 must submit a Letter of Intent by May 1 and an application by June 1. Second-round Letters of Intent and applications will be available in spring 2016. More information on the Next Generation model can be found on CMS’ Web page.

On Twitter @legal_med

The new Next Generation Accountable Care Organization (ACO) model improves upon other ACO models and allows for greater success for physicians, according to ACO experts.

“It’s a really good sign generally that CMS is willing and able to adapt to some of the major structural problems with the Medicare ACO model,” said Julian D. “Bo” Bobbitt Jr., a health law attorney in Raleigh, N.C. “Changing incentives to reward higher quality at lower cost and to align those is extraordinarily promising.”

The Next Generation ACO model offers predictable financial targets, enables providers and patients greater opportunities to coordinate care, and aims to attain the highest standards of care, according to a March 10 announcement from the Centers for Medicare & Medicaid Services. The new model means greater financial risks for doctors and hospitals in exchange for greater shared savings for high performance. To support the increased risk sharing, the new ACOs will have a stable, predictable benchmark and flexible payment options that support investments in care improvement infrastructure that provide high quality care to patients, CMS said in its release.

Like the Pioneer ACO Model and the Medicare Shared Savings Program, ACOs that successfully reduce the cost of care may keep some of the savings. But the next generation model uses a new formula to calculate savings targets that do not exclusively rely on historical performance. Physicians have criticized that older method as unfair to health providers who already deliver lower-cost care. The new formula will take into account regional and national efficiency, and ACOs that have already attained cost efficiency, compared with their regions, will receive a more favorable discount, according to CMS.

Beneficiaries, too, will have the chance to voluntarily align with the Next Generation ACO model by confirming their care relationship with specific ACO providers. Patients can also receive rewards, such as waived or reduced copays, for receiving their care from ACO physicians as well as coverage of skilled nursing care without prior hospitalization, and expanded coverage of telehealth and postdischarge home services. In any event, patients retain the freedom to seek services and providers of their choice.

Beneficiary incentives are a key contributor to successful care management, said Larry Kocot, a health law attorney in Washington.

“It’s really hard for a provider to be able to deliver coordinated care to a beneficiary if the beneficiary is not a full participant,” Mr. Kocot said in an interview. “In order for the beneficiary to be a full participant, [he or she] should for instance, be able to select [his or her] provider. This model will allow for that.”

Dr. Patrick Conway, chief medical officer at CMS, said the next generation ACO is a response to physicians’ feedback and requests.

“The ACO model responds to stakeholder requests for ... greater engagement of beneficiaries; a more predictable, prospective financial model; and the flexibility to utilize additional tools to coordinate care for beneficiaries,” he said in a statement.

CMS will accept ACOs into the next generation program through two rounds of applications in 2015 and 2016, with participation expected to last up to 5 years. Participants in the Medicare Shared Savings Program and the Pioneer ACO Model may apply, as well as all other groups that meet

eligibility requirements. CMS expects about 15-20 ACOs to participate in the Next Generation ACO Model.

Mr. Kocot notes that the new model will not be the best choice for physicians new to ACOs or for those in smaller communities, who cannot take on the extra risk.

“This is really limited to a small subset of providers who are able to accept a higher amount of risk,” he said in an interview. “Physician practices vary across the country; they’re not all homogeneous. It’s not going to be the option for all providers.”

The unveiling of the next generation ACO comes on the heels of an effort by the Obama administration to shift payments away from fee for service by having half of all Medicare dollars paid to doctors through alternative payment models by the end of 2018.

The new ACO model is a likely reflection of how other accountable care organizations will be structured in the future, notes Dr. Farzad Mostashari, cofounder and CEO of Aledade, an ACO consultancy. Dr. Mostashari is the former national coordinator for health information technology.

“It is a glimpse of what the whole program is going to look like in a few years’ time,” Dr. Mostashari said in an interview. “This is directionally, absolutely where the Medicare Shared Savings Program is headed.”

Those interested in applying to the next generation models in 2015 must submit a Letter of Intent by May 1 and an application by June 1. Second-round Letters of Intent and applications will be available in spring 2016. More information on the Next Generation model can be found on CMS’ Web page.

On Twitter @legal_med

Cost of ACA lowers budget deficit

The Congressional Budget Office (CBO) has reduced its budget deficit estimate over the next decade because of lower projected costs for the Affordable Care Act.

Updated projections released March 9 by the CBO find cumulative deficits between 2016 and 2025 will be $431 billion less than the office’s January projection of $7.6 trillion.

Lower costs for ACA provisions driven by smaller spending growth for insurance subsidies, the Children’s Health Insurance Program (CHIP), and Medicaid drove the reduced figure, the CBO said in an online post.

The total projected cost of ACA provisions to the federal government over the next 9 years is $1.2 billion, 11% less than CBO and the Joint Committee on Taxation estimated in January.

However, CBO predicts the annual budget deficit will rise to $486 billion in fiscal 2015, slightly higher than last year’s shortfall. The latest deficit estimate for 2015 is $18 billion higher than CBO had originally projected.

CBO said the estimated rise stems primarily from a projected rise in spending for student loans, Medicaid, and Medicare. The deficit for 2015 represents a slightly lower percentage of gross domestic product of 2.7%, compared with 2.8% last year.

On Twitter @legal_med

The Congressional Budget Office (CBO) has reduced its budget deficit estimate over the next decade because of lower projected costs for the Affordable Care Act.

Updated projections released March 9 by the CBO find cumulative deficits between 2016 and 2025 will be $431 billion less than the office’s January projection of $7.6 trillion.