User login

Conflicts of interest among FDA advisers

An investigative report has unearthed potential conflicts of interest among physicians who serve on advisory panels for the US Food and Drug Administration (FDA).

The investigation revealed that some FDA advisers are receiving significant post-hoc payments from the makers of drugs they reviewed.

The investigation also uncovered relationships between advisers and drug companies that predate drug reviews.

Journalist Charles Piller and his colleagues conducted this investigation and detailed the results in Science.

The report includes data—from the federal Open Payments website—on 107 physicians who voted on FDA advisory committees between 2013 and 2016.

Forty of these advisers received more than $10,000 in post-hoc earnings or research support from the makers of drugs they reviewed or from competing drug companies.

Twenty-six advisers received more than $100,000, and 7 advisers received more than $1 million.

The 17 top earners received more than $300,000 each. For these advisers, 94% of their earnings came from the makers of drugs they previously reviewed or from those companies’ competitors.

The data also show that some advisers received funds from drug companies concurrent with or in the year before their advisory service.

Of the 17 top-earning advisers, 11 received financial support from competing companies on one or more of the drugs they reviewed. Five advisers also received support from the makers of one or more of the drugs reviewed.

The FDA did not disclose this information to the public or issue waivers for these potential conflicts. The FDA can issue a waiver to allow the participation of an adviser with an active conflict or one that ended in the year before a vote, as long as the adviser in question can provide expertise that cannot be provided by someone else.

It is possible that the FDA dismissed the aforementioned financial ties that predated drug reviews, deciding these relationships were not conflicts and did not require a waiver. However, it is also possible that the FDA did not know about these potential conflicts.

Piller and his colleagues were unable to determine what the FDA knew, as the agency refused to release disclosure documents, discuss individual advisers, or explain what steps, if any, the FDA takes to validate advisers’ disclosures.

An investigative report has unearthed potential conflicts of interest among physicians who serve on advisory panels for the US Food and Drug Administration (FDA).

The investigation revealed that some FDA advisers are receiving significant post-hoc payments from the makers of drugs they reviewed.

The investigation also uncovered relationships between advisers and drug companies that predate drug reviews.

Journalist Charles Piller and his colleagues conducted this investigation and detailed the results in Science.

The report includes data—from the federal Open Payments website—on 107 physicians who voted on FDA advisory committees between 2013 and 2016.

Forty of these advisers received more than $10,000 in post-hoc earnings or research support from the makers of drugs they reviewed or from competing drug companies.

Twenty-six advisers received more than $100,000, and 7 advisers received more than $1 million.

The 17 top earners received more than $300,000 each. For these advisers, 94% of their earnings came from the makers of drugs they previously reviewed or from those companies’ competitors.

The data also show that some advisers received funds from drug companies concurrent with or in the year before their advisory service.

Of the 17 top-earning advisers, 11 received financial support from competing companies on one or more of the drugs they reviewed. Five advisers also received support from the makers of one or more of the drugs reviewed.

The FDA did not disclose this information to the public or issue waivers for these potential conflicts. The FDA can issue a waiver to allow the participation of an adviser with an active conflict or one that ended in the year before a vote, as long as the adviser in question can provide expertise that cannot be provided by someone else.

It is possible that the FDA dismissed the aforementioned financial ties that predated drug reviews, deciding these relationships were not conflicts and did not require a waiver. However, it is also possible that the FDA did not know about these potential conflicts.

Piller and his colleagues were unable to determine what the FDA knew, as the agency refused to release disclosure documents, discuss individual advisers, or explain what steps, if any, the FDA takes to validate advisers’ disclosures.

An investigative report has unearthed potential conflicts of interest among physicians who serve on advisory panels for the US Food and Drug Administration (FDA).

The investigation revealed that some FDA advisers are receiving significant post-hoc payments from the makers of drugs they reviewed.

The investigation also uncovered relationships between advisers and drug companies that predate drug reviews.

Journalist Charles Piller and his colleagues conducted this investigation and detailed the results in Science.

The report includes data—from the federal Open Payments website—on 107 physicians who voted on FDA advisory committees between 2013 and 2016.

Forty of these advisers received more than $10,000 in post-hoc earnings or research support from the makers of drugs they reviewed or from competing drug companies.

Twenty-six advisers received more than $100,000, and 7 advisers received more than $1 million.

The 17 top earners received more than $300,000 each. For these advisers, 94% of their earnings came from the makers of drugs they previously reviewed or from those companies’ competitors.

The data also show that some advisers received funds from drug companies concurrent with or in the year before their advisory service.

Of the 17 top-earning advisers, 11 received financial support from competing companies on one or more of the drugs they reviewed. Five advisers also received support from the makers of one or more of the drugs reviewed.

The FDA did not disclose this information to the public or issue waivers for these potential conflicts. The FDA can issue a waiver to allow the participation of an adviser with an active conflict or one that ended in the year before a vote, as long as the adviser in question can provide expertise that cannot be provided by someone else.

It is possible that the FDA dismissed the aforementioned financial ties that predated drug reviews, deciding these relationships were not conflicts and did not require a waiver. However, it is also possible that the FDA did not know about these potential conflicts.

Piller and his colleagues were unable to determine what the FDA knew, as the agency refused to release disclosure documents, discuss individual advisers, or explain what steps, if any, the FDA takes to validate advisers’ disclosures.

EC approves new use, formulation of dasatinib

The European Commission (EC) has expanded the marketing authorization for dasatinib (Sprycel).

The drug is now approved to treat patients ages 1 to 18 with Philadelphia chromosome-positive (Ph+) chronic myeloid leukemia (CML) in chronic phase (CP).

The EC has also approved a new formulation of dasatinib—a powder for oral suspension (PFOS) intended for patients who cannot swallow tablets whole or who weigh 10 kg or less.

Dasatinib is also EC-approved to treat adults with:

- Newly diagnosed Ph+ CML-CP

- Chronic, accelerated, or blast phase CML with resistance or intolerance to prior therapy, including imatinib

- Ph+ acute lymphoblastic leukemia and lymphoid blast CML with resistance or intolerance to prior therapy.

The EC’s latest approval of dasatinib is supported by results from a phase 2 trial (NCT00777036), which were published in the Journal of Clinical Oncology in March.

The trial included 29 patients with imatinib-resistant/intolerant CML-CP and 84 patients with newly diagnosed CML-CP.

The previously treated patients received dasatinib tablets. Newly diagnosed patients were treated with dasatinib tablets (n=51) or PFOS (n=33).

Patients who started on PFOS could switch to tablets after receiving PFOS for at least 1 year. Sixty-seven percent of patients on PFOS switched to tablets due to patient preference.

The average daily dose of dasatinib was 58.18 mg/m2 in the previously treated patients and 59.84 mg/m2 in the newly diagnosed patients (for both tablets and PFOS). The median duration of treatment was 49.91 months (range, 1.9 to 90.2) and 42.30 months (range, 0.1 to 75.2), respectively.

Rates of confirmed complete hematologic response (CHR) at any time were 93% in the previously treated patients and 96% in the newly diagnosed patients.

At 12 months, previously treated patients had a major molecular response (MMR) rate of 41% and a complete molecular response (CMR) rate of 7%. In newly diagnosed patients, MMR was 52%, and CMR was 8%.

At 24 months, previously treated patients had an MMR rate of 55% and a CMR rate of 17%. In the newly diagnosed patients, MMR was 70%, and CMR was 21%.

The rate of major cytogenetic response (MCyR) at any time was 89.7% in all previously treated patients and 90% when the researchers excluded patients with MCyR or unknown cytogenetic status at baseline.

The rate of complete cytogenetic response (CCyR) at any time was 94% in all newly diagnosed patients and 93.9% when the researchers excluded patients with CCyR or unknown cytogenetic status at baseline.

The median progression-free survival and overall survival had not been reached at last follow-up.

The estimated 48-month progression-free survival was 78% in the previously treated patients and 93% in the newly diagnosed patients. The estimated 48-month overall survival was 96% and 100%, respectively.

Dasatinib-related adverse events (AEs) occurring in at least 10% of the previously treated patients included nausea/vomiting (31%), myalgia/arthralgia (17%), fatigue (14%), rash (14%), diarrhea (14%), hemorrhage (10%), bone growth and development events (10%), and shortness of breath (10%).

Dasatinib-related AEs occurring in at least 10% of the newly diagnosed patients included nausea/vomiting (20%), myalgia/arthralgia (10%), fatigue (11%), rash (19%), diarrhea (18%), and hemorrhage (10%).

The European Commission (EC) has expanded the marketing authorization for dasatinib (Sprycel).

The drug is now approved to treat patients ages 1 to 18 with Philadelphia chromosome-positive (Ph+) chronic myeloid leukemia (CML) in chronic phase (CP).

The EC has also approved a new formulation of dasatinib—a powder for oral suspension (PFOS) intended for patients who cannot swallow tablets whole or who weigh 10 kg or less.

Dasatinib is also EC-approved to treat adults with:

- Newly diagnosed Ph+ CML-CP

- Chronic, accelerated, or blast phase CML with resistance or intolerance to prior therapy, including imatinib

- Ph+ acute lymphoblastic leukemia and lymphoid blast CML with resistance or intolerance to prior therapy.

The EC’s latest approval of dasatinib is supported by results from a phase 2 trial (NCT00777036), which were published in the Journal of Clinical Oncology in March.

The trial included 29 patients with imatinib-resistant/intolerant CML-CP and 84 patients with newly diagnosed CML-CP.

The previously treated patients received dasatinib tablets. Newly diagnosed patients were treated with dasatinib tablets (n=51) or PFOS (n=33).

Patients who started on PFOS could switch to tablets after receiving PFOS for at least 1 year. Sixty-seven percent of patients on PFOS switched to tablets due to patient preference.

The average daily dose of dasatinib was 58.18 mg/m2 in the previously treated patients and 59.84 mg/m2 in the newly diagnosed patients (for both tablets and PFOS). The median duration of treatment was 49.91 months (range, 1.9 to 90.2) and 42.30 months (range, 0.1 to 75.2), respectively.

Rates of confirmed complete hematologic response (CHR) at any time were 93% in the previously treated patients and 96% in the newly diagnosed patients.

At 12 months, previously treated patients had a major molecular response (MMR) rate of 41% and a complete molecular response (CMR) rate of 7%. In newly diagnosed patients, MMR was 52%, and CMR was 8%.

At 24 months, previously treated patients had an MMR rate of 55% and a CMR rate of 17%. In the newly diagnosed patients, MMR was 70%, and CMR was 21%.

The rate of major cytogenetic response (MCyR) at any time was 89.7% in all previously treated patients and 90% when the researchers excluded patients with MCyR or unknown cytogenetic status at baseline.

The rate of complete cytogenetic response (CCyR) at any time was 94% in all newly diagnosed patients and 93.9% when the researchers excluded patients with CCyR or unknown cytogenetic status at baseline.

The median progression-free survival and overall survival had not been reached at last follow-up.

The estimated 48-month progression-free survival was 78% in the previously treated patients and 93% in the newly diagnosed patients. The estimated 48-month overall survival was 96% and 100%, respectively.

Dasatinib-related adverse events (AEs) occurring in at least 10% of the previously treated patients included nausea/vomiting (31%), myalgia/arthralgia (17%), fatigue (14%), rash (14%), diarrhea (14%), hemorrhage (10%), bone growth and development events (10%), and shortness of breath (10%).

Dasatinib-related AEs occurring in at least 10% of the newly diagnosed patients included nausea/vomiting (20%), myalgia/arthralgia (10%), fatigue (11%), rash (19%), diarrhea (18%), and hemorrhage (10%).

The European Commission (EC) has expanded the marketing authorization for dasatinib (Sprycel).

The drug is now approved to treat patients ages 1 to 18 with Philadelphia chromosome-positive (Ph+) chronic myeloid leukemia (CML) in chronic phase (CP).

The EC has also approved a new formulation of dasatinib—a powder for oral suspension (PFOS) intended for patients who cannot swallow tablets whole or who weigh 10 kg or less.

Dasatinib is also EC-approved to treat adults with:

- Newly diagnosed Ph+ CML-CP

- Chronic, accelerated, or blast phase CML with resistance or intolerance to prior therapy, including imatinib

- Ph+ acute lymphoblastic leukemia and lymphoid blast CML with resistance or intolerance to prior therapy.

The EC’s latest approval of dasatinib is supported by results from a phase 2 trial (NCT00777036), which were published in the Journal of Clinical Oncology in March.

The trial included 29 patients with imatinib-resistant/intolerant CML-CP and 84 patients with newly diagnosed CML-CP.

The previously treated patients received dasatinib tablets. Newly diagnosed patients were treated with dasatinib tablets (n=51) or PFOS (n=33).

Patients who started on PFOS could switch to tablets after receiving PFOS for at least 1 year. Sixty-seven percent of patients on PFOS switched to tablets due to patient preference.

The average daily dose of dasatinib was 58.18 mg/m2 in the previously treated patients and 59.84 mg/m2 in the newly diagnosed patients (for both tablets and PFOS). The median duration of treatment was 49.91 months (range, 1.9 to 90.2) and 42.30 months (range, 0.1 to 75.2), respectively.

Rates of confirmed complete hematologic response (CHR) at any time were 93% in the previously treated patients and 96% in the newly diagnosed patients.

At 12 months, previously treated patients had a major molecular response (MMR) rate of 41% and a complete molecular response (CMR) rate of 7%. In newly diagnosed patients, MMR was 52%, and CMR was 8%.

At 24 months, previously treated patients had an MMR rate of 55% and a CMR rate of 17%. In the newly diagnosed patients, MMR was 70%, and CMR was 21%.

The rate of major cytogenetic response (MCyR) at any time was 89.7% in all previously treated patients and 90% when the researchers excluded patients with MCyR or unknown cytogenetic status at baseline.

The rate of complete cytogenetic response (CCyR) at any time was 94% in all newly diagnosed patients and 93.9% when the researchers excluded patients with CCyR or unknown cytogenetic status at baseline.

The median progression-free survival and overall survival had not been reached at last follow-up.

The estimated 48-month progression-free survival was 78% in the previously treated patients and 93% in the newly diagnosed patients. The estimated 48-month overall survival was 96% and 100%, respectively.

Dasatinib-related adverse events (AEs) occurring in at least 10% of the previously treated patients included nausea/vomiting (31%), myalgia/arthralgia (17%), fatigue (14%), rash (14%), diarrhea (14%), hemorrhage (10%), bone growth and development events (10%), and shortness of breath (10%).

Dasatinib-related AEs occurring in at least 10% of the newly diagnosed patients included nausea/vomiting (20%), myalgia/arthralgia (10%), fatigue (11%), rash (19%), diarrhea (18%), and hemorrhage (10%).

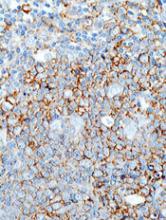

CHMP recommends CAR T for ALL, DLBCL

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended the approval of tisagenlecleucel (Kymriah®, formerly CTL019) for 2 indications.

According to the CHMP, the chimeric antigen receptor (CAR) T-cell therapy should be approved to treat adults with relapsed/refractory diffuse large B-cell lymphoma (DLBCL) who have received 2 or more lines of systemic therapy and patients up to 25 years of age who have B-cell acute lymphoblastic leukemia (ALL) that is refractory, in relapse post-transplant, or in second or later relapse.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

The CHMP’s recommendation is based on results from a pair of phase 2 trials—ELIANA and JULIET.

JULIET trial

Updated results from JULIET were presented at the recent 23rd Annual Congress of the European Hematology Association (EHA) as abstract S799.

The trial enrolled 165 adults with relapsed/refractory DLBCL, and 111 of them received a single infusion of tisagenlecleucel. Most of the patients who discontinued before dosing did so due to disease progression or clinical deterioration. The patients’ median age at baseline was 56 (range, 22-76).

Ninety-two percent of patients received bridging therapy, and 93% received lymphodepleting chemotherapy prior to tisagenlecleucel.

The median time from infusion to data cutoff was 13.9 months.

The overall response rate was 52%, and the complete response (CR) rate was 40%. Of the patients in CR at month 3, 83% remained in CR at month 12. The median duration of response was not reached.

At the time of data cutoff, none of the responders had proceeded to stem cell transplant.

For all infused patients (n=111), the 12-month overall survival (OS) rate was 49%, and the median OS was 11.7 months. The median OS was not reached for patients in CR.

Within 8 weeks of tisagenlecleucel infusion, 22% of patients had developed grade 3/4 cytokine release syndrome (CRS). Fifteen percent of patients received tocilizumab for CRS, including 3% of patients with grade 2 CRS and 50% of patients with grade 3 CRS.

Other adverse events (AEs) of interest included grade 3/4 neurologic events (12%), grade 3/4 cytopenias lasting more than 28 days (32%), grade 3/4 infections (20%), and grade 3/4 febrile neutropenia (15%).

ELIANA trial

Updated results from ELIANA were published in NEJM in February.

The trial included 75 children and young adults with relapsed/refractory ALL. The patients’ median age was 11 (range, 3 to 23).

All 75 patients received a single infusion of tisagenlecleucel, and 72 received lymphodepleting chemotherapy.

The median duration of follow-up was 13.1 months. The study’s primary endpoint was overall remission rate, which was defined as the rate of a best overall response of either CR or CR with incomplete hematologic recovery (CRi) within 3 months.

The overall remission rate was 81% (61/75), with 60% of patients (n=45) achieving a CR and 21% (n=16) achieving a CRi.

All patients whose best response was CR/CRi were negative for minimal residual disease. The median duration of response was not met.

Eight patients proceeded to transplant while in remission. At last follow-up, 4 were still in remission, and 4 had unknown disease status.

At 6 months, the event-free survival rate was 73%, and the OS rate was 90%. At 12 months, the rates were 50% and 76%, respectively.

All patients experienced at least 1 AE, and 95% had AEs thought to be related to tisagenlecleucel. The rate of grade 3/4 AEs was 88%, and the rate of related grade 3/4 AEs was 73%.

AEs of special interest included CRS (77%), neurologic events (40%), infections (43%), febrile neutropenia (35%), cytopenias not resolved by day 28 (37%), and tumor lysis syndrome (4%).

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended the approval of tisagenlecleucel (Kymriah®, formerly CTL019) for 2 indications.

According to the CHMP, the chimeric antigen receptor (CAR) T-cell therapy should be approved to treat adults with relapsed/refractory diffuse large B-cell lymphoma (DLBCL) who have received 2 or more lines of systemic therapy and patients up to 25 years of age who have B-cell acute lymphoblastic leukemia (ALL) that is refractory, in relapse post-transplant, or in second or later relapse.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

The CHMP’s recommendation is based on results from a pair of phase 2 trials—ELIANA and JULIET.

JULIET trial

Updated results from JULIET were presented at the recent 23rd Annual Congress of the European Hematology Association (EHA) as abstract S799.

The trial enrolled 165 adults with relapsed/refractory DLBCL, and 111 of them received a single infusion of tisagenlecleucel. Most of the patients who discontinued before dosing did so due to disease progression or clinical deterioration. The patients’ median age at baseline was 56 (range, 22-76).

Ninety-two percent of patients received bridging therapy, and 93% received lymphodepleting chemotherapy prior to tisagenlecleucel.

The median time from infusion to data cutoff was 13.9 months.

The overall response rate was 52%, and the complete response (CR) rate was 40%. Of the patients in CR at month 3, 83% remained in CR at month 12. The median duration of response was not reached.

At the time of data cutoff, none of the responders had proceeded to stem cell transplant.

For all infused patients (n=111), the 12-month overall survival (OS) rate was 49%, and the median OS was 11.7 months. The median OS was not reached for patients in CR.

Within 8 weeks of tisagenlecleucel infusion, 22% of patients had developed grade 3/4 cytokine release syndrome (CRS). Fifteen percent of patients received tocilizumab for CRS, including 3% of patients with grade 2 CRS and 50% of patients with grade 3 CRS.

Other adverse events (AEs) of interest included grade 3/4 neurologic events (12%), grade 3/4 cytopenias lasting more than 28 days (32%), grade 3/4 infections (20%), and grade 3/4 febrile neutropenia (15%).

ELIANA trial

Updated results from ELIANA were published in NEJM in February.

The trial included 75 children and young adults with relapsed/refractory ALL. The patients’ median age was 11 (range, 3 to 23).

All 75 patients received a single infusion of tisagenlecleucel, and 72 received lymphodepleting chemotherapy.

The median duration of follow-up was 13.1 months. The study’s primary endpoint was overall remission rate, which was defined as the rate of a best overall response of either CR or CR with incomplete hematologic recovery (CRi) within 3 months.

The overall remission rate was 81% (61/75), with 60% of patients (n=45) achieving a CR and 21% (n=16) achieving a CRi.

All patients whose best response was CR/CRi were negative for minimal residual disease. The median duration of response was not met.

Eight patients proceeded to transplant while in remission. At last follow-up, 4 were still in remission, and 4 had unknown disease status.

At 6 months, the event-free survival rate was 73%, and the OS rate was 90%. At 12 months, the rates were 50% and 76%, respectively.

All patients experienced at least 1 AE, and 95% had AEs thought to be related to tisagenlecleucel. The rate of grade 3/4 AEs was 88%, and the rate of related grade 3/4 AEs was 73%.

AEs of special interest included CRS (77%), neurologic events (40%), infections (43%), febrile neutropenia (35%), cytopenias not resolved by day 28 (37%), and tumor lysis syndrome (4%).

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended the approval of tisagenlecleucel (Kymriah®, formerly CTL019) for 2 indications.

According to the CHMP, the chimeric antigen receptor (CAR) T-cell therapy should be approved to treat adults with relapsed/refractory diffuse large B-cell lymphoma (DLBCL) who have received 2 or more lines of systemic therapy and patients up to 25 years of age who have B-cell acute lymphoblastic leukemia (ALL) that is refractory, in relapse post-transplant, or in second or later relapse.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

The CHMP’s recommendation is based on results from a pair of phase 2 trials—ELIANA and JULIET.

JULIET trial

Updated results from JULIET were presented at the recent 23rd Annual Congress of the European Hematology Association (EHA) as abstract S799.

The trial enrolled 165 adults with relapsed/refractory DLBCL, and 111 of them received a single infusion of tisagenlecleucel. Most of the patients who discontinued before dosing did so due to disease progression or clinical deterioration. The patients’ median age at baseline was 56 (range, 22-76).

Ninety-two percent of patients received bridging therapy, and 93% received lymphodepleting chemotherapy prior to tisagenlecleucel.

The median time from infusion to data cutoff was 13.9 months.

The overall response rate was 52%, and the complete response (CR) rate was 40%. Of the patients in CR at month 3, 83% remained in CR at month 12. The median duration of response was not reached.

At the time of data cutoff, none of the responders had proceeded to stem cell transplant.

For all infused patients (n=111), the 12-month overall survival (OS) rate was 49%, and the median OS was 11.7 months. The median OS was not reached for patients in CR.

Within 8 weeks of tisagenlecleucel infusion, 22% of patients had developed grade 3/4 cytokine release syndrome (CRS). Fifteen percent of patients received tocilizumab for CRS, including 3% of patients with grade 2 CRS and 50% of patients with grade 3 CRS.

Other adverse events (AEs) of interest included grade 3/4 neurologic events (12%), grade 3/4 cytopenias lasting more than 28 days (32%), grade 3/4 infections (20%), and grade 3/4 febrile neutropenia (15%).

ELIANA trial

Updated results from ELIANA were published in NEJM in February.

The trial included 75 children and young adults with relapsed/refractory ALL. The patients’ median age was 11 (range, 3 to 23).

All 75 patients received a single infusion of tisagenlecleucel, and 72 received lymphodepleting chemotherapy.

The median duration of follow-up was 13.1 months. The study’s primary endpoint was overall remission rate, which was defined as the rate of a best overall response of either CR or CR with incomplete hematologic recovery (CRi) within 3 months.

The overall remission rate was 81% (61/75), with 60% of patients (n=45) achieving a CR and 21% (n=16) achieving a CRi.

All patients whose best response was CR/CRi were negative for minimal residual disease. The median duration of response was not met.

Eight patients proceeded to transplant while in remission. At last follow-up, 4 were still in remission, and 4 had unknown disease status.

At 6 months, the event-free survival rate was 73%, and the OS rate was 90%. At 12 months, the rates were 50% and 76%, respectively.

All patients experienced at least 1 AE, and 95% had AEs thought to be related to tisagenlecleucel. The rate of grade 3/4 AEs was 88%, and the rate of related grade 3/4 AEs was 73%.

AEs of special interest included CRS (77%), neurologic events (40%), infections (43%), febrile neutropenia (35%), cytopenias not resolved by day 28 (37%), and tumor lysis syndrome (4%).

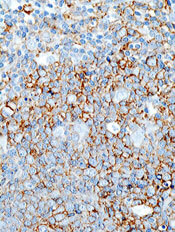

CHMP recommends CAR T for DLBCL, PMBCL

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended approval for the chimeric antigen receptor (CAR) T-cell therapy axicabtagene ciloleucel (Yescarta®, formerly KTE-C19).

The recommendation pertains to axicabtagene ciloleucel as a treatment for adults with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) or primary mediastinal large B-cell lymphoma (PMBCL) who have received 2 or more lines of systemic therapy.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

The marketing authorization application for axicabtagene ciloleucel is supported by data from the ZUMA-1 trial.

Results from this phase 2 trial were presented at the 2017 ASH Annual Meeting and published simultaneously in NEJM.

The trial enrolled 111 patients with relapsed/refractory B-cell lymphomas. There were 101 patients who received axicabtagene ciloleucel—77 with DLBCL, 8 with PMBCL, and 16 with transformed follicular lymphoma (TFL).

Patients received conditioning with low-dose cyclophosphamide and fludarabine, followed by axicabtagene ciloleucel.

The objective response rate (ORR) was 82% (n=83), and the complete response (CR) rate was 54% (n=55).

Among the DLBCL patients, the ORR was 82% (63/77), and the CR rate was 49% (38/77). In the patients with PMBCL or TFL, the ORR was 83% (20/24), and the CR rate was 71% (17/24).

With a median follow-up of 15.4 months, 42% of patients retained their response, and 40% retained a CR.

At 18 months, the overall survival was 52%. Most deaths were due to disease progression.

However, 2 patients died of adverse events related to axicabtagene ciloleucel, both cytokine release syndrome (CRS).

The most common grade 3 or higher adverse events were neutropenia (78%), anemia (43%), thrombocytopenia (38%), and febrile neutropenia (31%).

Grade 3 or higher CRS occurred in 13% of patients, and grade 3 or higher neurologic events occurred in 28%.

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended approval for the chimeric antigen receptor (CAR) T-cell therapy axicabtagene ciloleucel (Yescarta®, formerly KTE-C19).

The recommendation pertains to axicabtagene ciloleucel as a treatment for adults with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) or primary mediastinal large B-cell lymphoma (PMBCL) who have received 2 or more lines of systemic therapy.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

The marketing authorization application for axicabtagene ciloleucel is supported by data from the ZUMA-1 trial.

Results from this phase 2 trial were presented at the 2017 ASH Annual Meeting and published simultaneously in NEJM.

The trial enrolled 111 patients with relapsed/refractory B-cell lymphomas. There were 101 patients who received axicabtagene ciloleucel—77 with DLBCL, 8 with PMBCL, and 16 with transformed follicular lymphoma (TFL).

Patients received conditioning with low-dose cyclophosphamide and fludarabine, followed by axicabtagene ciloleucel.

The objective response rate (ORR) was 82% (n=83), and the complete response (CR) rate was 54% (n=55).

Among the DLBCL patients, the ORR was 82% (63/77), and the CR rate was 49% (38/77). In the patients with PMBCL or TFL, the ORR was 83% (20/24), and the CR rate was 71% (17/24).

With a median follow-up of 15.4 months, 42% of patients retained their response, and 40% retained a CR.

At 18 months, the overall survival was 52%. Most deaths were due to disease progression.

However, 2 patients died of adverse events related to axicabtagene ciloleucel, both cytokine release syndrome (CRS).

The most common grade 3 or higher adverse events were neutropenia (78%), anemia (43%), thrombocytopenia (38%), and febrile neutropenia (31%).

Grade 3 or higher CRS occurred in 13% of patients, and grade 3 or higher neurologic events occurred in 28%.

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended approval for the chimeric antigen receptor (CAR) T-cell therapy axicabtagene ciloleucel (Yescarta®, formerly KTE-C19).

The recommendation pertains to axicabtagene ciloleucel as a treatment for adults with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) or primary mediastinal large B-cell lymphoma (PMBCL) who have received 2 or more lines of systemic therapy.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

The marketing authorization application for axicabtagene ciloleucel is supported by data from the ZUMA-1 trial.

Results from this phase 2 trial were presented at the 2017 ASH Annual Meeting and published simultaneously in NEJM.

The trial enrolled 111 patients with relapsed/refractory B-cell lymphomas. There were 101 patients who received axicabtagene ciloleucel—77 with DLBCL, 8 with PMBCL, and 16 with transformed follicular lymphoma (TFL).

Patients received conditioning with low-dose cyclophosphamide and fludarabine, followed by axicabtagene ciloleucel.

The objective response rate (ORR) was 82% (n=83), and the complete response (CR) rate was 54% (n=55).

Among the DLBCL patients, the ORR was 82% (63/77), and the CR rate was 49% (38/77). In the patients with PMBCL or TFL, the ORR was 83% (20/24), and the CR rate was 71% (17/24).

With a median follow-up of 15.4 months, 42% of patients retained their response, and 40% retained a CR.

At 18 months, the overall survival was 52%. Most deaths were due to disease progression.

However, 2 patients died of adverse events related to axicabtagene ciloleucel, both cytokine release syndrome (CRS).

The most common grade 3 or higher adverse events were neutropenia (78%), anemia (43%), thrombocytopenia (38%), and febrile neutropenia (31%).

Grade 3 or higher CRS occurred in 13% of patients, and grade 3 or higher neurologic events occurred in 28%.

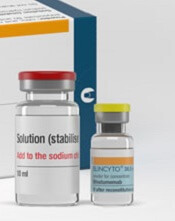

CHMP backs expanded approval of tocilizumab

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended expanding the approved use of tocilizumab (RoActemra).

The recommendation is for tocilizumab to treat adults and pediatric patients age 2 and older who have severe or life-threatening cytokine release syndrome (CRS) induced by chimeric antigen receptor (CAR) T-cell therapy.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

Tocilizumab is a humanized interleukin-6 receptor antagonist marketed by Roche Registration GmbH.

The drug is already approved by the European Commission to treat rheumatoid arthritis, active systemic juvenile idiopathic arthritis, and juvenile idiopathic polyarthritis.

The CHMP’s recommendation to expand the approved use of tocilizumab is supported by results from a retrospective analysis of data from clinical trials of CAR T-cell therapies in patients with hematologic malignancies.

For this analysis, researchers assessed 45 pediatric and adult patients treated with tocilizumab, with or without additional high-dose corticosteroids, for severe or life-threatening CRS.

Thirty-one patients (69%) achieved a response, defined as resolution of CRS within 14 days of the first dose of tocilizumab.

No more than 2 doses of tocilizumab were needed, and no drugs other than tocilizumab and corticosteroids were used for treatment.

No adverse reactions related to tocilizumab were reported.

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended expanding the approved use of tocilizumab (RoActemra).

The recommendation is for tocilizumab to treat adults and pediatric patients age 2 and older who have severe or life-threatening cytokine release syndrome (CRS) induced by chimeric antigen receptor (CAR) T-cell therapy.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

Tocilizumab is a humanized interleukin-6 receptor antagonist marketed by Roche Registration GmbH.

The drug is already approved by the European Commission to treat rheumatoid arthritis, active systemic juvenile idiopathic arthritis, and juvenile idiopathic polyarthritis.

The CHMP’s recommendation to expand the approved use of tocilizumab is supported by results from a retrospective analysis of data from clinical trials of CAR T-cell therapies in patients with hematologic malignancies.

For this analysis, researchers assessed 45 pediatric and adult patients treated with tocilizumab, with or without additional high-dose corticosteroids, for severe or life-threatening CRS.

Thirty-one patients (69%) achieved a response, defined as resolution of CRS within 14 days of the first dose of tocilizumab.

No more than 2 doses of tocilizumab were needed, and no drugs other than tocilizumab and corticosteroids were used for treatment.

No adverse reactions related to tocilizumab were reported.

The European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has recommended expanding the approved use of tocilizumab (RoActemra).

The recommendation is for tocilizumab to treat adults and pediatric patients age 2 and older who have severe or life-threatening cytokine release syndrome (CRS) induced by chimeric antigen receptor (CAR) T-cell therapy.

The CHMP’s recommendation will be reviewed by the European Commission, which has the authority to approve medicines for use in the European Union, Norway, Iceland, and Liechtenstein.

The European Commission usually makes a decision within 67 days of the CHMP’s recommendation.

Tocilizumab is a humanized interleukin-6 receptor antagonist marketed by Roche Registration GmbH.

The drug is already approved by the European Commission to treat rheumatoid arthritis, active systemic juvenile idiopathic arthritis, and juvenile idiopathic polyarthritis.

The CHMP’s recommendation to expand the approved use of tocilizumab is supported by results from a retrospective analysis of data from clinical trials of CAR T-cell therapies in patients with hematologic malignancies.

For this analysis, researchers assessed 45 pediatric and adult patients treated with tocilizumab, with or without additional high-dose corticosteroids, for severe or life-threatening CRS.

Thirty-one patients (69%) achieved a response, defined as resolution of CRS within 14 days of the first dose of tocilizumab.

No more than 2 doses of tocilizumab were needed, and no drugs other than tocilizumab and corticosteroids were used for treatment.

No adverse reactions related to tocilizumab were reported.

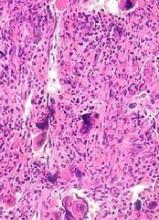

EC grants blinatumomab full approval

The European Commission (EC) has granted a full marketing authorization for blinatumomab (BLINCYTO®) as a treatment for adults with Philadelphia chromosome-negative (Ph-), relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL).

The EC granted blinatumomab conditional authorization for this indication in 2015. Now, the drug has full authorization based on overall survival (OS) data from the phase 3 TOWER study.

This authorization is valid in all European Union and European Economic Area-European Free Trade Association states (Norway, Iceland, and Liechtenstein).

Blinatumomab is a bispecific CD19-directed CD3 T cell engager (BiTE®) immunotherapy construct. It binds to CD19 expressed on the surface of cells of B-lineage origin and CD3 expressed on the surface of effector T cells.

The TOWER study was a phase 3, randomized trial in which researchers compared blinatumomab to standard of care (SOC) chemotherapy in 405 adults with Ph-, relapsed/refractory B-cell precursor ALL.

Patients were randomized in a 2:1 ratio to receive blinatumomab (n=271) or investigator’s choice of SOC chemotherapy (n=134).

On the recommendation of an independent data monitoring committee, Amgen ended the study early for evidence of superior efficacy in the blinatumomab arm.

The median OS was 7.7 months in the blinatumomab arm and 4 months in the SOC arm (hazard ratio=0.71; P=0.012).

For patients treated in first salvage, the median OS was 11.1 months in the blinatumomab arm and 5.3 months in the SOC arm (hazard ratio=0.6).

Safety results in the blinatumomab arm were comparable to those seen in previous phase 2 studies.

These results were published in NEJM in March 2017.

The European Commission (EC) has granted a full marketing authorization for blinatumomab (BLINCYTO®) as a treatment for adults with Philadelphia chromosome-negative (Ph-), relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL).

The EC granted blinatumomab conditional authorization for this indication in 2015. Now, the drug has full authorization based on overall survival (OS) data from the phase 3 TOWER study.

This authorization is valid in all European Union and European Economic Area-European Free Trade Association states (Norway, Iceland, and Liechtenstein).

Blinatumomab is a bispecific CD19-directed CD3 T cell engager (BiTE®) immunotherapy construct. It binds to CD19 expressed on the surface of cells of B-lineage origin and CD3 expressed on the surface of effector T cells.

The TOWER study was a phase 3, randomized trial in which researchers compared blinatumomab to standard of care (SOC) chemotherapy in 405 adults with Ph-, relapsed/refractory B-cell precursor ALL.

Patients were randomized in a 2:1 ratio to receive blinatumomab (n=271) or investigator’s choice of SOC chemotherapy (n=134).

On the recommendation of an independent data monitoring committee, Amgen ended the study early for evidence of superior efficacy in the blinatumomab arm.

The median OS was 7.7 months in the blinatumomab arm and 4 months in the SOC arm (hazard ratio=0.71; P=0.012).

For patients treated in first salvage, the median OS was 11.1 months in the blinatumomab arm and 5.3 months in the SOC arm (hazard ratio=0.6).

Safety results in the blinatumomab arm were comparable to those seen in previous phase 2 studies.

These results were published in NEJM in March 2017.

The European Commission (EC) has granted a full marketing authorization for blinatumomab (BLINCYTO®) as a treatment for adults with Philadelphia chromosome-negative (Ph-), relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL).

The EC granted blinatumomab conditional authorization for this indication in 2015. Now, the drug has full authorization based on overall survival (OS) data from the phase 3 TOWER study.

This authorization is valid in all European Union and European Economic Area-European Free Trade Association states (Norway, Iceland, and Liechtenstein).

Blinatumomab is a bispecific CD19-directed CD3 T cell engager (BiTE®) immunotherapy construct. It binds to CD19 expressed on the surface of cells of B-lineage origin and CD3 expressed on the surface of effector T cells.

The TOWER study was a phase 3, randomized trial in which researchers compared blinatumomab to standard of care (SOC) chemotherapy in 405 adults with Ph-, relapsed/refractory B-cell precursor ALL.

Patients were randomized in a 2:1 ratio to receive blinatumomab (n=271) or investigator’s choice of SOC chemotherapy (n=134).

On the recommendation of an independent data monitoring committee, Amgen ended the study early for evidence of superior efficacy in the blinatumomab arm.

The median OS was 7.7 months in the blinatumomab arm and 4 months in the SOC arm (hazard ratio=0.71; P=0.012).

For patients treated in first salvage, the median OS was 11.1 months in the blinatumomab arm and 5.3 months in the SOC arm (hazard ratio=0.6).

Safety results in the blinatumomab arm were comparable to those seen in previous phase 2 studies.

These results were published in NEJM in March 2017.

PU-H71 receives orphan drug designation for myelofibrosis

The US Food and Drug Administration (FDA) has granted orphan drug designation to PU-H71 to treat patients with myelofibrosis.

The drug specifically targets the epichaperome, a network of high-molecular-weight complexes found in multiple diseases, including cancer and neurologic disorders. These complexes enhance cellular survival, irrespective of tissue of origin or genetic background.

According to research published in Nature Reviews Cancer, Pu-H71 interferes with the epichaperome function in diseases and does not affect normal cells.

PU-H71 is being evaluated in a phase 1b trial in myelofibrosis and advanced metastatic breast cancer.

“In myelofibrosis, the epichaperome plays a central role in optimizing the JAK-STAT pathway,” said Srdan Verstovsek, MD, PhD, “allowing JAK2 to form dimers that evade inhibition with a JAK2 inhibitor such as ruxolitinib.”

“By inhibiting epichaperome function and breaking this mechanism, we believe PU-H71 can increase anti-cancer activity of JAK2 inhibitors,” he said. Dr Verstovsek, of the MD Anderson Cancer Center in Houston, Texas, is lead clinical research advisor for the phase 1b myelofibrosis study.

Phase 1b Study (NCT01393509)

This is a multicenter study designed to assess the safety, tolerability, pharmacokinetic and preliminary efficacy of PU-H71 in patients taking concomitant ruxolitinib.

The safety expansion phase of the trial is open for accrual only to patients with myeloproliferative neoplasms (MPNs).

These patients must have been on ruxolitinib for at least 3 months, be on a stable dose for at least 1 month prior to enrollment and be taking at least 5 mg twice daily.

Patients must have persistent disease manifestations, despite ruxolitinib therapy. These include persistent splenomegaly, abnormal blood counts, persistent constitutional symptoms, residual fibrosis in bone marrow (2+ or greater), or measurable allele burden as evidenced by clonal JAK2 or MPL mutation.

Samus Therapeutics, the developer of PU-H71, announced, simultaneously with the orphan drug designation, the dosing of the first patient in the phase 1b myelofibrosis study.

“Targeting the epichaperome offers an exciting new avenue for treating myelofibrosis and related diseases,” Dr Verstovsek said.

“I look forward to seeing how the combination of these therapies can affect outcomes in patients for whom this resistance is associated with poor prognoses.”

The US Food and Drug Administration (FDA) has granted orphan drug designation to PU-H71 to treat patients with myelofibrosis.

The drug specifically targets the epichaperome, a network of high-molecular-weight complexes found in multiple diseases, including cancer and neurologic disorders. These complexes enhance cellular survival, irrespective of tissue of origin or genetic background.

According to research published in Nature Reviews Cancer, Pu-H71 interferes with the epichaperome function in diseases and does not affect normal cells.

PU-H71 is being evaluated in a phase 1b trial in myelofibrosis and advanced metastatic breast cancer.

“In myelofibrosis, the epichaperome plays a central role in optimizing the JAK-STAT pathway,” said Srdan Verstovsek, MD, PhD, “allowing JAK2 to form dimers that evade inhibition with a JAK2 inhibitor such as ruxolitinib.”

“By inhibiting epichaperome function and breaking this mechanism, we believe PU-H71 can increase anti-cancer activity of JAK2 inhibitors,” he said. Dr Verstovsek, of the MD Anderson Cancer Center in Houston, Texas, is lead clinical research advisor for the phase 1b myelofibrosis study.

Phase 1b Study (NCT01393509)

This is a multicenter study designed to assess the safety, tolerability, pharmacokinetic and preliminary efficacy of PU-H71 in patients taking concomitant ruxolitinib.

The safety expansion phase of the trial is open for accrual only to patients with myeloproliferative neoplasms (MPNs).

These patients must have been on ruxolitinib for at least 3 months, be on a stable dose for at least 1 month prior to enrollment and be taking at least 5 mg twice daily.

Patients must have persistent disease manifestations, despite ruxolitinib therapy. These include persistent splenomegaly, abnormal blood counts, persistent constitutional symptoms, residual fibrosis in bone marrow (2+ or greater), or measurable allele burden as evidenced by clonal JAK2 or MPL mutation.

Samus Therapeutics, the developer of PU-H71, announced, simultaneously with the orphan drug designation, the dosing of the first patient in the phase 1b myelofibrosis study.

“Targeting the epichaperome offers an exciting new avenue for treating myelofibrosis and related diseases,” Dr Verstovsek said.

“I look forward to seeing how the combination of these therapies can affect outcomes in patients for whom this resistance is associated with poor prognoses.”

The US Food and Drug Administration (FDA) has granted orphan drug designation to PU-H71 to treat patients with myelofibrosis.

The drug specifically targets the epichaperome, a network of high-molecular-weight complexes found in multiple diseases, including cancer and neurologic disorders. These complexes enhance cellular survival, irrespective of tissue of origin or genetic background.

According to research published in Nature Reviews Cancer, Pu-H71 interferes with the epichaperome function in diseases and does not affect normal cells.

PU-H71 is being evaluated in a phase 1b trial in myelofibrosis and advanced metastatic breast cancer.

“In myelofibrosis, the epichaperome plays a central role in optimizing the JAK-STAT pathway,” said Srdan Verstovsek, MD, PhD, “allowing JAK2 to form dimers that evade inhibition with a JAK2 inhibitor such as ruxolitinib.”

“By inhibiting epichaperome function and breaking this mechanism, we believe PU-H71 can increase anti-cancer activity of JAK2 inhibitors,” he said. Dr Verstovsek, of the MD Anderson Cancer Center in Houston, Texas, is lead clinical research advisor for the phase 1b myelofibrosis study.

Phase 1b Study (NCT01393509)

This is a multicenter study designed to assess the safety, tolerability, pharmacokinetic and preliminary efficacy of PU-H71 in patients taking concomitant ruxolitinib.

The safety expansion phase of the trial is open for accrual only to patients with myeloproliferative neoplasms (MPNs).

These patients must have been on ruxolitinib for at least 3 months, be on a stable dose for at least 1 month prior to enrollment and be taking at least 5 mg twice daily.

Patients must have persistent disease manifestations, despite ruxolitinib therapy. These include persistent splenomegaly, abnormal blood counts, persistent constitutional symptoms, residual fibrosis in bone marrow (2+ or greater), or measurable allele burden as evidenced by clonal JAK2 or MPL mutation.

Samus Therapeutics, the developer of PU-H71, announced, simultaneously with the orphan drug designation, the dosing of the first patient in the phase 1b myelofibrosis study.

“Targeting the epichaperome offers an exciting new avenue for treating myelofibrosis and related diseases,” Dr Verstovsek said.

“I look forward to seeing how the combination of these therapies can affect outcomes in patients for whom this resistance is associated with poor prognoses.”

FDA grants pembrolizumab accelerated approval for PMBCL

The US Food and Drug Administration (FDA) granted accelerated approval to the anti-PD-1 therapy pembrolizumab (Keytruda) for the treatment of adult and pediatric patients with refractory primary mediastinal large B-cell lymphoma (PMBCL).

The indication also includes patients who have relapsed after 2 or more prior lines of therapy.

Pembrolizumab had received priority review for PMBCL late last year and also has orphan drug designation and breakthrough therapy designation for this indication.

The FDA based its approval on data from the KEYNOTE-170 (NCT02576990 ) trial.

Investigators enrolled 53 patients onto the multicenter, open-label, single-arm trial. Patients received pembrolizumab 200 mg intravenously every 3 weeks until unacceptable toxicity or documented disease progression.

Patients whose disease did not progress received the drug for up to 24 months.

Patient characteristics

Patients were a median age of 33 years (range, 20 – 61), 43% were male, 92% white, 43% had an ECOG performance status of 0, and 57% had an ECOG performance status of 1.

Almost half (49%) had relapsed disease, and 36% had primary refractory disease.

About a quarter (26%) had undergone prior autologous hematopoietic stem cell transplant, and 32% had prior radiation therapy.

All patients had received prior rituximab.

Results

At a median follow-up of 9.7 months, the overall response rate was 45% (24 responders), including 11% complete responses and 34% partial responses.

The median duration of response was not reached during the follow-up period and ranged from a median 1.1 to 19.2 months.

Median time to first objective response was 2.8 months (range, 2.1 – 8.5). Accordingly, investigators do not recommend pembrolizumab for PMBCL patients who require urgent cytoreductive therapy.

Safety

The most common adverse events occurring in 10% or more of patients were musculoskeletal pain (30%), upper respiratory tract infection (28%), pyrexia (28%), fatigue (23%), cough (26%), dyspnea (21%), diarrhea (13%), abdominal pain (13%), nausea (11%), arrhythmia (11%), and headache (11%).

Eight percent of patients discontinued treatment, and 15% interrupted treatment due to adverse reactions.

Adverse events requiring systemic corticosteroid therapy occurred in 25% of patients.

Serious adverse events occurred in 26% and included arrhythmia (4 %), cardiac tamponade (2%), myocardial infarction (2%), pericardial effusion (2%), and pericarditis (2%).

Six (11%) patients died within 30 days of start of treatment.

The recommended pembrolizumab dose for treatment of adults with PMBCL is 200 mg every 3 weeks. The recommended dose in pediatric patients is 2 mg/kg (up to a maximum of 200 mg) every 3 weeks.

Additional indications for pembrolizumab include melanoma, non-small cell lung cancer, head and neck squamous cell cancer, classical Hodgkin lymphoma, urothelial carcinoma, microsatellite instability-high cancer, gastric cancer, and cervical cancer.

The full prescribing information is available on the FDA website.

Pembrolizumab (Keytruda) is a product of Merck & Co, Inc.

The US Food and Drug Administration (FDA) granted accelerated approval to the anti-PD-1 therapy pembrolizumab (Keytruda) for the treatment of adult and pediatric patients with refractory primary mediastinal large B-cell lymphoma (PMBCL).

The indication also includes patients who have relapsed after 2 or more prior lines of therapy.

Pembrolizumab had received priority review for PMBCL late last year and also has orphan drug designation and breakthrough therapy designation for this indication.

The FDA based its approval on data from the KEYNOTE-170 (NCT02576990 ) trial.

Investigators enrolled 53 patients onto the multicenter, open-label, single-arm trial. Patients received pembrolizumab 200 mg intravenously every 3 weeks until unacceptable toxicity or documented disease progression.

Patients whose disease did not progress received the drug for up to 24 months.

Patient characteristics

Patients were a median age of 33 years (range, 20 – 61), 43% were male, 92% white, 43% had an ECOG performance status of 0, and 57% had an ECOG performance status of 1.

Almost half (49%) had relapsed disease, and 36% had primary refractory disease.

About a quarter (26%) had undergone prior autologous hematopoietic stem cell transplant, and 32% had prior radiation therapy.

All patients had received prior rituximab.

Results

At a median follow-up of 9.7 months, the overall response rate was 45% (24 responders), including 11% complete responses and 34% partial responses.

The median duration of response was not reached during the follow-up period and ranged from a median 1.1 to 19.2 months.

Median time to first objective response was 2.8 months (range, 2.1 – 8.5). Accordingly, investigators do not recommend pembrolizumab for PMBCL patients who require urgent cytoreductive therapy.

Safety

The most common adverse events occurring in 10% or more of patients were musculoskeletal pain (30%), upper respiratory tract infection (28%), pyrexia (28%), fatigue (23%), cough (26%), dyspnea (21%), diarrhea (13%), abdominal pain (13%), nausea (11%), arrhythmia (11%), and headache (11%).

Eight percent of patients discontinued treatment, and 15% interrupted treatment due to adverse reactions.

Adverse events requiring systemic corticosteroid therapy occurred in 25% of patients.

Serious adverse events occurred in 26% and included arrhythmia (4 %), cardiac tamponade (2%), myocardial infarction (2%), pericardial effusion (2%), and pericarditis (2%).

Six (11%) patients died within 30 days of start of treatment.

The recommended pembrolizumab dose for treatment of adults with PMBCL is 200 mg every 3 weeks. The recommended dose in pediatric patients is 2 mg/kg (up to a maximum of 200 mg) every 3 weeks.

Additional indications for pembrolizumab include melanoma, non-small cell lung cancer, head and neck squamous cell cancer, classical Hodgkin lymphoma, urothelial carcinoma, microsatellite instability-high cancer, gastric cancer, and cervical cancer.

The full prescribing information is available on the FDA website.

Pembrolizumab (Keytruda) is a product of Merck & Co, Inc.

The US Food and Drug Administration (FDA) granted accelerated approval to the anti-PD-1 therapy pembrolizumab (Keytruda) for the treatment of adult and pediatric patients with refractory primary mediastinal large B-cell lymphoma (PMBCL).

The indication also includes patients who have relapsed after 2 or more prior lines of therapy.

Pembrolizumab had received priority review for PMBCL late last year and also has orphan drug designation and breakthrough therapy designation for this indication.

The FDA based its approval on data from the KEYNOTE-170 (NCT02576990 ) trial.

Investigators enrolled 53 patients onto the multicenter, open-label, single-arm trial. Patients received pembrolizumab 200 mg intravenously every 3 weeks until unacceptable toxicity or documented disease progression.

Patients whose disease did not progress received the drug for up to 24 months.

Patient characteristics

Patients were a median age of 33 years (range, 20 – 61), 43% were male, 92% white, 43% had an ECOG performance status of 0, and 57% had an ECOG performance status of 1.

Almost half (49%) had relapsed disease, and 36% had primary refractory disease.

About a quarter (26%) had undergone prior autologous hematopoietic stem cell transplant, and 32% had prior radiation therapy.

All patients had received prior rituximab.

Results

At a median follow-up of 9.7 months, the overall response rate was 45% (24 responders), including 11% complete responses and 34% partial responses.

The median duration of response was not reached during the follow-up period and ranged from a median 1.1 to 19.2 months.

Median time to first objective response was 2.8 months (range, 2.1 – 8.5). Accordingly, investigators do not recommend pembrolizumab for PMBCL patients who require urgent cytoreductive therapy.

Safety

The most common adverse events occurring in 10% or more of patients were musculoskeletal pain (30%), upper respiratory tract infection (28%), pyrexia (28%), fatigue (23%), cough (26%), dyspnea (21%), diarrhea (13%), abdominal pain (13%), nausea (11%), arrhythmia (11%), and headache (11%).

Eight percent of patients discontinued treatment, and 15% interrupted treatment due to adverse reactions.

Adverse events requiring systemic corticosteroid therapy occurred in 25% of patients.

Serious adverse events occurred in 26% and included arrhythmia (4 %), cardiac tamponade (2%), myocardial infarction (2%), pericardial effusion (2%), and pericarditis (2%).

Six (11%) patients died within 30 days of start of treatment.

The recommended pembrolizumab dose for treatment of adults with PMBCL is 200 mg every 3 weeks. The recommended dose in pediatric patients is 2 mg/kg (up to a maximum of 200 mg) every 3 weeks.

Additional indications for pembrolizumab include melanoma, non-small cell lung cancer, head and neck squamous cell cancer, classical Hodgkin lymphoma, urothelial carcinoma, microsatellite instability-high cancer, gastric cancer, and cervical cancer.

The full prescribing information is available on the FDA website.

Pembrolizumab (Keytruda) is a product of Merck & Co, Inc.

Mircera approved for anemia in pediatric patients with CKD

Mircera®, methoxy polyethylene glycol-epoetin beta, was approved by the US Food and Drug Administration (FDA) to treat anemia in pediatric patients who have chronic kidney disease (CKD).

The drug is indicated for patients ages 5 to 17 years on hemodialysis who are switching from another erythropoiesis-stimulating agent (ESA) after their hemoglobin levels have stabilized.

The FDA also approved the agent to treat adult patients with CKD-associated anemia.

However, the drug is not approved to treat anemia caused by cancer chemotherapy.

The FDA based its approval on data from an open-label, multiple-dose, multicenter, dose-finding trial (NCT00717366).

Investigators enrolled 64 pediatric patients with CKD on hemodialysis. The patients had to have stable hemoglobin levels while receiving another ESA, such as epoetin alfa/beta or darbepoetin alfa.

Patients received Mircera intravenously once every 4 weeks for 20 weeks. Investigators adjusted the dosages, if necessary, after the first administration to maintain target hemoglobin levels.

Efficacy was based on the patients’ ability to maintain target hemoglobin levels and also on data extrapolated from trials of Mircera in adults with CKD.

Patients who received Mircera had a mean change in hemoglobin concentration from baseline of -0.15g/dL and 75% maintained hemoglobin values within ± 1g/dL of baseline.

Eighty-one percent maintained hemoglobin values within 10–12g/dL during the evaluation period.

The safety findings in pediatric patients were consistent with those previously reported in adults.

The most common adverse reactions occurring in 10% or more patients, as indicated in the prescribing information, are hypertension, diarrhea, and nasopharyngitis.

The drug carries a black box warning for increased risk of death, myocardial infarction, stroke, venous thromboembolism, thrombosis of vascular access, and tumor progression of recurrence.

Mircera is an erythropoietin receptor activator with greater activity in vivo as well as increased half-life, compared to erythropoietin.

Mircera is manufactured by Vifor (International) Inc.

Mircera®, methoxy polyethylene glycol-epoetin beta, was approved by the US Food and Drug Administration (FDA) to treat anemia in pediatric patients who have chronic kidney disease (CKD).

The drug is indicated for patients ages 5 to 17 years on hemodialysis who are switching from another erythropoiesis-stimulating agent (ESA) after their hemoglobin levels have stabilized.

The FDA also approved the agent to treat adult patients with CKD-associated anemia.

However, the drug is not approved to treat anemia caused by cancer chemotherapy.

The FDA based its approval on data from an open-label, multiple-dose, multicenter, dose-finding trial (NCT00717366).

Investigators enrolled 64 pediatric patients with CKD on hemodialysis. The patients had to have stable hemoglobin levels while receiving another ESA, such as epoetin alfa/beta or darbepoetin alfa.

Patients received Mircera intravenously once every 4 weeks for 20 weeks. Investigators adjusted the dosages, if necessary, after the first administration to maintain target hemoglobin levels.

Efficacy was based on the patients’ ability to maintain target hemoglobin levels and also on data extrapolated from trials of Mircera in adults with CKD.

Patients who received Mircera had a mean change in hemoglobin concentration from baseline of -0.15g/dL and 75% maintained hemoglobin values within ± 1g/dL of baseline.

Eighty-one percent maintained hemoglobin values within 10–12g/dL during the evaluation period.

The safety findings in pediatric patients were consistent with those previously reported in adults.

The most common adverse reactions occurring in 10% or more patients, as indicated in the prescribing information, are hypertension, diarrhea, and nasopharyngitis.

The drug carries a black box warning for increased risk of death, myocardial infarction, stroke, venous thromboembolism, thrombosis of vascular access, and tumor progression of recurrence.

Mircera is an erythropoietin receptor activator with greater activity in vivo as well as increased half-life, compared to erythropoietin.

Mircera is manufactured by Vifor (International) Inc.

Mircera®, methoxy polyethylene glycol-epoetin beta, was approved by the US Food and Drug Administration (FDA) to treat anemia in pediatric patients who have chronic kidney disease (CKD).

The drug is indicated for patients ages 5 to 17 years on hemodialysis who are switching from another erythropoiesis-stimulating agent (ESA) after their hemoglobin levels have stabilized.

The FDA also approved the agent to treat adult patients with CKD-associated anemia.

However, the drug is not approved to treat anemia caused by cancer chemotherapy.

The FDA based its approval on data from an open-label, multiple-dose, multicenter, dose-finding trial (NCT00717366).

Investigators enrolled 64 pediatric patients with CKD on hemodialysis. The patients had to have stable hemoglobin levels while receiving another ESA, such as epoetin alfa/beta or darbepoetin alfa.

Patients received Mircera intravenously once every 4 weeks for 20 weeks. Investigators adjusted the dosages, if necessary, after the first administration to maintain target hemoglobin levels.

Efficacy was based on the patients’ ability to maintain target hemoglobin levels and also on data extrapolated from trials of Mircera in adults with CKD.

Patients who received Mircera had a mean change in hemoglobin concentration from baseline of -0.15g/dL and 75% maintained hemoglobin values within ± 1g/dL of baseline.

Eighty-one percent maintained hemoglobin values within 10–12g/dL during the evaluation period.

The safety findings in pediatric patients were consistent with those previously reported in adults.

The most common adverse reactions occurring in 10% or more patients, as indicated in the prescribing information, are hypertension, diarrhea, and nasopharyngitis.

The drug carries a black box warning for increased risk of death, myocardial infarction, stroke, venous thromboembolism, thrombosis of vascular access, and tumor progression of recurrence.

Mircera is an erythropoietin receptor activator with greater activity in vivo as well as increased half-life, compared to erythropoietin.

Mircera is manufactured by Vifor (International) Inc.

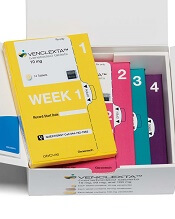

FDA approves venetoclax for CLL/SLL with or without del 17p

The US Food and Drug Administration (FDA) has approved venetoclax tablets (Venclexta ®) in combination with rituximab to treat patients with chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL) who have received 1 prior therapy.

The combination is approved for patients with or without deletion of 17p (del 17p).

The FDA based its approval on the phase 3 MURANO trial, in which venetoclax in combination with rituximab (VEN+R) significantly improved progression-free survival (PFS) in relapsed or refractory CLL patients compared to the chemoimmunotherapy regimen of bendamustine plus rituximab(B+R).

This approval, according to the drug’s developers, makes venetoclax plus rituximab the first oral-based, chemotherapy-free combination with a fixed treatment duration for CLL.

The FDA has also converted venetoclax's accelerated approval to a full approval. The drug was previously granted accelerated approval as a single agent for the treatment of people with CLL with 17p deletion.

Venetoclax is being developed by AbbVie and Roche and jointly commercialized by AbbVie and Genentech in the US and by AbbVie outside the US.

Phase 3 MURANO trial (NCT02005471)

The multicenter, open-label trial randomized 389 patients to VEN+R (194 patients) or B+R (195 patients). Median age of the patients was 65 years (range, 22 – 85).

Patients in the VEN+R arm completed a 5-week ramp-up of venetoclax followed by venetoclax 400 mg once daily for 24 months measured from the rituximab start date.

Tumor lysis syndrome (TLS), caused by a rapid reduction in tumor volume, is an identified risk with venetoclax treatment. The dose ramp-up was intended to mitigate this risk.

Rituximab was initiated after venetoclax ramp-up and given for 6 cycles (375 mg/m2 intravenously on cycle 1 day 1 and 500 mg/m2 intravenously on day 1 of cycles 2-6, with a 28-day cycle length).

Patients in the B+R arm received 6 cycles of B+R (bendamustine 70 mg/m2 on days 1 and 2 of each 28-day cycle and rituximab at the above described dose and schedule).

Efficacy was based on PFS as assessed by an independent review committee.

After a median follow-up of 23 months, the median PFS was not reached in the VEN+R arm and was 18.1 months in the B+R arm (P<0.0001).

The overall response rate was 92% for patients treated with VEN+R compared to 72% for those treated with B+R.

Safety

The most common adverse events (AEs) in the VEN+R arms that occurred in 20% or more patients were neutropenia (65%), diarrhea (40%), upper respiratory tract infection (39%), fatigue (22%), cough (22%), and nausea (21%).

Grade 3 or 4 neutropenia developed in 64% of patients, and grade 4 neutropenia in 31%.

Serious adverse events (SAEs) developed in 46% of patients and serious infections in 21%, consisting most frequently of pneumonia (9%).

The incidence of TLS was 3%, occurring in 6 of 194 patients.

In the VEN+R arm, discontinuations due to any AEs occurred in 16% of patients, dose reductions in 15%, and dose interruptions in 71%.

Neutropenia led to dose interruptions in 46% of patients and discontinuations in 3%. Thrombocytopenia led to discontinuations in 3% of patients.

Fatal AEs that occurred in the absence of disease progression and within 30 days of the last VEN+R treatment and/or 90 days of the last rituximab infusion were reported in 2% (4/194) of patients.

In the B+R arm, AEs led to treatment discontinuations in 10% of patients, dose reductions in 15%, and dose interruptions in 40 %.

Investigators previously reported data from the phase 3 MURANO study as a late-breaking abstract at the 2017 ASH Annual Meeting and published the findings in NEJM.

John Seymour, MBBS, PhD, lead investigator of the MURANO study, said in the corporate release, the approval "validates the results seen in the phase 3 trial, including the significant improvement in progression-free survival over a standard of care comparator arm."

"Progression-free survival is considered a gold standard for demonstrating clinical benefit in oncology," he added.

Full prescribing information for venetoclax is available here.

The US Food and Drug Administration (FDA) has approved venetoclax tablets (Venclexta ®) in combination with rituximab to treat patients with chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL) who have received 1 prior therapy.

The combination is approved for patients with or without deletion of 17p (del 17p).

The FDA based its approval on the phase 3 MURANO trial, in which venetoclax in combination with rituximab (VEN+R) significantly improved progression-free survival (PFS) in relapsed or refractory CLL patients compared to the chemoimmunotherapy regimen of bendamustine plus rituximab(B+R).

This approval, according to the drug’s developers, makes venetoclax plus rituximab the first oral-based, chemotherapy-free combination with a fixed treatment duration for CLL.

The FDA has also converted venetoclax's accelerated approval to a full approval. The drug was previously granted accelerated approval as a single agent for the treatment of people with CLL with 17p deletion.

Venetoclax is being developed by AbbVie and Roche and jointly commercialized by AbbVie and Genentech in the US and by AbbVie outside the US.

Phase 3 MURANO trial (NCT02005471)

The multicenter, open-label trial randomized 389 patients to VEN+R (194 patients) or B+R (195 patients). Median age of the patients was 65 years (range, 22 – 85).

Patients in the VEN+R arm completed a 5-week ramp-up of venetoclax followed by venetoclax 400 mg once daily for 24 months measured from the rituximab start date.

Tumor lysis syndrome (TLS), caused by a rapid reduction in tumor volume, is an identified risk with venetoclax treatment. The dose ramp-up was intended to mitigate this risk.

Rituximab was initiated after venetoclax ramp-up and given for 6 cycles (375 mg/m2 intravenously on cycle 1 day 1 and 500 mg/m2 intravenously on day 1 of cycles 2-6, with a 28-day cycle length).

Patients in the B+R arm received 6 cycles of B+R (bendamustine 70 mg/m2 on days 1 and 2 of each 28-day cycle and rituximab at the above described dose and schedule).

Efficacy was based on PFS as assessed by an independent review committee.

After a median follow-up of 23 months, the median PFS was not reached in the VEN+R arm and was 18.1 months in the B+R arm (P<0.0001).

The overall response rate was 92% for patients treated with VEN+R compared to 72% for those treated with B+R.

Safety

The most common adverse events (AEs) in the VEN+R arms that occurred in 20% or more patients were neutropenia (65%), diarrhea (40%), upper respiratory tract infection (39%), fatigue (22%), cough (22%), and nausea (21%).

Grade 3 or 4 neutropenia developed in 64% of patients, and grade 4 neutropenia in 31%.

Serious adverse events (SAEs) developed in 46% of patients and serious infections in 21%, consisting most frequently of pneumonia (9%).

The incidence of TLS was 3%, occurring in 6 of 194 patients.

In the VEN+R arm, discontinuations due to any AEs occurred in 16% of patients, dose reductions in 15%, and dose interruptions in 71%.

Neutropenia led to dose interruptions in 46% of patients and discontinuations in 3%. Thrombocytopenia led to discontinuations in 3% of patients.

Fatal AEs that occurred in the absence of disease progression and within 30 days of the last VEN+R treatment and/or 90 days of the last rituximab infusion were reported in 2% (4/194) of patients.

In the B+R arm, AEs led to treatment discontinuations in 10% of patients, dose reductions in 15%, and dose interruptions in 40 %.

Investigators previously reported data from the phase 3 MURANO study as a late-breaking abstract at the 2017 ASH Annual Meeting and published the findings in NEJM.

John Seymour, MBBS, PhD, lead investigator of the MURANO study, said in the corporate release, the approval "validates the results seen in the phase 3 trial, including the significant improvement in progression-free survival over a standard of care comparator arm."

"Progression-free survival is considered a gold standard for demonstrating clinical benefit in oncology," he added.

Full prescribing information for venetoclax is available here.

The US Food and Drug Administration (FDA) has approved venetoclax tablets (Venclexta ®) in combination with rituximab to treat patients with chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL) who have received 1 prior therapy.

The combination is approved for patients with or without deletion of 17p (del 17p).