User login

The highlight of SHM’s biennial State of Hospital Medicine (SOHM) report is how much hospitalists earn. So it’s to be expected that rank-and-file practitioners and group leaders who read this year’s edition will first notice that median compensation for adult hospitalists rose 8% to $252,996 in 2013, according to data from the Medical Group Management Association (MGMA). The compensation data from MGMA is wrapped into the SOHM 2014 report this year.

But to stop there would be a wasted opportunity, says William “Tex” Landis, MD, FHM, medical director of Wellspan Hospitalists in York, Pa., and a member and former chair of SHM’s Practice Analysis Committee. Along with compensation, the report (available at www.hospitalmedicine.org/survey) delves into scheduling, productivity, staffing, how compensation is broken down, practice models, and dozens of other topics that hospital medicine group (HMG) leaders will find useful.

“Scope of services is a big one,” Dr. Landis adds. “What other things are hospital medicine groups around the country being held responsible for? Are we morphing into universal admitters? How involved in palliative care are we? What about transitions of care? How many hospital medicine groups are becoming involved in managing nursing home patients? What’s the relationship with surgical co-management? How much ICU work are we doing?”

Dr. Landis’ laundry list of unanswered questions might seem daunting, but that’s the point of the research SHM has been collecting and reporting for years. The society surveyed 499 groups, representing some 6,300 providers, to give the specialty’s most detailed list of most popular, if not best, practices.

“It has the usual limitations of any survey; however, it is the very best survey, quantity and quality, of hospital medicine groups,” Dr. Landis says. “And so it becomes the best source of information to make important decisions about resourcing and operating hospital medicine groups.”

Earnings Up

And, like it or not, compensation for providers typically is a HMG’s largest budget line. In that regard, the specialty appears to be doing well. Median compensation for adult hospitalists rose to a record high last year, according to the MGMA Physician Compensation and Production Survey: 2014 Report Based on 2013 Data. Half of respondents work in practices owned by hospitals/integrated delivery systems, down from 56% in SOHM 2012.

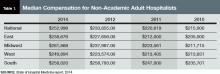

Although hospitalists in the South region continue to earn the most (median compensation $258,020, essentially static with the $258,793 figure reported in 2012), the region was the only one to report a decrease (see Table 1 for historical data). The largest percentage jump (11.8%) was for hospitalists in the West region ($249,894). Hospitalists in the Midwest saw a 10% increase ($261,868), while those in the East had both the smallest increase (4.8%) and the lowest median compensation ($238,676).

—R. Jeffrey Taylor, president and COO, IPC The Hospitalist Co., North Hollywood, Calif.

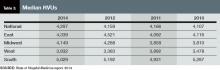

Part of the compensation increase is tied to upward pressure on productivity. Nationwide, median relative value units (RVUs) rose 3.3%, to 4,297 from 4,159. Median collection-to-work RVUs ticked up 6.8%, to 51.5 from 48.21 (see Table 2 for regional breakdowns). Production (10.5%) and performance (6.6%) are also slightly larger portions of mean compensation than they were in 2012, a figure many expect to increase further in future reports. The report also noted that academic/university hospitalists receive more in base pay, while hospitalists in private practice receive less.

Compensation and work volume will be intrinsically tied in the coming years, says R. Jeffrey Taylor, president and chief operating officer of IPC The Hospitalist Co., based in North Hollywood, Calif. And if pay outpaces productivity, “then it’s a bit concerning for the system at large,” he says.

“Particularly for whoever is subsidizing that shortfall, whether it’s a hospital employing doctors or an outsourced group employing the doctors but requiring a large subsidy from the hospital because the doctors are not seeing enough patient flow to pay their salary and benefits,” Taylor says.

More than 89% of HMGs rely on their host hospitals for financial support, according to the new data. The median support is $156,063 per full-time employee (FTE), which would total $1 million at just over seven FTEs. As healthcare reform progresses and hospitals’ budgets are increasingly burdened, Taylor says that pressure for hospitalists to generate enough revenue to cover their own salaries will grow. That sets up a likely showdown between hospitalists and their institutions; SOHM 2014 reported that just 6% of HMGs received enough income from professional fee revenue to cover expenses.

SOURCE: State of Hospital Medicine report, 2014

SOURCE: State of Hospital Medicine report, 2014

“Some productivity element in compensation plans, we believe, and I believe personally, is important,” Taylor says, later adding: “We already have a physician shortage and a shortage of people to see all these patients. It’s exacerbated by two things: lack of productivity and shift-model scheduling.”

To wit, IPC pays lower base salaries but provides bonuses tied to productivity and quality metrics. The average IPC hospitalist, Taylor says, earned more than $290,000 last year, nearly 15% above the median figure in the SOHM report. Between 30%-40% of that compensation, however, was earned via bonus tied to both “productivity and clinical achievement.”

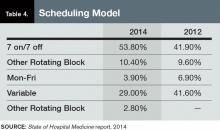

Taylor, an outspoken advocate for moving away from the seven-on/seven-off scheduling model popular throughout hospital medicine, ties some of his doctors’ higher compensation to his firm’s preference for avoiding that schedule. But he’s not surprised the new report shows that 53.8% of responding HMGs use the model, up from 41.9% in 2012.

“It will be interesting to see what the data shows over the next three or four years,” he says, “if stipends, as we believe we are seeing, come under pressure and hospitals are doing more outsourcing.”

SOURCE: State of Hospital Medicine report, 2014

The PCP Link

Industry leaders use the information in the biennial reports to gauge where the specialty stands in the overall healthcare spectrum. Dea Robinson, MA, FACMPE, CPC, director of consulting for MGMA Health Care Consulting Group, says that the growth of hospital medicine (HM) compensation is tied to that of primary care physicians (PCPs).

“I don’t think we can look at hospitalists without looking at primary care, because it’s really an extension of primary care,” says Robinson, a member of SHM’s Practice Management Committee. “As primary care compensation increases, hospitalists’ compensation might increase as well. And with the focus on patient-centered medical homes, which is basically primary care centered, that might very well be part of the driver in the future of seeing hospitalists grow.”

While facing a well-known physician shortage, primary care’s compensation growth also lags behind HM. For example, median compensation for hospitalists rose 8%; it increased 5.5% for PCPs.

“When it comes to growth of the two individual industries, I think they are connected in some way,” she adds. “But in terms of the compensation, now we’re starting to see different codes that hospitalists are able to use but that primary care used to use exclusively. So, you really see more of an extension and a collaboration between true primary care and hospitalists.”

Bryan Weiss, MBA, FHM, managing director of the consulting services practice at Irving, Texas-based MedSynergies, agrees that hospitalists and PCPs are connected. He believes the higher compensation figures are a sign of how young HM is as a specialty. He fears compensation “is probably growing too fast.”

“This takes me back to the 1990s, with the private [physician practice management]-type model, where it just grew so fast that the bottom fell out,” says Weiss, a member of Team Hospitalist. “Not that I think the bottom is going to fall out of hospital medicine, but a lot of this is reminiscent of that, and I think there’s going to be a ceiling, or at least a slowing down.”

—Stuart Guterman, vice president, Medicare and cost control, The Commonwealth Fund

In contrast, one good sign for the specialty’s compensation and financial support is that “hospitals are still the hub of the healthcare system and need to be an important part of healthcare reform,” says Stuart Guterman, vice president for Medicare and cost control at The Commonwealth Fund, a New York foundation focused on improving healthcare delivery. Guterman says that while President Obama and congressional leaders are looking to cut the rate of growth in healthcare spending, the figure is already so high that there should still be plenty of resources in the system.

“If you took today’s spending and you increased it at the [GDP] growth rate for 10 years, I think we’re talking about something over $30 trillion over 10 years,” Guterman says. “And remember that we’re starting at a point that’s over 50% higher than any other country in the world. So, we’re talking about plenty of resources still in this healthcare system.”

With accountable care organizations, the specter of bundled payments, and penalties for readmitted patients, Guterman says that the pending issue for the specialty isn’t whether hospitalists—or other hospital-based practitioners—are going to get paid more or less, but rather what their compensation will be based on.

“Things like better coordination of care, sending the patients to the right place, having the patients in the right place, having them in the hospital if they need to be, or keeping them out of the hospital if they don’t need to be in the hospital,” he explains. “But the hospital is certainly a big part of that health system.”

In fact, physicians who play to the strengths of the new healthcare metrics—quality, value, lower-cost care—can probably earn as much compensation as, if not more than, they could in the traditional fee-for-service model hospitalists, Guterman says.

“The big point is to remind people that when we’re talking about controlling health spending growth, we’re still talking about a growing industry,” he notes. “We’re not talking about disenfranchising healthcare or providers. We’re talking about more reasonable growth and about, more than anything, paying for the right things. Folks ought to be able to do quite well if they do the right things.”

SOURCE: State of Hospital Medicine report, 2014

Multiple Uses

The SOHM report can be used as a measuring stick to compare against national and regional competitors and to provide data points for discussions with hospital administrators, says Team Hospitalist’s Weiss.

“This is vital in terms of recruiting physicians,” he says, “as well as negotiating with the hospital, as far as what the average investment is.”

Dr. Landis of SHM’s Practice Analysis Committee believes that having data points to make “resourcing decisions” with is particularly helpful, both in hiring and scheduling and in “right-sizing” hospital support for groups that are not self-sufficient.

“It is critical for physicians and their administrative partners to get the resourcing right, as inappropriately resourced groups [too much or too little] can quickly become unsustainable and/or unstable,” Dr. Landis says.

Take his group’s compensation.

“When we look at what we want to incent physicians, we’ll look at what other groups are doing,” Dr. Landis adds. “Are they using core measures? Are they using patient satisfaction? What about good citizenship? It’s one thing to say, ‘A hospital down the road is doing it.’ It’s another thing to take this book and say, ‘Let’s look the numbers up.’”

Of course, the wrinkle in benchmarking against national or regional figures is that HMGs can be “very particular,” says MGMA’s Robinson.

“We use benchmarks to give us an idea of what the pulse is, but we don’t use it as the only number,” she adds. “It’s very individualistic to the practice and to the program.”

Dr. Landis understands that point of view. Take his group’s policy on how much of hospitalists’ compensation is based on performance. The median component of compensation tied to performance for hospitalists nationwide is 6.6%, according to SOHM 2014. Dr. Landis’ group is at 15%. In meetings with his C-suite executives, he says he thinks in the back of his mind about how far outside the mean his group is in that regard. But he tempers that thought with the view that many hospitalists believe that performance and other metrics will continue to grow into a larger portion of hospitalists’ overall compensation.

“You have to be careful,” he says. “The first person to do an innovative, valuable thing isn’t going to be the 85%. You have to be careful not to stifle innovation. One of the cautions is not to use ‘just because everyone else is doing it means it’s the best way.’”

Weiss calls on an old adage in the industry: “If you’ve seen one hospitalist program, you’ve seen exactly one hospitalist program,” he says. “Because while they can be part of a large health system or a management company, while they try to have some commonality or some typical procedures, there’s still going to be individuality.”

Richard Quinn is a freelance writer in New Jersey.

The highlight of SHM’s biennial State of Hospital Medicine (SOHM) report is how much hospitalists earn. So it’s to be expected that rank-and-file practitioners and group leaders who read this year’s edition will first notice that median compensation for adult hospitalists rose 8% to $252,996 in 2013, according to data from the Medical Group Management Association (MGMA). The compensation data from MGMA is wrapped into the SOHM 2014 report this year.

But to stop there would be a wasted opportunity, says William “Tex” Landis, MD, FHM, medical director of Wellspan Hospitalists in York, Pa., and a member and former chair of SHM’s Practice Analysis Committee. Along with compensation, the report (available at www.hospitalmedicine.org/survey) delves into scheduling, productivity, staffing, how compensation is broken down, practice models, and dozens of other topics that hospital medicine group (HMG) leaders will find useful.

“Scope of services is a big one,” Dr. Landis adds. “What other things are hospital medicine groups around the country being held responsible for? Are we morphing into universal admitters? How involved in palliative care are we? What about transitions of care? How many hospital medicine groups are becoming involved in managing nursing home patients? What’s the relationship with surgical co-management? How much ICU work are we doing?”

Dr. Landis’ laundry list of unanswered questions might seem daunting, but that’s the point of the research SHM has been collecting and reporting for years. The society surveyed 499 groups, representing some 6,300 providers, to give the specialty’s most detailed list of most popular, if not best, practices.

“It has the usual limitations of any survey; however, it is the very best survey, quantity and quality, of hospital medicine groups,” Dr. Landis says. “And so it becomes the best source of information to make important decisions about resourcing and operating hospital medicine groups.”

Earnings Up

And, like it or not, compensation for providers typically is a HMG’s largest budget line. In that regard, the specialty appears to be doing well. Median compensation for adult hospitalists rose to a record high last year, according to the MGMA Physician Compensation and Production Survey: 2014 Report Based on 2013 Data. Half of respondents work in practices owned by hospitals/integrated delivery systems, down from 56% in SOHM 2012.

Although hospitalists in the South region continue to earn the most (median compensation $258,020, essentially static with the $258,793 figure reported in 2012), the region was the only one to report a decrease (see Table 1 for historical data). The largest percentage jump (11.8%) was for hospitalists in the West region ($249,894). Hospitalists in the Midwest saw a 10% increase ($261,868), while those in the East had both the smallest increase (4.8%) and the lowest median compensation ($238,676).

—R. Jeffrey Taylor, president and COO, IPC The Hospitalist Co., North Hollywood, Calif.

Part of the compensation increase is tied to upward pressure on productivity. Nationwide, median relative value units (RVUs) rose 3.3%, to 4,297 from 4,159. Median collection-to-work RVUs ticked up 6.8%, to 51.5 from 48.21 (see Table 2 for regional breakdowns). Production (10.5%) and performance (6.6%) are also slightly larger portions of mean compensation than they were in 2012, a figure many expect to increase further in future reports. The report also noted that academic/university hospitalists receive more in base pay, while hospitalists in private practice receive less.

Compensation and work volume will be intrinsically tied in the coming years, says R. Jeffrey Taylor, president and chief operating officer of IPC The Hospitalist Co., based in North Hollywood, Calif. And if pay outpaces productivity, “then it’s a bit concerning for the system at large,” he says.

“Particularly for whoever is subsidizing that shortfall, whether it’s a hospital employing doctors or an outsourced group employing the doctors but requiring a large subsidy from the hospital because the doctors are not seeing enough patient flow to pay their salary and benefits,” Taylor says.

More than 89% of HMGs rely on their host hospitals for financial support, according to the new data. The median support is $156,063 per full-time employee (FTE), which would total $1 million at just over seven FTEs. As healthcare reform progresses and hospitals’ budgets are increasingly burdened, Taylor says that pressure for hospitalists to generate enough revenue to cover their own salaries will grow. That sets up a likely showdown between hospitalists and their institutions; SOHM 2014 reported that just 6% of HMGs received enough income from professional fee revenue to cover expenses.

SOURCE: State of Hospital Medicine report, 2014

SOURCE: State of Hospital Medicine report, 2014

“Some productivity element in compensation plans, we believe, and I believe personally, is important,” Taylor says, later adding: “We already have a physician shortage and a shortage of people to see all these patients. It’s exacerbated by two things: lack of productivity and shift-model scheduling.”

To wit, IPC pays lower base salaries but provides bonuses tied to productivity and quality metrics. The average IPC hospitalist, Taylor says, earned more than $290,000 last year, nearly 15% above the median figure in the SOHM report. Between 30%-40% of that compensation, however, was earned via bonus tied to both “productivity and clinical achievement.”

Taylor, an outspoken advocate for moving away from the seven-on/seven-off scheduling model popular throughout hospital medicine, ties some of his doctors’ higher compensation to his firm’s preference for avoiding that schedule. But he’s not surprised the new report shows that 53.8% of responding HMGs use the model, up from 41.9% in 2012.

“It will be interesting to see what the data shows over the next three or four years,” he says, “if stipends, as we believe we are seeing, come under pressure and hospitals are doing more outsourcing.”

SOURCE: State of Hospital Medicine report, 2014

The PCP Link

Industry leaders use the information in the biennial reports to gauge where the specialty stands in the overall healthcare spectrum. Dea Robinson, MA, FACMPE, CPC, director of consulting for MGMA Health Care Consulting Group, says that the growth of hospital medicine (HM) compensation is tied to that of primary care physicians (PCPs).

“I don’t think we can look at hospitalists without looking at primary care, because it’s really an extension of primary care,” says Robinson, a member of SHM’s Practice Management Committee. “As primary care compensation increases, hospitalists’ compensation might increase as well. And with the focus on patient-centered medical homes, which is basically primary care centered, that might very well be part of the driver in the future of seeing hospitalists grow.”

While facing a well-known physician shortage, primary care’s compensation growth also lags behind HM. For example, median compensation for hospitalists rose 8%; it increased 5.5% for PCPs.

“When it comes to growth of the two individual industries, I think they are connected in some way,” she adds. “But in terms of the compensation, now we’re starting to see different codes that hospitalists are able to use but that primary care used to use exclusively. So, you really see more of an extension and a collaboration between true primary care and hospitalists.”

Bryan Weiss, MBA, FHM, managing director of the consulting services practice at Irving, Texas-based MedSynergies, agrees that hospitalists and PCPs are connected. He believes the higher compensation figures are a sign of how young HM is as a specialty. He fears compensation “is probably growing too fast.”

“This takes me back to the 1990s, with the private [physician practice management]-type model, where it just grew so fast that the bottom fell out,” says Weiss, a member of Team Hospitalist. “Not that I think the bottom is going to fall out of hospital medicine, but a lot of this is reminiscent of that, and I think there’s going to be a ceiling, or at least a slowing down.”

—Stuart Guterman, vice president, Medicare and cost control, The Commonwealth Fund

In contrast, one good sign for the specialty’s compensation and financial support is that “hospitals are still the hub of the healthcare system and need to be an important part of healthcare reform,” says Stuart Guterman, vice president for Medicare and cost control at The Commonwealth Fund, a New York foundation focused on improving healthcare delivery. Guterman says that while President Obama and congressional leaders are looking to cut the rate of growth in healthcare spending, the figure is already so high that there should still be plenty of resources in the system.

“If you took today’s spending and you increased it at the [GDP] growth rate for 10 years, I think we’re talking about something over $30 trillion over 10 years,” Guterman says. “And remember that we’re starting at a point that’s over 50% higher than any other country in the world. So, we’re talking about plenty of resources still in this healthcare system.”

With accountable care organizations, the specter of bundled payments, and penalties for readmitted patients, Guterman says that the pending issue for the specialty isn’t whether hospitalists—or other hospital-based practitioners—are going to get paid more or less, but rather what their compensation will be based on.

“Things like better coordination of care, sending the patients to the right place, having the patients in the right place, having them in the hospital if they need to be, or keeping them out of the hospital if they don’t need to be in the hospital,” he explains. “But the hospital is certainly a big part of that health system.”

In fact, physicians who play to the strengths of the new healthcare metrics—quality, value, lower-cost care—can probably earn as much compensation as, if not more than, they could in the traditional fee-for-service model hospitalists, Guterman says.

“The big point is to remind people that when we’re talking about controlling health spending growth, we’re still talking about a growing industry,” he notes. “We’re not talking about disenfranchising healthcare or providers. We’re talking about more reasonable growth and about, more than anything, paying for the right things. Folks ought to be able to do quite well if they do the right things.”

SOURCE: State of Hospital Medicine report, 2014

Multiple Uses

The SOHM report can be used as a measuring stick to compare against national and regional competitors and to provide data points for discussions with hospital administrators, says Team Hospitalist’s Weiss.

“This is vital in terms of recruiting physicians,” he says, “as well as negotiating with the hospital, as far as what the average investment is.”

Dr. Landis of SHM’s Practice Analysis Committee believes that having data points to make “resourcing decisions” with is particularly helpful, both in hiring and scheduling and in “right-sizing” hospital support for groups that are not self-sufficient.

“It is critical for physicians and their administrative partners to get the resourcing right, as inappropriately resourced groups [too much or too little] can quickly become unsustainable and/or unstable,” Dr. Landis says.

Take his group’s compensation.

“When we look at what we want to incent physicians, we’ll look at what other groups are doing,” Dr. Landis adds. “Are they using core measures? Are they using patient satisfaction? What about good citizenship? It’s one thing to say, ‘A hospital down the road is doing it.’ It’s another thing to take this book and say, ‘Let’s look the numbers up.’”

Of course, the wrinkle in benchmarking against national or regional figures is that HMGs can be “very particular,” says MGMA’s Robinson.

“We use benchmarks to give us an idea of what the pulse is, but we don’t use it as the only number,” she adds. “It’s very individualistic to the practice and to the program.”

Dr. Landis understands that point of view. Take his group’s policy on how much of hospitalists’ compensation is based on performance. The median component of compensation tied to performance for hospitalists nationwide is 6.6%, according to SOHM 2014. Dr. Landis’ group is at 15%. In meetings with his C-suite executives, he says he thinks in the back of his mind about how far outside the mean his group is in that regard. But he tempers that thought with the view that many hospitalists believe that performance and other metrics will continue to grow into a larger portion of hospitalists’ overall compensation.

“You have to be careful,” he says. “The first person to do an innovative, valuable thing isn’t going to be the 85%. You have to be careful not to stifle innovation. One of the cautions is not to use ‘just because everyone else is doing it means it’s the best way.’”

Weiss calls on an old adage in the industry: “If you’ve seen one hospitalist program, you’ve seen exactly one hospitalist program,” he says. “Because while they can be part of a large health system or a management company, while they try to have some commonality or some typical procedures, there’s still going to be individuality.”

Richard Quinn is a freelance writer in New Jersey.

The highlight of SHM’s biennial State of Hospital Medicine (SOHM) report is how much hospitalists earn. So it’s to be expected that rank-and-file practitioners and group leaders who read this year’s edition will first notice that median compensation for adult hospitalists rose 8% to $252,996 in 2013, according to data from the Medical Group Management Association (MGMA). The compensation data from MGMA is wrapped into the SOHM 2014 report this year.

But to stop there would be a wasted opportunity, says William “Tex” Landis, MD, FHM, medical director of Wellspan Hospitalists in York, Pa., and a member and former chair of SHM’s Practice Analysis Committee. Along with compensation, the report (available at www.hospitalmedicine.org/survey) delves into scheduling, productivity, staffing, how compensation is broken down, practice models, and dozens of other topics that hospital medicine group (HMG) leaders will find useful.

“Scope of services is a big one,” Dr. Landis adds. “What other things are hospital medicine groups around the country being held responsible for? Are we morphing into universal admitters? How involved in palliative care are we? What about transitions of care? How many hospital medicine groups are becoming involved in managing nursing home patients? What’s the relationship with surgical co-management? How much ICU work are we doing?”

Dr. Landis’ laundry list of unanswered questions might seem daunting, but that’s the point of the research SHM has been collecting and reporting for years. The society surveyed 499 groups, representing some 6,300 providers, to give the specialty’s most detailed list of most popular, if not best, practices.

“It has the usual limitations of any survey; however, it is the very best survey, quantity and quality, of hospital medicine groups,” Dr. Landis says. “And so it becomes the best source of information to make important decisions about resourcing and operating hospital medicine groups.”

Earnings Up

And, like it or not, compensation for providers typically is a HMG’s largest budget line. In that regard, the specialty appears to be doing well. Median compensation for adult hospitalists rose to a record high last year, according to the MGMA Physician Compensation and Production Survey: 2014 Report Based on 2013 Data. Half of respondents work in practices owned by hospitals/integrated delivery systems, down from 56% in SOHM 2012.

Although hospitalists in the South region continue to earn the most (median compensation $258,020, essentially static with the $258,793 figure reported in 2012), the region was the only one to report a decrease (see Table 1 for historical data). The largest percentage jump (11.8%) was for hospitalists in the West region ($249,894). Hospitalists in the Midwest saw a 10% increase ($261,868), while those in the East had both the smallest increase (4.8%) and the lowest median compensation ($238,676).

—R. Jeffrey Taylor, president and COO, IPC The Hospitalist Co., North Hollywood, Calif.

Part of the compensation increase is tied to upward pressure on productivity. Nationwide, median relative value units (RVUs) rose 3.3%, to 4,297 from 4,159. Median collection-to-work RVUs ticked up 6.8%, to 51.5 from 48.21 (see Table 2 for regional breakdowns). Production (10.5%) and performance (6.6%) are also slightly larger portions of mean compensation than they were in 2012, a figure many expect to increase further in future reports. The report also noted that academic/university hospitalists receive more in base pay, while hospitalists in private practice receive less.

Compensation and work volume will be intrinsically tied in the coming years, says R. Jeffrey Taylor, president and chief operating officer of IPC The Hospitalist Co., based in North Hollywood, Calif. And if pay outpaces productivity, “then it’s a bit concerning for the system at large,” he says.

“Particularly for whoever is subsidizing that shortfall, whether it’s a hospital employing doctors or an outsourced group employing the doctors but requiring a large subsidy from the hospital because the doctors are not seeing enough patient flow to pay their salary and benefits,” Taylor says.

More than 89% of HMGs rely on their host hospitals for financial support, according to the new data. The median support is $156,063 per full-time employee (FTE), which would total $1 million at just over seven FTEs. As healthcare reform progresses and hospitals’ budgets are increasingly burdened, Taylor says that pressure for hospitalists to generate enough revenue to cover their own salaries will grow. That sets up a likely showdown between hospitalists and their institutions; SOHM 2014 reported that just 6% of HMGs received enough income from professional fee revenue to cover expenses.

SOURCE: State of Hospital Medicine report, 2014

SOURCE: State of Hospital Medicine report, 2014

“Some productivity element in compensation plans, we believe, and I believe personally, is important,” Taylor says, later adding: “We already have a physician shortage and a shortage of people to see all these patients. It’s exacerbated by two things: lack of productivity and shift-model scheduling.”

To wit, IPC pays lower base salaries but provides bonuses tied to productivity and quality metrics. The average IPC hospitalist, Taylor says, earned more than $290,000 last year, nearly 15% above the median figure in the SOHM report. Between 30%-40% of that compensation, however, was earned via bonus tied to both “productivity and clinical achievement.”

Taylor, an outspoken advocate for moving away from the seven-on/seven-off scheduling model popular throughout hospital medicine, ties some of his doctors’ higher compensation to his firm’s preference for avoiding that schedule. But he’s not surprised the new report shows that 53.8% of responding HMGs use the model, up from 41.9% in 2012.

“It will be interesting to see what the data shows over the next three or four years,” he says, “if stipends, as we believe we are seeing, come under pressure and hospitals are doing more outsourcing.”

SOURCE: State of Hospital Medicine report, 2014

The PCP Link

Industry leaders use the information in the biennial reports to gauge where the specialty stands in the overall healthcare spectrum. Dea Robinson, MA, FACMPE, CPC, director of consulting for MGMA Health Care Consulting Group, says that the growth of hospital medicine (HM) compensation is tied to that of primary care physicians (PCPs).

“I don’t think we can look at hospitalists without looking at primary care, because it’s really an extension of primary care,” says Robinson, a member of SHM’s Practice Management Committee. “As primary care compensation increases, hospitalists’ compensation might increase as well. And with the focus on patient-centered medical homes, which is basically primary care centered, that might very well be part of the driver in the future of seeing hospitalists grow.”

While facing a well-known physician shortage, primary care’s compensation growth also lags behind HM. For example, median compensation for hospitalists rose 8%; it increased 5.5% for PCPs.

“When it comes to growth of the two individual industries, I think they are connected in some way,” she adds. “But in terms of the compensation, now we’re starting to see different codes that hospitalists are able to use but that primary care used to use exclusively. So, you really see more of an extension and a collaboration between true primary care and hospitalists.”

Bryan Weiss, MBA, FHM, managing director of the consulting services practice at Irving, Texas-based MedSynergies, agrees that hospitalists and PCPs are connected. He believes the higher compensation figures are a sign of how young HM is as a specialty. He fears compensation “is probably growing too fast.”

“This takes me back to the 1990s, with the private [physician practice management]-type model, where it just grew so fast that the bottom fell out,” says Weiss, a member of Team Hospitalist. “Not that I think the bottom is going to fall out of hospital medicine, but a lot of this is reminiscent of that, and I think there’s going to be a ceiling, or at least a slowing down.”

—Stuart Guterman, vice president, Medicare and cost control, The Commonwealth Fund

In contrast, one good sign for the specialty’s compensation and financial support is that “hospitals are still the hub of the healthcare system and need to be an important part of healthcare reform,” says Stuart Guterman, vice president for Medicare and cost control at The Commonwealth Fund, a New York foundation focused on improving healthcare delivery. Guterman says that while President Obama and congressional leaders are looking to cut the rate of growth in healthcare spending, the figure is already so high that there should still be plenty of resources in the system.

“If you took today’s spending and you increased it at the [GDP] growth rate for 10 years, I think we’re talking about something over $30 trillion over 10 years,” Guterman says. “And remember that we’re starting at a point that’s over 50% higher than any other country in the world. So, we’re talking about plenty of resources still in this healthcare system.”

With accountable care organizations, the specter of bundled payments, and penalties for readmitted patients, Guterman says that the pending issue for the specialty isn’t whether hospitalists—or other hospital-based practitioners—are going to get paid more or less, but rather what their compensation will be based on.

“Things like better coordination of care, sending the patients to the right place, having the patients in the right place, having them in the hospital if they need to be, or keeping them out of the hospital if they don’t need to be in the hospital,” he explains. “But the hospital is certainly a big part of that health system.”

In fact, physicians who play to the strengths of the new healthcare metrics—quality, value, lower-cost care—can probably earn as much compensation as, if not more than, they could in the traditional fee-for-service model hospitalists, Guterman says.

“The big point is to remind people that when we’re talking about controlling health spending growth, we’re still talking about a growing industry,” he notes. “We’re not talking about disenfranchising healthcare or providers. We’re talking about more reasonable growth and about, more than anything, paying for the right things. Folks ought to be able to do quite well if they do the right things.”

SOURCE: State of Hospital Medicine report, 2014

Multiple Uses

The SOHM report can be used as a measuring stick to compare against national and regional competitors and to provide data points for discussions with hospital administrators, says Team Hospitalist’s Weiss.

“This is vital in terms of recruiting physicians,” he says, “as well as negotiating with the hospital, as far as what the average investment is.”

Dr. Landis of SHM’s Practice Analysis Committee believes that having data points to make “resourcing decisions” with is particularly helpful, both in hiring and scheduling and in “right-sizing” hospital support for groups that are not self-sufficient.

“It is critical for physicians and their administrative partners to get the resourcing right, as inappropriately resourced groups [too much or too little] can quickly become unsustainable and/or unstable,” Dr. Landis says.

Take his group’s compensation.

“When we look at what we want to incent physicians, we’ll look at what other groups are doing,” Dr. Landis adds. “Are they using core measures? Are they using patient satisfaction? What about good citizenship? It’s one thing to say, ‘A hospital down the road is doing it.’ It’s another thing to take this book and say, ‘Let’s look the numbers up.’”

Of course, the wrinkle in benchmarking against national or regional figures is that HMGs can be “very particular,” says MGMA’s Robinson.

“We use benchmarks to give us an idea of what the pulse is, but we don’t use it as the only number,” she adds. “It’s very individualistic to the practice and to the program.”

Dr. Landis understands that point of view. Take his group’s policy on how much of hospitalists’ compensation is based on performance. The median component of compensation tied to performance for hospitalists nationwide is 6.6%, according to SOHM 2014. Dr. Landis’ group is at 15%. In meetings with his C-suite executives, he says he thinks in the back of his mind about how far outside the mean his group is in that regard. But he tempers that thought with the view that many hospitalists believe that performance and other metrics will continue to grow into a larger portion of hospitalists’ overall compensation.

“You have to be careful,” he says. “The first person to do an innovative, valuable thing isn’t going to be the 85%. You have to be careful not to stifle innovation. One of the cautions is not to use ‘just because everyone else is doing it means it’s the best way.’”

Weiss calls on an old adage in the industry: “If you’ve seen one hospitalist program, you’ve seen exactly one hospitalist program,” he says. “Because while they can be part of a large health system or a management company, while they try to have some commonality or some typical procedures, there’s still going to be individuality.”

Richard Quinn is a freelance writer in New Jersey.