User login

I have reported previously on major incentive programs under Medicare and the Affordable Care Act that affect hospitals and, by extension, their affiliated hospitalists. I’d like to provide you with an update on these programs. The bad news is that hospitals have more revenue than ever that is at risk based on performance. The good news is that such risk, and its mitigation, centers on performance measures in the sweet spot of hospitalists and the teams they work with to improve patient care.

Hospital-Acquired Conditions

On Dec. 17, 2014, the Centers for Medicare and Medicaid Services (CMS) announced that 724 U.S. hospitals—the lowest quartile—will have 1% of their reimbursement docked effective Oct. 1, 2014, as part of the Hospital-Acquired Condition Reduction Program (HACRP). The HACRP is divided into the following domains:

- 35%, Agency for Healthcare Research and Quality Patient Safety Indicators (PSI-90). This is a composite of eight claims-based harm measures.

- 65%, CDC National Health Safety Network measures. These are clinically derived metrics, currently central line-associated blood stream infection (CLABSI) and catheter-associated urinary tract infection (CAUTI).

The HACRP program, which debuted in October 2014, will continue at least through 2020. The 65% weight domain will change in FY16 with the addition of surgical site infections (colon, hysterectomy) and in FY17 with the addition of MRSA and Clostridium difficile infections.

The full list of U.S. hospitals and their performance in the HACRP and the Hospital Value-Based Purchasing (VBP) program is available at www.modernhealthcare.com/article/20141108/INFO/141109959.

Just two weeks prior to the CMS announcement, AHRQ announced some major accomplishments in efforts to address patient safety at U.S. hospitals. The agency reported that the number of hospital-acquired conditions in the Partnership for Patients (PfP) program in the U.S. declined 9% over a one-year period (2012 to 2013) and 17% over a three-year period (2010 to 2013). Hospital-acquired conditions are defined somewhat differently in the PfP than in the HACRP, with PfP targeting certain hospital-acquired infections, pressure ulcers, falls, and adverse drug effects.

The report noted that reductions in adverse drug events and pressure ulcers were the largest contributors to a reported 50,000 fewer in-hospital deaths over the 2010-2013 period.

Hospital Value-Based Purchasing

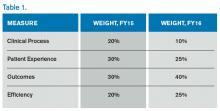

The Hospital VBP program continues to evolve. See Table 1 for a breakdown of the program for the next two years.

Unlike the HACRP and the Hospital Readmissions Reduction Program, which are pure penalty programs, VBP has hospitals at risk for 1.5% (for 2015) of Medicare payments, but they may earn back some, all, or an amount in excess of the 1.5% based on performance. For the years noted above, the VBP program metrics are as follows:

- Clinical Process: selected heart failure (HF), pneumonia (PN), myocardial infarction (MI), and surgical care measures.

- Patient Experience: a subset of the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) survey questions.

- Outcomes: HF, PN, MI, 30-day mortality, CLABSI, and PSI-90.

- Efficiency: Medicare spending per beneficiary (spending from three days prior to an inpatient hospital admission through 30 days after discharge)

Readmission Penalties

CMS announced that in the latest round of the Hospital Readmissions Reduction Program, 2,610 hospitals were penalized in total, while 39 hospitals will receive the largest penalty allowed. For FY15, the program added chronic obstructive pulmonary disease and hip and knee arthroplasty to HF, PN, and MI as the conditions counting toward excess readmissions.

For FY15, the number of hospitals penalized and the amount of the penalty are expected to increase. In addition, 1% of hospitals are anticipated to receive the maximum penalty, while 77% are expected to have some penalty, and 22% will likely have no penalty. The maximum penalty has topped out at 3% of Medicare inpatient payments.

HCAHPS Star Ratings

The CMS Hospital Compare website will debut ‘star ratings’ in April 2015 to make it easier for consumers to decipher the site’s information. In a format similar to the one used by Nursing Home Compare, the website will use a five-star rating system based on the 11 publicly reported HCAHPS measures. The initial ratings will be based on discharges during the period ranging from July 2013 through June 2014.

What’s a Hospitalist to Do?

The latest version of CMS incentive programs should serve to reinforce your hospital medicine group’s strategy to be agents of collaboration and change. Link up with your quality department to align priorities, and make sure you have hospitalist representatives on key patient safety, patient experience, and quality improvement committees.

Because dollars are at stake for your hospital, have a clear understanding of the value your hospitalist group brings to the table, so you can secure the appropriate financial support for the time and work expended on these initiatives.

And don’t forget to keep the patient at the center of your efforts.

I have reported previously on major incentive programs under Medicare and the Affordable Care Act that affect hospitals and, by extension, their affiliated hospitalists. I’d like to provide you with an update on these programs. The bad news is that hospitals have more revenue than ever that is at risk based on performance. The good news is that such risk, and its mitigation, centers on performance measures in the sweet spot of hospitalists and the teams they work with to improve patient care.

Hospital-Acquired Conditions

On Dec. 17, 2014, the Centers for Medicare and Medicaid Services (CMS) announced that 724 U.S. hospitals—the lowest quartile—will have 1% of their reimbursement docked effective Oct. 1, 2014, as part of the Hospital-Acquired Condition Reduction Program (HACRP). The HACRP is divided into the following domains:

- 35%, Agency for Healthcare Research and Quality Patient Safety Indicators (PSI-90). This is a composite of eight claims-based harm measures.

- 65%, CDC National Health Safety Network measures. These are clinically derived metrics, currently central line-associated blood stream infection (CLABSI) and catheter-associated urinary tract infection (CAUTI).

The HACRP program, which debuted in October 2014, will continue at least through 2020. The 65% weight domain will change in FY16 with the addition of surgical site infections (colon, hysterectomy) and in FY17 with the addition of MRSA and Clostridium difficile infections.

The full list of U.S. hospitals and their performance in the HACRP and the Hospital Value-Based Purchasing (VBP) program is available at www.modernhealthcare.com/article/20141108/INFO/141109959.

Just two weeks prior to the CMS announcement, AHRQ announced some major accomplishments in efforts to address patient safety at U.S. hospitals. The agency reported that the number of hospital-acquired conditions in the Partnership for Patients (PfP) program in the U.S. declined 9% over a one-year period (2012 to 2013) and 17% over a three-year period (2010 to 2013). Hospital-acquired conditions are defined somewhat differently in the PfP than in the HACRP, with PfP targeting certain hospital-acquired infections, pressure ulcers, falls, and adverse drug effects.

The report noted that reductions in adverse drug events and pressure ulcers were the largest contributors to a reported 50,000 fewer in-hospital deaths over the 2010-2013 period.

Hospital Value-Based Purchasing

The Hospital VBP program continues to evolve. See Table 1 for a breakdown of the program for the next two years.

Unlike the HACRP and the Hospital Readmissions Reduction Program, which are pure penalty programs, VBP has hospitals at risk for 1.5% (for 2015) of Medicare payments, but they may earn back some, all, or an amount in excess of the 1.5% based on performance. For the years noted above, the VBP program metrics are as follows:

- Clinical Process: selected heart failure (HF), pneumonia (PN), myocardial infarction (MI), and surgical care measures.

- Patient Experience: a subset of the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) survey questions.

- Outcomes: HF, PN, MI, 30-day mortality, CLABSI, and PSI-90.

- Efficiency: Medicare spending per beneficiary (spending from three days prior to an inpatient hospital admission through 30 days after discharge)

Readmission Penalties

CMS announced that in the latest round of the Hospital Readmissions Reduction Program, 2,610 hospitals were penalized in total, while 39 hospitals will receive the largest penalty allowed. For FY15, the program added chronic obstructive pulmonary disease and hip and knee arthroplasty to HF, PN, and MI as the conditions counting toward excess readmissions.

For FY15, the number of hospitals penalized and the amount of the penalty are expected to increase. In addition, 1% of hospitals are anticipated to receive the maximum penalty, while 77% are expected to have some penalty, and 22% will likely have no penalty. The maximum penalty has topped out at 3% of Medicare inpatient payments.

HCAHPS Star Ratings

The CMS Hospital Compare website will debut ‘star ratings’ in April 2015 to make it easier for consumers to decipher the site’s information. In a format similar to the one used by Nursing Home Compare, the website will use a five-star rating system based on the 11 publicly reported HCAHPS measures. The initial ratings will be based on discharges during the period ranging from July 2013 through June 2014.

What’s a Hospitalist to Do?

The latest version of CMS incentive programs should serve to reinforce your hospital medicine group’s strategy to be agents of collaboration and change. Link up with your quality department to align priorities, and make sure you have hospitalist representatives on key patient safety, patient experience, and quality improvement committees.

Because dollars are at stake for your hospital, have a clear understanding of the value your hospitalist group brings to the table, so you can secure the appropriate financial support for the time and work expended on these initiatives.

And don’t forget to keep the patient at the center of your efforts.

I have reported previously on major incentive programs under Medicare and the Affordable Care Act that affect hospitals and, by extension, their affiliated hospitalists. I’d like to provide you with an update on these programs. The bad news is that hospitals have more revenue than ever that is at risk based on performance. The good news is that such risk, and its mitigation, centers on performance measures in the sweet spot of hospitalists and the teams they work with to improve patient care.

Hospital-Acquired Conditions

On Dec. 17, 2014, the Centers for Medicare and Medicaid Services (CMS) announced that 724 U.S. hospitals—the lowest quartile—will have 1% of their reimbursement docked effective Oct. 1, 2014, as part of the Hospital-Acquired Condition Reduction Program (HACRP). The HACRP is divided into the following domains:

- 35%, Agency for Healthcare Research and Quality Patient Safety Indicators (PSI-90). This is a composite of eight claims-based harm measures.

- 65%, CDC National Health Safety Network measures. These are clinically derived metrics, currently central line-associated blood stream infection (CLABSI) and catheter-associated urinary tract infection (CAUTI).

The HACRP program, which debuted in October 2014, will continue at least through 2020. The 65% weight domain will change in FY16 with the addition of surgical site infections (colon, hysterectomy) and in FY17 with the addition of MRSA and Clostridium difficile infections.

The full list of U.S. hospitals and their performance in the HACRP and the Hospital Value-Based Purchasing (VBP) program is available at www.modernhealthcare.com/article/20141108/INFO/141109959.

Just two weeks prior to the CMS announcement, AHRQ announced some major accomplishments in efforts to address patient safety at U.S. hospitals. The agency reported that the number of hospital-acquired conditions in the Partnership for Patients (PfP) program in the U.S. declined 9% over a one-year period (2012 to 2013) and 17% over a three-year period (2010 to 2013). Hospital-acquired conditions are defined somewhat differently in the PfP than in the HACRP, with PfP targeting certain hospital-acquired infections, pressure ulcers, falls, and adverse drug effects.

The report noted that reductions in adverse drug events and pressure ulcers were the largest contributors to a reported 50,000 fewer in-hospital deaths over the 2010-2013 period.

Hospital Value-Based Purchasing

The Hospital VBP program continues to evolve. See Table 1 for a breakdown of the program for the next two years.

Unlike the HACRP and the Hospital Readmissions Reduction Program, which are pure penalty programs, VBP has hospitals at risk for 1.5% (for 2015) of Medicare payments, but they may earn back some, all, or an amount in excess of the 1.5% based on performance. For the years noted above, the VBP program metrics are as follows:

- Clinical Process: selected heart failure (HF), pneumonia (PN), myocardial infarction (MI), and surgical care measures.

- Patient Experience: a subset of the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) survey questions.

- Outcomes: HF, PN, MI, 30-day mortality, CLABSI, and PSI-90.

- Efficiency: Medicare spending per beneficiary (spending from three days prior to an inpatient hospital admission through 30 days after discharge)

Readmission Penalties

CMS announced that in the latest round of the Hospital Readmissions Reduction Program, 2,610 hospitals were penalized in total, while 39 hospitals will receive the largest penalty allowed. For FY15, the program added chronic obstructive pulmonary disease and hip and knee arthroplasty to HF, PN, and MI as the conditions counting toward excess readmissions.

For FY15, the number of hospitals penalized and the amount of the penalty are expected to increase. In addition, 1% of hospitals are anticipated to receive the maximum penalty, while 77% are expected to have some penalty, and 22% will likely have no penalty. The maximum penalty has topped out at 3% of Medicare inpatient payments.

HCAHPS Star Ratings

The CMS Hospital Compare website will debut ‘star ratings’ in April 2015 to make it easier for consumers to decipher the site’s information. In a format similar to the one used by Nursing Home Compare, the website will use a five-star rating system based on the 11 publicly reported HCAHPS measures. The initial ratings will be based on discharges during the period ranging from July 2013 through June 2014.

What’s a Hospitalist to Do?

The latest version of CMS incentive programs should serve to reinforce your hospital medicine group’s strategy to be agents of collaboration and change. Link up with your quality department to align priorities, and make sure you have hospitalist representatives on key patient safety, patient experience, and quality improvement committees.

Because dollars are at stake for your hospital, have a clear understanding of the value your hospitalist group brings to the table, so you can secure the appropriate financial support for the time and work expended on these initiatives.

And don’t forget to keep the patient at the center of your efforts.